EX-99.2

Published on September 30, 2025

NYSE: TBN, ASX: TBN Tamboran to acquire Falcon Oil & Gas Ltd. | Creating the leading Beetaloo Basin E&P with 2.9 million net prospective acres September 30, 2025

Forward-Looking Statements Certain statements in this presentation concerning the transaction, including any statements regarding the expected timetable for completing the transaction, the results, effects, benefits and synergies of the transaction, future opportunities for the combined company, future financial performance and condition, guidance and any other statements regarding Tamboran Resources Corporation’s (“Tamboran”) or Falcon Oil & Gas Ltd.’s (“Falcon”) future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward- looking” statements based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations. Forward-looking statements are all statements other than statements of historical facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward-looking statements. Specific forward-looking statements include statements regarding Tamboran’s or Falcon’s plans and expectations with respect to the transaction, timing of closing, and the anticipated impact of the transaction on the combined company’s results of operations, financial position, growth opportunities and competitive position. The forward- looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that stockholders of Tamboran may not approve the issuance of new shares of Tamboran common stock in the transaction or that shareholders of Falcon may not approve the transaction; the risk that a condition to closing of the transaction may not be satisfied; that either party may terminate the arrangement agreement or that the closing of the transaction might be delayed or not occur at all; the outcome of any legal proceedings that may be instituted against Tamboran or Falcon; reputational risks and potential adverse reactions from or changes to the relationships with the companies’ employees or other business partners of Tamboran or Falcon, including those resulting from the announcement or completion of the transaction; the diversion of management time on transaction-related issues; the dilution caused by Tamboran’s issuance of common stock in connection with the transaction; the ultimate timing, outcome and results of integrating the operations of Tamboran and Falcon; the effects of the business combination of Tamboran and Falcon, including the combined company’s future financial condition, results of operations, strategy and plans; changes in capital markets and the ability of the combined company to finance operations in the manner expected; regulatory approvals of the transaction; the effects of commodity prices; the risks of oil and gas activities; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the transaction. Expectations regarding business outlook, including changes in strategies for the combined company’s operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters. These factors are not necessarily all of the factors that could cause Tamboran or Falcon actual results, performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors also could harm Tamboran’s or Falcon’s results. Additional factors that could cause results to differ materially from those described above can be found in Tamboran’s Annual Report on Form 10-K for the fiscal year ended June 30, 2025, and subsequent Quarterly Reports on Form 10-Q, which are on file with the Securities and Exchange Commission (the “SEC”) and available from Tamboran’s website at www.tamboran.com under the “Investor Relations” tab, and in other documents Tamboran files with the SEC; and in Falcon’s annual information form for the year ended December 31, 2024, which is on SEDAR+ and available from Falcon’s website at www.falconoilandgas.com under the “Investor Centre” tab, and in other documents Falcon files on SEDAR+. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Tamboran nor Falcon assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by applicable securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. 2 Disclaimer

Communications in this presentation do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. None of the securities anticipated to be issued pursuant to the transaction have been or will be registered under the Securities Act, or any state securities laws, and any securities issued in the transaction are anticipated to be issued in reliance upon available exemptions from registration requirements pursuant to Section 3(a) (10) of the Securities Act and applicable exemptions under state securities laws. This announcement doe not constitute an offer to sell or the solicitation of an offer to buy any securities. Additional Information and Where You Can Find It In connection with the proposed transaction, Tamboran and Falcon intend to file materials with the SEC and on SEDAR+, as applicable. Tamboran intends to file a preliminary Proxy Statement on Schedule 14A (the “Proxy Statement”) with the SEC in connection with the solicitation of proxies to obtain Tamboran stockholder approval of the Stock Issuance, and Falcon intends to file an information circular and proxy statement (the “Circular”) on SEDAR+ in connection with the solicitation of proxies to obtain Falcon shareholder approval of the proposed transaction. After the Proxy Statement is cleared by the SEC, Tamboran intends to mail a definitive Proxy Statement to the stockholders of Tamboran. This document is not a substitute for the Proxy Statement, the Circular or for any other document that Tamboran or Falcon may file with the SEC or on SEDAR+ and/or send to Tamboran’s stockholders and/or Falcon’s shareholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF TAMBORAN AND FALCON ARE URGED TO CAREFULLY AND THOROUGHLY READ THE PROXY STATEMENT AND THE CIRCULAR, RESPECTIVELY, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY TAMBORAN AND/OR FALCON WITH THE SEC OR ON SEDAR+, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TAMBORAN, FALCON, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. Stockholders of Tamboran and shareholders of Falcon will be able to obtain free copies of the Proxy Statement and the Circular, as each may be amended from time to time, and other relevant documents filed by Tamboran and/or Falcon with the SEC or on SEDAR+ (when they become available) through the website maintained by the SEC at www.sec.gov or at www.sedarplus.ca, as applicable. Copies of documents filed with the SEC by Tamboran will be available free of charge from Tamboran’s website at www.tamboran.com under the “Investor Relations” tab or by contacting Tamboran’s Investor Relations Department at +61 2 8330 6626 or Investors@tamboran.com. Copies of documents filed on SEDAR+ by Falcon will be available free of charge from Falcon’s website at www.falconoilandgas.com under the “Investor Centre” tab or by contacting Falcon’s Investor Relations Department at +353 1 676 8702. Participants in the Solicitation Tamboran, Falcon and their respective directors and certain of their respective executive officers and other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from Tamboran’s stockholders and Falcon’s shareholders in connection with the transaction. Information regarding the executive officers and directors of Tamboran is included in its definitive proxy statement for its 2024 annual meeting in the sections entitled “Corporate Governance,” “Executive and Director Compensation” and “Security Ownership of Certain Beneficial Owners and Management,” which was filed with the SEC on October 17, 2024; in the section entitled “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Tamboran’s Annual Report on Form 10-K for the fiscal year ended June 30, 2025, which was filed with the SEC on September 25, 2025; and other documents subsequently filed by Tamboran with the SEC. Information regarding the executive officers and directors of Falcon is included in its management information circular and proxy statement for its 2025 annual which was filed on SEDAR+ on July 28, 2025. To the extent holdings of Tamboran common stock by the directors and executive officers of Tamboran have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the persons who may be deemed participants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement, the Circular and other materials when they are filed on SEDAR+ in connection with the transaction. Free copies of these documents may be obtained as described in the paragraphs above. Disclaimer 3

4 Tamboran to acquire Falcon Oil & Gas Ltd. Strategic rationale | Building a leading acreage position across the Beetaloo depocenter Consolidates leading Beetaloo depocenter position >50% increase in Tamboran’s Beetaloo Basin acreage to ~2.9 million net prospective acres with >40,000 (gross) pro forma drilling locations(1) 1 Strategic positioning ahead of Phase 2 Development Area farmout Tamboran’s pro forma interest in the Phase 2 Development Area to increase to 80.62% (pre-farmout) 2 Consolidates Tamboran’s ownership across the majority of the Beetaloo depocenter Pro forma interest across >90% of net prospective acres 3 Accretive transaction at an attractive acreage value Implied acreage value of US$169 per acre(2) implies a 4% discount to Tamboran’s currently traded acreage value4 + (1) Based on 10,000-foot horizontal wells, with well spacing of ~1,640 feet and includes the Mid Velkerri A, B, Lower B and C shale formations. (2) Implied acreage value is based enterprise value of US$172 million (acquisition price based on 6.54 million Tamboran NYSE Common Stock at US$22.64 per share and cash consideration of US$23.7 million less US$4.8 million in cash) and a net prospective acreage position of 986,803 acres.

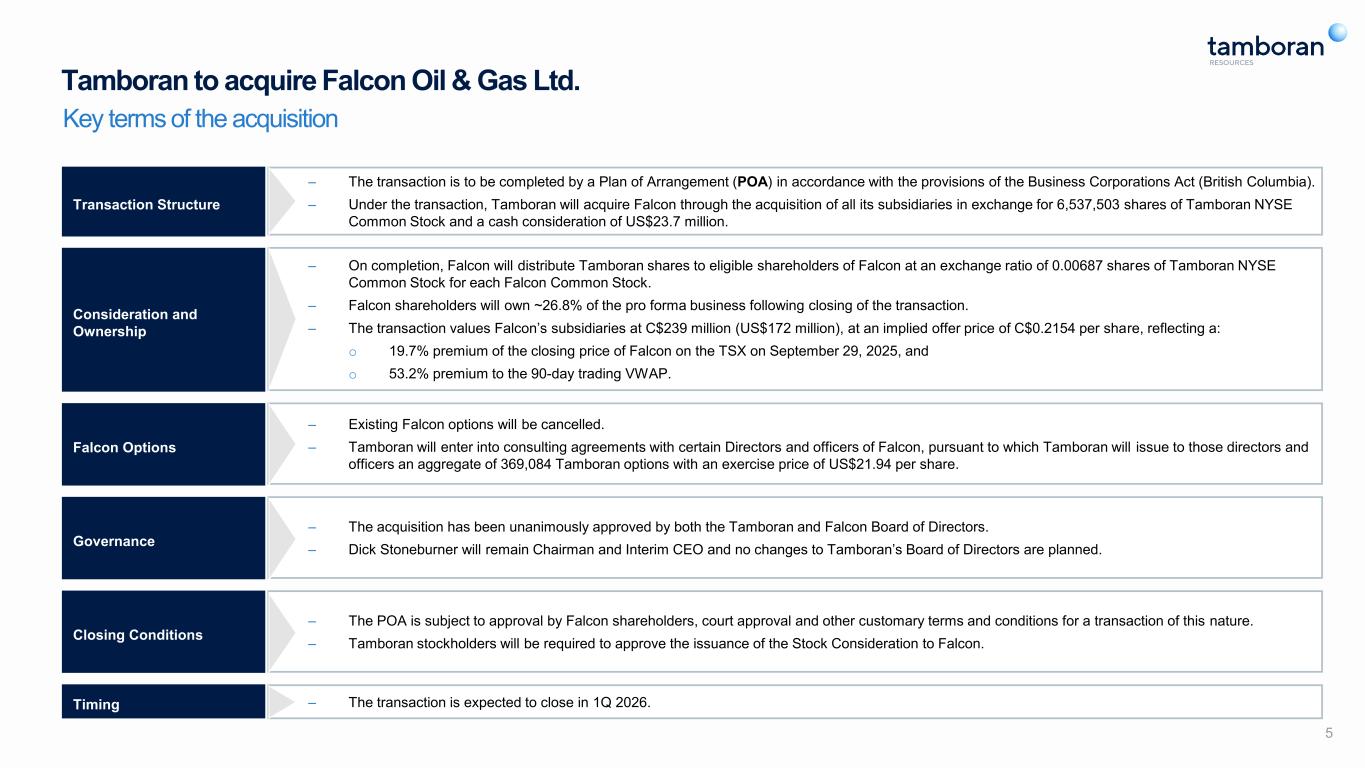

5 Tamboran to acquire Falcon Oil & Gas Ltd. Key terms of the acquisition Transaction Structure ‒ The transaction is to be completed by a Plan of Arrangement (POA) in accordance with the provisions of the Business Corporations Act (British Columbia). ‒ Under the transaction, Tamboran will acquire Falcon through the acquisition of all its subsidiaries in exchange for 6,537,503 shares of Tamboran NYSE Common Stock and a cash consideration of US$23.7 million. Consideration and Ownership Falcon Options Governance Closing Conditions Timing ‒ On completion, Falcon will distribute Tamboran shares to eligible shareholders of Falcon at an exchange ratio of 0.00687 shares of Tamboran NYSE Common Stock for each Falcon Common Stock. ‒ Falcon shareholders will own ~26.8% of the pro forma business following closing of the transaction. ‒ The transaction values Falcon’s subsidiaries at C$239 million (US$172 million), at an implied offer price of C$0.2154 per share, reflecting a: o 19.7% premium of the closing price of Falcon on the TSX on September 29, 2025, and o 53.2% premium to the 90-day trading VWAP. ‒ Existing Falcon options will be cancelled. ‒ Tamboran will enter into consulting agreements with certain Directors and officers of Falcon, pursuant to which Tamboran will issue to those directors and officers an aggregate of 369,084 Tamboran options with an exercise price of US$21.94 per share. ‒ The acquisition has been unanimously approved by both the Tamboran and Falcon Board of Directors. ‒ Dick Stoneburner will remain Chairman and Interim CEO and no changes to Tamboran’s Board of Directors are planned. ‒ The POA is subject to approval by Falcon shareholders, court approval and other customary terms and conditions for a transaction of this nature. ‒ Tamboran stockholders will be required to approve the issuance of the Stock Consideration to Falcon. ‒ The transaction is expected to close in 1Q 2026.

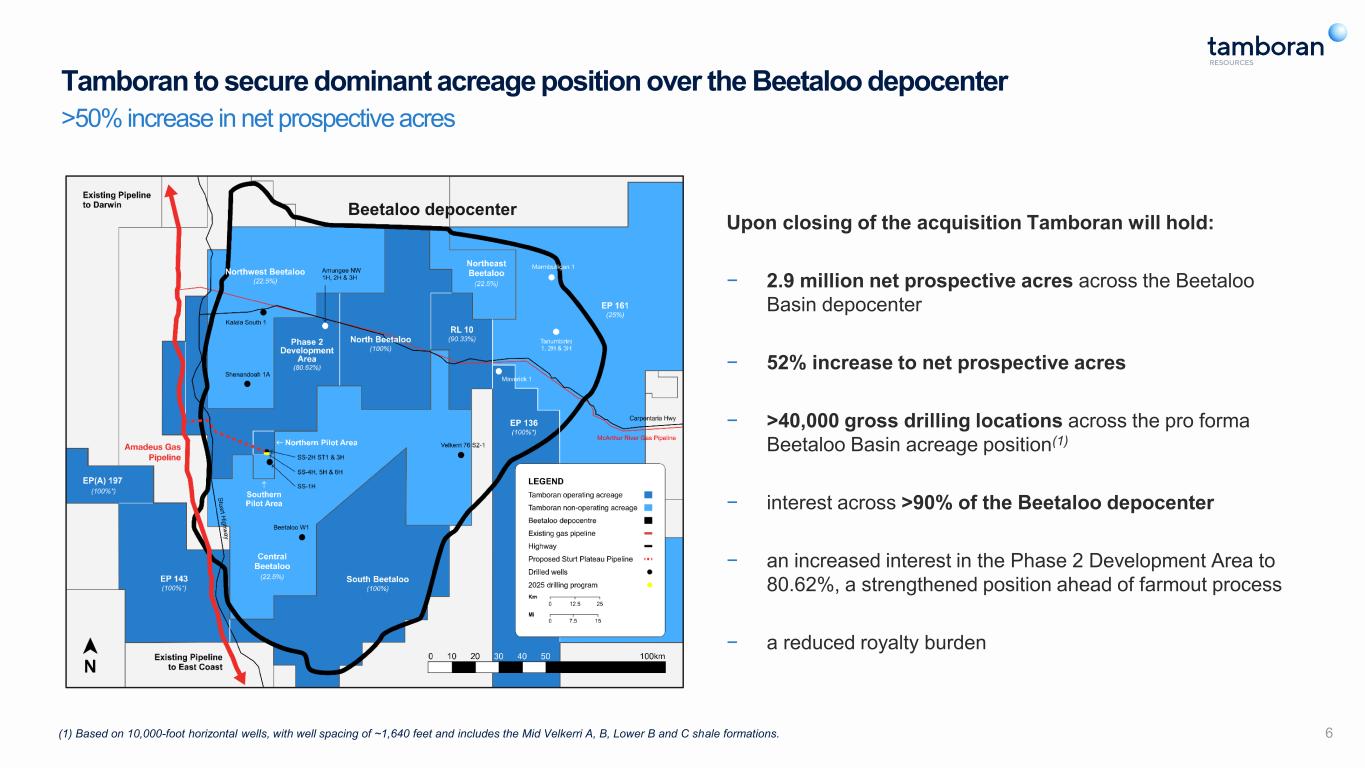

6 Tamboran to secure dominant acreage position over the Beetaloo depocenter >50% increase in net prospective acres Upon closing of the acquisition Tamboran will hold: − 2.9 million net prospective acres across the Beetaloo Basin depocenter − 52% increase to net prospective acres − >40,000 gross drilling locations across the pro forma Beetaloo Basin acreage position(1) − interest across >90% of the Beetaloo depocenter − an increased interest in the Phase 2 Development Area to 80.62%, a strengthened position ahead of farmout process − a reduced royalty burden Beetaloo depocenter (1) Based on 10,000-foot horizontal wells, with well spacing of ~1,640 feet and includes the Mid Velkerri A, B, Lower B and C shale formations.

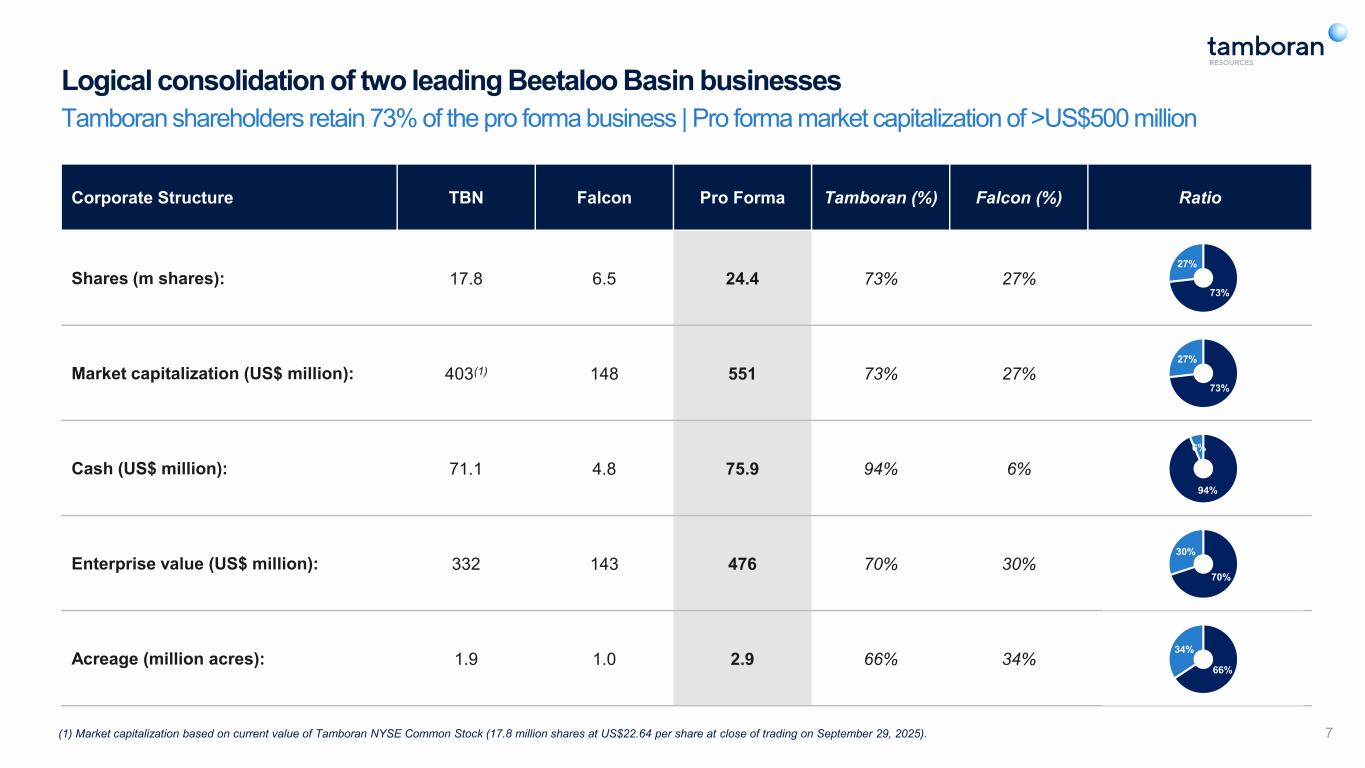

7 Logical consolidation of two leading Beetaloo Basin businesses Tamboran shareholders retain 73% of the pro forma business | Pro forma market capitalization of >US$500 million Corporate Structure TBN Falcon Pro Forma Tamboran (%) Falcon (%) Ratio Shares (m shares): 17.8 6.5 24.4 73% 27% Market capitalization (US$ million): 403(1) 148 551 73% 27% Cash (US$ million): 71.1 4.8 75.9 94% 6% Enterprise value (US$ million): 332 143 476 70% 30% Acreage (million acres): 1.9 1.0 2.9 66% 34% 73% 27% 73% 27% 94% 6% 70% 30% 66% 34% (1) Market capitalization based on current value of Tamboran NYSE Common Stock (17.8 million shares at US$22.64 per share at close of trading on September 29, 2025).

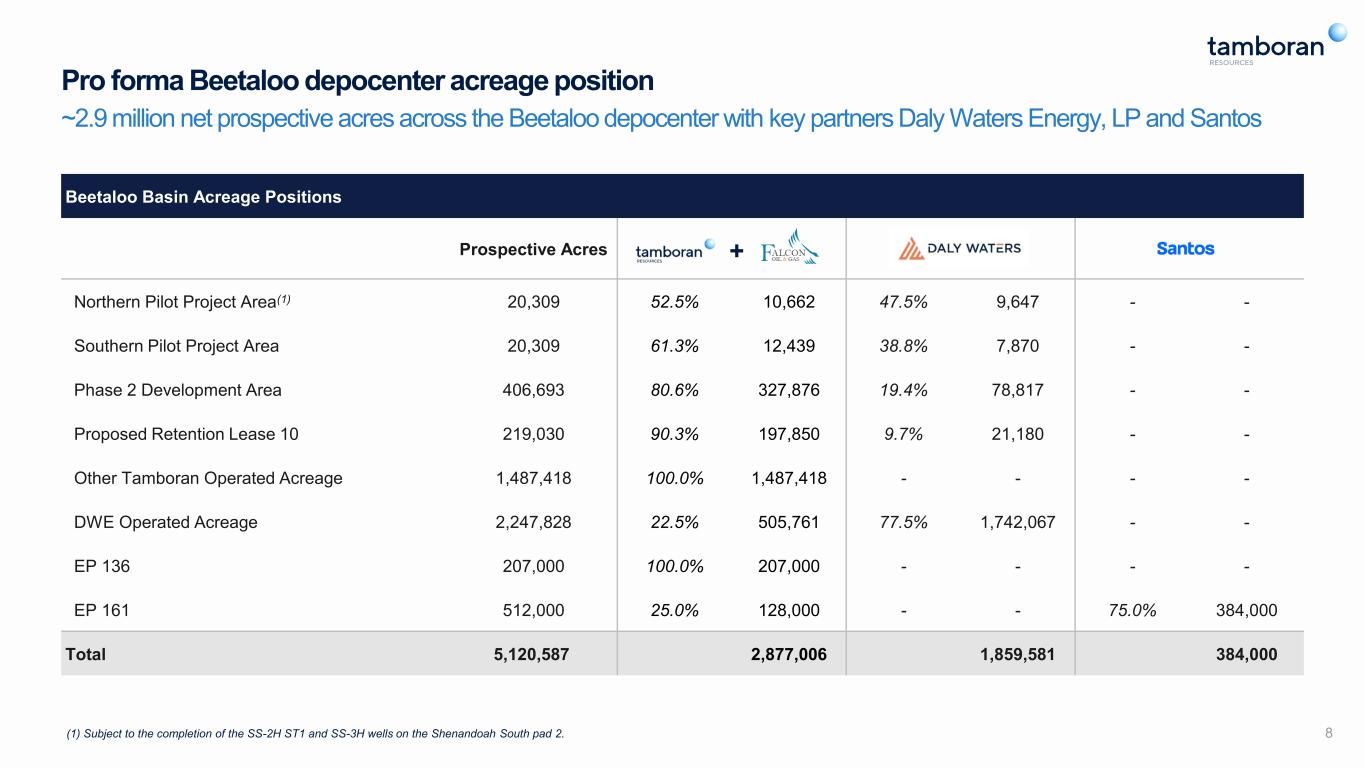

Pro forma Beetaloo depocenter acreage position ~2.9 million net prospective acres across the Beetaloo depocenter with key partners Daly Waters Energy, LP and Santos 8 Beetaloo Basin Acreage Positions Prospective Acres Northern Pilot Project Area(1) 20,309 52.5% 10,662 47.5% 9,647 - - Southern Pilot Project Area 20,309 61.3% 12,439 38.8% 7,870 - - Phase 2 Development Area 406,693 80.6% 327,876 19.4% 78,817 - - Proposed Retention Lease 10 219,030 90.3% 197,850 9.7% 21,180 - - Other Tamboran Operated Acreage 1,487,418 100.0% 1,487,418 - - - - DWE Operated Acreage 2,247,828 22.5% 505,761 77.5% 1,742,067 - - EP 136 207,000 100.0% 207,000 - - - - EP 161 512,000 25.0% 128,000 - - 75.0% 384,000 Total 5,120,587 2,877,006 1,859,581 384,000 (1) Subject to the completion of the SS-2H ST1 and SS-3H wells on the Shenandoah South pad 2. +

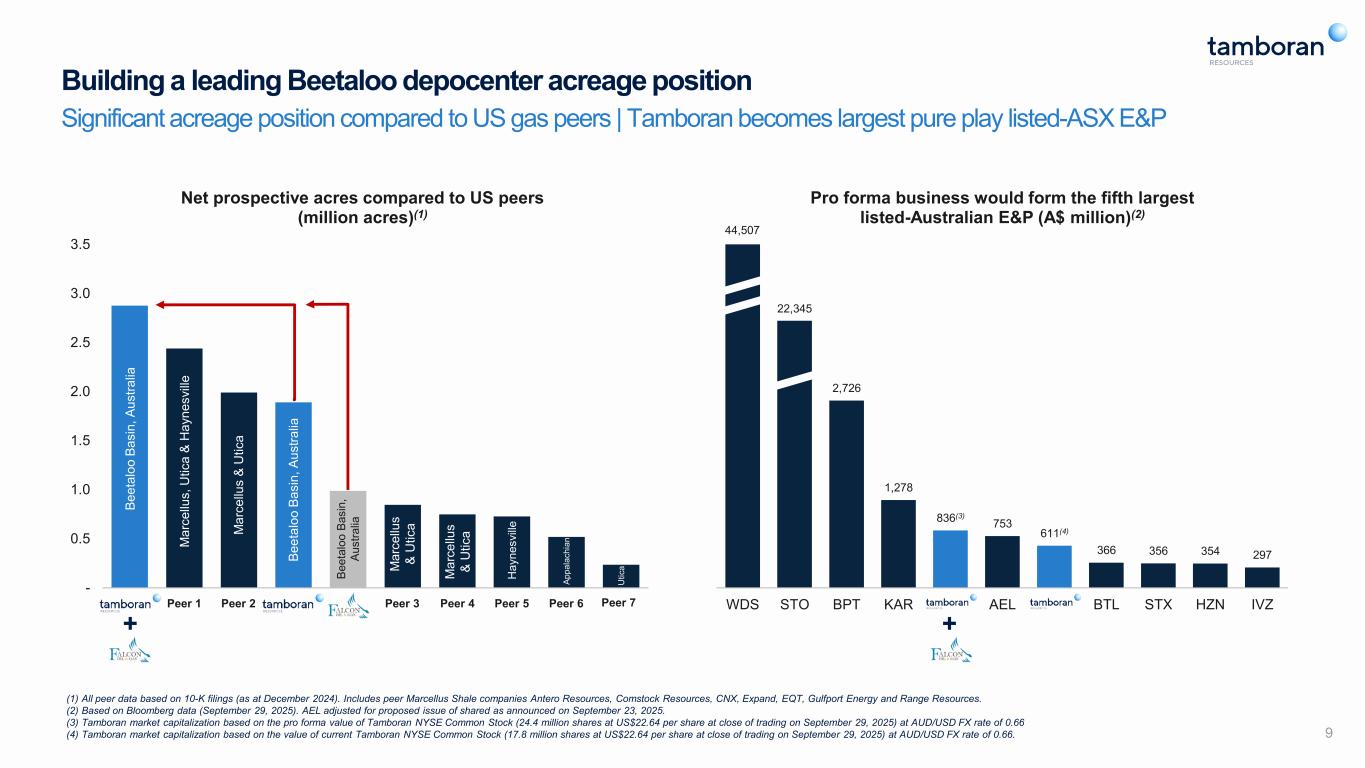

9 Significant acreage position compared to US gas peers | Tamboran becomes largest pure play listed-ASX E&P - 0.5 1.0 1.5 2.0 2.5 3.0 3.5 1 2 3 4 5 6 7 8 9 10 Net prospective acres compared to US peers (million acres)(1) M a rc e llu s , U ti c a & H a y n e s v ill e M a rc e llu s & U ti c a M a rc e llu s & U ti c a B e e ta lo o B a s in , A u s tr a lia B e e ta lo o B a s in , A u s tr a lia B e e ta lo o B a s in , A u s tr a lia H a y n e s v ill e A p p a la c h ia n U ti c a M a rc e llu s & U ti c a Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 + (1) All peer data based on 10-K filings (as at December 2024). Includes peer Marcellus Shale companies Antero Resources, Comstock Resources, CNX, Expand, EQT, Gulfport Energy and Range Resources. (2) Based on Bloomberg data (September 29, 2025). AEL adjusted for proposed issue of shared as announced on September 23, 2025. (3) Tamboran market capitalization based on the pro forma value of Tamboran NYSE Common Stock (24.4 million shares at US$22.64 per share at close of trading on September 29, 2025) at AUD/USD FX rate of 0.66 (4) Tamboran market capitalization based on the value of current Tamboran NYSE Common Stock (17.8 million shares at US$22.64 per share at close of trading on September 29, 2025) at AUD/USD FX rate of 0.66. 2,726 1,278 836(3) 753 611(4) 366 356 354 297 WDS STO BPT KAR AEL BTL STX HZN IVZ Pro forma business would form the fifth largest listed-Australian E&P (A$ million)(2) + 22,345 44,507 Building a leading Beetaloo depocenter acreage position

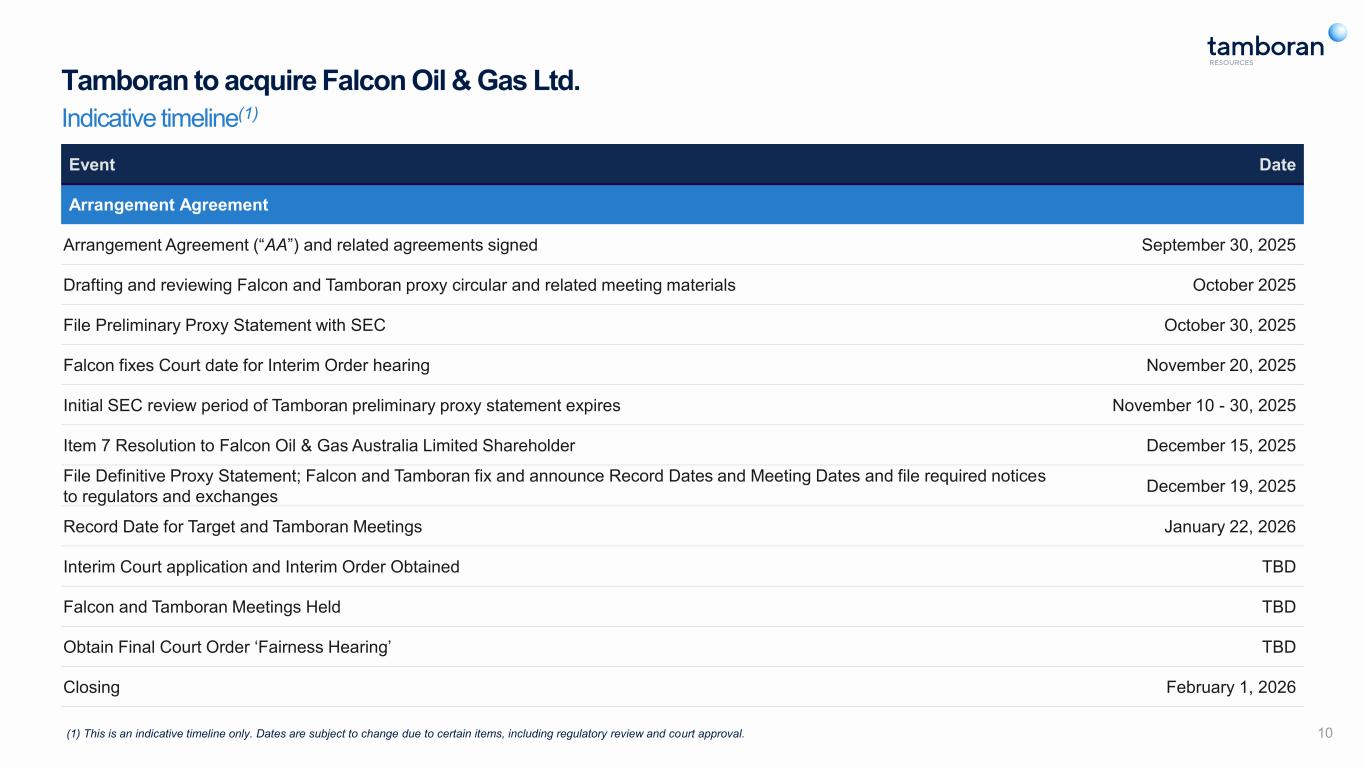

10 Tamboran to acquire Falcon Oil & Gas Ltd. Indicative timeline(1) Event Date Arrangement Agreement Arrangement Agreement (“AA”) and related agreements signed September 30, 2025 Drafting and reviewing Falcon and Tamboran proxy circular and related meeting materials October 2025 File Preliminary Proxy Statement with SEC October 30, 2025 Falcon fixes Court date for Interim Order hearing November 20, 2025 Initial SEC review period of Tamboran preliminary proxy statement expires November 10 - 30, 2025 Item 7 Resolution to Falcon Oil & Gas Australia Limited Shareholder December 15, 2025 File Definitive Proxy Statement; Falcon and Tamboran fix and announce Record Dates and Meeting Dates and file required notices to regulators and exchanges December 19, 2025 Record Date for Target and Tamboran Meetings January 22, 2026 Interim Court application and Interim Order Obtained TBD Falcon and Tamboran Meetings Held TBD Obtain Final Court Order ‘Fairness Hearing’ TBD Closing February 1, 2026 (1) This is an indicative timeline only. Dates are subject to change due to certain items, including regulatory review and court approval.