EX-10.1

Published on September 30, 2025

Exhibit 10.1 SUPPORT AND VOTING AGREEMENT THIS AGREEMENT made as of the 30th day of September, 2025. B E T W E E N : The person executing this Agreement as the “Holder” (hereinafter referred to as the “Holder”), - and - TAMBORAN RESOURCES CORPORATION a corporation existing under the laws of the State of Delaware, U.S.A. (hereinafter referred to as the “Purchaser”). WHEREAS the Holder is, directly or indirectly, the registered and/or beneficial owner of, or exercises control or direction over, the securities of Falcon Oil & Gas Ltd. (the “Company”) set forth on Schedule A hereto (together with any additional securities of the Company which the Holder may, directly or indirectly, acquire registered and/or beneficial ownership of, or control or direction over, after the date hereof, the “Subject Securities”); AND WHEREAS the Purchaser is concurrently herewith entering into an arrangement agreement (the “Arrangement Agreement”) with Tamboran (Beetaloo) Pty Ltd, Tamboran Resources Investments Holding Corporation and the Company pursuant to which, and subject to the terms and conditions set forth therein, they will, among other things, implement the Arrangement, the result of which will be, among other things, the Purchaser acquiring all of the issued and outstanding equity interests of the Company’s subsidiaries; AND WHEREAS this Agreement sets out the terms and conditions of the agreement of the Holder to: (a) vote or cause to be voted all of the Subject Securities in favour of the Arrangement, including the Arrangement Resolution, and any other matter that could reasonably be expected to facilitate the Arrangement; and (b) to abide by the restrictions and covenants set forth herein; AND WHEREAS the Purchaser is relying on the covenants, representations and warranties of the Holder set forth in this Agreement in connection with its execution and delivery of the Arrangement Agreement; NOW THEREFORE this Agreement witnesses that, in consideration of the premises and the covenants and agreement herein contained, the parties hereto agree as follows: ARTICLE 1 INTERPRETATION 1.1 All capitalized terms used but not otherwise defined herein shall have the respective meaning ascribed to them in the Arrangement Agreement. 1.2 Except as may be otherwise specifically provided in this Agreement and unless the context otherwise requires, in this Agreement: – 1 –

(a) the terms “Agreement”, “this Agreement”, “the Agreement”, “hereto”, “hereof”, “herein”, “hereby”, “hereunder” and similar expressions refer to this Agreement in its entirety and not to any particular provision hereof; (b) references to an “Article” or “Section” followed by a number refer to the specified Article or Section of this Agreement; (c) the division of this Agreement into articles and sections and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement; (d) words importing the singular number only shall include the plural and vice versa and words importing the use of any gender shall include all genders; (e) the word “including” is deemed to mean “including without limitation”; (f) the terms “party” and “the parties” refer to a party or the parties to this Agreement; and (g) any reference to any contract or agreement, including this Agreement and the Arrangement Agreement, means such contract or agreement as amended, modified, replaced or supplemented from time to time. 1.3 Any time period within which any action is to be taken hereunder shall be calculated excluding the day on which the period commences and including the day on which the period ends. Whenever any action is required to be taken or period of time is to expire on a day other than a Business Day, such action shall be taken or period shall expire on the next following Business Day. ARTICLE 2 CERTAIN COVENANTS OF THE HOLDER 2.1 The Holder hereby irrevocably and unconditionally covenants and agrees that he, she or it shall and shall cause the registered holder of the Subject Securities as set forth in Schedule A to, from the date hereof until the termination of this Agreement pursuant to Article 5, except in accordance with the terms of this Agreement or the Arrangement Agreement or pursuant to the Arrangement, and subject to Section 7.1: (a) not option, offer, sell, assign, transfer, tender, exchange, dispose of, pledge, encumber, grant a security interest in, hypothecate or otherwise convey or enter into any forward sale, repurchase agreement or other monetization transaction with respect to any of the Subject Securities, or any right or interest therein (legal or equitable), to any Person or group or agree to do any of the foregoing; (b) not grant or agree to grant any proxy, power of attorney or other right to vote the Subject Securities, or enter into any voting agreement, voting trust, vote pooling or other agreement with respect to the right to vote, or give any consent or approval of any kind with respect to any of the Subject Securities or relinquish or modify the Holder’s right to exercise control or direction over or to vote any Subject Securities or agree to do any of the foregoing; (c) exercise the voting rights attaching to the Subject Securities to oppose any proposed action by the Company, its shareholders, and of the Subsidiaries of the Company or any other – 2 –

person which action could reasonably be expected to prevent or delay the completion of, the Arrangement and the other transactions contemplated by the Arrangement Agreement and this Agreement; (d) promptly notify the Purchaser of any new Subject Securities acquired by the Holder after the execution of this Agreement, and the Holder acknowledges that any such new Subject Securities will be subject to the terms of this Agreement as though owned by the Holder on the date of this Agreement; (e) not requisition or join in any requisition of any meeting of the Company, without the prior written consent of the Purchaser; (f) irrevocably waive, and not exercise any rights of dissent or appraisal or any other security holder rights or remedies provided under any Law or otherwise in connection with the Arrangement; (g) not take any other action of any kind, directly or indirectly, which might reasonably be regarded as likely to reduce the success of, or delay or interfere with the completion of, the Arrangement and the other transactions contemplated by the Arrangement Agreement and this Agreement; (h) not vote or cause to be voted any of the Subject Securities in respect of any proposed action by the Company or its shareholders or Affiliates or any other person or group in a manner that might reasonably be regarded as likely to reduce the success of, or delay or interfere with the completion of, the Arrangement and the other transactions contemplated by the Arrangement Agreement and this Agreement; (i) not do indirectly that which he, she or it may not do directly by the terms of this Article 2; and (j) not take any action, or allow any other Person to take any action, that would cause any of the representations and warranties of the Holder in Section 4.1 to become untrue or incorrect. ARTICLE 3 AGREEMENT TO VOTE 3.1 The Holder hereby irrevocably and unconditionally covenants and agrees, subject to Canadian Securities Laws, including the requirements of MI 61-101, and Section 7.1, from the date hereof until the termination of this Agreement pursuant to Article 5: (a) to vote or to cause to be voted the Subject Securities (which have a right to vote at such meeting) at any meeting of the Company, including the Company Meeting, in favour of the Arrangement, including the Arrangement Resolution, and any other matter that could reasonably be expected to facilitate the Arrangement; (b) to vote or to cause to be voted the Subject Securities (which have a right to vote at such meeting) at any meeting of the holders of common shares in the capital of the Company (the “Company Common Shares”) (including in connection with any separate vote of any sub-group of shareholders of the Company that may be required to be held and of which sub-group the Holder forms a part) against any Acquisition Proposal and any other matter – 3 –

that could reasonably be expected to delay, prevent or frustrate the successful completion of the Arrangement; and (c) no later than five Business Days prior to the date of the Company Meeting, that the Holder shall deliver or cause to be delivered to the Company or the intermediary through which the Holder holds its beneficial interest Company Common Shares, with a copy to the Purchaser concurrently, duly completed and executed forms of proxy or voting instruction forms directing the holder of such forms of proxy or voting instruction forms to vote in favour of the Arrangement, including the Arrangement Resolution, and any matter that could reasonably be expected to facilitate the Arrangement, such forms of proxy or voting instruction forms shall name those individuals as may be designated by the Company in the Company Circular and shall not be revoked. ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF THE HOLDER 4.1 The Holder represents and warrants to the Purchaser as follows, and acknowledges that the Purchaser is relying upon such representations and warranties in connection with the entering into of this Agreement and the Arrangement Agreement: (a) the Holder has the power and capacity to execute and deliver this Agreement, and to perform his, her or its obligations hereunder; (b) the Holder is the sole legal and beneficial owner of the number of Subject Securities listed opposite the Holder’s name on Schedule A to this Agreement; (c) this Agreement has been duly executed and delivered by the Holder and, assuming the due authorization, execution and delivery by the counterparties hereto, constitutes a legal, valid and binding obligation, enforceable by the counterparties hereto against the Holder in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency and other laws affecting the rights of creditors generally and except that equitable remedies such as specific performance and injunction may be granted only in the discretion of a court of competent jurisdiction; (d) (i) the registered and/or beneficial ownership of the number of Subject Securities are as set out in Schedule A of this Agreement, (ii) the only securities of the Company owned, directly or indirectly, or over which control or direction is exercised, by the Holder on the date hereof are those listed on Schedule A of this Agreement, (iii) no Person has any agreement or option, or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option, for the purchase, acquisition or transfer of any of the Subject Securities or any interest therein or right thereto, including any right to vote, except pursuant to the Arrangement Agreement and this Agreement, and (iv) the Holder does not have any agreement or option, or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option, for the purchase, acquisition or transfer of any of additional securities of the Company or any interest therein or right thereto, other than pursuant to the Arrangement Agreement or this Agreement; (e) the Holder has, and immediately prior to the Effective Time the Holder will continue to have, the sole right to vote or cause the voting of all of the Subject Securities; – 4 –

(f) no individual or entity has any agreement or option, or any right or privilege (whether by Applicable Law, pre-emptive or contractual) capable of becoming an agreement or option, for the purchase, acquisition or transfer of any of the Subject Securities or any interest therein or right thereto, including without limitation any right to vote, except the Purchaser pursuant to this Agreement; (g) the execution, delivery and performance by the Holder of this Agreement and the other transactions contemplated hereby, do not and will not (or would not with the giving of notice, the lapse of time or the happening of any other event or condition): (i) result in a breach or a violation of, or conflict with or result in a default under, or give rise to any rights under (including requiring notice or consent) allow any other Person to exercise any rights under, any of the terms or provisions of: (A) any judgment, decree, order or award of any court, Governmental Entity or arbitrator having jurisdiction over the Holder; or (B) any Contracts to which the Holder or the Holder’s Affiliates is a party except for which would not, individually or the aggregate, be reasonably expected to have a material adverse effect on the ability of the Holder to perform its obligations hereunder; (ii) result in the violation of any Laws; and (iii) result in the creation or imposition of any Lien upon any of the Subject Securities; and (h) there are no Proceedings in progress or pending or, to the knowledge of the Holder, threatened against the Holder or any of the Holder’s Affiliates that would adversely affect in any manner (i) the ability of the Holder to enter into this Agreement and to perform its obligations hereunder or (ii) the title of the Holder to any of the Subject Securities. 4.2 The representations and warranties of the Holder set forth in Section 4.1 shall not survive the completion of the Arrangement, and shall expire and be terminated on the date on which the Arrangement Agreement is terminated in accordance with its terms. ARTICLE 5 TERMINATION 5.1 This Agreement shall be effective from and after the date hereof until the termination of this Agreement in accordance with its terms. This Agreement shall be automatically terminated upon the earliest of: (a) the collective written agreement among the Purchaser and the Holder; (b) the Effective Time; and (c) the date on which the Arrangement Agreement is terminated in accordance with its terms, – 5 –

provided, however, that any such termination shall not relieve any party of liability for any breach of any representation, warranty or covenant in this Agreement or fraud arising prior to such termination, and shall not prejudice the rights of any party as a result of any such breach or fraud. ARTICLE 6 DISCLOSURE 6.1 The Holder irrevocably and unconditionally: (a) consents to the details of this Agreement being set out in the circular in respect of the Arrangement and this Agreement being made publicly available, including by filing on SEDAR+, as may be required pursuant to Canadian Securities Laws; (b) consents to and authorizes the publication and disclosure by the Company or the Purchaser of the Holder’s identity and holding of the Subject Securities, the nature of the Holder’s commitments and obligations under this Agreement and any other information, in each case that the Company or the Purchaser reasonably determines is required to be disclosed by Law in any press release, the circular in respect of the Arrangement or any other disclosure document in connection with the Arrangement and any transactions contemplated by the Arrangement Agreement; (c) agrees promptly to give to the Company and/or the Purchaser any information it may reasonably require for the preparation of any such disclosure documents; and (d) agrees to promptly notify the Company and the Purchaser of any required corrections with respect to any written information supplied by it specifically for use in any such disclosure document, if and to the extent that any such information shall have become false or misleading in any material respect. Except as contemplated by the immediately preceding sentence and as otherwise required by Law, the Holder shall not make any public announcement or statement with respect to this Agreement without the approval of the Company and the Purchaser, which shall not be unreasonably withheld or delayed. ARTICLE 7 GENERAL 7.1 The Purchaser acknowledges that the Holder is bound hereby solely in his or her capacity as a direct or indirect security holder of the Company and nothing in this Agreement shall or shall be interpreted to refer or apply to nor bind the Holder in his or her capacity as a director or officer of the Company or any of its Affiliates. Without limiting the foregoing and notwithstanding any other provision of this Agreement, nothing in this Agreement: (a) shall or shall be interpreted to prohibit, inhibit, limit or otherwise affect any actions or omissions of the Holder solely in his or her capacity as a director or officer of the Company or any of its Affiliates, including exercising any rights under the Arrangement Agreement on behalf of the Company or any of its Affiliates or taking any actions or omitting to take any actions permitted thereby on behalf of the Company or any of its Affiliates, and all such actions and omissions shall be deemed not to be a breach of this Agreement by the Holder acting in his or her capacity as a security holder, or (b) shall or shall be interpreted to prohibit, limit or restrict the Holder from taking any action or omitting to take any action in furtherance of his or her fiduciary duties as a director or officer of the Company or any of its Affiliates. 7.2 The Holder shall, from time to time hereafter and upon any reasonable request of the Company and/or the Purchaser, promptly do, execute, deliver or cause to be done, executed and delivered, all further acts, documents and things as may be required or necessary for the purposes of giving effect to this Agreement. 7.3 This Agreement shall not be assignable by any party without the prior written consent of the other parties. This Agreement shall be binding upon and shall enure to the benefit of and be enforceable by each of the parties hereto and their respective successors and permitted assigns. – 6 –

7.4 Any notice, direction or other communication given regarding the matters contemplated by this Agreement (each a “Notice”) must be in writing, sent by personal delivery, courier or electronic mail and addressed as follows: (a) in the case of the Holder: (b) in the case of the Purchaser: Tamboran Resources Corporation Suite 01, Level 39, Tower One, International Towers Sydney 100 Barangaroo Avenue, Barangaroo NSW 2000 Attention: E-mail: Eric Dyer Rohan Vardaro with copies to (which shall not constitute notice): Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 Attention: John M. Greer Ryan J. Lynch David J. Miller E-mail: John.Greer@lw.com Ryan.Lynch@lw.com David.Miller@lw.com and Torys LLP 4600, 525 8 Avenue SW Calgary, AB T2P 1G1 Attention: Janan Paskaran E-mail: jpaskaran@torys.com A Notice is deemed to be given and received: (i) if sent by personal delivery or courier, on the date of delivery if it is a Business Day and the delivery was made prior to 4:00 p.m. (local time in place of receipt) and otherwise on the next Business Day; or (ii) if sent by email, the earlier of 24 hours after delivery (unless the sender receives an automated reply indicating a failure of delivery) and when the sender receives an email from the recipient acknowledging receipt, provided that an automatic “read receipt” does – 7 –

not constitute acknowledgment of an email for purposes of this Section 7.4. A party may change its address for service from time to time by providing a Notice in accordance with the foregoing. Any subsequent Notice must be sent to the party at its changed address. Any element of a party’s address that is not specifically changed in a Notice will be assumed not to be changed. Sending a copy of a Notice to a party’s legal counsel as contemplated above is for information purposes only and does not constitute delivery of the Notice to that party. The failure to send a copy of a Notice to legal counsel does not invalidate delivery of that Notice to a party. 7.5 This Agreement shall be interpreted and enforced in accordance with, and the respective rights and obligations of the parties shall be governed by, the laws of the Province of British Columbia and the federal laws of Canada applicable in that province. Each of the parties irrevocably and unconditionally: (a) submits to the exclusive jurisdiction of the courts of the Province of British Columbia over any action or proceeding arising out of or relating to this Agreement; (b) waives any objection that it might otherwise be entitled to assert to the jurisdiction of such courts; and (c) agrees not to assert that such courts are not a convenient forum for the determination of any such action or proceeding. 7.6 The parties agree that irreparable harm would occur for which money damages would not be an adequate remedy at law in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties shall be entitled to injunctive and other equitable relief (including specific performance) to prevent breaches or threatened breaches of this Agreement, and to enforce compliance with the terms of this Agreement, without any requirement for the securing or posting of any bond in connection with the obtaining of any such injunctive or other equitable relief (including specific performance), and no party shall oppose any such application on the basis that the applicant has an adequate remedy at Law, this being in addition to any other remedy to which the parties may be entitled at Law or in equity. The parties acknowledge and agree that the right of injunctive relief and specific enforcement is an integral part of the transactions contemplated by this Agreement and without that right, none of the parties would have entered into this Agreement. 7.7 If any provision of this Agreement is determined by a court of competent jurisdiction to be invalid, illegal or unenforceable in any respect, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not irremediably affected in any manner materially adverse to any party hereto. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties hereto as closely as possible in an acceptable manner to the end that transactions contemplated hereby are fulfilled according to their original tenor to the extent possible. 7.8 This Agreement and the Arrangement Agreement constitute the entire agreement between the parties with respect to the subject matter hereof and supersedes all other prior agreements, understandings, undertakings, negotiations and discussions, whether written or oral. There are no conditions, covenants, agreements, representations, warranties or other provisions, express or implied, collateral, statutory or otherwise, relating to the subject matter hereof except as provided herein and the Arrangement Agreement. 7.9 No amendment or waiver of any provision of this Agreement shall be binding on any party unless consented to in writing by such party. No waiver of any provision of this Agreement shall constitute a waiver of any other provision, nor shall any waiver of any provision of this Agreement constitute a continuing waiver unless otherwise expressly provided. – 8 –

7.10 This Agreement and any document contemplated by or delivered under or in connection with this Agreement may be executed in any number of counterparts (including, in electronic form and/or with electronic signatures), with the same effect as if all parties had executed and delivered the same Agreement or document, and all counterparts shall be construed together to be an original and will constitute one and the same Agreement or document. [Remainder of page black; signature page follows] – 9 –

IN WITNESS WHEREOF the parties have executed this Agreement as of the date first written above. As the Holder: By: Name: Title:

As the Purchaser: TAMBORAN RESOURCES CORPORATION By: Name: Title:

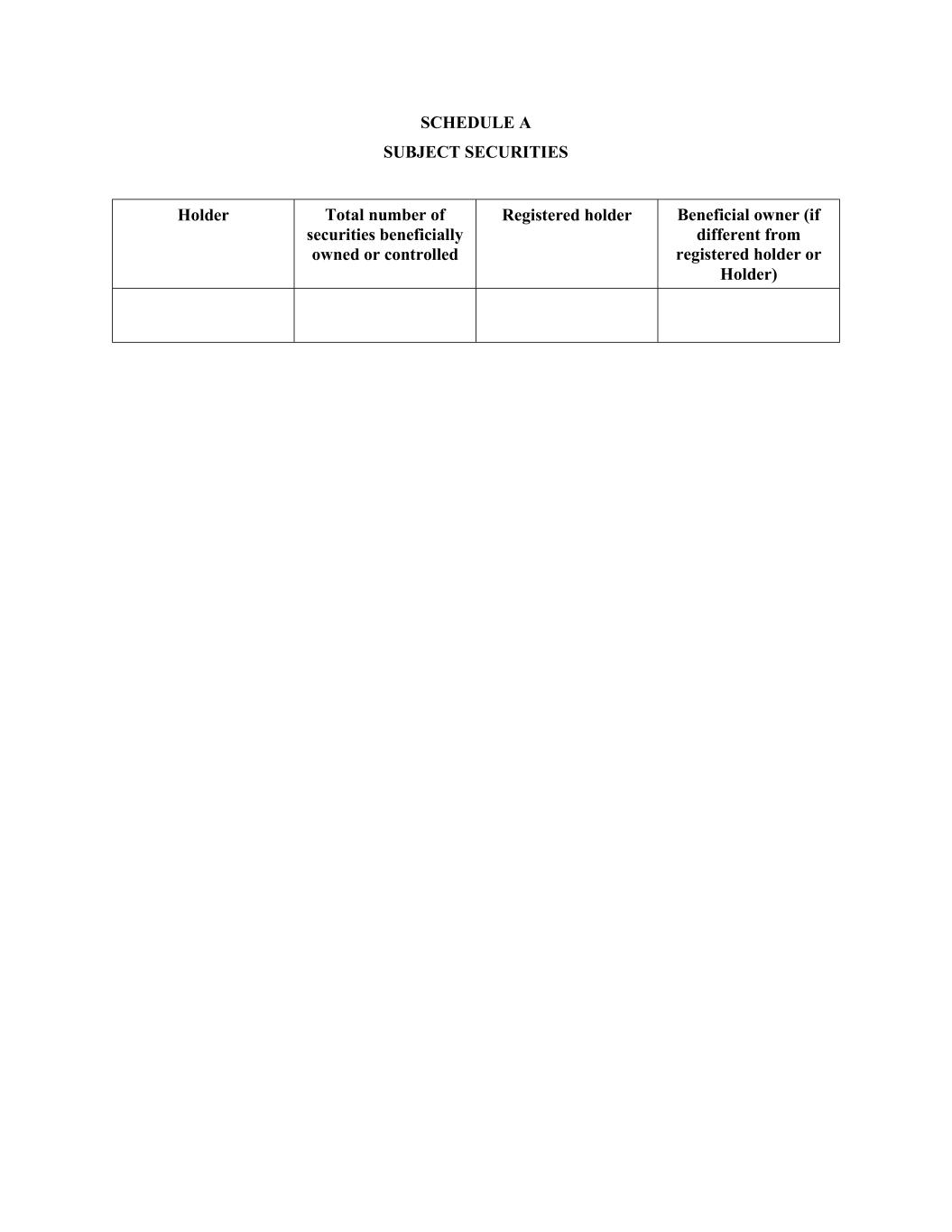

SCHEDULE A SUBJECT SECURITIES Holder Total number of securities beneficially owned or controlled Registered holder Beneficial owner (if different from registered holder or Holder)