EX-99.1

Published on September 25, 2025

NYSE: TBN, ASX: TBN 4Q FY25 Result Presentation Mr. Dick Stoneburner – Chairman & Interim CEO North America: September 25, 2025 | Australia: September 26, 2025

The information in this presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which include statements on Tamboran Resources Corporation's ("we", "us" or the "Company") opinions, expectations, beliefs, plans objectives, assumptions or projections regarding future events or future results. All statements, other than statements of historical fact included in this presentation regarding our strategy, present and future operations, financial position, estimated revenues and losses, projected costs, estimated reserves, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, words such as “may,” “assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget”, "achieve," "progress," "target," "expand," "deliver“, "potential," "propose," "enter," "provide," "contribute," and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events at the time such statement was made. These forward‐looking statements are not a guarantee of our performance, and you should not place undue reliance on such statements. Forward looking statements may include statements about, among other things: our business strategy and the successful implementation of our business strategy; our future reserves; our financial strategy, liquidity and capital required for our development programs; estimated natural gas prices; our dividend policy; the timing and amount of future production of natural gas; our drilling and production plans; competition and government regulation; our ability to obtain and retain permits and governmental approvals; legal, regulatory or environmental matters; marketing of natural gas; business or leasehold acquisitions and integration of acquired businesses; our ability to develop our properties; the availability and cost of developing appropriate infrastructure around and transportation to our properties; the availability and cost of drilling rigs, production equipment, supplies, personnel and oilfield services; costs of developing our properties and of conducting our operations; our ability to reach FID and execute and complete our planned pipeline or planned LNG export projects; our anticipated Scope 1, Scope 2 and Scope 3 emissions from our businesses and our plans to offset our Scope 1, Scope 2 and Scope 3 emissions from our business; our ESG strategy and initiatives, including those relating to the generation and marketing of environmental attributes or new products seeking to benefit from ESG related activities; general economic conditions, including cost inflation; credit markets and the ability to obtain future financing on commercially acceptable terms; our ability to expand our business, including through the recruitment and retention of skilled personnel; our dependence on our key management personnel; our future operating results; and our plans, objectives, expectations and intentions. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Tamboran is subject to known and unknown risks, many of which are beyond the ability of Tamboran to control or predict. These risks may include, for example, movements in oil and gas prices, risks associated with the development and operation of the acreage, exchange rate fluctuations, an inability to obtain funding on acceptable terms or at all, loss of key personnel, an inability to obtain appropriate licenses, permits and or/or other approvals, inaccuracies in resource estimates, share market risks and changes in general economic conditions. Such risks may affect actual and future results of Tamboran and its securities. Maps and diagrams contained in this presentation are provided to assist with the identification and description of Tamboran’s interests. The maps and diagrams may not be drawn to scale. This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, which could cause our results to differ materially from those expressed in these third-party publications. Numbers in this report have been rounded. As a result, some figures may differ insignificantly due to rounding and totals reported may differ insignificantly from arithmetic addition of the rounded numbers. All currency amounts are represented as USD unless otherwise stated (AUD/USD exchange rate of 0.65). This presentation does not purport to be all inclusive or to necessarily contain all the information that you may need or desire to perform your analysis. In all cases, you should conduct your own investigation and analysis of the data set forth in this presentation, and should rely solely on your own judgment, review and analysis in evaluating this presentation. This presentation contains trademarks, tradenames and servicemarks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, tradenames and servicemarks to imply relationships with, or endorsement or sponsorship of us by, these other companies. This announcement was approved and authorised for release by Mr. Dick Stoneburner, the Chairman & Interim CEO of Tamboran Resources Corporation. Disclaimer 2

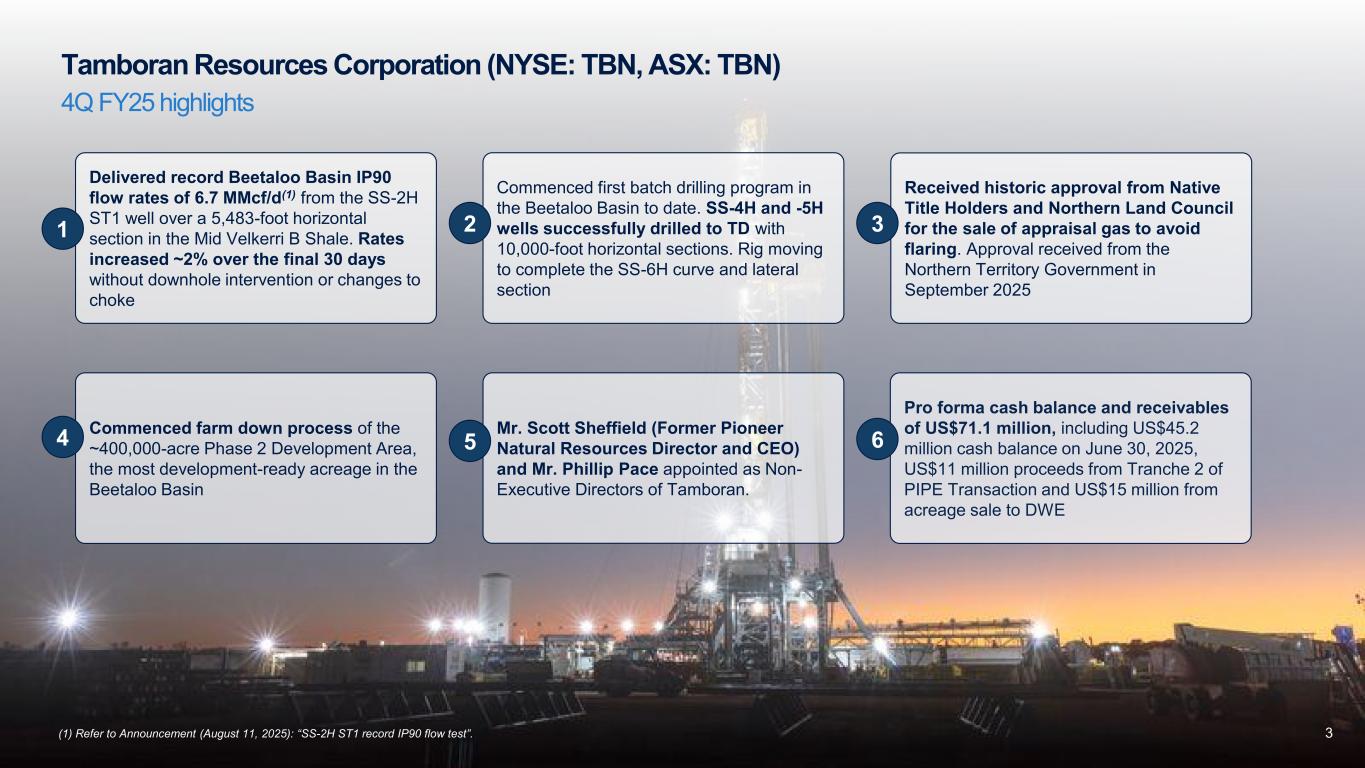

3 Tamboran Resources Corporation (NYSE: TBN, ASX: TBN) 4Q FY25 highlights Delivered record Beetaloo Basin IP90 flow rates of 6.7 MMcf/d(1) from the SS-2H ST1 well over a 5,483-foot horizontal section in the Mid Velkerri B Shale. Rates increased ~2% over the final 30 days without downhole intervention or changes to choke Commenced first batch drilling program in the Beetaloo Basin to date. SS-4H and -5H wells successfully drilled to TD with 10,000-foot horizontal sections. Rig moving to complete the SS-6H curve and lateral section Commenced farm down process of the ~400,000-acre Phase 2 Development Area, the most development-ready acreage in the Beetaloo Basin Received historic approval from Native Title Holders and Northern Land Council for the sale of appraisal gas to avoid flaring. Approval received from the Northern Territory Government in September 2025 Mr. Scott Sheffield (Former Pioneer Natural Resources Director and CEO) and Mr. Phillip Pace appointed as Non- Executive Directors of Tamboran. Pro forma cash balance and receivables of US$71.1 million, including US$45.2 million cash balance on June 30, 2025, US$11 million proceeds from Tranche 2 of PIPE Transaction and US$15 million from acreage sale to DWE 1 2 4 3 5 6 (1) Refer to Announcement (August 11, 2025): “SS-2H ST1 record IP90 flow test”.

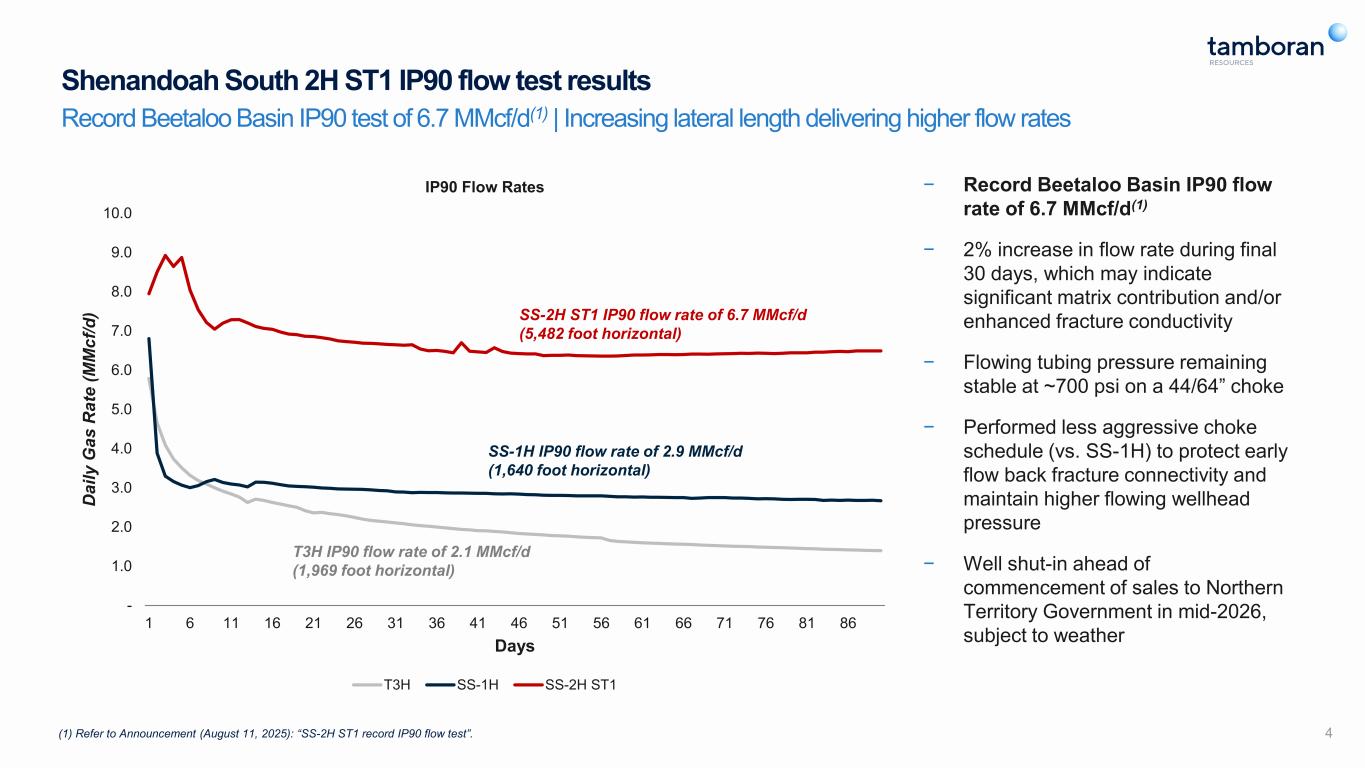

- 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 1 6 11 16 21 26 31 36 41 46 51 56 61 66 71 76 81 86 D a il y G a s R a te ( M M c f/ d ) Days IP90 Flow Rates T3H SS-1H SS-2H ST1 − Record Beetaloo Basin IP90 flow rate of 6.7 MMcf/d(1) − 2% increase in flow rate during final 30 days, which may indicate significant matrix contribution and/or enhanced fracture conductivity − Flowing tubing pressure remaining stable at ~700 psi on a 44/64” choke − Performed less aggressive choke schedule (vs. SS-1H) to protect early flow back fracture connectivity and maintain higher flowing wellhead pressure − Well shut-in ahead of commencement of sales to Northern Territory Government in mid-2026, subject to weather 4 Shenandoah South 2H ST1 IP90 flow test results Record Beetaloo Basin IP90 test of 6.7 MMcf/d(1) | Increasing lateral length delivering higher flow rates SS-1H IP90 flow rate of 2.9 MMcf/d (1,640 foot horizontal) SS-2H ST1 IP90 flow rate of 6.7 MMcf/d (5,482 foot horizontal) T3H IP90 flow rate of 2.1 MMcf/d (1,969 foot horizontal) (1) Refer to Announcement (August 11, 2025): “SS-2H ST1 record IP90 flow test”.

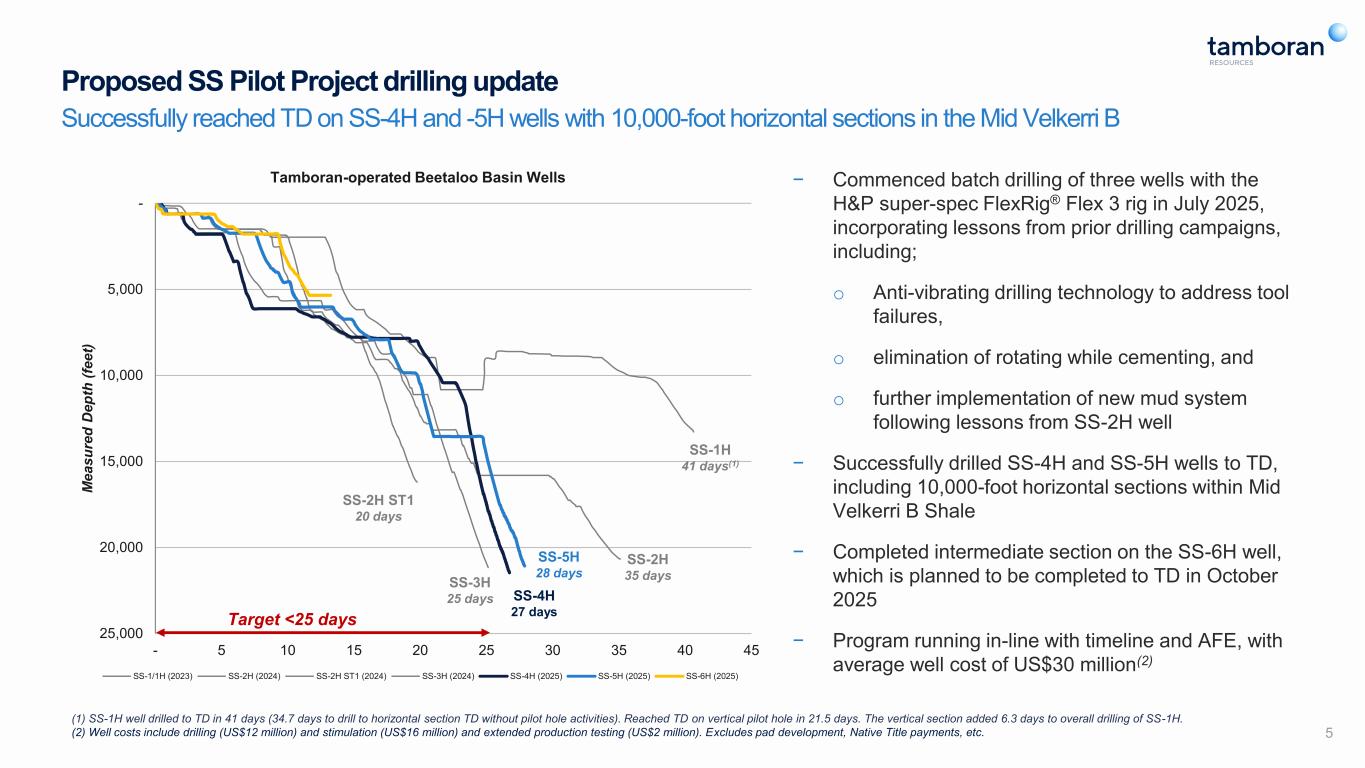

5 Proposed SS Pilot Project drilling update Successfully reached TD on SS-4H and -5H wells with 10,000-foot horizontal sections in the Mid Velkerri B - 5,000 10,000 15,000 20,000 25,000 - 5 10 15 20 25 30 35 40 45 M e a s u re d D e p th ( fe e t) Tamboran-operated Beetaloo Basin Wells SS-1/1H (2023) SS-2H (2024) SS-2H ST1 (2024) SS-3H (2024) SS-4H (2025) SS-5H (2025) SS-6H (2025) SS-2H ST1 20 days − Commenced batch drilling of three wells with the H&P super-spec FlexRig® Flex 3 rig in July 2025, incorporating lessons from prior drilling campaigns, including; o Anti-vibrating drilling technology to address tool failures, o elimination of rotating while cementing, and o further implementation of new mud system following lessons from SS-2H well − Successfully drilled SS-4H and SS-5H wells to TD, including 10,000-foot horizontal sections within Mid Velkerri B Shale − Completed intermediate section on the SS-6H well, which is planned to be completed to TD in October 2025 − Program running in-line with timeline and AFE, with average well cost of US$30 million(2) Target <25 days (1) SS-1H well drilled to TD in 41 days (34.7 days to drill to horizontal section TD without pilot hole activities). Reached TD on vertical pilot hole in 21.5 days. The vertical section added 6.3 days to overall drilling of SS-1H. (2) Well costs include drilling (US$12 million) and stimulation (US$16 million) and extended production testing (US$2 million). Excludes pad development, Native Title payments, etc. SS-3H 25 days SS-2H 35 days SS-1H 41 days(1) SS-5H 28 days SS-4H 27 days

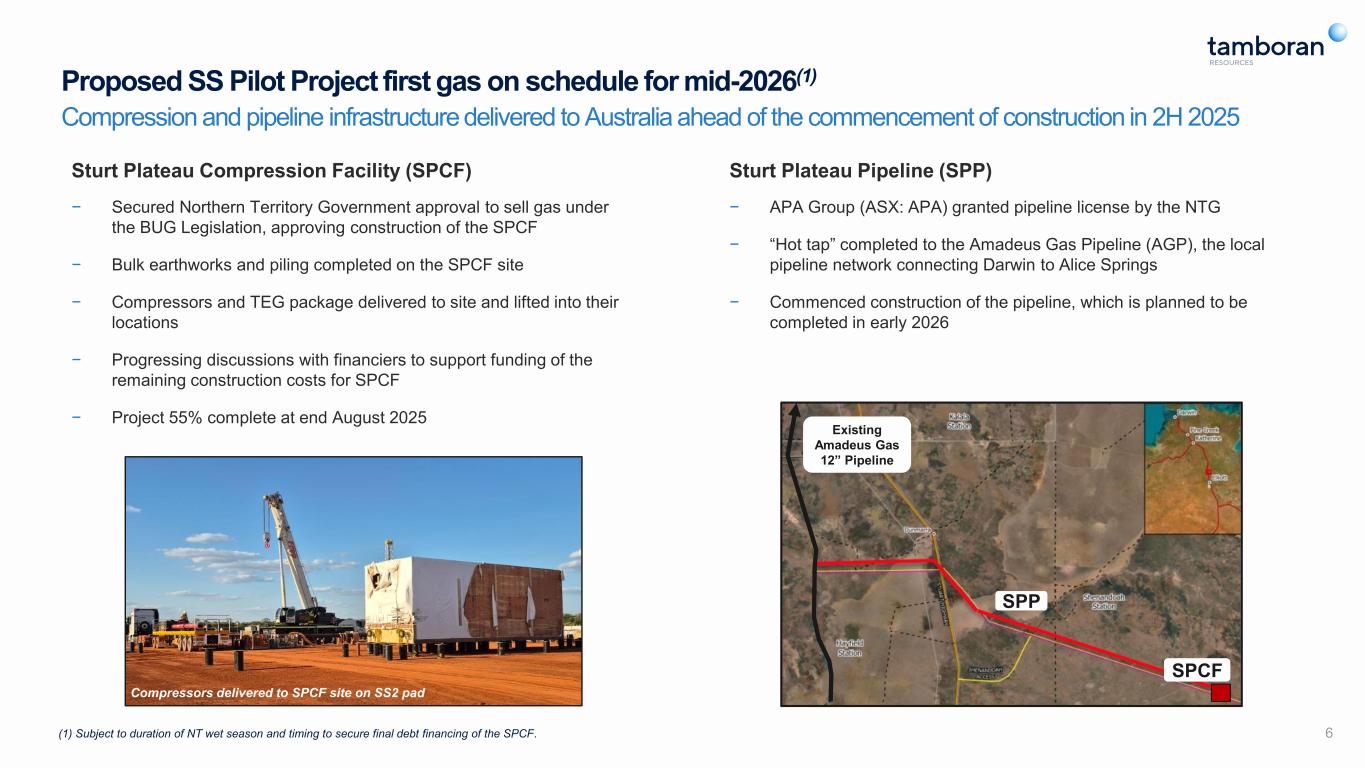

6 Proposed SS Pilot Project first gas on schedule for mid-2026(1) Compression and pipeline infrastructure delivered to Australia ahead of the commencement of construction in 2H 2025 Sturt Plateau Pipeline (SPP) − APA Group (ASX: APA) granted pipeline license by the NTG − “Hot tap” completed to the Amadeus Gas Pipeline (AGP), the local pipeline network connecting Darwin to Alice Springs − Commenced construction of the pipeline, which is planned to be completed in early 2026 Sturt Plateau Compression Facility (SPCF) − Secured Northern Territory Government approval to sell gas under the BUG Legislation, approving construction of the SPCF − Bulk earthworks and piling completed on the SPCF site − Compressors and TEG package delivered to site and lifted into their locations − Progressing discussions with financiers to support funding of the remaining construction costs for SPCF − Project 55% complete at end August 2025 Compressors delivered to SPCF site on SS2 pad SPP SPCF Existing Amadeus Gas 12” Pipeline (1) Subject to duration of NT wet season and timing to secure final debt financing of the SPCF.

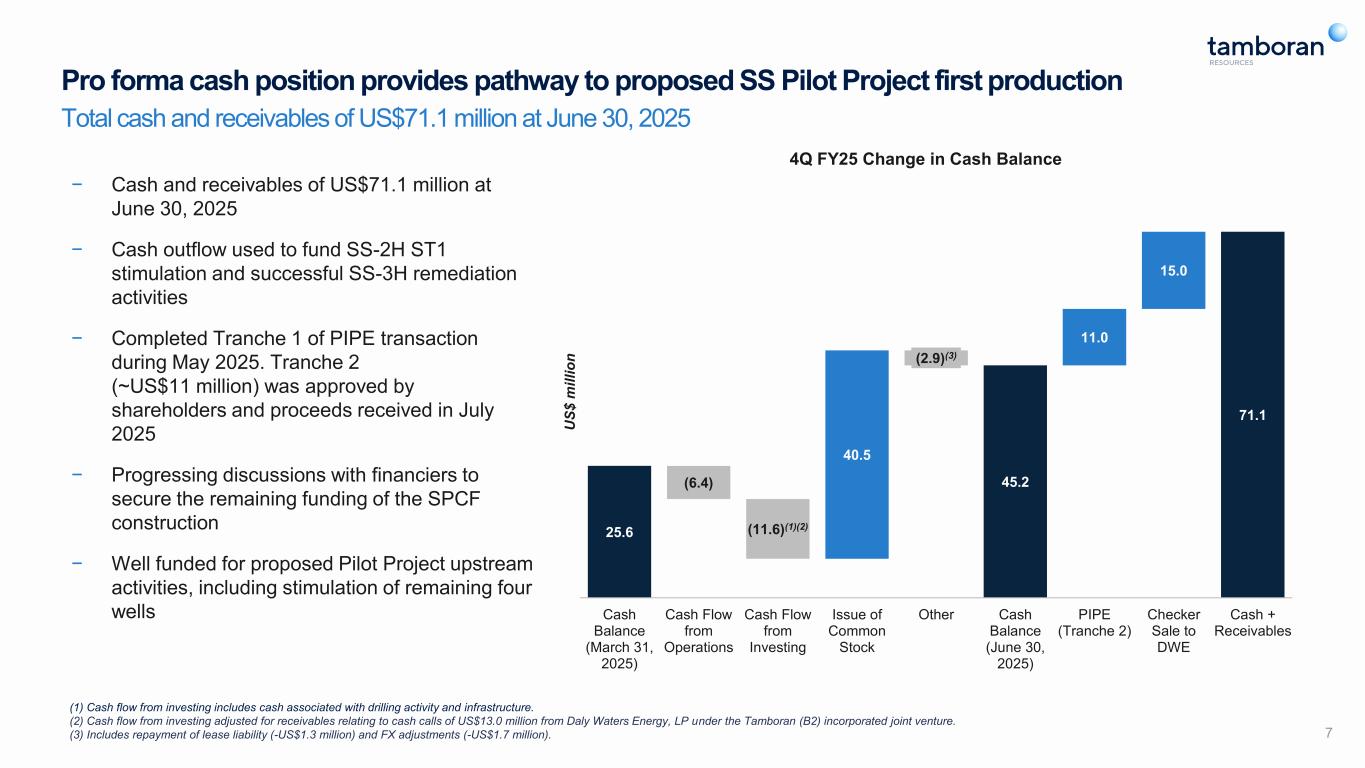

Pro forma cash position provides pathway to proposed SS Pilot Project first production 7 (1) Cash flow from investing includes cash associated with drilling activity and infrastructure. (2) Cash flow from investing adjusted for receivables relating to cash calls of US$13.0 million from Daly Waters Energy, LP under the Tamboran (B2) incorporated joint venture. (3) Includes repayment of lease liability (-US$1.3 million) and FX adjustments (-US$1.7 million). Total cash and receivables of US$71.1 million at June 30, 2025 45.2 71.1 (6.4) (11.6)(1)(2) (2.9)(3) 25.6 40.5 11.0 15.0 Cash Balance (March 31, 2025) Cash Flow from Operations Cash Flow from Investing Issue of Common Stock Other Cash Balance (June 30, 2025) PIPE (Tranche 2) Checker Sale to DWE Cash + Receivables U S $ m il li o n 4Q FY25 Change in Cash Balance − Cash and receivables of US$71.1 million at June 30, 2025 − Cash outflow used to fund SS-2H ST1 stimulation and successful SS-3H remediation activities − Completed Tranche 1 of PIPE transaction during May 2025. Tranche 2 (~US$11 million) was approved by shareholders and proceeds received in July 2025 − Progressing discussions with financiers to secure the remaining funding of the SPCF construction − Well funded for proposed Pilot Project upstream activities, including stimulation of remaining four wells

Upcoming catalysts Progressing towards production from proposed 40 TJ/d (~39 MMcf/d) SS Pilot Project in mid-2026 8Note: Timing of upcoming catalysts is indicative, and subject to change in the event of unforeseen events, delays due to weather and key stakeholder and Joint Venture approvals. Refer to disclaimer on Slide 2. 4Q 2025 Reach FID on proposed Pilot Project 4Q 2025 Complete drilling of SS-6H Pilot well 4Q 2025 Stimulate SS-4H well with Liberty Energy equipment Early 2026 Complete construction of the SPP 1Q 2026 Target completion of the Phase 2 Development Area farmout 1H 2026 Stimulation 3H, 5H and 6H wells ahead of commencement of gas sales Mid-2026 Complete construction of the SPCF Mid 2026 Target SS Pilot Project first gas sales of 40 TJ/d

Q&A