EX-2.1

Published on September 30, 2025

Exhibit 2.1 ARRANGEMENT AGREEMENT among TAMBORAN RESOURCES CORPORATION, TAMBORAN (BEETALOO) PTY LTD, TAMBORAN RESOURCES INVESTMENTS HOLDING CORPORATION and FALCON OIL & GAS LTD. dated as of September 30, 2025

TABLE OF CONTENTS Page ARTICLE 1 THE ARRANGEMENT ...........................................................................................10 Section 1.1 Arrangement ......................................................................................................10 Section 1.2 Company Implementation Steps ........................................................................10 Section 1.3 Parent Implementation Steps .............................................................................14 Section 1.4 Dissenting Shares ..............................................................................................15 Section 1.5 Closing ...............................................................................................................15 Section 1.6 Directors and Officers of Parent .......................................................................15 Section 1.7 U.S. Securities Act Matters ................................................................................15 Section 1.8 Canadian Securities Laws Matters ....................................................................17 Section 1.9 Payment of Consideration .................................................................................17 Section 1.10 Withholding Rights ............................................................................................17 ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF COMPANY .............................18 Section 2.1 Organization, Standing and Power ...................................................................18 Section 2.2 Capital Structure ...............................................................................................18 Section 2.3 Authority; No Violations....................................................................................19 Section 2.4 Consents.............................................................................................................20 Section 2.5 Securities Documents; Financial Statements.....................................................20 Section 2.6 Absence of Certain Changes or Events .............................................................22 Section 2.7 No Undisclosed Material Liabilities..................................................................22 Section 2.8 Company Circular .............................................................................................22 Section 2.9 Permits; Compliance with Applicable Law .......................................................23 Section 2.10 Compensation; Benefits .....................................................................................23 Section 2.11 Employment and Labor Matters ........................................................................25 Section 2.12 Taxes ..................................................................................................................27 Section 2.13 Litigation............................................................................................................29 Section 2.14 Intellectual Property and IT Assets ...................................................................29 Section 2.15 Real Property.....................................................................................................30 Section 2.16 Rights-of-Way ....................................................................................................30 Section 2.17 Oil and Gas Matters ..........................................................................................31 Section 2.18 Environmental Matters ......................................................................................33 Section 2.19 Material Contracts.............................................................................................33 Section 2.20 Insurance ...........................................................................................................36 Section 2.21 Cultural Business...............................................................................................36 Section 2.22 Opinion of Company’s Financial Advisor .........................................................37 Section 2.23 Brokers...............................................................................................................37 Section 2.24 Related Party Transactions ...............................................................................37 Section 2.25 Regulatory Matters ............................................................................................37 Section 2.26 Corrupt Practices Legislation ...........................................................................37 Section 2.27 Sanctions............................................................................................................38 Section 2.28 Sufficiency of Assets...........................................................................................39 Section 2.29 Bankruptcy, Insolvency and Reorganization .....................................................40 Section 2.30 Banking Information ..........................................................................................40

ii Section 2.31 No Additional Representations ..........................................................................40 ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF PARENT, AUSTRALIA SUB AND U.S. SUB ....................................................................................................41 Section 3.1 Organization, Standing and Power ...................................................................41 Section 3.2 Capital Structure ...............................................................................................41 Section 3.3 Authority; No Violations....................................................................................43 Section 3.4 Consents.............................................................................................................44 Section 3.5 SEC Documents; Financial Statements .............................................................44 Section 3.6 Absence of Certain Changes or Events .............................................................45 Section 3.7 No Undisclosed Material Liabilities..................................................................45 Section 3.8 Parent Proxy Statement .....................................................................................46 Section 3.9 Parent Permits; Compliance with Applicable Law ...........................................46 Section 3.10 Brokers...............................................................................................................47 Section 3.11 Funds Available .................................................................................................47 Section 3.12 Takeover Laws ...................................................................................................47 Section 3.13 Compliance with Applicable Law ......................................................................47 Section 3.14 Litigation............................................................................................................47 Section 3.15 No Additional Representations ..........................................................................47 ARTICLE 4 CERTAIN COVENANTS........................................................................................48 Section 4.1 Conduct of Company Business Pending the Arrangement ................................48 Section 4.2 Conduct of Parent Business Pending the Arrangement ....................................52 Section 4.3 No Solicitation; Adverse Recommendation Change..........................................53 Section 4.4 Preparation of Company Circular and Parent Proxy Statement ......................58 Section 4.5 Mutual Covenants of the Parties Relating to the Transactions .........................61 Section 4.6 Meetings.............................................................................................................62 Section 4.7 Access to Information; Confidentiality ..............................................................64 Section 4.8 Consummation of the Arrangement; Additional Agreements ............................66 Section 4.9 Transaction Litigation .......................................................................................67 Section 4.10 Public Announcements.......................................................................................67 Section 4.11 Control of Business............................................................................................68 Section 4.12 Intercompany Indebtedness ...............................................................................68 Section 4.13 No Relevant Interest ..........................................................................................68 Section 4.14 Tax Matters. .......................................................................................................68 Section 4.15 Registration Status, Stock Exchange Listing and Delisting...............................69 Section 4.16 Falcon Australia ................................................................................................69 Section 4.17 Other Obligations. .............................................................................................69 Section 4.18 Obligations of Australia Sub, U.S. Sub and Parent...........................................70 Section 4.19 Falcon Hungary.................................................................................................71 ARTICLE 5 CONDITIONS ..........................................................................................................71 Section 5.1 Conditions to Obligation of Each Party ............................................................71 Section 5.2 Additional Conditions to Obligation of Parent, Australia Sub and U.S. Sub .....................................................................................................................71 Section 5.3 Additional Conditions to Obligation of Company .............................................73 Section 5.4 Frustration of Conditions ..................................................................................74 Section 5.5 Merger of Conditions.........................................................................................74

iii ARTICLE 6 TERMINATION.......................................................................................................74 Section 6.1 Termination........................................................................................................74 Section 6.2 Effect of Termination .........................................................................................76 Section 6.3 Termination Fees ...............................................................................................76 ARTICLE 7 MISCELLANEOUS .................................................................................................80 Section 7.1 Schedule Definitions ..........................................................................................80 Section 7.2 Non-Survival of Representations, Warranties and Agreements ........................80 Section 7.3 Expenses ............................................................................................................80 Section 7.4 Notices ...............................................................................................................80 Section 7.5 Entire Agreement; No Third Party Beneficiaries. .............................................81 Section 7.6 Assignment; Binding Effect................................................................................81 Section 7.7 Governing Law; Jurisdiction and Venue ...........................................................82 Section 7.8 Severability ........................................................................................................82 Section 7.9 Amendment ........................................................................................................82 Section 7.10 Waiver of Jury Trial...........................................................................................82 Section 7.11 Interpretation .....................................................................................................82 Section 7.12 Counterparts ......................................................................................................83 Section 7.13 No Recourse.......................................................................................................83 Section 7.14 Specific Performance.........................................................................................84 Section 7.15 Extension; Waiver..............................................................................................84 Section 7.16 Definitions..........................................................................................................84 Exhibit A – Arrangement Resolution Exhibit B – Plan of Arrangement Exhibit C – Parent Consultants INDEX OF DEFINED TERMS Defined Term Section Acceptable Confidentiality Agreement............................................... Section 7.16 Affected Person................................................................................... Section 1.10 Affiliates.............................................................................................. Section 7.16 Aggregated Group............................................................................... Section 7.16 Agreement ........................................................................................... Preamble AIM ..................................................................................................... Section 7.16 Applicable Date................................................................................... Section 2.5(a) Applicable Proxy Statement / Circular ............................................... Section 7.16 Applicable Securities Laws................................................................. Section 7.16 Arrangement........................................................................................ Section 7.16 Arrangement Resolution ..................................................................... Recitals Australia Entities ................................................................................. Recitals Australia Sub ....................................................................................... Preamble Australia Sub Board ............................................................................ Recitals Beetaloo Joint Venture ........................................................................ Section 7.16

iv Defined Term Section Blocked Account Agent ...................................................................... Section 7.16 Broker.................................................................................................. Section 1.10 Business............................................................................................... Section 7.16 Business Day....................................................................................... Section 7.16 Canadian Securities Authorities .......................................................... Section 7.16 Canadian Securities Laws ................................................................... Section 7.16 Cash Calls............................................................................................ Section 4.17(a) Cash Call Period.................................................................................. Section 4.17(a) Cash Consideration ............................................................................. Section 1.1(b) Closing ................................................................................................ Section 7.16 Closing Date........................................................................................ Section 7.16 Code .................................................................................................... Section 7.16 Company ............................................................................................. Preamble Company Acquisition Proposal........................................................... Section 7.16 Company Adverse Recommendation Change .................................... Section 4.3(b) Company Benefit Plan ........................................................................ Section 7.16 Company Board .................................................................................. Recitals Company Board Recommendation ..................................................... Section 2.3(a) Company Capital Stock....................................................................... Section 2.2(a) Company Circular ............................................................................... Section 7.16 Company Common Shares.................................................................. Recitals Company Contracts ............................................................................. Section 2.19(b) Company Data Room.......................................................................... Section 7.16 Company Disclosure Letter................................................................. Article 2 Company Employment Agreements ................................................... Section 7.16 Company Expense Reimbursement .................................................... Section 6.3(k) Company Intellectual Property ........................................................... Section 2.14 Company Intervening Event ............................................................... Section 7.16 Company Issued Securities ................................................................. Section 1.7(d) Company IT Assets ............................................................................. Section 7.16 Company Marketing Contract............................................................. Section 2.19(a)(ii) Company Material Adverse Effect...................................................... Section 2.1 Company Meeting............................................................................... Section 7.16 Company Notice of Change ................................................................ Section 4.3(b) Company Preferred Stock ................................................................... Section 2.2(a) Company Requisite Shareholder Vote ................................................ Section 1.2(a)(ii) Company Securities Documents ......................................................... Section 2.5(a) Company Stock Option ....................................................................... Section 7.16 Company Termination Fee.................................................................. Section 6.3(f) Company Undisclosed Liabilities ....................................................... Section 7.16 Confidential Information..................................................................... Section 4.7(b) Consent................................................................................................ Section 7.16 Consideration ...................................................................................... Section 1.1(b) Contract ............................................................................................... Section 7.16 Court.................................................................................................... Recitals

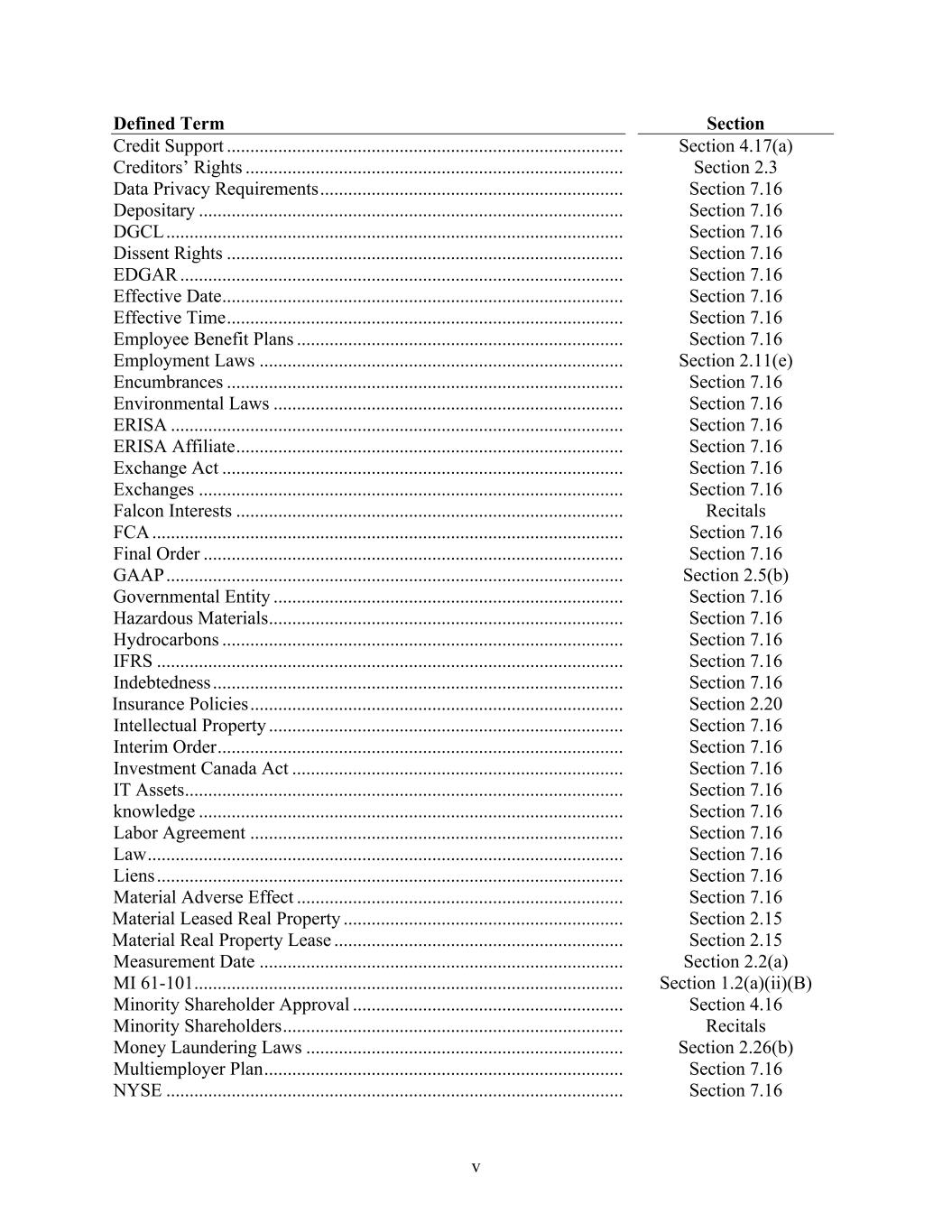

v Defined Term Section Credit Support ..................................................................................... Section 4.17(a) Creditors’ Rights ................................................................................. Section 2.3 Data Privacy Requirements................................................................. Section 7.16 Depositary ........................................................................................... Section 7.16 DGCL.................................................................................................. Section 7.16 Dissent Rights ..................................................................................... Section 7.16 EDGAR ............................................................................................... Section 7.16 Effective Date...................................................................................... Section 7.16 Effective Time..................................................................................... Section 7.16 Employee Benefit Plans ...................................................................... Section 7.16 Employment Laws .............................................................................. Section 2.11(e) Encumbrances ..................................................................................... Section 7.16 Environmental Laws ........................................................................... Section 7.16 ERISA ................................................................................................. Section 7.16 ERISA Affiliate................................................................................... Section 7.16 Exchange Act ...................................................................................... Section 7.16 Exchanges ........................................................................................... Section 7.16 Falcon Interests ................................................................................... Recitals FCA ..................................................................................................... Section 7.16 Final Order .......................................................................................... Section 7.16 GAAP.................................................................................................. Section 2.5(b) Governmental Entity ........................................................................... Section 7.16 Hazardous Materials............................................................................ Section 7.16 Hydrocarbons ...................................................................................... Section 7.16 IFRS .................................................................................................... Section 7.16 Indebtedness ........................................................................................ Section 7.16 Insurance Policies................................................................................ Section 2.20 Intellectual Property ............................................................................ Section 7.16 Interim Order....................................................................................... Section 7.16 Investment Canada Act ....................................................................... Section 7.16 IT Assets.............................................................................................. Section 7.16 knowledge ........................................................................................... Section 7.16 Labor Agreement ................................................................................ Section 7.16 Law...................................................................................................... Section 7.16 Liens .................................................................................................... Section 7.16 Material Adverse Effect ...................................................................... Section 7.16 Material Leased Real Property ............................................................ Section 2.15 Material Real Property Lease .............................................................. Section 2.15 Measurement Date .............................................................................. Section 2.2(a) MI 61-101............................................................................................ Section 1.2(a)(ii)(B) Minority Shareholder Approval .......................................................... Section 4.16 Minority Shareholders......................................................................... Recitals Money Laundering Laws .................................................................... Section 2.26(b) Multiemployer Plan............................................................................. Section 7.16 NYSE .................................................................................................. Section 7.16

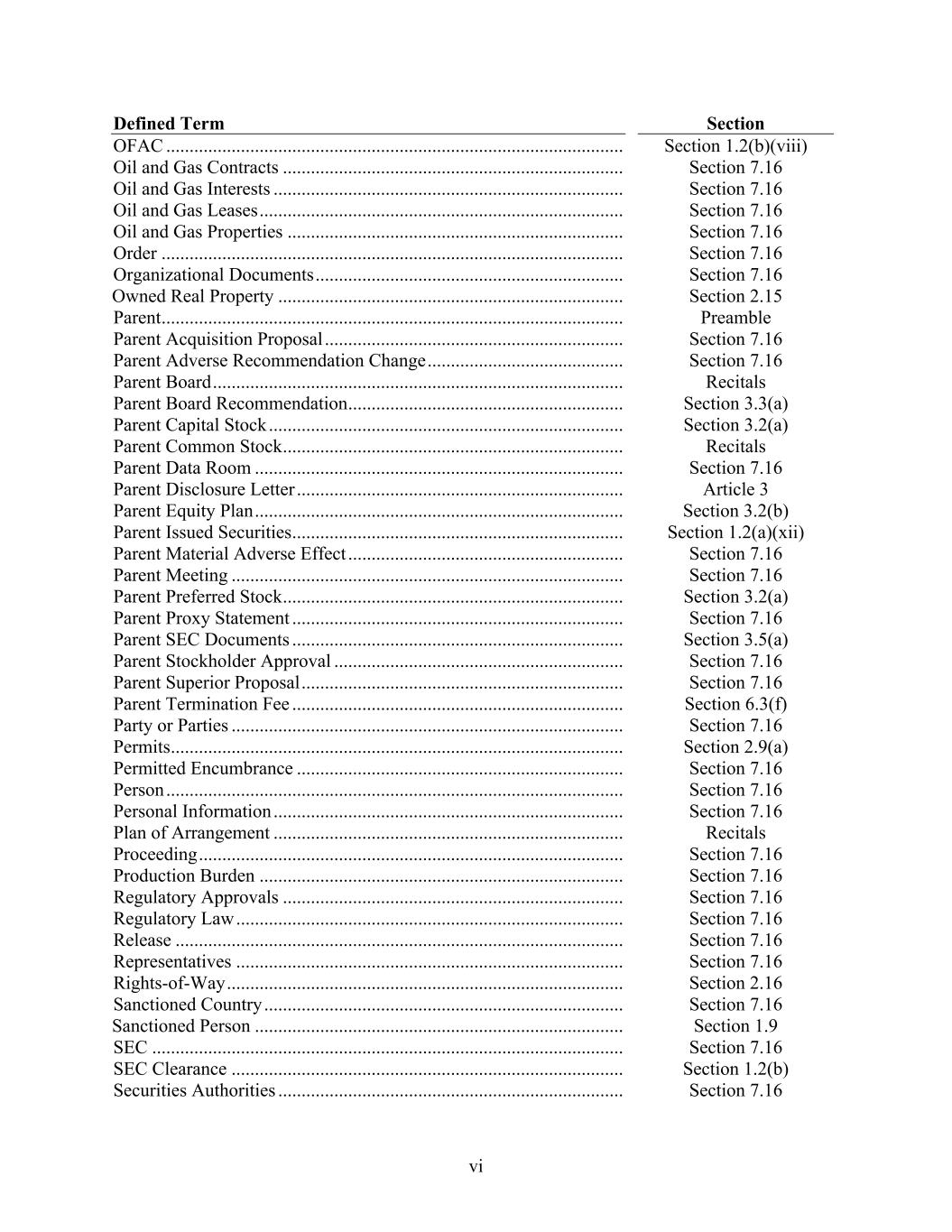

vi Defined Term Section OFAC .................................................................................................. Section 1.2(b)(viii) Oil and Gas Contracts ......................................................................... Section 7.16 Oil and Gas Interests ........................................................................... Section 7.16 Oil and Gas Leases.............................................................................. Section 7.16 Oil and Gas Properties ........................................................................ Section 7.16 Order ................................................................................................... Section 7.16 Organizational Documents.................................................................. Section 7.16 Owned Real Property .......................................................................... Section 2.15 Parent................................................................................................... Preamble Parent Acquisition Proposal ................................................................ Section 7.16 Parent Adverse Recommendation Change.......................................... Section 7.16 Parent Board........................................................................................ Recitals Parent Board Recommendation........................................................... Section 3.3(a) Parent Capital Stock............................................................................ Section 3.2(a) Parent Common Stock......................................................................... Recitals Parent Data Room ............................................................................... Section 7.16 Parent Disclosure Letter ...................................................................... Article 3 Parent Equity Plan............................................................................... Section 3.2(b) Parent Issued Securities....................................................................... Section 1.2(a)(xii) Parent Material Adverse Effect ........................................................... Section 7.16 Parent Meeting .................................................................................... Section 7.16 Parent Preferred Stock......................................................................... Section 3.2(a) Parent Proxy Statement ....................................................................... Section 7.16 Parent SEC Documents ....................................................................... Section 3.5(a) Parent Stockholder Approval .............................................................. Section 7.16 Parent Superior Proposal..................................................................... Section 7.16 Parent Termination Fee ....................................................................... Section 6.3(f) Party or Parties .................................................................................... Section 7.16 Permits................................................................................................. Section 2.9(a) Permitted Encumbrance ...................................................................... Section 7.16 Person.................................................................................................. Section 7.16 Personal Information........................................................................... Section 7.16 Plan of Arrangement ........................................................................... Recitals Proceeding........................................................................................... Section 7.16 Production Burden .............................................................................. Section 7.16 Regulatory Approvals ......................................................................... Section 7.16 Regulatory Law................................................................................... Section 7.16 Release ................................................................................................ Section 7.16 Representatives ................................................................................... Section 7.16 Rights-of-Way..................................................................................... Section 2.16 Sanctioned Country ............................................................................. Section 7.16 Sanctioned Person ............................................................................... Section 1.9 SEC ..................................................................................................... Section 7.16 SEC Clearance .................................................................................... Section 1.2(b) Securities Authorities .......................................................................... Section 7.16

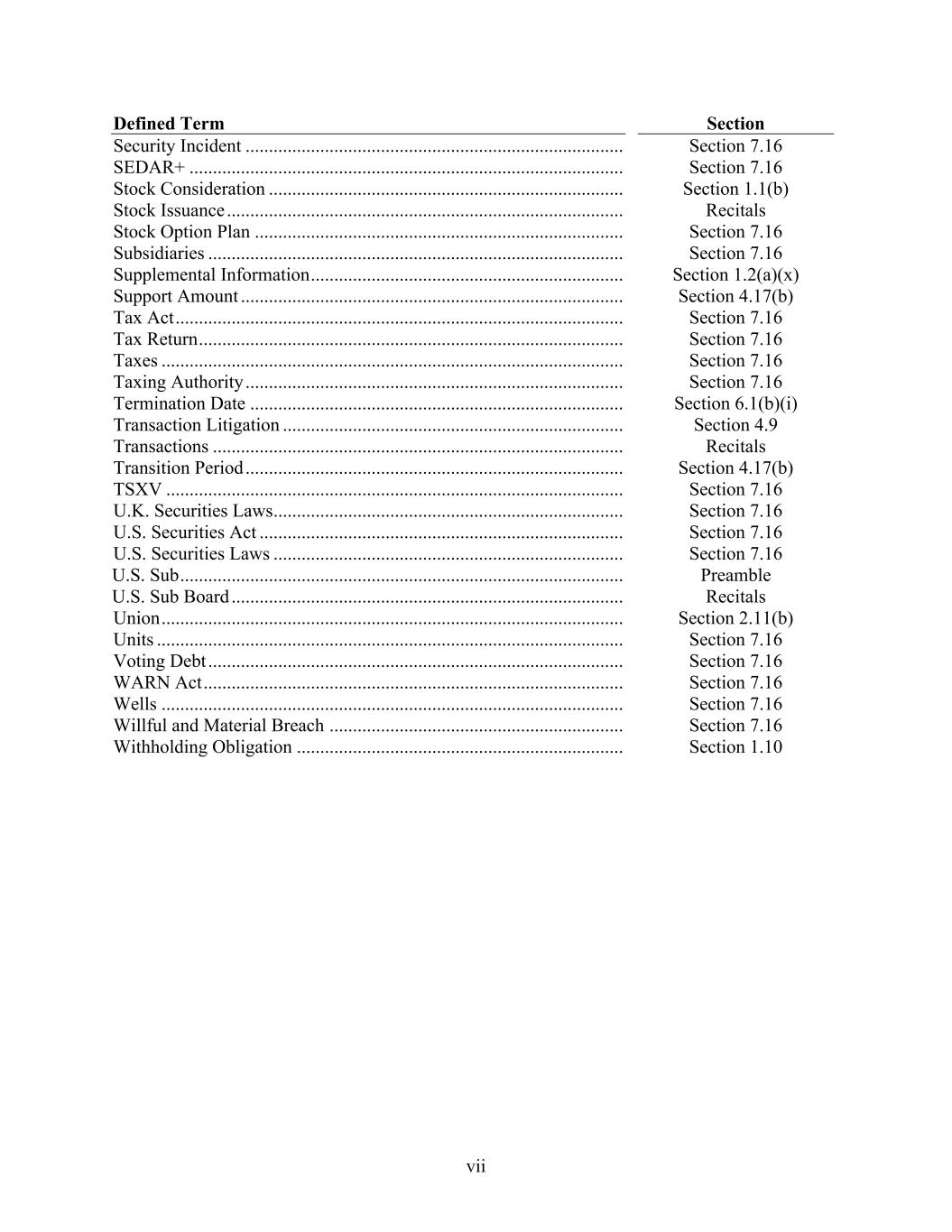

vii Defined Term Section Security Incident ................................................................................. Section 7.16 SEDAR+ ............................................................................................. Section 7.16 Stock Consideration ............................................................................ Section 1.1(b) Stock Issuance..................................................................................... Recitals Stock Option Plan ............................................................................... Section 7.16 Subsidiaries ......................................................................................... Section 7.16 Supplemental Information................................................................... Section 1.2(a)(x) Support Amount .................................................................................. Section 4.17(b) Tax Act................................................................................................ Section 7.16 Tax Return........................................................................................... Section 7.16 Taxes ................................................................................................... Section 7.16 Taxing Authority ................................................................................. Section 7.16 Termination Date ................................................................................ Section 6.1(b)(i) Transaction Litigation ......................................................................... Section 4.9 Transactions ........................................................................................ Recitals Transition Period................................................................................. Section 4.17(b) TSXV .................................................................................................. Section 7.16 U.K. Securities Laws........................................................................... Section 7.16 U.S. Securities Act .............................................................................. Section 7.16 U.S. Securities Laws ........................................................................... Section 7.16 U.S. Sub............................................................................................... Preamble U.S. Sub Board .................................................................................... Recitals Union................................................................................................... Section 2.11(b) Units .................................................................................................... Section 7.16 Voting Debt ......................................................................................... Section 7.16 WARN Act.......................................................................................... Section 7.16 Wells ................................................................................................... Section 7.16 Willful and Material Breach ............................................................... Section 7.16 Withholding Obligation ...................................................................... Section 1.10

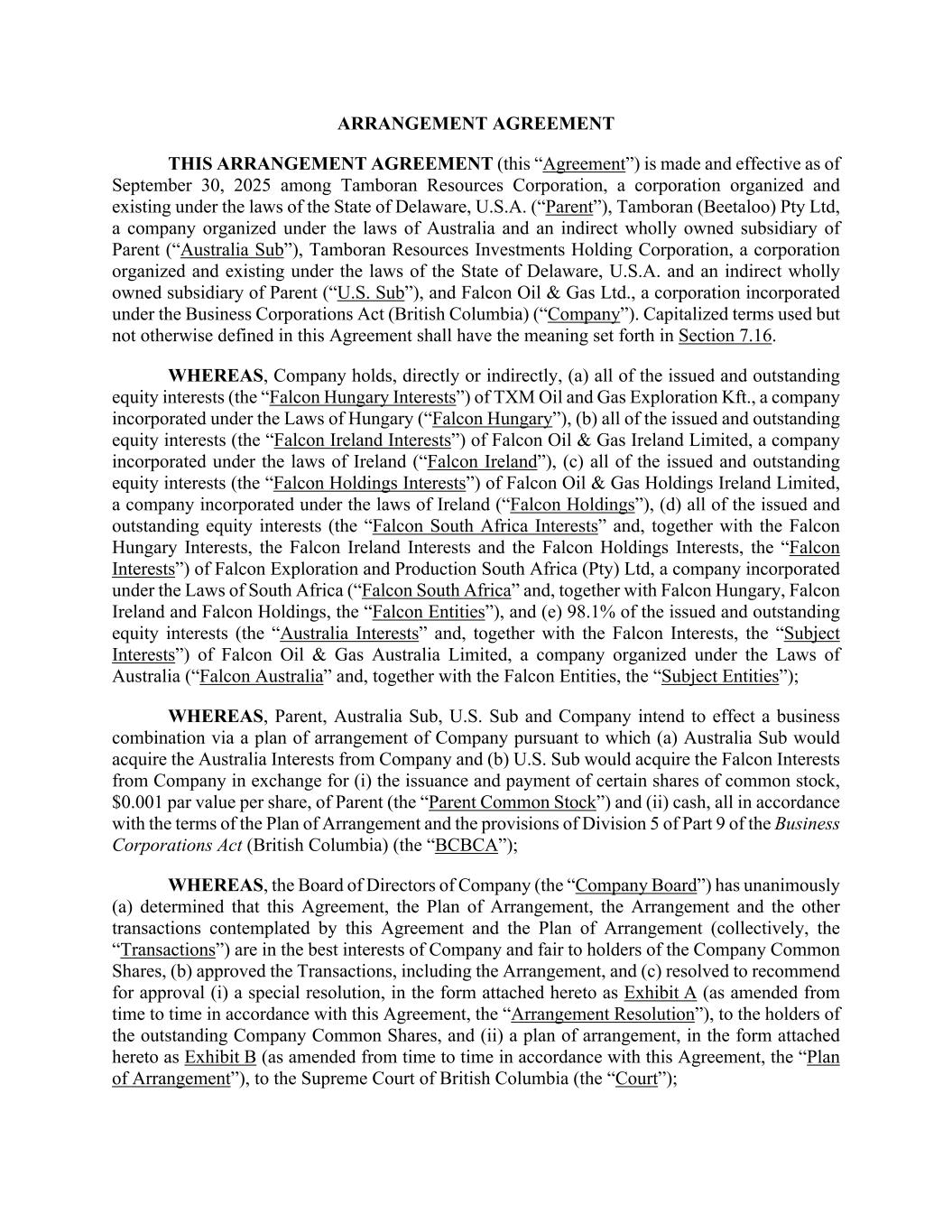

ARRANGEMENT AGREEMENT THIS ARRANGEMENT AGREEMENT (this “Agreement”) is made and effective as of September 30, 2025 among Tamboran Resources Corporation, a corporation organized and existing under the laws of the State of Delaware, U.S.A. (“Parent”), Tamboran (Beetaloo) Pty Ltd, a company organized under the laws of Australia and an indirect wholly owned subsidiary of Parent (“Australia Sub”), Tamboran Resources Investments Holding Corporation, a corporation organized and existing under the laws of the State of Delaware, U.S.A. and an indirect wholly owned subsidiary of Parent (“U.S. Sub”), and Falcon Oil & Gas Ltd., a corporation incorporated under the Business Corporations Act (British Columbia) (“Company”). Capitalized terms used but not otherwise defined in this Agreement shall have the meaning set forth in Section 7.16. WHEREAS, Company holds, directly or indirectly, (a) all of the issued and outstanding equity interests (the “Falcon Hungary Interests”) of TXM Oil and Gas Exploration Kft., a company incorporated under the Laws of Hungary (“Falcon Hungary”), (b) all of the issued and outstanding equity interests (the “Falcon Ireland Interests”) of Falcon Oil & Gas Ireland Limited, a company incorporated under the laws of Ireland (“Falcon Ireland”), (c) all of the issued and outstanding equity interests (the “Falcon Holdings Interests”) of Falcon Oil & Gas Holdings Ireland Limited, a company incorporated under the laws of Ireland (“Falcon Holdings”), (d) all of the issued and outstanding equity interests (the “Falcon South Africa Interests” and, together with the Falcon Hungary Interests, the Falcon Ireland Interests and the Falcon Holdings Interests, the “Falcon Interests”) of Falcon Exploration and Production South Africa (Pty) Ltd, a company incorporated under the Laws of South Africa (“Falcon South Africa” and, together with Falcon Hungary, Falcon Ireland and Falcon Holdings, the “Falcon Entities”), and (e) 98.1% of the issued and outstanding equity interests (the “Australia Interests” and, together with the Falcon Interests, the “Subject Interests”) of Falcon Oil & Gas Australia Limited, a company organized under the Laws of Australia (“Falcon Australia” and, together with the Falcon Entities, the “Subject Entities”); WHEREAS, Parent, Australia Sub, U.S. Sub and Company intend to effect a business combination via a plan of arrangement of Company pursuant to which (a) Australia Sub would acquire the Australia Interests from Company and (b) U.S. Sub would acquire the Falcon Interests from Company in exchange for (i) the issuance and payment of certain shares of common stock, $0.001 par value per share, of Parent (the “Parent Common Stock”) and (ii) cash, all in accordance with the terms of the Plan of Arrangement and the provisions of Division 5 of Part 9 of the Business Corporations Act (British Columbia) (the “BCBCA”); WHEREAS, the Board of Directors of Company (the “Company Board”) has unanimously (a) determined that this Agreement, the Plan of Arrangement, the Arrangement and the other transactions contemplated by this Agreement and the Plan of Arrangement (collectively, the “Transactions”) are in the best interests of Company and fair to holders of the Company Common Shares, (b) approved the Transactions, including the Arrangement, and (c) resolved to recommend for approval (i) a special resolution, in the form attached hereto as Exhibit A (as amended from time to time in accordance with this Agreement, the “Arrangement Resolution”), to the holders of the outstanding Company Common Shares, and (ii) a plan of arrangement, in the form attached hereto as Exhibit B (as amended from time to time in accordance with this Agreement, the “Plan of Arrangement”), to the Supreme Court of British Columbia (the “Court”);

9 WHEREAS, the Board of Directors of Parent (the “Parent Board”) has unanimously (i) determined that the form, terms and provisions of each of the Arrangement Agreement and the Plan of Arrangement are advisable, fair and reasonable to and in the best interests of Parent and the holders of outstanding Parent Common Stock, (ii) approved and adopted this Agreement, the Plan of Arrangement and the Transactions, including the issuance of the Stock Consideration (the “Stock Issuance”), (iii) authorized and empowered Parent to enter into this Agreement and the Plan of Arrangement, and to consummate the Transactions, including the Stock Issuance, on the terms and subject to the conditions set forth in the this Agreement and the Plan of Arrangement and (iv) resolved to recommend that the holders of the outstanding Parent Common Stock approve the Stock Issuance; WHEREAS, the directors of Australia Sub (the “Australia Sub Board”) have unanimously (i) approved the Transactions and (ii) approved the execution, delivery and performance of this Agreement and the Australian Transaction Implementation Deed; WHEREAS, the Board of Directors of U.S. Sub (the “U.S. Sub Board”) has unanimously (i) determined that this Agreement and the Transactions are advisable and in the best interests of, U.S. Sub and its sole stockholder and (ii) authorized and approved this Agreement and the Transactions; WHEREAS, concurrently with the execution and delivery of this Agreement and as a material inducement to Parent’s, Australia Sub’s and U.S. Sub’s execution and delivery of this Agreement, certain holders of outstanding Company Common Shares (the “Support Parties”) are executing support and voting agreements (the “Support Agreements”) with Parent, pursuant to which each such Support Party agreed to vote in favour of the Arrangement, including the Arrangement Resolution, and any other matter that could reasonably be expected to facilitate the Arrangement; WHEREAS, prior to the Effective Time, and as a material inducement to Parent’s, Australia Sub’s and U.S. Sub’s execution and delivery of this Agreement, each of the individuals identified on Exhibit C hereto (collectively, the “Parent Consultants”) will execute a consulting agreement, in each case, to be effective upon the Closing, pursuant to which each of the Parent Consultants will be issued certain options of Parent; WHEREAS, prior to the Effective Time, Company shall solicit the approval of holders of a majority of the outstanding equity interests in Falcon Australia not held by Company (the “Minority Shareholders”) to obtain the Minority Shareholder Approval (as defined herein); and WHEREAS, Parent, Australia Sub, U.S. Sub and Company desire to make certain representations, warranties and covenants in connection with, and to prescribe certain conditions to, the Transactions. NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and conditions set forth in this Agreement, and intending to be legally bound, Parent, Australia Sub, U.S. Sub and Company agree as follows:

10 ARTICLE 1 THE ARRANGEMENT Section 1.1 Arrangement. (a) The Parties agree to implement the Arrangement in accordance with and subject to the terms and conditions contained in this Agreement and the Plan of Arrangement. (b) The Closing will take place on the Effective Date, or at such other time and place as may be agreed by Parent and Company, via electronic document exchange. Section 1.2 Company Implementation Steps. (a) As promptly as reasonably practicable following execution of this Agreement and in any event in sufficient time to hold the Company Meeting in accordance with this Agreement, Company shall apply to the Court in a manner reasonably acceptable to Parent, pursuant to Section 291 of the BCBCA, and in cooperation with Parent, prepare, file and diligently pursue an application for the Interim Order. Company shall use reasonable best efforts to schedule the Interim Order hearing with the Court for a date on or about the fifteenth (15th) calendar day immediately following the date of filing of the Parent Proxy Statement with the SEC; provided that Company shall reschedule such hearing if SEC Clearance is not obtained (or not obtainable) by the third (3rd) Business Day prior to the date of the hearing; provided further that in the event such hearing is rescheduled, Company shall use reasonable best efforts to reschedule such hearing to occur as soon as reasonably practicable following the receipt of SEC Clearance, in each case subject to the availability of the Court. The Interim Order shall provide (among other things): (i) for the class of persons to whom notice shall be provided in respect of the Arrangement on the terms and subject to the conditions set forth in the Plan of Arrangement and the Company Meeting and for the manner in which such notice shall be provided; (ii) that the requisite approval (the “Company Requisite Shareholder Vote”) for the Arrangement Resolution shall be: (A) at least two-thirds of the votes cast on the Arrangement Resolution by those holders of Company Common Shares present in person or represented by proxy at the Company Meeting, each Company Common Share entitling the holder thereof to one vote on the Arrangement Resolution; and (B) if required under Canadian Securities Laws, a simple majority of the votes cast on the Arrangement Resolution by holders of Company Common Shares present in person or represented by proxy at the Company Meeting after excluding the votes cast by those persons whose votes are required to be excluded in accordance with Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”);

11 (iii) that, in all other material respects, other than as ordered by the Court, the terms, restrictions and conditions of the Organizational Documents of Company as in effect as of the entry into this Agreement, including quorum requirements and all other matters, shall apply in respect of the Company Meeting; (iv) for the notice requirements with respect to the presentation of the application to the Court for the Final Order; (v) that, for purposes of the BCBCA and consideration of the Arrangement Resolution, the Company Meeting may be adjourned or postponed from time to time by Company (subject to the terms of this Agreement) without the need for additional approval of the Court, and that notice of such adjournment or postponement may be given by such method as Company determines is appropriate in the circumstances, and that, subject to the terms of this Agreement, the time period required for any such adjournment or postponement shall be for such time period or periods as Company deems advisable; (vi) confirmation of the record date for the purposes of determining the holders of Company Common Shares entitled to receive material and vote at the Company Meeting in accordance with the Interim Order; (vii) that the record date for holders of Company Common Shares entitled to notice of, and for holders of Company Common Shares entitled to vote at, the Company Meeting will not change in respect of any adjournment(s) or postponement(s) of the Company Meeting, unless required by the Court or applicable Laws; (viii) that, subject to the discretion of the Court, the Company Meeting may be held as a virtual-only or hybrid shareholder meeting and that holders of Company Common Shares that participate in the Company Meeting by virtual means will be deemed to be present at the Company Meeting; (ix) that, if a virtual-only Company Meeting is held with the approval of the Court, such Company Meeting will be deemed to be held at the location of Company’s registered office; (x) that Company and Parent are authorized to make such amendments, revisions or supplements (the “Supplemental Information”) to the Applicable Proxy Statement / Circular, form of proxy, notices of the Company Meeting and Parent Meeting, letter of transmittal and notice of originating application and similar documents, subject to the other provisions of this Agreement, as they may determine, subject to the prior written consent of the other Party (not to be unreasonably withheld, conditioned or delayed), or as is necessary to comply with Applicable Securities Laws (provided that the other Party has been provided a reasonable opportunity to comment thereon and the disclosing Party has considered such comments in good faith), and Company and Parent shall disclose such Supplemental Information (subject to the terms of this Section 1.2(a)(x)), including any material changes, by the method and in the time most reasonably practicable in the circumstances as determined by Company or Parent and in compliance with Applicable

12 Securities Laws (including by news release, newspaper advertisement, Current Report on Form 8-K, or by notice sent to the Company shareholders or Parent stockholders, as applicable, by any of the means such meeting materials are otherwise sent to such holders); and without limiting the generality of the foregoing, if any material change or material fact (each within the meaning of Applicable Securities Laws) arises between the date of the Interim Order and the date of the Company Meeting or Parent Meeting, which change or fact, if known prior to mailing of the Applicable Proxy Statement / Circular, would have been disclosed in the Applicable Proxy Statement / Circular, then, subject to the other terms of this Section 1.2(a)(x): (A) Parent or Company, as applicable, shall advise the Parent stockholders or Company shareholders, respectively, of the material change or material fact by disseminating a news release and making all requisite filings with the SEC and SEDAR+, as applicable, in accordance with Applicable Securities Laws and the policies of the applicable Exchanges; and (B) provided that the foregoing news release describes the applicable material change or material fact in reasonable detail and no amendment to the Applicable Proxy Statement / Circular is required to be filed pursuant to the Securities Laws, neither Parent nor Company shall be required to deliver an amendment to the Applicable Proxy Statement / Circular to the Parent stockholders or Company shareholders, respectively, or otherwise give notice to the Parent stockholders or Company shareholders, respectively, of the material change or material fact other than dissemination and filing of the foregoing news release; (xi) that each holder of Company Common Shares entitled to receive the Consideration pursuant to the Arrangement will have the right to appear before the Court so long as they enter an appearance within a reasonable time and in accordance with the procedures set out in the Interim Order; (xii) that it is Parent’s intention to rely upon the exemption from registration provided by Section 3(a)(10) of the U.S. Securities Act with respect to the issuance of the Parent Common Stock (the “Parent Issued Securities”) to be issued to Company and distributed to certain holders of Company Common Shares pursuant to the Arrangement, based on the Court’s approval of the Arrangement; and (xiii) for such other matters as Parent and Company may reasonably require, subject to obtaining the prior consent of the other Party, such consent not to be unreasonably withheld, conditioned or delayed. (b) Company shall, as soon as reasonably practicable after the earliest to occur of (y) the SEC informing Parent that it has no comments to or will not review the Parent Proxy Statement (and Parent agrees to advise Company of such matters promptly after the SEC informs Parent of such) or (z) the passage of at least ten (10) calendar days (as calculated pursuant to Rule 14a-6 of the Exchange Act) since the filing of a preliminary Parent Proxy Statement with the SEC not informing Parent that it intends to review the Parent Proxy Statement (in either case, “SEC Clearance”) and consistent with the provisions set forth in Section 4.6:

13 (i) duly take all lawful action to call, give written notice of, convene and hold the Company Meeting in accordance with the Interim Order, the Organizational Documents of Company and applicable Laws; (ii) in consultation with Parent, fix and publish a record date for purposes of determining the Company shareholders entitled to receive notice of and vote at the Company Meeting in accordance with the Interim Order; (iii) without Parent’s prior written consent, Company will not propose or submit for consideration at the Company Meeting any business other than the Arrangement, matters of procedure and any other matters required by applicable Laws to be voted on by the Company shareholders in connection with the Arrangement; (iv) allow Parent’s Representatives and legal counsel to attend the Company Meeting; (v) not adjourn, postpone or cancel (or propose or permit the adjournment, postponement or cancellation of) the Company Meeting without Parent’s prior written consent, which written consent shall not be unreasonably withheld, conditioned or delayed, except pursuant to and in accordance with Section 4.6(a) or as otherwise expressly permitted under this Agreement; (vi) subject to the terms of this Agreement, solicit proxies in favor of the Arrangement Resolution, including, if so requested by Parent using the services of dealers and proxy solicitation firms to solicit proxies in favor of the approval of the Arrangement Resolution (which costs shall be borne by Company); (vii) promptly advise Parent of any written notice of dissent or purported exercise by any Company shareholder of Dissent Rights received by Company in relation to the Arrangement and any withdrawal of Dissent Rights received by Company and any written communications sent by or on behalf of Company to any Company shareholder exercising or purporting to exercise Dissent Rights in relation to the Arrangement; and (viii) at the reasonable request of Parent from time to time, promptly provide Parent with a list (in both written and electronic form as may be provided by Company’s registrar and transfer agent) of: (A) the registered Company shareholders, together with their addresses and respective holdings of Company Common Shares; and (B) to the extent available to Company, participants in book-based systems and non- objecting beneficial owners of Company Common Shares, together with their addresses and respective holdings of Company Common Shares. Company shall from time to time require that its registrar and transfer agent furnish Parent with such additional information, including updated or additional lists of Company shareholders and lists of holdings and other assistance as Parent may reasonably request. For the avoidance of doubt, Parent or Company shall not be required to take any action pursuant to, in connection with, or with respect to this Agreement that is, or in Parent’s or

14 Company’s (as applicable) sole and reasonable judgement would constitute, a violation of economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time by the United States (including the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”) and the U.S. Department of State), the United Nations Security Council, the European Union, any European Union Member State, or the United Kingdom (collectively, “Sanctions”). (c) If (i) the Interim Order is obtained, (ii) the Arrangement Resolution is approved at the Company Meeting by Company shareholders as provided for in the Interim Order and as required by applicable Law, and (iii) the Stock Issuance is approved at the Parent Meeting by Parent stockholders as required by NYSE rules, Company shall take all steps necessary or desirable to submit the Arrangement to the Court and diligently pursue an application for the Final Order pursuant to Section 291 of the BCBCA as soon as reasonably practicable, and in any event such that the Final Order hearing occurs not later than five (5) Business Days after the later of the approval of the Arrangement Resolution and the approval of the Stock Issuance, subject to the availability of the Court. Section 1.3 Parent Implementation Steps. (a) Parent shall, as soon as reasonably practicable after SEC Clearance and consistent with the provisions set forth in Section 4.6: (i) duly take all lawful action to call, give written notice of, convene and hold the Parent Meeting; (ii) in consultation with Company, fix and publish a record date for the purposes of determining Parent stockholders entitled to receive notice of and vote at the Parent Meeting and give notice to Company of the Parent Meeting; (iii) allow Company’s Representatives and legal counsel to attend the Parent Meeting; (iv) not adjourn, postpone or cancel (or propose or permit the adjournment, postponement or cancellation of) the Parent Meeting without Company’s prior written consent, which written consent shall not be unreasonably withheld, conditioned or delayed, except pursuant to and in accordance with Section 4.6(b) or as otherwise expressly permitted under this Agreement; (v) subject to the terms of this Agreement, solicit proxies in favor of the Stock Issuance by Parent, including, if reasonably requested by Company, using the services of dealers and proxy solicitation firms to solicit proxies in favor of the approval of the Stock Issuance (which costs shall be borne by Parent); and (vi) at the reasonable request of Company from time to time, promptly provide Company with a list (in both written and electronic form as may be provided by Parent’s registrar and transfer agent) of: (A) the registered Parent stockholders, together with their addresses and respective holdings of Parent Common Stock and (B) to the extent

15 available to Parent, participants in book-based systems and non-objecting beneficial owners of Parent Common Stock, together with their addresses and respective holdings of Parent Common Stock. Parent shall from time to time require that its registrar and transfer agent furnish Company with such additional information, including updated or additional lists of Parent stockholders and lists of holdings and other assistance as Company may reasonably request. Section 1.4 Dissenting Shares. Prior to the Company Meeting, Company shall provide Parent with prompt (and in no event later than two (2) Business Days after receipt of notice) written notice of any purported exercise or withdrawal of Dissent Rights by any shareholder of Company that is received by or on behalf of Company or any of its Representatives in relation to the Arrangement Resolution. Subject to applicable Law, Company shall provide Parent with the opportunity to participate in and direct all negotiations and proceedings with respect to any exercise of such Dissent Rights. Company shall not make any payment with respect to, settle or offer to settle, or otherwise negotiate any exercise of such Dissent Rights without the prior written consent of Parent. Section 1.5 Closing. (a) Subject to satisfaction or waiver of all of the conditions set forth in Article 5, the Arrangement shall be effective at the Effective Time on the Closing Date and will have all of the effects provided by applicable Law, including the BCBCA. (b) As soon as reasonably practicable, but in any event not later than five (5) Business Days after the last of the conditions set forth in Article 5 (excluding conditions that, by their terms, cannot be satisfied until the Closing Date, but subject to the satisfaction of such conditions) have been satisfied or, waived by the applicable Party in whose favor the condition is, or at such later date as is mutually agreed to in writing by the Parties, the Parties will complete the Arrangement, and the Arrangement shall become effective at the Effective Time and the steps comprising the Plan of Arrangement will be deemed to occur in the order, at the times, and in the manner set forth therein. Section 1.6 Directors and Officers of Parent. From and after the Effective Time, until successors are duly elected or appointed and qualified in accordance with applicable Law, (a) the members of the Parent Board immediately prior to the Effective Time shall be the members of the Parent Board and (b) the officers of Parent immediately prior to the Effective Time shall be the officers of Parent. Section 1.7 U.S. Securities Act Matters. The Parties agree that the Arrangement will be carried out with the intention, and will use their reasonable best efforts to ensure that, all Parent Issued Securities issued on completion of the Arrangement pursuant to this Agreement and the Plan of Arrangement will be issued by Parent in reliance on the exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) thereunder. In order to ensure the availability of the exemption under Section 3(a)(10) of the U.S. Securities Act and to facilitate the Parties compliance with other U.S. Securities Laws, the Parties agree that the Arrangement will be carried out on the following basis:

16 (a) the Arrangement will be subject to the approval of the Court, including an affirmative determination of procedural and substantive fairness; (b) prior to the issuance of the Interim Order, the Court will be advised of the intention of Parent to rely on the exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) of the U.S. Securities Act prior to the hearing required to approve the Arrangement; (c) prior to the issuance of the Interim Order, Company will file with the Court a draft copy of the proposed text of the Company Circular together with any other documents required by Law in connection with the Company Meeting; (d) the Court will be required to satisfy itself as to the fairness of the Arrangement to the holders of Company Common Shares (the “Company Issued Securities”), subject to the Arrangement; (e) Company will ensure that: (i) holders of Company Common Shares entitled to receive Parent Common Stock on completion of the Arrangement will be given adequate notice advising them of their right to attend the hearing of the Court to give approval of the Arrangement and providing them with sufficient information necessary for them to exercise that right; and (ii) holders of Company Stock Options as of the date of this Agreement will be given adequate notice advising them of their right to attend and observe the hearing of the Court; (f) the holders of Company Issued Securities entitled to receive Parent Issued Securities pursuant to the Arrangement will be advised that the Parent Issued Securities issued pursuant to the Arrangement have not been registered under the U.S. Securities Act and will be issued by Parent in reliance on the exemption from registration under Section 3(a)(10) of the U.S. Securities Act; (g) the Final Order approving the Arrangement that is obtained from the Court will expressly state that the Court is satisfied that the Arrangement is procedurally and substantively fair to the holders of Company Issued Securities; (h) the Interim Order approving the Company Meeting will specify that each holder of Company Common Shares will have the right to appear before the Court at the hearing of the Court to give approval of the Arrangement so long as they enter an appearance within a reasonable time; and (i) the Final Order shall include a statement (which may be in the recitals thereof) to substantially the following effect: “AND UPON being advised that the approval of the Arrangement by this Court will have the effect of providing the basis for an exemption from the registration requirements of the United States Securities Act of 1933, as amended, pursuant to Section 3(a)(10) thereof, with respect to the issuance of securities of Tamboran Resources Corporation pursuant to the Arrangement.”

17 Section 1.8 Canadian Securities Laws Matters. The Parties agree that the Arrangement will be carried out with the intention that, and each shall use reasonable best efforts to ensure that, all Parent Issued Securities issued on completion of the Arrangement pursuant to this Agreement and the Plan of Arrangement will be issued by Parent in reliance on exemptions from the prospectus requirements of applicable Canadian Securities Laws. Section 1.9 Payment of Consideration. Australia Sub and U.S. Sub (or Parent, on behalf of Australia Sub and U.S. Sub, as the case may be) will, following receipt by Company of the Final Order and prior to the Effective Time, deposit in escrow, or cause to be deposited in escrow (the terms and conditions of such escrow to be satisfactory to the Parties, acting reasonably) (a) with the Depositary sufficient shares of Parent Common Stock to satisfy the aggregate Stock Consideration issuable pursuant to the Arrangement and the Company shall have received written confirmation (e-mail being sufficient) from the Depositary of the receipt of such Stock Consideration by the Depositary; and (b) with the Blocked Account Agent, sufficient cash to satisfy the aggregate Cash Consideration payable pursuant to the Arrangement, and the Company shall have received written confirmation (e-mail being sufficient) from the Blocked Account Agent of the receipt of such Cash Consideration by the Blocked Account Agent. For the avoidance of doubt, Cash Consideration owed to Company in which any Person that is the target of Sanctions, including (w) any Person listed in any Sanctions-related list of designated Persons maintained by OFAC or the U.S. Department of State, the United Nations Security Council, the European Union, any Member State of the European Union, or the United Kingdom; (x) any Person operating, organized, or resident in a Sanctioned Country; (y) the government of a Sanctioned Country or the Government of Venezuela; or (z) any Person fifty percent (50%) or more owned or controlled by any such Person or Persons or acting for or on behalf of such Person or Persons (a “Sanctioned Person”), holds an interest will be placed in a blocked account at the Blocked Account Agent and reported to OFAC as blocked property. Section 1.10 Withholding Rights. Parent, Australia Sub, U.S. Sub, Company and the Depositary and their respective affiliates and agents shall be entitled to deduct and withhold from all distributions or payments otherwise payable to any former Company shareholder or other person (an “Affected Person”) such amounts as any of them is required to deduct and withhold with respect to such payment under the Tax Act, the Code or any provision of any applicable federal, provincial, state, local or foreign Tax Law or treaty, in each case, as amended (a “Withholding Obligation”). To the extent that amounts are so deducted and withheld, such deducted and withheld amounts shall be treated for all purposes hereof as having been paid or delivered to the Affected Person in respect of which such deduction and withholding was made. Parent, Australia Sub, U.S. Sub, Company, and the Depositary and their respective affiliates and agents shall cooperate in good faith with one another and use their respective reasonable best efforts to obtain, upon request, a permitted reduction of or relief from any Withholding Obligation. Parent, Australia Sub, U.S. Sub, Company and the Depositary and their respective affiliates and agents shall also have the right to:withhold and sell, on their own account or through a broker (the “Broker”), and on behalf of any Affected Person; or (b) require the Affected Person to irrevocably direct the sale through a Broker and irrevocably direct the Broker to pay the proceeds of such sale to Company, the Depositary,

18 Australia Sub, U.S. Sub or Parent as appropriate (and, in the absence of such irrevocable direction, the Affected Person shall be deemed to have provided such irrevocable direction); such number of shares of Parent Common Stock issued or issuable to such Affected Person pursuant to the Agreement as is necessary to produce sale proceeds (after deducting commissions payable to the Broker and other reasonable costs and expenses) sufficient to fund any Withholding Obligation. Any such sale of shares of Parent Common Stock shall be effected in good faith at prevailing market prices employing commercially reasonable practices on a public market and as soon as practicable following the Effective Date. None of Parent, Australia Sub, U.S. Sub, Company, the Depositary or the Broker or their respective affiliates and agents will be liable for any loss arising out of any sale of such shares of Parent Common Stock if such sale is made in accordance with this Section 1.10. ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF COMPANY Except as set forth in the applicable section or subsection of the disclosure letter dated as of the date of this Agreement and delivered by Company to Parent, Australia Sub and U.S. Sub on or prior to the entry into this Agreement (the “Company Disclosure Letter”) and except as disclosed in the Company Securities Documents (including all exhibits and schedules thereto and documents incorporated by reference therein) filed with or furnished to Canadian Securities Authorities and available on SEDAR+, since December 31, 2023 and prior to the date of this Agreement (excluding any disclosures set forth or referenced in any risk factor section or in any other section, in each case, to the extent they are forward-looking statements or cautionary, predictive, non-specific or forward-looking in nature (but, for clarity, including any historical factual information contained within such headings, disclosure or statements)), Company represents and warrants to Parent, Australia Sub and U.S. Sub as follows: Section 2.1 Organization, Standing and Power. Each of Company and the Subject Entities is a corporation, partnership, limited liability company or other entity duly organized, as the case may be, validly existing and in good standing under the Laws of its jurisdiction of incorporation, continuation or organization, with all requisite entity power and authority to own, lease and operate its assets and properties and to carry on its business as now being conducted. Each of Company and the Subject Entities is duly qualified or licensed and in good standing to do business in each jurisdiction in which the business it is conducting, or the operation, ownership or leasing of its assets or properties, makes such qualification or license necessary, other than where the failure to so qualify, license or be in good standing would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect on Company and the Subject Entities, taken as a whole (a “Company Material Adverse Effect”). Company has heretofore made available to Parent in the Company Data Room complete and correct copies of its Organizational Documents and the Organizational Documents of each of the Subject Entities, each as amended prior to the execution of this Agreement, and each as made available to Parent is in full force and effect, and neither Company nor any of the Subject Entities is in violation of any of the provisions of such Organizational Documents. Section 2.2 Capital Structure.

19 (a) As of the date of this Agreement, the authorized capital stock of Company consists of (i) an unlimited number of Company Common Shares. At the close of business on September 26, 2025 (the “Measurement Date”) no more than 1,109,141,512 Company Common Shares were issued and outstanding. (b) Except as set forth in Schedule 2.2(b) of the Company Disclosure Letter, all Subject Interests are owned by Company or a Subject Entity, are free and clear of all Encumbrances, other than Permitted Encumbrances, and have been duly authorized, validly issued, fully paid and nonassessable and all such shares or equity ownership interests are set forth in Schedule 2.2(b) of the Company Disclosure Letter. There are not any shareholder agreements, voting trusts or other agreements to which Company or any of the Subject Entities is a party or by which it is bound relating to the voting of any shares of capital stock or other equity interest of Company or any of the Subject Entities. Since December 31, 2023, Company has not waived any “standstill” or similar provision applicable to the Company Common Shares or other equity interests in Company or the Subject Entities, whether at the request of a third party or otherwise. No Subject Entity owns any Company Common Shares. (c) As of the date of this Agreement, neither Company nor any of the Subject Entities has any (i) interests in a joint venture or, directly or indirectly, equity securities or other similar equity interests in any Person or (ii) obligations, whether contingent or otherwise, to consummate any additional investment in any Person, in each case, other than the Subject Entities and the joint ventures listed on Schedule 2.2(c) of the Company Disclosure Letter. (d) Schedule 2.2(d) of the Company Disclosure Letter sets forth a true, correct and complete list of the holders of all Company Stock Options as of the date of this Agreement, indicating, with respect to each Company Stock Option, the number of Company Common Shares subject to such Company Stock Option, the date of grant, the vesting schedule, and the expiration date thereof. All Company Stock Options have been granted in both documentary and operational compliance in accordance with the terms of the applicable equity incentive plan, all applicable Laws, including all Applicable Securities Laws. Section 2.3 Authority; No Violations. (a) Company has all requisite corporate power and authority to execute and deliver this Agreement and, subject to obtaining the approval by the Court of the Interim Order and the Final Order and obtaining the Company Requisite Shareholder Vote to approve the Arrangement Resolution, to perform its obligations hereunder. The execution and delivery of this Agreement by Company and the consummation by Company of the Transactions have been duly authorized by all necessary corporate action on the part of Company, subject to obtaining the Company Requisite Shareholder Vote to approve the Arrangement Resolution and obtaining the approval by the Court of the Interim Order and the Final Order. This Agreement has been duly executed and delivered by Company, and assuming the due and valid execution of this Agreement by Parent, Australia Sub and U.S. Sub, constitutes a valid and binding obligation of Company enforceable against Company in accordance with its terms, subject, as to enforceability, to bankruptcy, insolvency, reorganization, moratorium and other Laws of general applicability relating to or affecting creditors’ rights and to general principles of equity regardless of whether

20 such enforceability is considered in a Proceeding in equity or at Law (collectively, “Creditors’ Rights”). The Company Board has unanimously (i) determined that the Arrangement is in the best interests of Company and is fair to the holders of the Company Common Shares, (ii) approved this Agreement and the Arrangement, and (iii) resolved to recommend for approval (A) the Arrangement Resolution, to the holders of the outstanding Company Common Shares, and (B) the Plan of Arrangement, to the Court (such recommendation described in this clause (iii), the “Company Board Recommendation”). The Company Requisite Shareholder Vote is the only vote of the holders of any class or series of the Company Capital Stock or any other security of Company or any of the Subject Entities necessary to approve and adopt this Agreement and the Transactions, including the Arrangement. (b) The execution, delivery and performance of this Agreement does not, and the consummation of the Transactions will not (i) contravene, conflict with or result in a breach or violation of any provision of the Organizational Documents of Company (assuming the Company Requisite Shareholder Vote is obtained) or any Subject Entity, (ii) with or without notice, lapse of time or both, result in a breach or violation of, a termination (or right of termination) of or default under, the creation or acceleration of any obligation or the loss of a benefit under, or result in the creation of any Encumbrance upon any of the properties or assets of Company or any of the Subject Entities under, any provision of any loan or credit agreement, note, bond, mortgage, indenture, lease or other agreement, permit, franchise or license to which Company or any of the Subject Entities is a party or by which it or any of the Subject Entities or its or their respective properties or assets are bound, or (iii) assuming the Consents referred to in Section 2.4 are duly and timely obtained or made and the Company Requisite Shareholder Vote has been obtained and the Court has granted the Interim Order and the Final Order, contravene, conflict with or result in a breach or violation of any Law applicable to Company or any of the Subject Entities or any of their respective properties or assets, other than, in the case of clauses (ii) and (iii), any such contraventions, conflicts, violations, defaults, acceleration, losses, or Encumbrances that would not reasonably be expected to have, individually or in the aggregate, a Company Material Adverse Effect. Section 2.4 Consents. No Consent from or with any Governmental Entity is required to be obtained or made by Company or any of the Subject Entities in connection with the execution, delivery and performance of this Agreement by Company or the consummation by Company of the Transactions and neither Company nor any of the Subject Entities is required to submit any notice, report or other filing with any Governmental Entity in connection with the execution, delivery or performance of this Agreement or the consummation of the Transactions, except for: (a) filings as required by Applicable Securities Laws and Regulatory Laws and obtaining the Regulatory Approvals, (b) the filing and recordation of appropriate documents as required by the BCBCA, and (c) filings that would not prevent or materially delay the consummation of the Transactions. Section 2.5 Securities Documents; Financial Statements. (a) Since December 31, 2023 (the “Applicable Date”), Company has filed or furnished with Canadian Securities Authorities and AIM, on a timely basis, all forms, reports, certifications, schedules, statements and documents required to be filed or furnished under Applicable Securities Laws (the “Company Securities Documents”). As of their respective dates,

21 each of the Company Securities Documents, as amended, complied, or if not yet filed or furnished, will comply, as to form in all material respects with the Applicable Securities Laws, and none of the Company Securities Documents contained, when filed (or, if amended prior to the entry into this Agreement, as of the date of such amendment with respect to those disclosures that are amended), or if filed with or furnished to the applicable Securities Authorities subsequent to the date of this Agreement, will contain any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading. (b) The financial statements of Company included in the Company Securities Documents, including all notes and schedules thereto, complied, or, in the case of Company Securities Documents filed after the entry into this Agreement, will comply in all material respects, when filed (or if amended prior to the date of this Agreement, as of the date of such amendment) with Applicable Securities Laws with respect thereto, were, or, in the case of Company Securities Documents filed after the date of this Agreement, will be prepared in accordance with IFRS applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto or, in the case of the unaudited statements, as permitted by applicable Canadian Securities Laws) and fairly present in all material respects in accordance with applicable requirements of IFRS (subject, in the case of the unaudited statements, to normal year-end audit adjustments) the financial position of Company and its consolidated Subsidiaries as of their respective dates and the results of operations and the cash flows of Company and its consolidated Subsidiaries for the periods presented therein. (c) Company has established and maintains a system of internal control over financial reporting and disclosure controls and procedures (as such terms are defined in Canadian Securities Laws); such disclosure controls and procedures are designed to ensure that material information relating to Company, including its consolidated Subsidiaries, required to be disclosed by Company in the reports that it files or submits under Applicable Securities Laws is accumulated and communicated to Company’s principal executive officer and its principal financial officer to allow timely decisions regarding required disclosure; and such disclosure controls and procedures are effective to ensure that information required to be disclosed by Company in the reports that it files or submits under Applicable Securities Laws is recorded, processed, summarized and reported within the time periods specified in Applicable Securities Laws, and further designed and maintained to provide reasonable assurance regarding the reliability of Company’s financial reporting and the preparation of Company financial statements for external purposes in accordance with IFRS. There is no significant deficiency or material weakness in the design or operation of internal control over financial reporting (as defined in Canadian Securities Laws) utilized by Company or its Subsidiaries, and, since December 31, 2023, there has not been, any illegal act or fraud, whether or not material, that involves management or other employees who have a significant role in Company’s internal controls. The principal executive officer and the principal financial officer of Company have made all certifications required by Applicable Securities Laws with respect to the Company Securities Documents, and the statements contained in such certifications were complete and correct in all material respects as of the dates they were made.