EX-99.1

Published on November 12, 2024

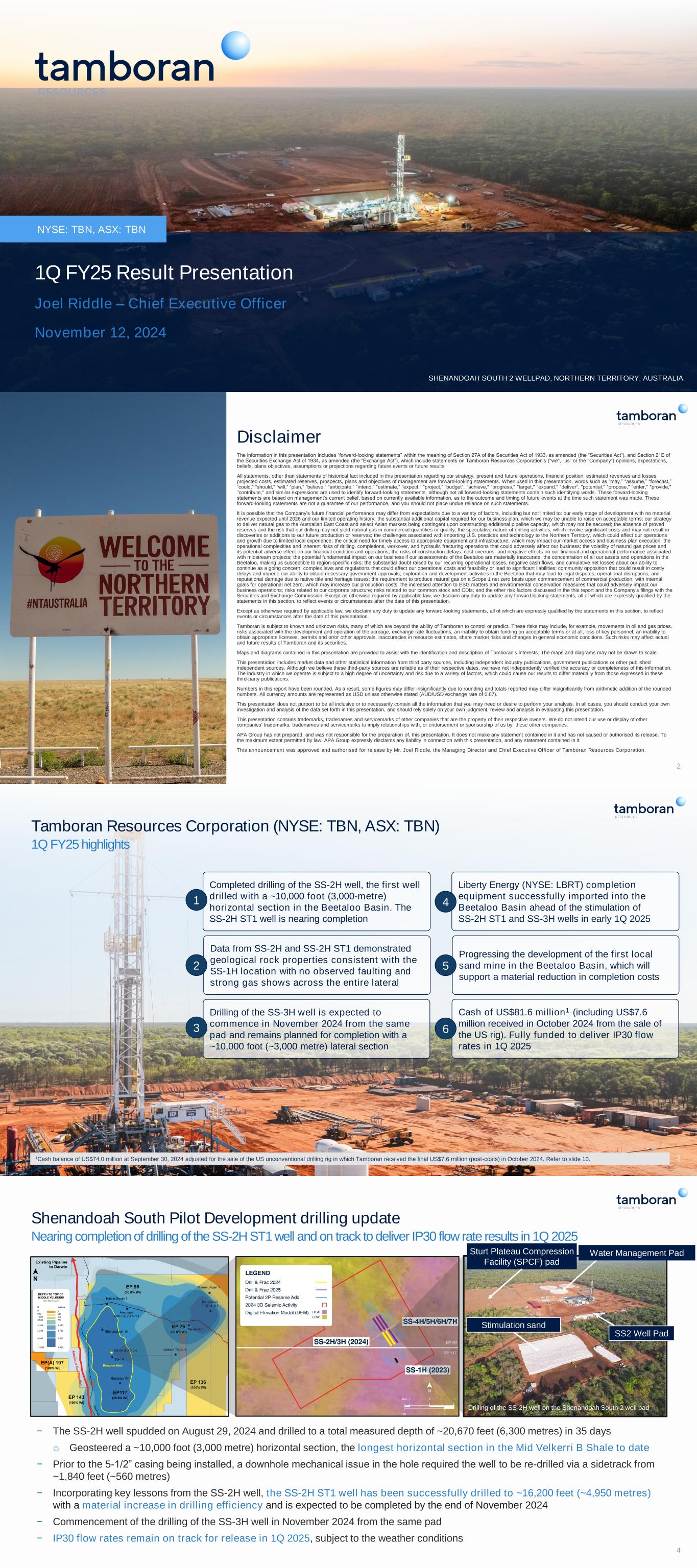

NYSE: TBN, ASX: TBN 1Q FY25 Result Presentation Joel Riddle – Chief Executive Officer November 12, 2024 SHENANDOAH SOUTH 2 WELLPAD, NORTHERN TERRITORY, AUSTRALIA The information in this presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which include statements on Tamboran Resources Corporation's ("we", "us" or the "Company") opinions, expectations, beliefs, plans objectives, assumptions or projections regarding future events or future results. All statements, other than statements of historical fact included in this presentation regarding our strategy, present and future operations, financial position, estimated revenues and losses, projected costs, estimated reserves, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, words such as “may,” “assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget”, "achieve," "progress," "target," "expand," "deliver“, "potential," "propose," "enter," "provide," "contribute," and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events at the time such statement was made. These forward‐looking statements are not a guarantee of our performance, and you should not place undue reliance on such statements. It is possible that the Company’s future financial performance may differ from expectations due to a variety of factors, including but not limited to: our early stage of development with no material revenue expected until 2026 and our limited operating history; the substantial additional capital required for our business plan, which we may be unable to raise on acceptable terms; our strategy to deliver natural gas to the Australian East Coast and select Asian markets being contingent upon constructing additional pipeline capacity, which may not be secured; the absence of proved reserves and the risk that our drilling may not yield natural gas in commercial quantities or quality; the speculative nature of drilling activities, which involve significant costs and may not result in discoveries or additions to our future production or reserves; the challenges associated with importing U.S. practices and technology to the Northern Territory, which could affect our operations and growth due to limited local experience; the critical need for timely access to appropriate equipment and infrastructure, which may impact our market access and business plan execution; the operational complexities and inherent risks of drilling, completions, workover, and hydraulic fracturing operations that could adversely affect our business; the volatility of natural gas prices and its potential adverse effect on our financial condition and operations; the risks of construction delays, cost overruns, and negative effects on our financial and operational performance associated with midstream projects; the potential fundamental impact on our business if our assessments of the Beetaloo are materially inaccurate; the concentration of all our assets and operations in the Beetaloo, making us susceptible to region-specific risks; the substantial doubt raised by our recurring operational losses, negative cash flows, and cumulative net losses about our ability to continue as a going concern; complex laws and regulations that could affect our operational costs and feasibility or lead to significant liabilities; community opposition that could result in costly delays and impede our ability to obtain necessary government approvals; exploration and development activities in the Beetaloo that may lead to legal disputes, operational disruptions, and reputational damage due to native title and heritage issues; the requirement to produce natural gas on a Scope 1 net zero basis upon commencement of commercial production, with internal goals for operational net zero, which may increase our production costs; the increased attention to ESG matters and environmental conservation measures that could adversely impact our business operations; risks related to our corporate structure; risks related to our common stock and CDIs; and the other risk factors discussed in the this report and the Company’s filings with the Securities and Exchange Commission. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Tamboran is subject to known and unknown risks, many of which are beyond the ability of Tamboran to control or predict. These risks may include, for example, movements in oil and gas prices, risks associated with the development and operation of the acreage, exchange rate fluctuations, an inability to obtain funding on acceptable terms or at all, loss of key personnel, an inability to obtain appropriate licenses, permits and or/or other approvals, inaccuracies in resource estimates, share market risks and changes in general economic conditions. Such risks may affect actual and future results of Tamboran and its securities. Maps and diagrams contained in this presentation are provided to assist with the identification and description of Tamboran’s interests. The maps and diagrams may not be drawn to scale. This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, which could cause our results to differ materially from those expressed in these third-party publications. Numbers in this report have been rounded. As a result, some figures may differ insignificantly due to rounding and totals reported may differ insignificantly from arithmetic addition of the rounded numbers. All currency amounts are represented as USD unless otherwise stated (AUD/USD exchange rate of 0.67). This presentation does not purport to be all inclusive or to necessarily contain all the information that you may need or desire to perform your analysis. In all cases, you should conduct your own investigation and analysis of the data set forth in this presentation, and should rely solely on your own judgment, review and analysis in evaluating this presentation. This presentation contains trademarks, tradenames and servicemarks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, tradenames and servicemarks to imply relationships with, or endorsement or sponsorship of us by, these other companies. APA Group has not prepared, and was not responsible for the preparation of, this presentation. It does not make any statement contained in it and has not caused or authorised its release. To the maximum extent permitted by law, APA Group expressly disclaims any liability in connection with this presentation, and any statement contained in it. This announcement was approved and authorised for release by Mr. Joel Riddle, the Managing Director and Chief Executive Officer of Tamboran Resources Corporation. Disclaimer 2 3 Tamboran Resources Corporation (NYSE: TBN, ASX: TBN) 1Q FY25 highlights Completed drilling of the SS-2H well, the first well drilled with a ~10,000 foot (3,000-metre) horizontal section in the Beetaloo Basin. The SS-2H ST1 well is nearing completion Data from SS-2H and SS-2H ST1 demonstrated geological rock properties consistent with the SS-1H location with no observed faulting and strong gas shows across the entire lateral Drilling of the SS-3H well is expected to commence in November 2024 from the same pad and remains planned for completion with a ~10,000 foot (~3,000 metre) lateral section Liberty Energy (NYSE: LBRT) completion equipment successfully imported into the Beetaloo Basin ahead of the stimulation of SS-2H ST1 and SS-3H wells in early 1Q 2025 Progressing the development of the first local sand mine in the Beetaloo Basin, which will support a material reduction in completion costs Cash of US$81.6 million1, (including US$7.6 million received in October 2024 from the sale of the US rig). Fully funded to deliver IP30 flow rates in 1Q 2025 1 2 4 3 5 6 1Cash balance of US$74.0 million at September 30, 2024 adjusted for the sale of the US unconventional drilling rig in which Tamboran received the final US$7.6 million (post-costs) in October 2024. Refer to slide 10. Shenandoah South Pilot Development drilling update Nearing completion of drilling of the SS-2H ST1 well and on track to deliver IP30 flow rate results in 1Q 2025 − The SS-2H well spudded on August 29, 2024 and drilled to a total measured depth of ~20,670 feet (6,300 metres) in 35 days o Geosteered a ~10,000 foot (3,000 metre) horizontal section, the longest horizontal section in the Mid Velkerri B Shale to date − Prior to the 5-1/2” casing being installed, a downhole mechanical issue in the hole required the well to be re-drilled via a sidetrack from ~1,840 feet (~560 metres) − Incorporating key lessons from the SS-2H well, the SS-2H ST1 well has been successfully drilled to ~16,200 feet (~4,950 metres) with a material increase in drilling efficiency and is expected to be completed by the end of November 2024 − Commencement of the drilling of the SS-3H well in November 2024 from the same pad − IP30 flow rates remain on track for release in 1Q 2025, subject to the weather conditions 4 Stimulation sand Sturt Plateau Compression Facility (SPCF) pad Water Management Pad SS2 Well Pad Drilling of the SS-2H well on the Shenandoah South 2 well pad

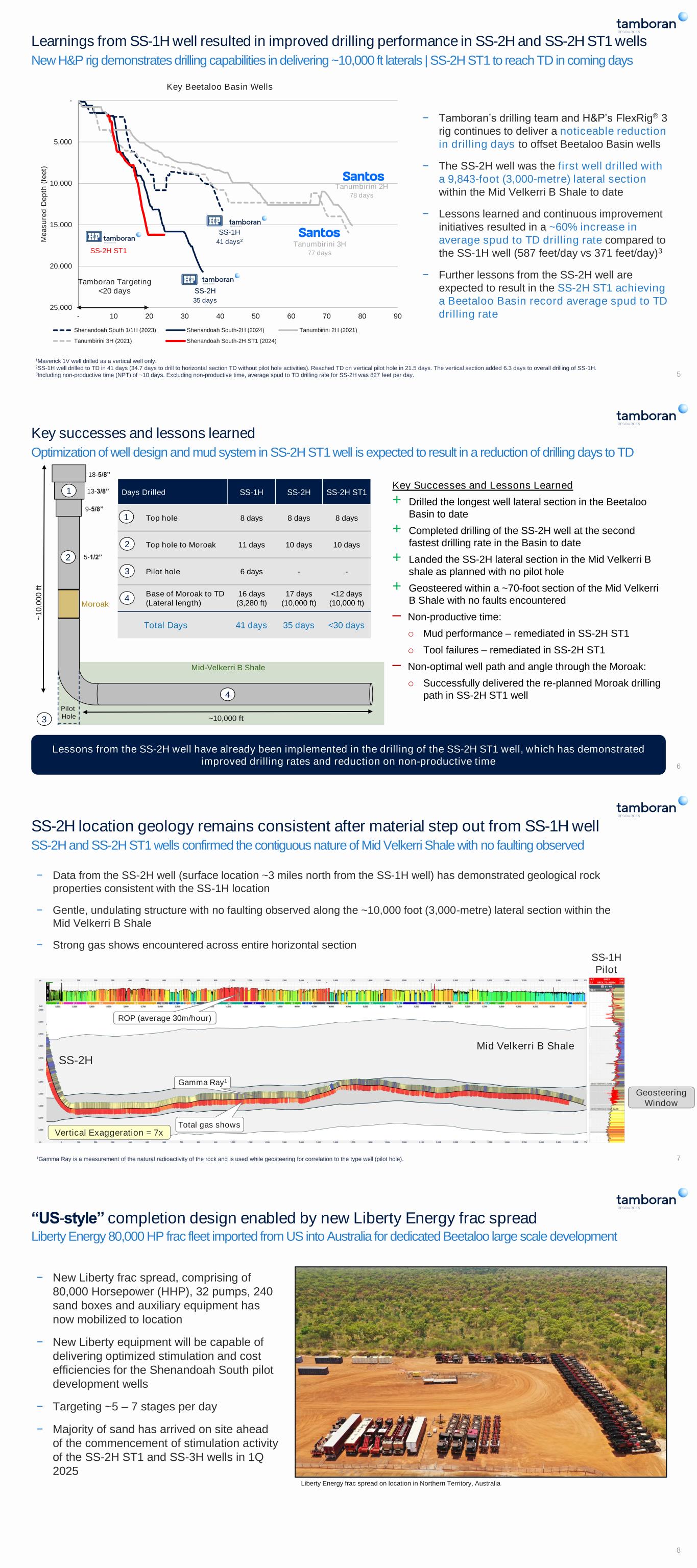

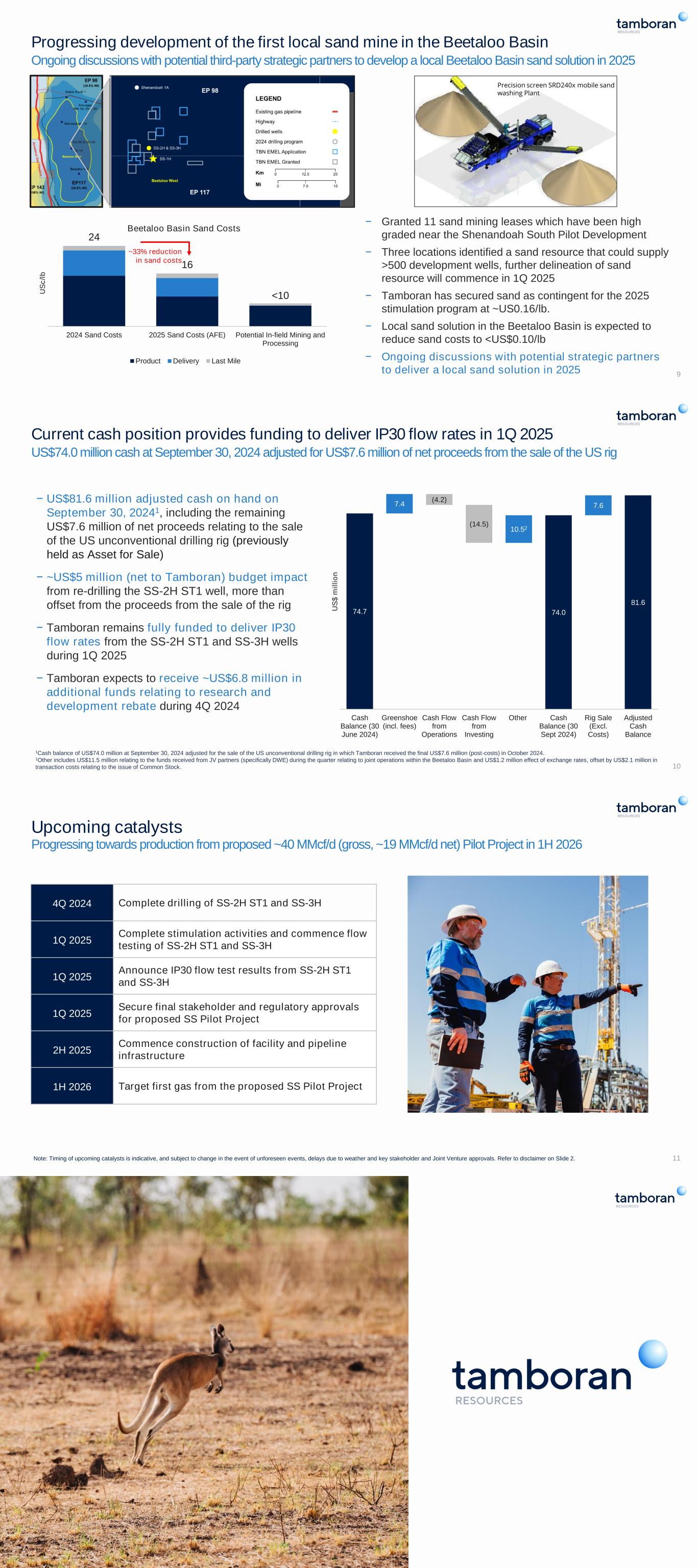

- 5,000 10,000 15,000 20,000 25,000 - 10 20 30 40 50 60 70 80 90 M e a s u re d D e p th ( fe e t) Key Beetaloo Basin Wells Shenandoah South 1/1H (2023) Shenandoah South-2H (2024) Tanumbirini 2H (2021) Tanumbirini 3H (2021) Shenandoah South-2H ST1 (2024) 5 − Tamboran’s drilling team and H&P’s FlexRig® 3 rig continues to deliver a noticeable reduction in drilling days to offset Beetaloo Basin wells − The SS-2H well was the first well drilled with a 9,843-foot (3,000-metre) lateral section within the Mid Velkerri B Shale to date − Lessons learned and continuous improvement initiatives resulted in a ~60% increase in average spud to TD drilling rate compared to the SS-1H well (587 feet/day vs 371 feet/day)3 − Further lessons from the SS-2H well are expected to result in the SS-2H ST1 achieving a Beetaloo Basin record average spud to TD drilling rate Learnings from SS-1H well resulted in improved drilling performance in SS-2H and SS-2H ST1 wells New H&P rig demonstrates drilling capabilities in delivering ~10,000 ft laterals | SS-2H ST1 to reach TD in coming days 1Maverick 1V well drilled as a vertical well only. 2SS-1H well drilled to TD in 41 days (34.7 days to drill to horizontal section TD without pilot hole activities). Reached TD on vertical pilot hole in 21.5 days. The vertical section added 6.3 days to overall drilling of SS-1H. 3Including non-productive time (NPT) of ~10 days. Excluding non-productive time, average spud to TD drilling rate for SS-2H was 827 feet per day. Tamboran Targeting <20 days Tanumbirini 2H 78 days SS-2H 35 days Tanumbirini 3H 77 days SS-1H 41 days2 SS-2H ST1 Days Drilled SS-1H SS-2H SS-2H ST1 Top hole 8 days 8 days 8 days Top hole to Moroak 11 days 10 days 10 days Pilot hole 6 days - - Base of Moroak to TD (Lateral length) 16 days (3,280 ft) 17 days (10,000 ft) <12 days (10,000 ft) Total Days 41 days 35 days <30 days 6 Key successes and lessons learned Optimization of well design and mud system in SS-2H ST1 well is expected to result in a reduction of drilling days to TD Moroak Pilot Hole 1 2 3 4 18-5/8” 13-3/8” 9-5/8” 5-1/2” ~ 1 0 ,0 0 0 f t 1 2 3 4 Mid-Velkerri B Shale ~10,000 ft Key Successes and Lessons Learned + Drilled the longest well lateral section in the Beetaloo Basin to date + Completed drilling of the SS-2H well at the second fastest drilling rate in the Basin to date + Landed the SS-2H lateral section in the Mid Velkerri B shale as planned with no pilot hole + Geosteered within a ~70-foot section of the Mid Velkerri B Shale with no faults encountered ‒ Non-productive time: o Mud performance – remediated in SS-2H ST1 o Tool failures – remediated in SS-2H ST1 ‒ Non-optimal well path and angle through the Moroak: o Successfully delivered the re-planned Moroak drilling path in SS-2H ST1 well Lessons from the SS-2H well have already been implemented in the drilling of the SS-2H ST1 well, which has demonstrated improved drilling rates and reduction on non-productive time SS-2H location geology remains consistent after material step out from SS-1H well SS-2H and SS-2H ST1 wells confirmed the contiguous nature of Mid Velkerri Shale with no faulting observed − Data from the SS-2H well (surface location ~3 miles north from the SS-1H well) has demonstrated geological rock properties consistent with the SS-1H location − Gentle, undulating structure with no faulting observed along the ~10,000 foot (3,000-metre) lateral section within the Mid Velkerri B Shale − Strong gas shows encountered across entire horizontal section 7 Geosteering Window Vertical Exaggeration = 7x Gamma Ray1 Total gas shows ROP (average 30m/hour) Mid Velkerri B Shale SS-2H 1Gamma Ray is a measurement of the natural radioactivity of the rock and is used while geosteering for correlation to the type well (pilot hole). SS-1H Pilot “US-style” completion design enabled by new Liberty Energy frac spread Liberty Energy 80,000 HP frac fleet imported from US into Australia for dedicated Beetaloo large scale development − New Liberty frac spread, comprising of 80,000 Horsepower (HHP), 32 pumps, 240 sand boxes and auxiliary equipment has now mobilized to location − New Liberty equipment will be capable of delivering optimized stimulation and cost efficiencies for the Shenandoah South pilot development wells − Targeting ~5 – 7 stages per day − Majority of sand has arrived on site ahead of the commencement of stimulation activity of the SS-2H ST1 and SS-3H wells in 1Q 2025 8 Liberty Energy frac spread on location in Northern Territory, Australia

24 16 <10 2024 Sand Costs 2025 Sand Costs (AFE) Potential In-field Mining and Processing U S c /l b Beetaloo Basin Sand Costs Product Delivery Last Mile Progressing development of the first local sand mine in the Beetaloo Basin Ongoing discussions with potential third-party strategic partners to develop a local Beetaloo Basin sand solution in 2025 − Granted 11 sand mining leases which have been high graded near the Shenandoah South Pilot Development − Three locations identified a sand resource that could supply >500 development wells, further delineation of sand resource will commence in 1Q 2025 − Tamboran has secured sand as contingent for the 2025 stimulation program at ~US0.16/lb. − Local sand solution in the Beetaloo Basin is expected to reduce sand costs to <US$0.10/lb − Ongoing discussions with potential strategic partners to deliver a local sand solution in 2025 9 ~33% reduction in sand costs Precision screen SRD240x mobile sand washing Plant Current cash position provides funding to deliver IP30 flow rates in 1Q 2025 US$74.0 million cash at September 30, 2024 adjusted for US$7.6 million of net proceeds from the sale of the US rig − US$81.6 million adjusted cash on hand on September 30, 20241, including the remaining US$7.6 million of net proceeds relating to the sale of the US unconventional drilling rig (previously held as Asset for Sale) − ~US$5 million (net to Tamboran) budget impact from re-drilling the SS-2H ST1 well, more than offset from the proceeds from the sale of the rig − Tamboran remains fully funded to deliver IP30 flow rates from the SS-2H ST1 and SS-3H wells during 1Q 2025 − Tamboran expects to receive ~US$6.8 million in additional funds relating to research and development rebate during 4Q 2024 10 Chris to update once finance finalize the quarterly 74.0 81.6 (4.2) (14.5) 74.7 7.4 10.52 7.6 Cash Balance (30 June 2024) Greenshoe (incl. fees) Cash Flow from Operations Cash Flow from Investing Other Cash Balance (30 Sept 2024) Rig Sale (Excl. Costs) Adjusted Cash Balance U S $ m il li o n 1Cash balance of US$74.0 million at September 30, 2024 adjusted for the sale of the US unconventional drilling rig in which Tamboran received the final US$7.6 million (post-costs) in October 2024. 1Other includes US$11.5 million relating to the funds received from JV partners (specifically DWE) during the quarter relating to joint operations within the Beetaloo Basin and US$1.2 million effect of exchange rates, offset by US$2.1 million in transaction costs relating to the issue of Common Stock. Upcoming catalysts Progressing towards production from proposed ~40 MMcf/d (gross, ~19 MMcf/d net) Pilot Project in 1H 2026 11Note: Timing of upcoming catalysts is indicative, and subject to change in the event of unforeseen events, delays due to weather and key stakeholder and Joint Venture approvals. Refer to disclaimer on Slide 2. 4Q 2024 Complete drilling of SS-2H ST1 and SS-3H 1Q 2025 Complete stimulation activities and commence flow testing of SS-2H ST1 and SS-3H 1Q 2025 Announce IP30 flow test results from SS-2H ST1 and SS-3H 1Q 2025 Secure final stakeholder and regulatory approvals for proposed SS Pilot Project 2H 2025 Commence construction of facility and pipeline infrastructure 1H 2026 Target first gas from the proposed SS Pilot Project