EX-10.1

Published on October 3, 2025

EXECUTION VERSION (i) Dated _29_ September 2025 Syndicated Facility Agreement between SPCF Financing Pty Ltd as Borrower Macquarie Bank Limited and Evolution Trustees Limited as trustee for the Alpha Wave Credit (Australia) Trust as Original Lenders Global Loan Agency Services Australia Specialist Activities Pty Limited as Agent Global Loan Agency Services Australia Nominees Pty Ltd as Security Trustee and others

Table of Contents Page (ii) 1. Definitions and Interpretation.................................................................................................169 2. The Facility.............................................................................................................................200 3. Purpose ...................................................................................................................................201 4. Conditions of Utilisation ........................................................................................................201 5. Utilisation - Loans ..................................................................................................................202 6. Repayment..............................................................................................................................203 7. Prepayment and Cancellation .................................................................................................203 8. Restrictions .............................................................................................................................206 9. Interest ....................................................................................................................................207 10. Interest Periods .......................................................................................................................208 11. Changes to the Calculation of Interest....................................................................................208 12. Fees.........................................................................................................................................210 13. Tax Gross-Up and Indemnities...............................................................................................211 14. Increased Costs.......................................................................................................................215 15. Other Indemnities ...................................................................................................................216 16. Mitigation by the Finance Parties...........................................................................................218 17. Costs and Expenses ................................................................................................................218 18. Representations ......................................................................................................................219 19. Information Undertakings ......................................................................................................225 20. General Undertakings.............................................................................................................229 21. Project Accounts.....................................................................................................................239 22. Events of Default....................................................................................................................247 23. Review Events ........................................................................................................................252 24. Changes to the Lenders ..........................................................................................................254 25. Changes to the Obligors .........................................................................................................260 26. Debt Purchase Transactions ...................................................................................................261 27. Role of the Agent ...................................................................................................................261 28. Conduct of Business by the Finance Parties ..........................................................................270 29. Sharing among the Finance Parties ........................................................................................271 30. Public Offer ............................................................................................................................273 31. Payment Mechanics................................................................................................................274 32. Set-Off ....................................................................................................................................278 33. Notices....................................................................................................................................278

Table of Contents Page (iii) 34. Calculations and Certificates..................................................................................................282 35. Partial Invalidity .....................................................................................................................283 36. Remedies and Waivers ...........................................................................................................283 37. Amendments and Waivers......................................................................................................284 38. Instructions and Decisions......................................................................................................285 39. Confidentiality........................................................................................................................286 40. PPSA Provisions.....................................................................................................................290 41. Confidentiality of Funding Rates and Reference Bank Quotations .......................................291 42. Counterparts ...........................................................................................................................292 43. Indemnities and Reimbursement ............................................................................................292 44. Acknowledgement..................................................................................................................292 45. Governing Law.......................................................................................................................293 46. Enforcement ...........................................................................................................................293 Schedule 1 The Original Parties ................................................................................................294 Part 1 The Original Obligors ...............................................................................................294 Part 2 The Original Lenders.................................................................................................295 Part 3 The Agent ..................................................................................................................296 Part 4 The Security Trustee .................................................................................................297 Schedule 2 Conditions Precedent ..............................................................................................298 Part 1 Conditions Precedent to Initial Utilisation ................................................................298 Part 2 Conditions Precedent Required to be Delivered by an Additional Guarantor ..........301 Part 3 Form of Verification Certificate................................................................................302 Schedule 3 Requests ....................................................................................................................304 Part 1 Utilisation Request ....................................................................................................304 Part 2 Selection Notice ........................................................................................................306 Schedule 4 Form of Transfer Certificate ..................................................................................307 Schedule 5 Form of Accession Letter ........................................................................................310 Schedule 6 Form of Resignation Letter ....................................................................................311 Schedule 7 Form of Cost to Complete Certificate....................................................................312 Schedule 8 Form of Production Certificate ..............................................................................314 Schedule 9 Timetables ................................................................................................................315

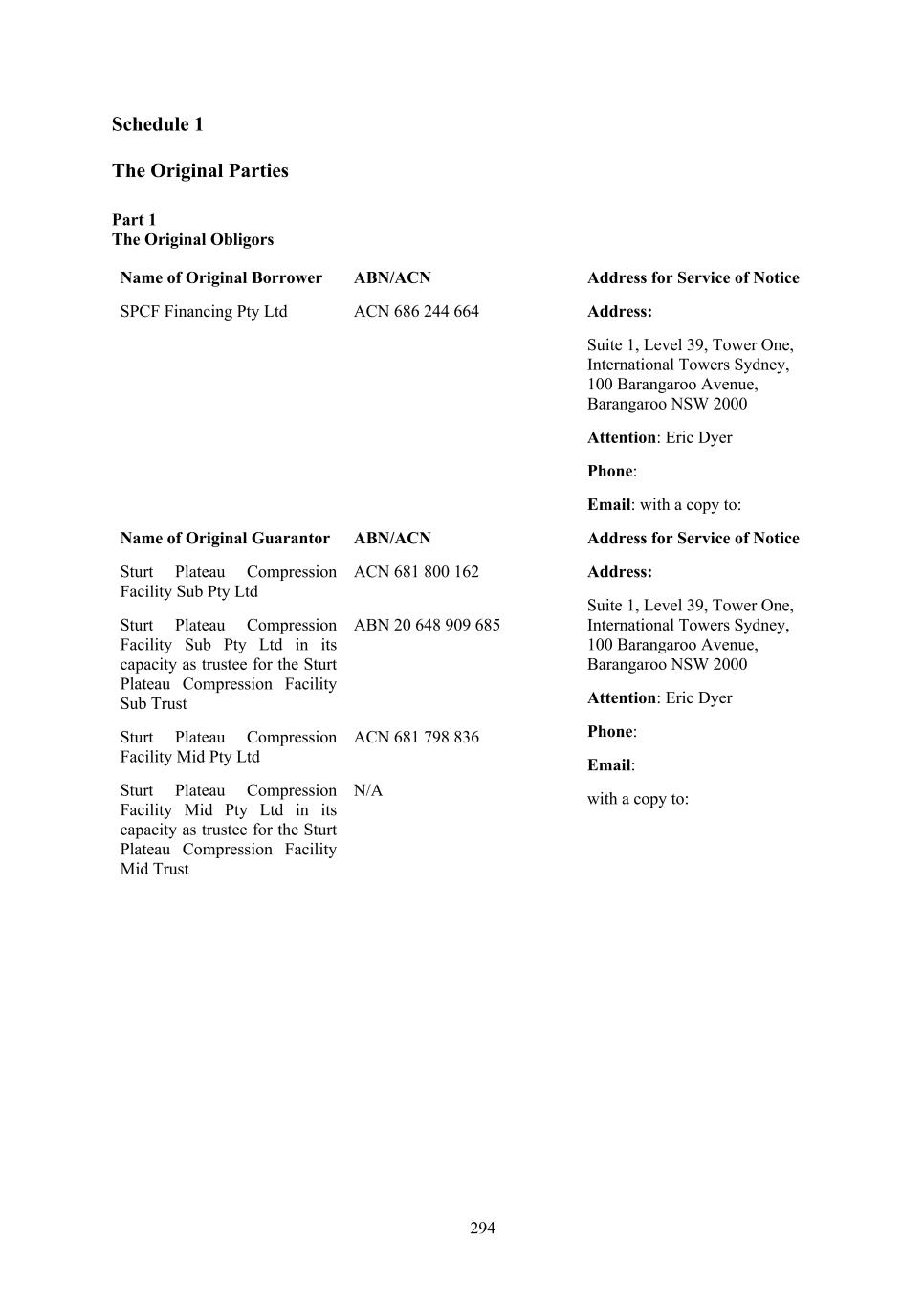

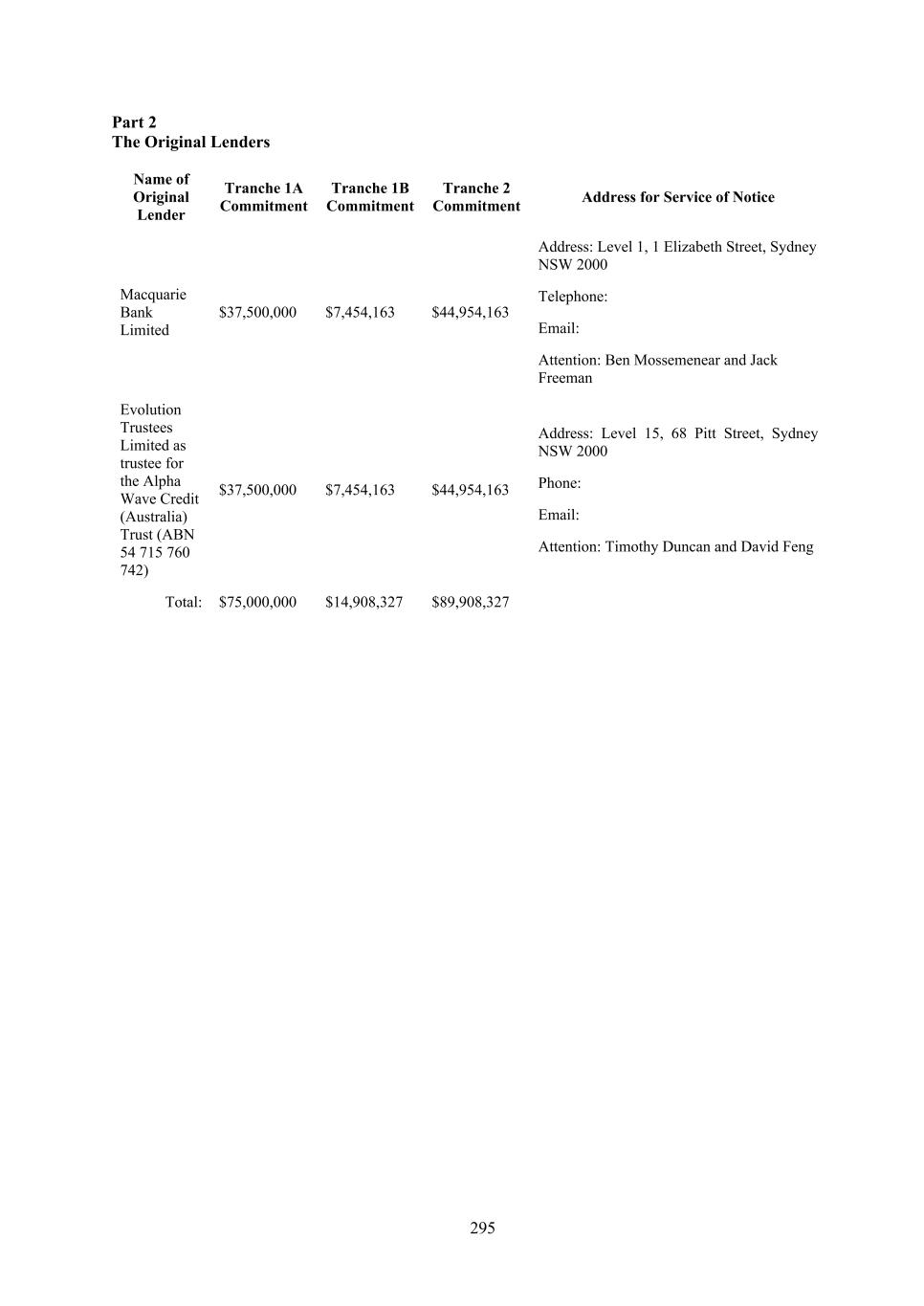

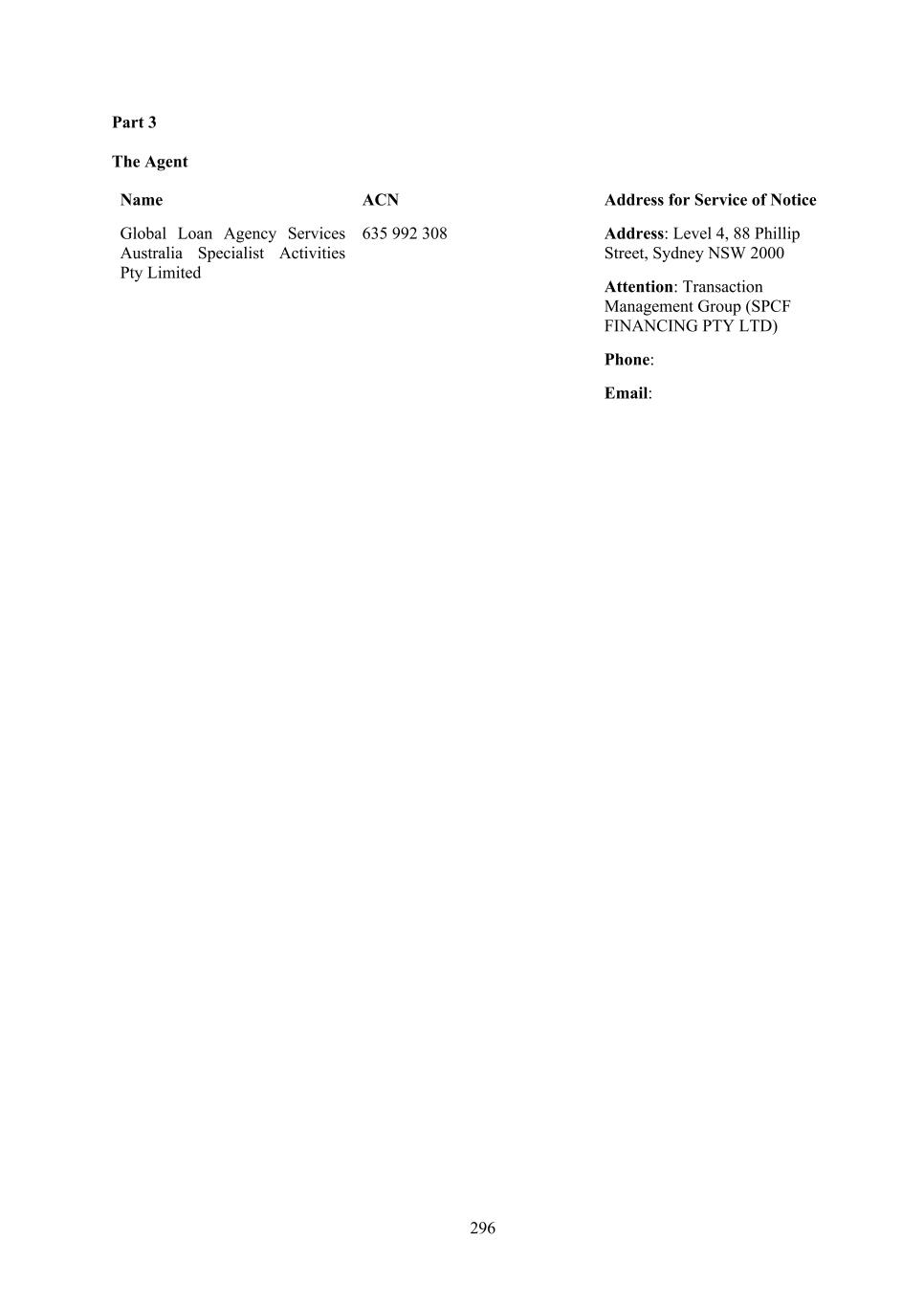

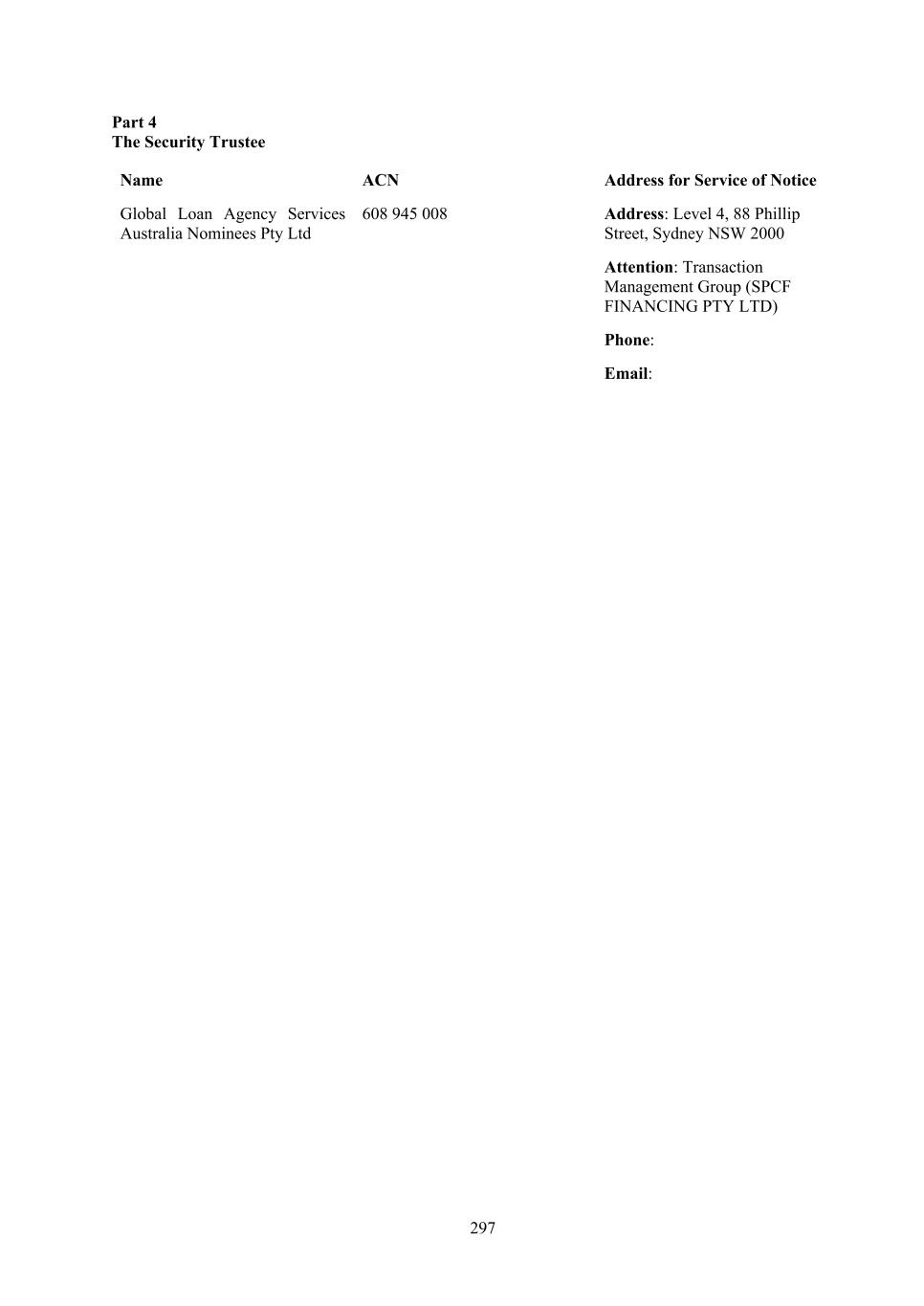

169 This Syndicated Facility Agreement is dated _29_ September 2025 and made between: Between: (1) SPCF Financing Pty Ltd (ACN 686 244 664) (the “Borrower”); (2) The entities listed in Part 1 of Schedule 1 as original guarantors (the “Original Guarantors”); (3) The entities listed in Part 2 of Schedule 1 as lenders (the “Original Lenders”); (4) Global Loan Agency Services Australia Specialist Activities Pty Limited (ACN 635 992 308) (the “Agent”); (5) Global Loan Agency Services Australia Nominees Pty Ltd (ACN 608 945 008) as security trustee for the Beneficiaries (the “Security Trustee”); and (6) Macquarie Bank Limited (the “Initial Account Bank”). It is agreed as follows: Section 1 Interpretation 1. Definitions and Interpretation 1.1 Definitions In this Agreement: “ABC Laws” means: (a) the U.K. Bribery Act 2010; (b) the United States Foreign Corrupt Practices Act of 1977, (15 U.S.C. § 78dd-1, et seq.); and (c) any anti-bribery or anti-corruption laws and regulations administered, enacted or enforced by Australia, Japan, the United States, the United Kingdom, the United Nations, the European Union and any other jurisdiction which are applicable to any Obligor and/or the transactions contemplated under the Finance Documents. “Acceptable Bank” means: (a) a bank or financial institution which has a rating for its long-term unsecured and non- credit-enhanced debt obligations of A- or higher by Standard & Poor’s Rating Services or Fitch Ratings Ltd or A3 or higher by Moody’s Investors Service Limited or a comparable rating from an internationally recognised credit rating agency; or (b) any other bank or financial institution approved by the Agent. “Acceptable Contractor” means: (a) GRPS Pty Ltd; or (b) a counterparty consented to by the Agent, provided that such consent must not be unreasonably withheld or delayed if the Borrower can demonstrate to the reasonable satisfaction of the Agent that the counterparty has the financial capability and experience in operating and maintaining projects that are similar to the Project.

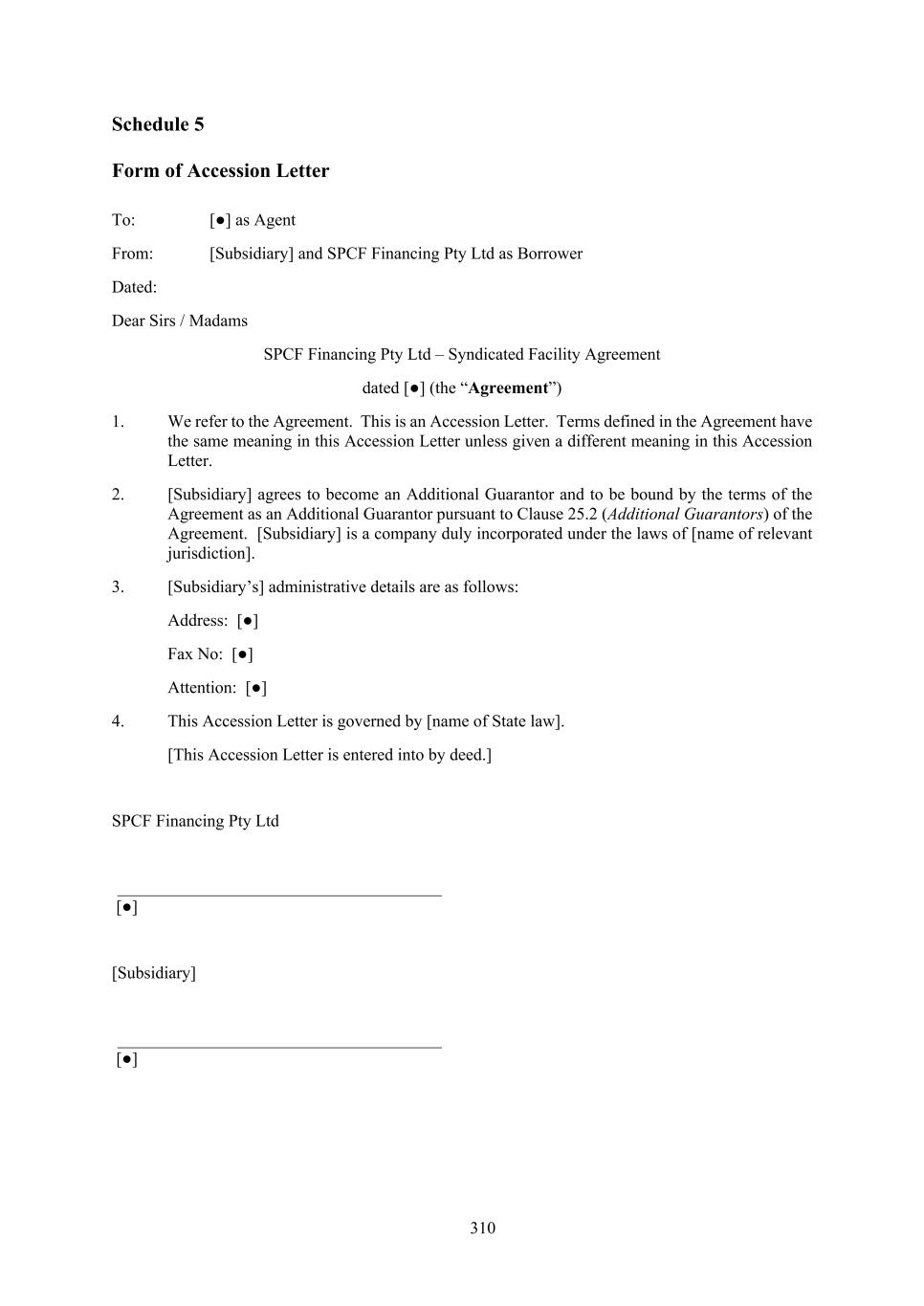

170 “Accession Deed” has the meaning given to that term in the Security Trust and Intercreditor Deed. “Accession Letter” means a document substantially in the form set out in Schedule 5 (Form of Accession Letter). “Account Bank” means the Initial Account Bank or any other bank or financial institution acceptable to the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Additional Guarantor” means a company which becomes an Additional Guarantor in accordance with Clause 25 (Changes to the Obligors). “Affected Lender” has the meaning given to that term in Clause 11.3 (Market Disruption). “Affiliate” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company. “AML/CTF Laws” means the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth), any regulations or rules made thereunder and any other anti-money laundering or counter-terrorism financing laws or regulations, and any Sanctions administered, enacted or enforced by Japan, Australia, the United States, the United Nations, the United Kingdom, the European Union and any other jurisdiction which are applicable to any Obligor and/or the transactions contemplated under the Finance Documents from time to time including, any laws or regulations imposing "know your customer" or other identification checks or procedures. “APA” means APA SPP Pty Ltd (ACN 679 801 819). “APA Development Agreement” means the development agreement dated 17 December 2024 between APA and Tamboran B2. “Approvals Side Agreement” means the side agreement to be entered into, between Tamboran B2 (Operator) and the Project Trustee, passing through to the Project Trustee the rights under the Retention Licence and the Production Licence for the area to be known as “FSDA North” (graticular block 668), to operate the Project on the Project Site. “Assignment Agreement” means an agreement in the form agreed between the Agent and the relevant assignor and assignee. “Associate” has the meaning given to that term in Section 128F(9) of the Tax Act. “Australian Withholding Tax” means any Australian tax required to be withheld or deducted from any interest or other payment under Division 11A of Part III of the Tax Act or Subdivision 12-F of Schedule 1 to the Taxation Administration Act 1953 (Cth). “Authorisation” means: (a) an authorisation, consent, approval, resolution, licence, exemption, filing or registration from or with a Governmental Agency; or (b) in relation to anything which will be fully or partly prohibited or restricted by law if a Governmental Agency intervenes or acts in any way within a specified period after lodgement, filing, registration or notification, the expiry of that period without intervention or action. “Availability Period” means the period from (and including) the date of Financial Close to (and including) the earlier of: (a) the Date of Practical Completion; and

171 (b) 3 May 2027. “Available Commitment” means, in relation to a Tranche, a Lender’s Commitment under that Tranche minus: (a) the amount of its participation in any outstanding Utilisations under that Tranche; and (b) in relation to any proposed Utilisation, the amount of its participation in any Utilisations that are due to be made under that Tranche on or before the proposed Utilisation Date. “Bail-In Action” means the exercise of any Write-down and Conversion Powers. “Bail-In Legislation” means: (a) in relation to an EEA Member Country which has implemented, or which at any time implements, Article 55 BRRD, the relevant implementing law or regulation as described in the EU Bail-In Legislation Schedule from time to time; and (b) in relation to the United Kingdom, the UK Bail-In Legislation. “Bail-in Lender” means any Lender who is subject to a Bail-in Action. “Base Case Financial Model” means the base case financial model provided to the Agent in accordance with item (4)(i) of Part 1 (Conditions Precedent to Initial Utilisation) of Schedule 2 (Conditions Precedent). “BBSW” means in relation to any Loan: (a) the Screen Rate as of the Specified Time for a period equal in length to the Interest Period of that Loan; or (b) as otherwise determined pursuant to Clause 11.1 (Unavailability of Screen Rate). “Beetaloo Joint Venture” means the unincorporated joint venture which, as at the date of this Agreement, is between Tamboran B2 and Falcon. “Beneficiaries” has the meaning given to that term in the Security Trust and Intercreditor Deed. “BJV Gas Balancing Agreement” has the meaning given to that term in the Infrastructure Agreement Side Deed. “Borrower Affiliate” means the Borrower, any Affiliates of the Borrower, any trust of which it or any of its Affiliates is a trustee, any partnership of which it or any of its Affiliates is a partner and any trust, fund or other entity which is managed by, or is under the Control of, it or any of its Affiliates. “Break Costs” means the amount (if any) by which: (a) the interest (excluding the Margin) which a Lender should have received for the period from the date of receipt of all or any part of its participation in a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; exceeds: (b) the amount which that Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank in

172 the Relevant Market or acquiring a bill of exchange accepted by a leading bank for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. It is an amount payable in lieu of interest which would otherwise have been paid. “BUG Agreement” means the ‘Beetaloo Basin Project - Appraisal Gas Agreement’ dated 7 August 2025 between Tamboran B2, Falcon, Northern Land Council (ABN 56 327 515 336) and Top End (Default PBC/CLA) Aboriginal Corporation RNTBC (ICN 7848) as agent for the affected native title holders. “Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in Sydney, Australia. “Business Interruption Insurance Proceeds” means all payments received by an Obligor in respect of Insurances pertaining to business interruption, revenue replacement, loss of profit, or delay in start up. “Cash Equivalent Investments” means at any time: (a) certificates of deposit maturing within one year after the relevant date of calculation and issued by an Acceptable Bank; (b) bonds, debentures, stock, treasury bills, notes or any other security issued or guaranteed by the Commonwealth of Australia or any government of any State or Territory of the Commonwealth of Australia or by an instrumentality or agency of any of them having an equivalent credit rating, maturing within one year after the relevant date of calculation and not convertible or exchangeable to any other security; (c) commercial paper not convertible or exchangeable to any other security: (i) for which a recognised trading market exists; (ii) issued by an issuer incorporated in Australia; (iii) which matures within one year after the relevant date of calculation; and (iv) which has a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or F1 or higher by Fitch Ratings Ltd or P-1 or higher by Moody’s Investors Service Limited, or, if no rating is available in respect of the commercial paper, the issuer of which has, in respect of its long-term unsecured and non-credit enhanced debt obligations, an equivalent rating; (d) any investment in money market funds (i) which have a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or F1 or higher by Fitch Ratings Ltd or P-1 or higher by Moody’s Investors Service Limited, (ii) which invest substantially all their assets in securities of the types described in paragraphs (a) to (c) above and (iii) to the extent that investment can be turned into cash on not more than 90 days’ notice; or (e) any other debt security approved by the Majority Lenders. “Change in Control” will occur where, at any time, either Sponsor ceases to hold at least a 50% direct or indirect interest in an Obligor. “CNFA Tripartite Deed” means a tripartite deed between the Security Trustee, the Project Trustee and APA in respect of the Connection and New Facility Agreement. “Code” means the US Internal Revenue Code of 1986.

173 “Commitment” means a Tranche 1A Commitment, Tranche 1B Commitment or Tranche 2 Commitment. “Compressor Supply and Purchase Agreement” means the compressor supply and purchase agreement dated 18 April 2024 as novated and amended on 28 January 2025 between the Project Trustee and Compass Energy Systems Ltd. “Compressor Supply and Purchase Agreement Tripartite Deed” means a tripartite deed between the Security Trustee, the Project Trustee and Compass Energy Systems Ltd in respect of the Compressor Supply and Purchase Agreement. “Confidential Information” means all information relating to the Borrower, any Obligor, a Sponsor, the Finance Documents or a Facility of which a Finance Party becomes aware in its capacity as, or for the purpose of becoming, a Finance Party or which is received by a Finance Party in relation to, or for the purpose of becoming a Finance Party under, the Finance Documents or a Facility from either: (a) any Obligor, a Sponsor or any of their respective advisers; or (b) another Finance Party, if the information was obtained by that Finance Party directly or indirectly from any Obligor, a Sponsor or any of their respective advisers, in whatever form, and includes information given orally and any document, electronic file or any other way of representing or recording information which contains or is derived or copied from such information but excludes: (i) information that: (A) is or becomes public information other than as a direct or indirect result of any breach by that Finance Party of Clause 39 (Confidentiality); or (B) is identified in writing at the time of delivery as non-confidential by any Obligor, a Sponsor or any of their respective advisers; or (C) is known by that Finance Party before the date the information is disclosed to it in accordance with paragraphs (a) or (b) above or is lawfully obtained by that Finance Party after that date, from a source which is, as far as that Finance Party is aware, unconnected with the Obligors or the Sponsors and which, in either case, as far as that Finance Party is aware, has not been obtained in breach of, and is not otherwise subject to, any obligation of confidentiality; and (ii) any Funding Rate or Reference Bank Quotation. “Confidentiality Undertaking” means a confidentiality undertaking substantially in a form agreed between the Borrower and the Agent. “Connection and New Facility Agreement” means the connection agreement dated 17 December 2024 between APA and the Project Trustee. “Construction Report” means a construction progress report in the form delivered to the Project Trustee by Enscope under the EPCM Contract. “Contested Taxes” means a Tax payable by an Obligor where that Obligor: (a) is contesting in good faith its liability to pay that Tax;

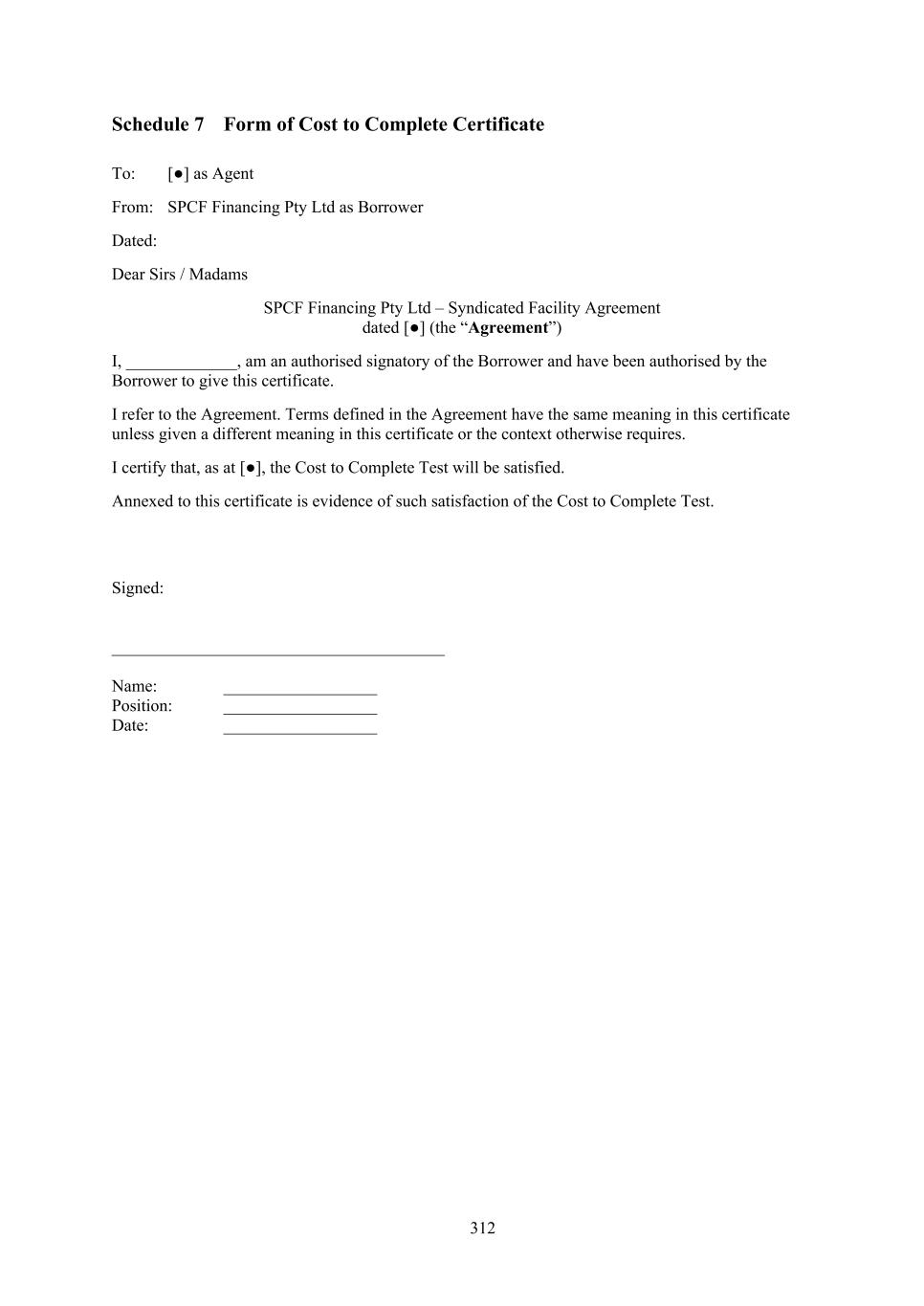

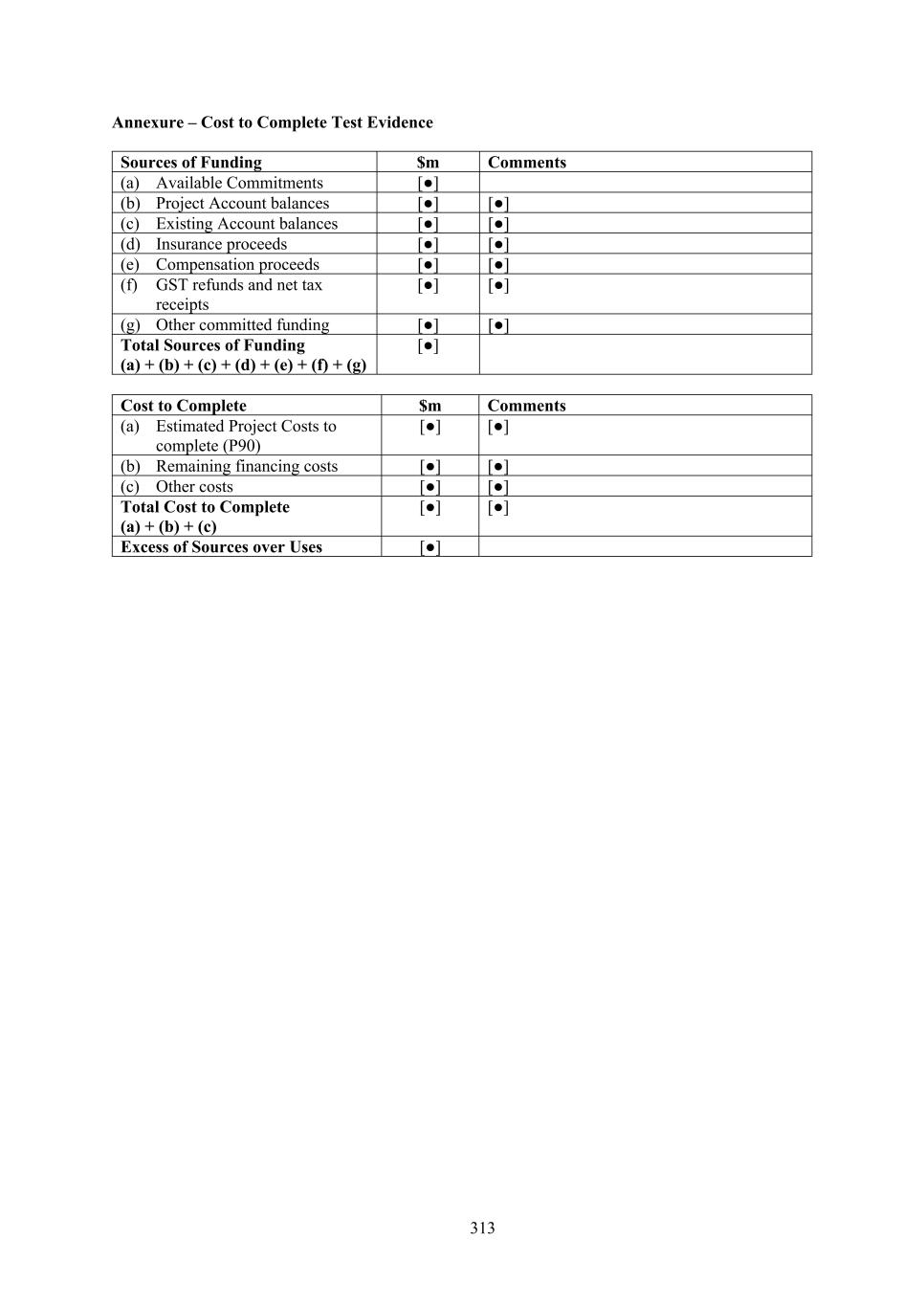

174 (b) is maintaining adequate reserves for those Taxes and the costs required to contest them; and (c) such payment can be lawfully withheld and failure to pay those Taxes does not have or is not reasonably likely to have a Material Adverse Effect. “Control” has the meaning given to that term in section 50AA of the Corporations Act. “Corporations Act” means the Corporations Act 2001 (Cth). “Cost to Complete Certificate” means a certificate substantially in the form set out in Schedule 7 (Form of Cost to Complete Certificate). “Cost to Complete Test” on any date, will be satisfied where: (a) the aggregate of the following amounts as confirmed by the Borrower, without double counting: (i) the Available Commitments; (ii) the amounts standing to the credit of a Project Account and each Existing Account that are available to be applied towards Project Costs; (iii) the proceeds of any insurance payable to the Obligors in relation to loss or property damage or delay in start-up (or similar) which may be applied towards Project Costs, provided that the claim has: (A) not been rejected by the relevant insurers and the Agent (acting on the instructions of the Majority Lenders, acting reasonably) has consented to the proceeds of that claim being counted for the purposes of this limb; or (B) been accepted in writing by the relevant insurers; (iv) any compensation (including liquidated damages) payable to an Obligor under the Project Documents where the relevant counterparty has: (A) not disputed the extent of the liability and the Agent (acting on the instructions of the Majority Lenders, acting reasonably) has consented to that compensation being counted for the purposes of this limb; or (B) accepted the extent of that liability, in each case excluding any amount which is required to be applied in mandatory prepayment of the Facility in accordance with Clause 7.4(b) (Mandatory Prepayment of Loans); (v) projected GST refunds and net tax receipts (including GST input tax credits) forecast in the Financial Model; and (vi) any other funds irrevocably and unconditionally available to an Obligor from a source and on terms (including as to security) acceptable to the Agent (acting on the instructions of the Majority Lenders, acting reasonably) for the purpose of funding Project Costs, is equal to or exceeds: (b) all Project Costs at that time that are:

175 (i) payable but unpaid and which are required to be paid to achieve the Date of Practical Completion; or (ii) reasonably likely to be payable for the purposes of achieving the Date of Practical Completion, as estimated by the Borrower and confirmed by the Technical Adviser. “Date of Practical Completion” has the meaning given to that term in the Gas Processing Agreement. “Debt Purchase Transaction” means, in relation to a person, a transaction where such person: (a) acquires by way of assignment, novation or transfer; (b) enters into any sub-participation in respect of; or (c) enters into any other agreement or arrangement having an economic effect substantially similar to a sub-participation in respect of, or allowing it to control the exercise of rights relating to, any Commitment or amount outstanding under this Agreement. “Default” means an Event of Default or a Potential Event of Default. “Defaulting Finance Party” means any Finance Party (other than a Lender which is a Borrower Affiliate): (a) which (in any capacity) has failed to make a payment when due under this Agreement or has notified a Party that it will not make such a payment; (b) which (in any capacity) has otherwise rescinded or repudiated a Finance Document; or (c) which: (i) is or is adjudicated to be insolvent; (ii) applies or resolves to be wound up, given protection against creditors or placed in bankruptcy or any analogous process; or (iii) is subject to the appointment of a liquidator, administrator, manager, trustee in bankruptcy or any analogous process, unless, in the case of paragraph (a) above, the Finance Party is disputing in good faith whether it is contractually obliged to make the payment in question. “Disruption Event” means either or both of: (a) a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facilities (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; or (b) the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing that, or any other Party: (i) from performing its payment obligations under the Finance Documents; or

176 (ii) from communicating with other Parties in accordance with the terms of the Finance Documents, and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted. “Distribution” means: (a) declare, make or pay any dividend, charge, fee, interest or other payment or distribution (or interest on any unpaid dividend, charge, fee, interest or other distribution) (whether in cash or in kind) to its members in their capacity as such or on or in respect of its share or equity capital (or any class of its share or equity capital) or Subordinated Debt; (b) repay or distribute any dividend or share premium reserve; (c) redeem, repurchase, defease, retire or repay any of its share or equity capital, membership interests or Subordinated Debt or resolve to do so; or (d) any payment of fees or any other amount to a Sponsor or Sponsor Affiliate. “Enscope” means Enscope Pty Ltd (ABN 38 136 478 030). “Environmental or Social Incident” means: (a) any unanticipated incident or accident relating to an Obligor or the Project which has, or could reasonably be expected to have a material adverse impact on the environment, or damage, impact or material harm to the lives, livelihood, quality of life, health, safety, security or property of any person; (b) an accident resulting in death or serious or multiple injury relating to an Obligor or the Project; or (c) a significant and sustained community or worker related grievance or protest of the Project. “Environmental and Social Law” means any law or regulation applicable to the Project that relates to the environment, social matters, heritage, planning, security, labour, human rights or health and safety, including laws concerning land use or the rehabilitation of any land, development, pollution (including water turbidity or noise pollution), waste disposal, toxic and hazardous substances (including cyanide), conservation of natural or cultural resources, resource allocation (including any law or regulations relating to the exploration for, and development or exploitation of, any natural resource), use of dangerous goods, the protection of human health and any other aspect of protection of the environment including any specific agreements entered into with competent authorities which include commitments relating to environment, social matters or health and safety. “Environmental or Social Claim” means any claim, liability, action, inquiry, litigation, proceeding or investigation by any party in respect of any Environmental and Social Laws. “EPCM Contract” means the engineering, procurement and construction management agreement in respect of the Project dated 20 January 2025 between Enscope and the Project Trustee. “EPCM Contractor Tripartite Deed” means a tripartite deed between the Security Trustee, the Project Trustee and Enscope in respect of the EPCM Contract and the Interface Deed. “Event of Default” means any event or circumstance specified as such in Clause 22 (Events of Default).

177 “Existing Account” means each of the following bank accounts: (a) the Australian dollar account with account name Sturt Plateau Comp Fac Sub Pty Ltd and account number 19887016 held with Bank of America; and (b) the US dollar account with account name Sturt Plateau Comp Fac Sub Pty Ltd and account number 19887024 held with Bank of America. “Exploration Permit” means an exploration permit under the Petroleum Act 1984 (NT). “Facility” means the term loan facility made available under this Agreement as described in Clause 2 (The Facility). “Facility Office” means the office or offices in Australia notified by a Lender to the Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five Business Days’ written notice) as the office or offices through which it will perform its obligations under this Agreement. “Falcon” means Falcon Oil & Gas Australia Limited (ABN 53 132 857 008). “FATCA” means: (a) sections 1471 to 1474 of the Code or any associated regulations; (b) any treaty, law or regulation of any other jurisdiction, or relating to an intergovernmental agreement between the US and any other jurisdiction, which (in either case) facilitates the implementation of any law or regulation referred to in paragraph (a) above; or (c) any agreement pursuant to the implementation of any treaty, law or regulation referred to in paragraphs (a) or (b) above with the US Internal Revenue Service, the US government or any governmental or taxation authority in any other jurisdiction. “FATCA Application Date” means: (a) in relation to a “withholdable payment” described in section 1473(1)(A)(i) of the Code (which relates to payments of interest and certain other payments from sources within the US), 1 July 2014; or (b) in relation to a “passthru payment” described in section 1471(d)(7) of the Code not falling within paragraph (a) above, the first date from which such payment may become subject to a deduction or withholding required by FATCA. “FATCA Deduction” means a deduction or withholding from a payment under a Finance Document required by FATCA. “FATCA Exempt Party” means a Party that is entitled to receive payments free from any FATCA Deduction. “Fee Letter” means any letter or letters dated on or about the date of this Agreement between the Borrower and a Lender (or the Agent and the Borrower or the Security Trustee and the Borrower) setting out any of the fees referred to in Clause 12 (Fees). “Finance Document” means: (a) this Agreement; (b) the Security Trust and Intercreditor Deed;

178 (c) each Transaction Security Document; (d) each Fee Letter; (e) each Selection Notice; (f) each Utilisation Request; (g) any Accession Letter; (h) any Resignation Letter; (i) any Recognition Certificate; and (j) any other document designated as such by the Agent and the Borrower. “Finance Lease” means any capital or finance lease that would at such time be required to be capitalised and reflected as a liability on a balance sheet (excluding the footnotes thereto) prepared in accordance with GAAP. “Finance Party” means the Agent, the Security Trustee, a Lender or the Account Bank. “Financial Close” means the date on which the Agent notifies the Borrower that each of the Initial Conditions Precedent have been satisfied or waived in accordance with Clause 4.1 (Initial Conditions Precedent). “Financial Indebtedness” means any indebtedness for or in respect of: (a) moneys borrowed and any debit balance at any financial institution; (b) any amount raised by acceptance under any acceptance credit, bill acceptance or bill endorsement facility or dematerialised equivalent; (c) any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; (d) the amount of any rental obligation (including any hire purchase payment obligation) which, under GAAP (and in particular, on the basis of IAS 17 (Leases) or any equivalent measure under GAAP), would be required to be treated as a Finance Lease or otherwise capitalised in the audited financial statements of that person, but only to the extent of that treatment and excluding, for the avoidance of doubt, any cash expenditure arising from an operating lease or lease which, in accordance with IAS 17 (Leases) or any equivalent measure under GAAP, is treated as an operating lease; (e) receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); (f) any redeemable shares where the holder has the right, or the right in certain conditions, to require redemption; (g) any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other paragraph of this definition having the commercial effect of a borrowing; (h) consideration for the acquisition of assets or services payable more than 90 days after acquisition; (i) any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative

179 transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) shall be taken into account); (j) any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution; and (k) the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs (a) to (j) above. “Financial Model” means the Base Case Financial Model, as amended from time to time in accordance with this Agreement. “Financing Costs” means, for any relevant period, the aggregate amount of all interest and fees to be paid under the Finance Documents as adjusted for net payments (or receipts) under Hedging Agreements, but excluding: (a) any agency and security trustee, upfront or establishment fees; (b) amounts payable in respect of voluntary or mandatory prepayments and any break costs payable under any Hedging Agreement in connection with such prepayments; and (c) any other costs associated with establishing or refinancing any of the Facilities to the extent such fees, costs or amounts are capitalised. “Formentera Australia” means Formentera Australia Fund 1, LP. “FSDAs” means the northern and southern areas of the ‘First Strategic Development Area’, more particularly described as graticular blocks 668 and 740 (respectively). “Funding Rate” means any individual rate notified by a Lender to the Agent pursuant to Clause 11.4 (Cost of Funds). “Future Project Document” means each of: (a) the SPCF Sublease; (b) the Option to Sublease; (c) the Approvals Side Agreement; (d) the Land Access and Use Agreement – Retention Licence; (e) the Land Access and Use Agreement – Production Licence; (f) any O&M Contract; and (g) any other agreement entered into by an Obligor in respect of the Project where the contracted expenditure or potential liability of the Obligor under that agreement exceeds $5,000,000. “GAAP” means generally accepted accounting principles, standards and practices in the United States of America. “Gas Processing Agreement” means the gas processing agreement dated on or about the date of this Agreement between the Project Trustee and Tamboran B2.

180 “Gas Processing Agreement Tripartite Deed” means the tripartite deed dated on or about the date of this Agreement between the Security Trustee, the Project Trustee and Tamboran B2 in respect of the Gas Processing Agreement. “Gas Sales Agreement” means the long-term gas sales agreement dated on or about the date of this Agreement between the Northern Territory Government, Tamboran B2 and Falcon, relating to the supply of a maximum daily quantity of 40TJ/day of gas from the FSDAs to the Northern Territory Government. “Good Industry Practice” means the exercise of that degree of skill, care, prudence, (operational and financial) foresight and operating practice which would reasonably and ordinarily be expected from a significant proportion of the operators of facilities (not being owned and operated by a Governmental Agency) similar to the Project with the asset and operating conditions being consistent with those of the Project. “Governmental Agency” means any government or any governmental, semi-governmental or judicial entity or authority. It also includes any self-regulatory organisation established under statute or any stock exchange. “GST” has the same meaning as in the GST Act. “GST Act” means the A New Tax System (Goods and Services Tax) Act 1999 (Cth). “Greenhouse Gas Abatement Plan” means the 'Beetaloo Exploration Project Greenhouse Gas Abatement Plan' originally issued for use by Tamboran B2 (Operator) on 8 December 2021 and available at https://environment.nt.gov.au/media/docs/onshore-gas/emp/pdf/tamboran-b2-pty- ltd/greenhouse-gas-abatement-plan.PDF, as may be amended or replaced from time to time in accordance with this Agreement. “Guarantor” means an Original Guarantor or an Additional Guarantor, unless it has ceased to be a Guarantor in accordance with Clause 25 (Changes to the Obligors). “Hedging Agreement” means any master agreement, confirmation, schedule or other agreement entered into or to be entered into by the Borrower and a hedge counterparty for the purpose of hedging only the types of liabilities and/or risks which are required or permitted to be entered into by this Agreement. “Holding Company” means, in relation to a person, any other person in respect of which it is a Subsidiary. “Illegal Lender” means a Lender whom an Obligor is or becomes obliged to repay or prepay pursuant to Clause 7.1 (Illegality). “Increased Costs Lender” means a Lender to whom the Borrower is required to pay any sum under Clause 14 (Increased Costs), any additional amount under paragraph (c) of Clause 13.2 (Tax Gross-Up) or any tax indemnity payment under Clause 13.3 (Tax Indemnity). “Indirect Tax” means any GST, consumption tax, value added tax or any tax of a similar nature. “Infrastructure Agreement Side Deed” means the document entitled “Infrastructure Agreements Side Deed” dated on or about the date of this agreement between Tamboran B2 and Falcon. “Initial Conditions Precedent” means each of the conditions precedent to the first Utilisation set out in Part 1 (Conditions Precedent to Initial Utilisation) of Schedule 2 (Conditions Precedent).

181 “Initial Security Document” means: (a) the Tranche 1 Guarantee; (b) each Sponsor Guarantee; (c) each Tripartite Deed; and (d) the general security deed dated on or about the date of this Agreement entered into by each Obligor in favour of the Security Trustee. “Insurance Proceeds Account” means the account established in accordance with Clause 21.6 (Insurance Proceeds Account). “Insurances” means the insurances required to be effected and maintained under the Project Documents and any other insurances effected and maintained, or required to be effected and maintained, by an Obligor in relation to the Project under Clause 20.8 (Insurance Undertakings). “Interest Period” means, in relation to a Loan, each period determined in accordance with Clause 10 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 9.3 (Default interest). “Interest Reserve Account” means the account established in accordance with Clause 21.7 (Interest Reserve Account). “Interface Deed” means the interface deed dated 20 January 2025 between the Project Trustee, Tamboran B2 (Operator) and Enscope. “Interpolated Screen Rate” means, in relation to any Loan, the rate (rounded to the same number of decimal places as the two relevant Screen Rates) which results from interpolating on a linear basis between: (a) the applicable Screen Rate for the longest period (for which that Screen Rate is available) which is less than the Interest Period of that Loan; and (b) the applicable Screen Rate for the shortest period (for which that Screen Rate is available) which exceeds the Interest Period of that Loan, each as of the Specified Time. “Investment Instrument” has the meaning given to that term in the PPSA. “Key Documents” means each of: (a) the Gas Sales Agreement; (b) the BUG Agreement; (c) any Land Access Agreement; and (d) the Infrastructure Agreement Side Deed. “Land Access Agreement” means: (a) the land access agreement dated 23 May 2023 between Tamboran B2 and A.P.N. Pty Ltd (ACN 000 742 781) (as the pastoral lessee) (as varied from time to time); and (b) any other land access agreement between Tamboran B2 and A.P.N. Pty Ltd (ACN 000 742 781) or its successors (as the pastoral lessee),

182 in each case entered into in accordance with Regulation 12 of the Petroleum Regulations 2020 (NT). “Land Access and Use Agreement – Exploration Permit” means the land access and use agreement dated on or about the date of this Agreement between Tamboran B2 (Operator) and the Project Trustee, passing through to the Project Trustee, the land rights and rights under Exploration Permit 98 and 117. “Land Access and Use Agreement – Exploration Permit Tripartite Deed” means the tripartite deed dated on or about the date of this Agreement between the Security Trustee, the Project Trustee and Tamboran B2 in respect of the Land Access and Use Agreement – Exploration Permit. “Land Access and Use Agreement – Retention Licence” means the land access and use agreement to be entered into between Tamboran B2 (Operator) and the Project Trustee, passing through to the Project Trustee, the land rights and the rights under the Retention Licence for the area to be known as “FSDA North” (graticular block 668). “Land Access and Use Agreement – Production Licence” means the land access and use agreement to be entered into between Tamboran B2 (Operator) and the Project Trustee, passing through to the Project Trustee the land rights and the rights under the Production Licence for the area to be known as “FSDA North” (graticular block 668). “Lender” means: (a) any Original Lender; and (b) any bank, financial institution, trust, fund or other entity which has become a Party as a “Lender” in accordance with Clause 24 (Changes to the Lenders), which in each case has not ceased to be a Party in accordance with the terms of this Agreement. “Loan” means a loan made or to be made under the Facility or the principal amount outstanding for the time being of that loan. “Majority Lenders” means: (a) in relation to 'Enforcement Action' under paragraphs (d) or (e) of that definition as set out in the Security Trust and Intercreditor Deed or the giving of an 'Enforcement Notice' as defined in the Security Trust and Intercreditor Deed, a Lender or Lenders (other than the Tranche 1 NTG Guarantor) whose Commitments aggregate at least 66⅔ per cent of the total Commitments of all Lenders excluding the Tranche 1 NTG Guarantor (or, if the Total Commitments have been reduced to zero, aggregated at least 66⅔ per cent of all such total Commitments immediately prior to the reduction); (b) in relation to the commencement of 'Enforcement Action' under paragraph (a) of that definition as set out in the Security Trust and Intercreditor Deed, if either: (i) a Lender or Lenders whose Commitments aggregate at least 66⅔ per cent of the total Commitments of all Lenders (or, if the Total Commitments have been reduced to zero, aggregated at least 66⅔ per cent of all such total Commitments immediately prior to the reduction); or (ii) a Lender or Lenders (other than the Tranche 1 NTG Guarantor) whose Commitments aggregate at least 66⅔ per cent of the total Commitments of all Lenders excluding the Tranche 1 NTG Guarantor (or, if the Total Commitments have been reduced to zero, aggregated at least 66⅔ per cent of all such total Commitments immediately prior to the reduction),

183 vote in favour of commencing that 'Enforcement Action', that constitutes Majority Lenders voting in favour of commencing that 'Enforcement Action'; and (c) otherwise: (i) at any time on or before 'Enforcement Time' as defined in the Security Trust and Intercreditor Deed, a Lender or Lenders (other than the Tranche 1 NTG Guarantor) whose Commitments aggregate at least 66⅔ per cent of the total Commitments of all Lenders excluding the Tranche 1 NTG Guarantor (or, if the Total Commitments have been reduced to zero, aggregated at least 66⅔ per cent of all such total Commitments immediately prior to the reduction); and (ii) after 'Enforcement Time' as defined in the Security Trust and Intercreditor Deed, a Lender or Lenders whose Commitments aggregate at least 50.1 per cent of the total Commitments of all Lenders (or, if the Total Commitments have been reduced to zero, aggregated at least 50.1 per cent of all Total Commitments immediately prior to the reduction). In each case where a Lender’s Commitment has been reduced to zero, but it has an outstanding participation in any outstanding Utilisations, then for this purpose its Commitment will be taken to be the aggregate amount of its participation. “Management Services Agreement” means the management services agreement dated 29 October 2024 as amended from time to time between, among others, the Project Trustee, the Mid Trustee and Tamboran Resources Pty Ltd (ACN 135 299 062). “Margin” means: (a) in respect of Tranche 1A: (i) on or prior to the Tranche 1 Guarantee Release Date, 4.00 per cent. per annum; and (ii) after the Tranche 1 Guarantee Release Date, 8.00 per cent. per annum; (b) in respect of Tranche 1B: (i) on or prior to the Tranche 1 Guarantee Release Date, 12.00 per cent. per annum; and (ii) after the Tranche 1 Guarantee Release Date, 8.00 per cent. per annum; and (c) in respect of Tranche 2: (i) on or prior to the Tranche 1 Guarantee Release Date, 12.00 per cent. per annum; and (ii) after the Tranche 1 Guarantee Release Date, 8.00 per cent. per annum. “Material Adverse Effect” means a material adverse effect on: (a) the assets, business or operations of the Obligors taken as a whole; or (b) the ability of the Obligors (taken as a whole) to perform their payment or other material obligations under the Finance Documents; or (c) the enforceability or priority of the whole or any material part of any Finance Document or any Security granted pursuant to the Transaction Security Documents.

184 “Mid Trust” means the Sturt Plateau Compression Facility Mid Trust. “Mid Trust Deed” means the ‘Sturt Plateau Compression Facility Mid Trust Constitution’ dated 24 October 2024 and executed by MidCo. “Mid Trustee” means MidCo in its capacity as trustee of the Mid Trust. “MidCo” means Sturt Plateau Compression Facility Mid Pty Ltd (ACN 681 798 836). “Modern Slavery” means any activity, prejudice or conduct prohibited or defined as 'modern slavery' for the purposes of any offence under the Modern Slavery Act 2018 (Cth), and any equivalent defined concept under other applicable laws concerned with anti-slavery and human trafficking in a relevant jurisdiction. “Month” means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that: (a) if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; and (b) if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month. “Negotiable Instrument” has the meaning given to that term in the PPSA. “New Lender” has the meaning given to that term in Clause 24 (Changes to the Lenders). “Non-Continuation Date” has the meaning given in Clause 23(d) (Review Events). “Non-Continuation Notice” means a notice described under Clause 23(c) (Review Events). “Non-Consenting Lender” means any Lender which does not consent to any decision requiring a waiver or amendment or other consent where the requested consent, waiver or amendment is one which requires greater than Majority Lender consent, if: (a) the Borrower has requested that consent, waiver or amendment in relation to any Finance Document; and (b) the Majority Lenders have agreed to that consent, waiver or amendment, but for the avoidance of doubt shall not include an RE Non-Consenting Lender. “Non-Responding Lender” means any Lender that fails to: (a) accept or reject, or actively abstains from responding to a request by or on behalf of any of the Obligors for any waiver, amendment or other consent requested in relation to any of the Facility within 10 Business Days (or any other period of time specified by the Borrower with, if less than 10 Business Days, the prior agreement of the Agent) of a written request being made or notifies the relevant Agent in writing that it is abstaining from responding to such request; or (b) sign a Transfer Certificate within three Business Days of any request pursuant to Clause 7.5 (Right of Replacement or Repayment and Cancellation in Relation to a Replaceable Lender). “Obligor” means the Borrower or a Guarantor.

185 “Offshore Associate” means an Associate: (a) which is a non-resident of Australia and does not become a Lender or receive a payment in carrying on a business in Australia at or through a permanent establishment of the Associate in Australia; or (b) which is a resident of Australia and which becomes a Lender or receives a payment in carrying on a business in a country outside Australia at or through a permanent establishment of the Associate in that country; and which does not become a Lender and receive payment in the capacity of a clearing house, custodian, funds manager or responsible entity of a registered scheme. “Option to Sublease” means the option to sublease to be entered into between Shenandoah Land Holdings Pty Ltd (ACN 679 772 555) (as the pastoral lessee) and the Project Trustee. “Original Financial Statements” means: (a) in respect of Tamboran Resources the audited annual consolidated financial statements of Tamboran Resources most recently available as at the date of this Agreement; and (b) in respect of Formentera Australia, the audited annual financial statements of Formentera Australia most recently available as at the date of this Agreement. “Original Obligor” means the Original Borrower or an Original Guarantor. “O&M Contract” means any operations and maintenance contract between the Project Trustee and an Acceptable Contractor entered into in connection with the Project. “Participating Member State” means any member state of the European Union that has the euro as its lawful currency in accordance with legislation of the European Union relating to Economic and Monetary Union. “Party” means a party to this Agreement. “Permitted Disposal” means any sale, lease, licence, transfer or other disposal: (a) of trading stock or cash made by any Obligor in the ordinary course of trading of the disposing entity or of any gas or the creation of any derivative or other financial product, environmental product in the ordinary course of the business of the Project; (b) required by a Transaction Document; (c) of any asset by an Obligor to another Obligor. (d) of assets in exchange for other assets comparable or superior as to type, value and quality (other than an exchange of a non-cash asset for cash); (e) of obsolete or redundant vehicles, plant and equipment for cash; (f) of Cash Equivalent Investments for cash or in exchange for other Cash Equivalent Investments; (g) arising as a result of any Permitted Security; (h) of assets which are subject to a circulating security interest in the ordinary course of day-to-day business and on arms’ length terms; (i) of assets for cash where net consideration received does not exceed $1,000,000 (or its equivalent) in any financial year of the Borrower; or

186 (j) with the prior written consent of the Agent (acting on the instructions of the Majority Lenders). “Permitted Distribution” means: (a) a Distribution made for the purposes of reimbursing any Sponsor or direct or indirect Holding Company of the Borrower in respect of any Project Costs incurred after 1 June 2025 but prior to Financial Close; (b) any Distribution by an Obligor to another Obligor; (c) any Distribution of the income of a Trust to a unitholder being presently entitled to income in accordance with a Trust Deed, to the extent that the Distribution is immediately reinvested in the relevant Trust by way of subscription for units in the relevant Trust or by way of a loan (from the unitholder to the Trustee) which is otherwise permitted under this Agreement; (d) any Distribution made to facilitate any payment under the Management Services Agreement, provided the aggregate amount of Distributions under this limb does not exceed $3,000,000 in any financial year; or (e) any Distribution made with the prior written consent of the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Permitted Financial Indebtedness” means Financial Indebtedness: (a) incurred under the Finance Documents; (b) incurred under a Hedging Agreement; (c) arising under a Permitted Loan or a transaction permitted by paragraph (j) of Clause 20.1 (General Undertakings); (d) under leases and hire purchase contracts constituting Financial Indebtedness under paragraph(d) of that definition of vehicles, plant, equipment or computers, provided that the aggregate capital value of all such items so leased under outstanding leases by Obligors does not exceed $3,000,000 (or its equivalent in any other currency or currencies) at any time; (e) which is subordinated to the Facility on terms acceptable to the Agent (acting on the instructions of the Majority Lenders, acting reasonably); (f) which is made available from any direct or indirect shareholder of an Obligor, provided that such Financial Indebtedness is repaid in full using the proceeds of a Permitted Distribution under paragraph (a) of the definition thereof; or (g) incurred with the prior written consent of the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Permitted Loan” means: (a) any loan which is required under the Transaction Documents; (b) any loan which constitutes Permitted Financial Indebtedness; (c) a loan made by an Obligor to another Obligor; (d) any loan so long as the aggregate amount of the Financial Indebtedness under any such loans does not exceed $1,000,000 (or its equivalent) at any time; or

187 (e) any loan made with the prior written consent of the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Permitted Security” means: (a) any Security which is required or arises under the Transaction Documents; (b) any lien arising by operation of law and in the ordinary course of trading so long as the debt it secures is paid when due or contested in good faith and appropriately provisioned; (c) any netting or set-off arrangement entered into by any Obligor in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances of Obligors; (d) any payment or close out netting or set-off arrangement pursuant to any transactional banking facilities or any Treasury Transaction or foreign exchange transaction entered into by an Obligor which constitutes Permitted Financial Indebtedness, excluding any Security under a credit support arrangement; (e) any Security arising under any retention of title, hire purchase or conditional sale arrangement or arrangements having similar effect in respect of goods supplied to an Obligor in the ordinary course of trading and on the supplier’s standard or usual terms (or on terms more favourable to the Obligors); (f) any Security arising as a result of a disposal which is a Permitted Disposal; (g) any Security arising as a consequence of any leases or hire purchase contracts constituting Financial Indebtedness under paragraph (d) of that definition of vehicles, plant, equipment or computers permitted pursuant to paragraph (d) of the definition of Permitted Financial Indebtedness and only over the asset being financed; or (h) any Security granted with the prior written consent of the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Pilot Project” means the development of the the unconventional shale gas resources located in the FSDAs to the extent necessary for the supply of 40TJ/day pursuant to the Gas Sales Agreement. “Potential Event of Default” means any event or circumstance specified in Clause 22 (Events of Default) which would (with the expiry of a grace period, the giving of notice, the making of any determination under the Finance Documents or any combination of any of the foregoing) be an Event of Default “PPSA” means the Personal Property Securities Act 2009 (Cth). “Prepayment Premium” has the meaning given to that term in Clause 12.4 (Prepayment Premium). “Prime Bank” means a bank determined by ASX Benchmarks Pty Limited (or any other person which takes over the administration of the Screen Rate for Australian dollars) as being a Prime Bank or an acceptor or issuer of bills of exchange or negotiable certificates of deposit for the purposes of calculating that Screen Rate. If ASX Benchmarks Pty Limited or such other person ceases to make such determination, the Prime Banks shall be the Prime Banks last so appointed.

188 “Proceeds Account” means the account established in accordance with Clause 21.5 (Proceeds Account). “Production Certificate” means a certificate substantially in the form set out in Schedule 8 (Form of Production Certificate). “Production Licence” means a production licence under the Petroleum Act 1984 (NT). “Project” means the development of the ‘Sturt Plateau Compression Facility’, a natural gas processing and compression facility (with ancillary infrastructure) to facilitate the injection of gas into the Sturt Plateau Pipeline for transportation to the Amadeus Gas Pipeline. “ProjectCo” means Sturt Plateau Compression Facility Sub Pty Ltd (ACN 681 800 162). “Project Account” means each of: (a) the Proceeds Account; (b) the Insurance Proceeds Account; and (c) the Interest Reserve Account. “Project Costs” means (without double counting): (a) payments under the Project Documents and other costs (including capital expenditure) incurred in connection with financing, development or construction (including transportation, installation and commissioning) of the Project, including, without limitation, all necessary above ground infrastructure located in the Beetaloo Basin of the Northern Territory of Australia, maintenance of access roads, pipelines, flowlines and gas compression kits and any associated engineering and management costs; (b) rentals or other payments in respect of the Project Site prior to the Date of Practical Completion; (c) any costs associated with the operation of the Project prior to the Date of Practical Completion; (d) fees, costs and expenses of the Obligors: (i) paid or payable under or in relation to the negotiation, preparation and execution of the Transaction Documents and satisfaction of conditions precedent under this Agreement including, without limitation, financing, engineering, insurances, financial advisers and legal consultants and other costs of the Obligors or the Finance Parties; (ii) for any duties payable in relation to the Project and other relevant documents; or (iii) paid or payable in relation to the administration and management of the Project; (e) Financing Costs, including without limitation, any fees payable under or in connection with the Finance Documents (including any agency and security trustee, upfront or establishment fees), fees in respect of the Tranche 1 Guarantee, net swap payments or FX forward amounts; (f) any other amount payable in connection with, or necessary to, enable the Project to achieve the Date of Practical Completion; and

189 (g) any other cost or expense that the Borrower and the Agent agree will be a “Project Cost”. For the avoidance of doubt, “Project Costs” shall not include upstream drilling and completion costs to be incurred by Tamboran B2. “Project Documents” means each of: (a) the Connection and New Facility Agreement; (b) the EPCM Contract; (c) the Gas Processing Agreement; (d) the Interface Deed; (e) the Land Access and Use Agreement – Exploration Permit; (f) the Management Services Agreement; (g) the Compressor Supply and Purchase Agreement; (h) the deed entitled ‘Reimbursement, Indemnity and Coordination Deed’ dated on or about the date of this Agreement between Tamboran B2 and the Project Trustee in respect of the Interface Deed; (i) each Future Project Document on and from the time it is entered into; and (j) any other document which the Borrower and the Agent agree will be a ‘Project Document. “Project Site” means that part of the land comprised in Perpetual Pastoral Lease 01201 known as Shenandoah Station, over Portion 7026, Certificate of Title Volume 899 Folio 490 (previously Volume 883 Folio 654), required for the Project. “Project Trust” means the Sturt Plateau Compression Facility Sub Trust (ABN 20 648 909 685). “Project Trust Deed” means the ‘Sturt Plateau Compression Facility Sub Trust Constitution’ dated 24 October 2024 and executed by ProjectCo. “Project Trustee” means Sturt Plateau Compression Facility Sub Pty Ltd (ACN 681 800 162) in its capacity as trustee of the Project Trust. “Quarter Date” means each of 31 March, 30 June, 30 September and 31 December. “Quotation Day” means, in relation to any period for which an interest rate is to be determined, the first day of that period. “Raw Gas GSA” has the meaning given to that term in the Infrastructure Agreement Side Deed. “RE Non-Consenting Lender” has the meaning given in Clause 23(c) (Review Events). “Recognition Certificate” has the meaning given to that term in the Security Trust and Intercreditor Deed. “Reference Bank” means: (a) Commonwealth Bank of Australia; (b) Westpac Banking Corporation;

190 (c) Australia and New Zealand Banking Group Limited; (d) National Australia Bank Limited; (e) any 'prime bank' as determined by the Australian Financial Markets Association; or (f) such other person as the Agent and the Borrower may agree. “Reference Bank Quotation” means any quotation supplied to the Agent by a Reference Bank. “Reference Bank Rate” means in relation to BBSW, the sum of: (a) the following rates: (i) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Agent at its request by the Reference Banks as the mid discount rate (expressed as a yield percent to maturity) observed by the relevant Reference Bank for marketable parcels of Australian dollar denominated bank accepted bills and negotiable certificates of deposit accepted or issued by Prime Banks, and which mature on the last day of the relevant period; or (ii) (if there is no observable market rate for marketable parcels of Prime Bank Australian dollar securities referred to in paragraph (i) above), the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Agent at its request by the Reference Banks as the rate at which the relevant Reference Bank could borrow funds in Australian dollars in the Australian interbank market for the relevant period were it to do so by asking for and then accepting interbank offers for deposits in reasonable market sizes and for that period; and (b) 0.05 per cent per annum. “Related Fund” in relation to a fund (the “first fund”), means a fund which is managed or advised by the same investment manager or investment adviser as the first fund or, if it is managed by a different investment manager or investment adviser, a fund whose investment manager or investment adviser is an Affiliate of the investment manager or investment adviser of the first fund. “Relevant Assets” means the assets constituting part of the Project which are damaged, lost or need to be reinstated as a result of an insurable event for which Relevant Insurance Proceeds are received. “Relevant Insurance Proceeds” all payments received by an Obligor in respect of Insurances (other than Business Interruption Insurance Proceeds and Third-Party Insurance Proceeds) in excess of $5,000,000. “Relevant Market” means in relation to Australian dollars, the Australian interbank market for bank accepted bills and negotiable certificates of deposits. “Retention Licence” means a retention licence under the Petroleum Act 1984 (NT). “Repayment Date” means each date that a repayment instalment in respect of the Facility is to be made in accordance with clause 6.1 (Scheduled Repayment of Loans). “Repayment Notice” means a notice described under Clause 23(d) (Review Events). “Repeating Representations” means each of the representations set out in Clause 18 (Representations) (other than Clauses 18.3 (No conflict with other Obligations), 18.6 (Insolvency), 18.8 (No Stamp Taxes), paragraph (c) of Clause 18.10 (No Misleading

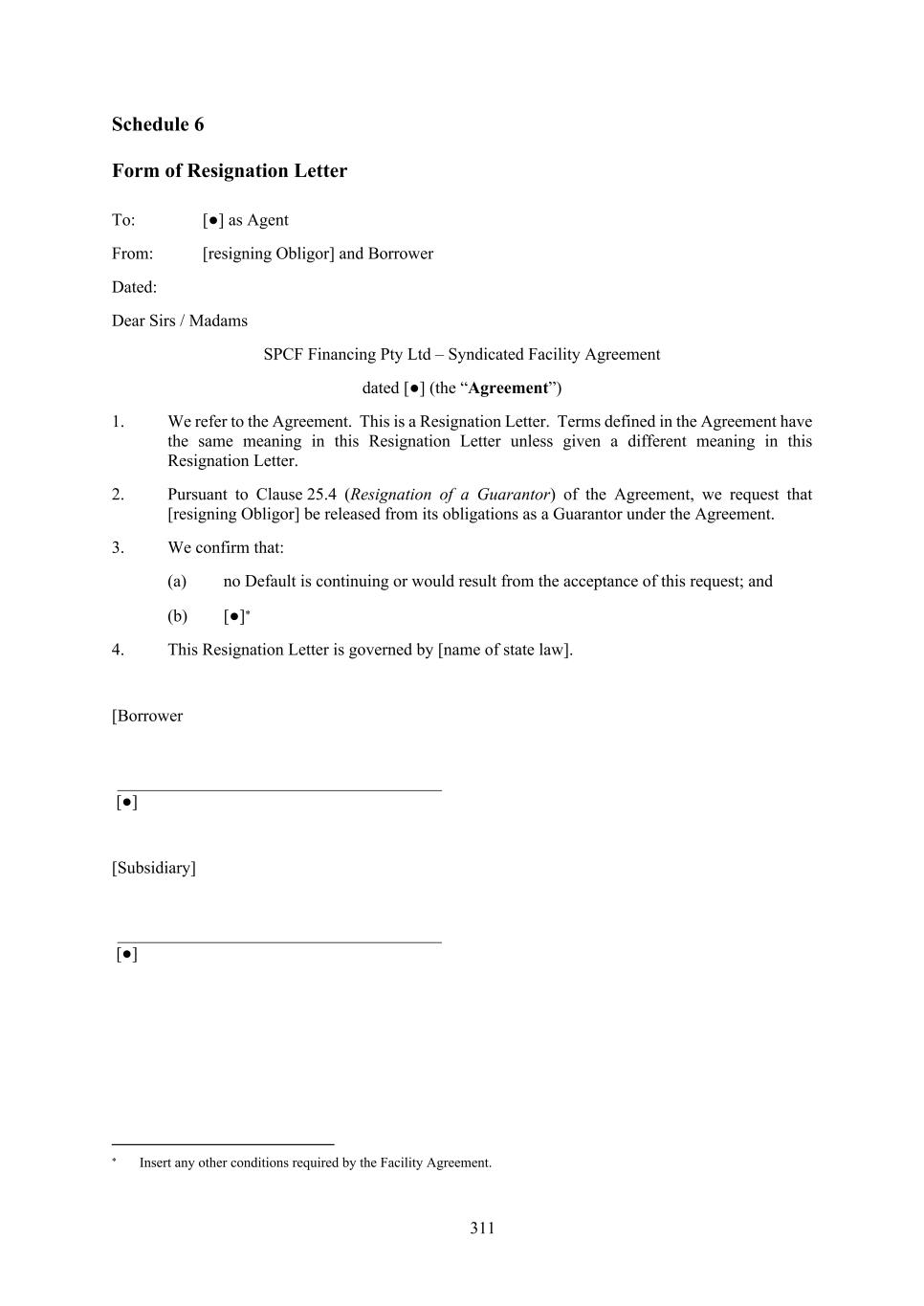

191 Information), 18.13 (No Proceedings Pending or Threatened), paragraph (a) of Clause 18.19 (Group Structure Chart) and paragraph (a) of Clause 18.22 (Project Documents). “Replaceable Lender” means an Affected Lender, a Bail-in Lender, a Defaulting Finance Party, an Increased Costs Lender, an Illegal Lender, a Non-Consenting Lender or a Sanctioned Lender. “Representative” means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian. “Required Balance” means an amount equal to 100% of the Financing Costs forecast to be payable from the date of first Utilisation until 3 May 2027. “Resignation Letter” means a letter substantially in the form set out in Schedule 6 (Form of Resignation Letter). “Retention Licence” means a retention licence granted under the Petroleum Act 1984 (NT). “Review Event” means: (a) a Change in Control occurs without the prior written consent of the Agent (acting on the instructions of the Majority Lenders); (b) by no later than the date that is 30 days after each Quarter Date before the Date of Practical Completion, the Borrower fails to supply to the Agent Cost to Complete Certificate demonstrating that the Cost to Complete Test is satisfied as at the applicable Quarter Date; (c) a person other than a Sponsor (or an Affiliate of a Sponsor) becomes the operator of the Beetaloo Joint Venture; or (d) by no later than the date that is 30 days after each Quarter Date on or after 30 September 2027, the Borrower fails to supply to the Agent a Production Certificate (signed by two directors of the Borrower, a director of the Borrower and the chief executive officer or chief financial officer of the Borrower or a Sponsor, or the chief executive officer or chief financial officer of the Borrower or a Sponsor) setting out (in reasonable detail) evidence that production of ‘Sales Gas’ (as defined in the Gas Processing Agreement) for the previous quarter met or exceeded an average of 25TJ/day, excluding: (i) days in the previous quarter where customer nominations were below 25 TJ/day; and (ii) scheduled maintenance days. “Sanctioned Lender” means any Lender which (as ascertained by the Borrower) is subject to any Sanctions, is located or resident in any Sanctioned Country or to whom a payment under the Finance Documents may not be made as a result of any applicable Sanctions. “Sanctions” means trade, economic or financial sanctions, immigration or humanitarian sanctions, proliferation financing risks (including dual use goods), laws, regulations, embargoes or restrictive measures published and imposed, administered or enforced from time to time by any Sanctions Authority. “Sanctions Authority” means: (a) the United Nations; (b) the European Union;

192 (c) the Council of Europe (founded under the Treaty of London, 1946); (d) the government of the United States of America; (e) the government of the United Kingdom; and (f) the Commonwealth of Australia, and any of their governmental authorities, including, without limitation, the Office of Foreign Assets Control for the US Department of Treasury (“OFAC”), the US Department of Commerce, the US State Department or the US Department of the Treasury, His Majesty's Treasury (“HMT”), and the Australian Sanctions Office of the Australian Department of Foreign Affairs and Trade (“DFAT”). “Sanctioned Country” means any country or territory which is listed on a Sanctions List or is subject to Sanctions. “Sanctioned Entity” means: (a) a person, country or territory which is listed on a Sanctions List or is subject to Sanctions; or (b) a person which is ordinarily resident in or whose principal place of business is in a Sanctioned Country. “Sanctions List” means, in each case to the extent applicable to the Obligors or in connection with the Project or any transaction contemplated by the Finance Documents, any of the lists of specifically designated nationals or designated persons or entities (or equivalent) held by any Sanctions Authority, including (i) the consolidated list of all persons and entities listed under Australian sanctions laws maintained and published by DFAT; (ii) the ‘Specially Designated Nationals and Blocked Persons’ list maintained by OFAC, (iii) the consolidated list of persons, groups or entities subject to European Union sanctions administered by the European External Action Service and (iv) the Consolidated List of Financial Sanctions Targets and the Investment Ban List maintained by Her Majesty’s Treasury, each as amended, supplemented or substituted from time to time; “Sanctioned Transaction” means financing or providing any credit, directly or indirectly, to: (a) a Sanctioned Entity; or (b) any other person or entity if an Obligor or any of its Affiliates has actual knowledge that the person or entity proposes financing or providing any credit, directly or indirectly, to a Sanctioned Entity, in each case to the extent that to do so is prohibited by, or would cause any breach of, Sanctions. “Screen Rate” means the 24-hour delayed Australian Bank Bill Swap Reference Rate published by ASX Benchmarks Pty Limited (or any other person which takes over the administration of that rate) as of 10:30 a.m. Australian Eastern Time for the ‘Mid’ rate for the relevant period displayed on the ‘Benchmark Rates’ page of the website of the Australian Stock Exchange (ASX) (or any replacement page which displays that rate). If such page or service ceases to be available, the Agent may reasonably specify another page or service displaying the relevant rate after consultation with the Borrower. “Secured Property” means all of the assets of the Obligors which from time to time are the subject of the Transaction Security.

193 “Security” means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect, including any “security interest” as defined in sections 12(1) or (2) of the PPSA. “Security Trust and Intercreditor Deed” means the deed entitled ‘Security Trust and Intercreditor Deed’ dated on or about the date of this Agreement and made between, among others, the Borrower, and the Security Trustee. “Selection Notice” means a notice substantially in the form set out in Part 2 (Selection Notice) of Schedule 3 (Requests) given in accordance with Clause 10 (Interest Periods). “SPCF Sublease” means a sublease with Shenandoah Land Holdings Pty Ltd (ACN 679 772 555) (as the pastoral lessee) which enables the Project Trustee to occupy the Project Site and perform its obligations under the Gas Processing Agreement. “SPCF Sublease Mortgage” means the real property mortgage to be entered into over the SPCF Sublease between Project Trustee and the Security Trustee. “Specified Time” means a day or time determined in accordance with Schedule 9 (Timetables). “Sponsor” means: (a) Tamboran Resources; and (b) Formentera Australia. “Sponsor Guarantee” means the: (a) deed of guarantee and indemnity dated on or about the date of this Agreement, provided by Tamboran Resources, Tamboran Resources Pty Ltd (ACN 135 299 062) and Tamboran (West) Pty Ltd (ACN 661 967 077) in favour of the Security Trustee in respect of all amounts payable in respect of Tranche 1A and Tranche 1B; and (b) deed of guarantee and indemnity dated on or about the date of this Agreement, provided by Formentera Australia, Daly Waters Energy, LP and Daly Waters Infrastructure, LP in favour of the Security Trustee in respect of all amounts payable in respect of Tranche 2. “Subordinated Debt” means Financial Indebtedness which is subordinated to the Facility on terms acceptable to the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Subsidiary” has the meaning given to that term in the Corporations Act, but an entity will also be taken to be a Subsidiary of an entity if it is Controlled by that entity and, without limitation: (a) a trust may be a Subsidiary, for the purposes of which a unit or other beneficial interest will be regarded as a share; and (b) an entity may be a Subsidiary of a trust if it would have been a Subsidiary if that trust were a corporation. “Tamboran B2” means Tamboran B2 Pty Ltd (ACN 105 431 525) acting in its personal capacity. “Tamboran B2 (Operator)” means Tamboran B2 Pty Ltd (ACN 105 431 525) acting in its capacity as operator of the Beetaloo Joint Venture. “Tamboran Resources” means Tamboran Resources Corporation (NYSE: TBN), a company incorporated in Delaware with company number 7640969.

194 “Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same). “Tax Act” means the Income Tax Assessment Act 1936 (Cth), the Income Tax Assessment Act 1997 (Cth) or the Taxation Administration Act 1953 (Cth) as the context requires. “Tax Consolidated Group” means a Consolidated Group or an MEC Group as defined in the Tax Act. “Tax Deduction” means a deduction or withholding for or on account of Tax from a payment under a Finance Document. “Technical Adviser” means Risc Advisory Pty Ltd (ACN 150 789 030) or such other entity selected by the Borrower and acceptable to the Agent (acting on the instructions of the Majority Lenders, acting reasonably). “Termination Date” means the date which is four years after Financial Close. “Third-Party Insurance Proceeds” means all payments in respect of Insurances pertaining to third party liability, including public liability, personal injury, workers compensation and directors and other officers' liability. “Title Document” means any original, duplicate or counterpart certificate or document of title including any real property certificate of title, certificate of units in a unit trust, share certificate, contract note, entitlement notice, marked transfer, or certificate evidencing an Investment Instrument or Negotiable Instrument (and in the case of the term “certificate”, within the meaning of the PPSA) but for the avoidance of doubt, excluding any lessee’s original registered duplicate of a registered lease. “Total Commitments” means the aggregate of the Tranche 1A Commitments, the Tranche 1B Commitments and the Tranche 2 Commitments, being $179,816,653 at the date of this Agreement. “Tranche” means Tranche 1A, Tranche 1B or Tranche 2. “Tranche 1 Guarantee” means the deed of guarantee dated on or about the date of this Agreement given by the Tranche 1 NTG Guarantor in favour of the Finance Parties in respect of all amounts payable with respect to Tranche 1A and Tranche 1B up to the ‘Guarantee Limit’ (as defined in the Tranche 1 Guarantee). “Tranche 1 Guarantee Release Date” means the date on which the ‘Guarantee Release Conditions’ (as defined in the Tranche 1 Guarantee) have been satisfied in accordance with the Tranche 1 Guarantee. "Tranche 1 NTG Guarantor" means Northern Territory of Australia. “Tranche 1A” means the part of the Facility made available under Clause 2.1(a) (The Facility). “Tranche 1A Commitments” means: (a) in relation to an Original Lender, the amount set opposite its name under the heading “Tranche 1A Commitment” in Part 2 (The Original Lenders) of Schedule 1 (The Original Parties) and the amount of any other Commitment transferred to it under this Agreement; and (b) in relation to any other Lender, the amount of any Tranche 1A Commitment transferred to it under this Agreement,