EX-10.4

Published on May 15, 2025

Hamilton Locke Asset Sale Agreement – Beetaloo Acreage Acquisition Tamboran (West) Pty Limited (ACN 661 967 077) and Tamboran Resources Corporation (ARBN 672 879 024) and Daly Waters Energy, LP Execution version

Hamilton Locke Asset Sale Agreement i Table of Contents 1. Definitions and interpretation 1 1.1 Definitions 1 1.2 Interpretation 7 2. Escrow 8 2.1 Escrow arrangement 8 2.2 Establishment of Escrow Account 9 2.3 Operation of Escrow Account 9 2.4 Release of Escrow Amount 9 2.5 Interest on Escrow Amount 9 3. Sale and Purchase 9 3.1 Sale and purchase 9 3.2 Consideration 10 3.3 Title, property and risk 10 3.4 Nominee 10 4. Conditions precedent 10 4.1 Conditions Precedent 10 4.2 Duties in relation to Dev A++ Conditions 12 4.3 Waiver 13 4.4 Termination following failure to satisfy or waive Conditions 13 4.5 Effect of termination 13 5. Conduct prior to Completion 13 5.1 Conduct in relation to the Assets 13 6. Dev A++ Completion 14 6.1 Time and place of Dev A++ Completion 14 6.2 Seller’s obligations at Dev A++ Completion 14 6.3 Buyer’s obligations at Completion 15 6.4 Completion simultaneous 15 6.5 Assumed obligations 15 7. Post Completion requirements 16 7.1 Duty and Registration 16 7.2 Conditions on sale of C10 Assets 17 7.3 Conduct prior to Completion in relation to C10 Assets 17 7.4 Completion in relation to C10 Assets 17 8. Tag along rights 18

Hamilton Locke Asset Sale Agreement ii 3468-7123-2057, v. 2 8.1 Tag along option 18 8.2 Exercise of Tag along option 18 9. Foreign resident capital gains withholding 19 10. Warranties and Indemnities 19 10.1 Seller Warranties 19 10.2 Seller Guarantor Warranties 19 10.3 Buyer Warranties 20 10.4 Reliance 20 10.5 Separate Warranties 20 10.6 Seller Indemnity 20 10.7 Seller to disclose breach 20 10.8 Maximum amount 20 10.9 Time limits for Claims of breach of Warranty 20 10.10 Other limitations 20 10.11 No double recovery 21 10.12 Exclusions 21 12. Termination 23 12.1 Termination by the Buyer 23 12.2 Termination by the Seller and/or Seller Guarantor 23 12.3 Effect of termination 23 13. Goods and Services Tax (GST) 23 13.1 Preliminary 23 13.2 GST exclusive 23 13.3 Liability to pay GST 24 13.4 Tax Invoice 24 13.5 Adjustment Event 24 13.6 Reimbursement of Expenses 24 13.7 Non Merger 24 14. Notices 24 14.1 Requirements 24 14.2 How a Notice must be given 24 14.3 When Notices considered given and received 25 14.4 Time of delivery and receipt 25 15. General 25 15.1 Governing law and jurisdiction 25 15.2 Variation 25

Hamilton Locke Asset Sale Agreement iii 3468-7123-2057, v. 2 15.3 Costs and expenses 25 15.4 Waiver 25 15.5 Severance 26 15.6 Confidentiality 26 15.7 Further assurances 26 15.8 No reliance 26 15.9 Entire agreement 26 15.10 Counterparts 26 15.11 Remedies cumulative 26 15.12 No merger 27 15.13 Electronic signature 27 15.14 Clauses that survive termination 27 Schedule 1 – Notice details 28 Schedule 2 – Seller Warranties 29 Schedule 3 – Seller Guarantor Warranties 31 Schedule 4 Buyer Warranties 32

Hamilton Locke Asset Sale Agreement 1 Parties Seller Name Tamboran (West) Pty Limited ACN 661 967 077 Address Tower One, International Towers Sydney Suite 1, Level 39 100 Barangaroo Avenue BARANGAROO NSW 2000 Seller Guarantor Name Tamboran Resources Corporation ARBN 672 879 024 Address Tower One, International Towers Sydney Suite 1, Level 39 100 Barangaroo Avenue BARANGAROO NSW 2000 DWE Name Daly Waters Energy, LP Address 300 Colorado Street Suite 1900 Austin, TX 78701 USA Buyer Name Elliott Energy I Pty Ltd Address 300 Colorado Street Suite 1900 Austin, TX 78701 USA Background A. The Seller and DWE (among others) are parties to the JVSA and are the shareholders of TB1. TB1 holds all of the shares in TB2 and TB2 holds a 77.5% interest in the Permits. B. Under the Checkerboard Process set out in the JVSA: a. As at the date of this agreement, the Seller and the Buyer each hold an indirect 38.75% interest in the Permits, through their shareholding in TB1; b. the Seller is or will be nominated to hold a 77.5% interest in each of the Dev A++ RL and the C10 RL (on grant); c. upon grant of the Dev A++ RL, the Seller will be the beneficial owner of a 77.5% interest in each of the Dev A++ RL and the C10 RL; and d. the Buyer has been nominated by DWE to take transfer of the Assets. C. The Seller has agreed to sell, and the Buyer has agreed to buy, the Assets on the terms set out in this agreement. D. The Seller Guarantor has agreed to guarantee the Seller’s obligations under this agreement. Operative provisions 1. Definitions and interpretation 1.1 Definitions Capitalised terms that are not otherwise defined below have, unless the context requires otherwise, the meaning given to that term in the Amended JVSA. In this agreement: Amended JVSA means the Deed of Amendment and Restatement in respect of the Existing JVSA, entered into between the Seller, DWE, Seller Parent, Sheffield Holdings, LP among

Hamilton Locke Asset Sale Agreement 2 3468-7123-2057, v. 2 others on or about the date of this agreement. Assets means: (a) the Dev A++ Assets; and (b) the C10 Assets. Assumed Contracts means any agreement, contract or deed that has been entered into in connection with the Dev A++ RL or the C10 RL that the Seller (acting reasonably) determines needs to be transferred (to the extent of the Sale Interest) to the Buyer in connection with the Transaction, and includes the Royalty Agreement. Assumed Obligations means, subject to the JVSA, all obligations and liabilities of the Seller under the Dev A++ JOA, C10 JOA and the Assumed Contracts, to the extent of the Sale Interest, which are to be performed, paid or satisfied on or after Completion, other than the Retained Obligations. Assumption Documents means, in respect of an Assumed Contract, a contract, deed or notification under which the Buyer accedes to, assumes or adopts, or takes a transfer, assignment or novation of, that Assumed Contract (to the extent of the Sale Interest) to effect the transfer to the Buyer of the rights, interests, liabilities and obligations of the Seller (to the extent of the Sale Interest), in the form agreed by the parties and the relevant third party (if applicable). Beetaloo Gas Project means the gas project comprising of the Permits that is governed by the Existing JOA (as amended). Binding Decision has the meaning given in clause 11.1. Business Day means a weekday on which trading banks are open for business in Perth, Western Australia. Buyer Warranties means the warranties given by the Buyer set out in Schedule 3. C10 Area has the meaning given in the JVSA. C10 Assets means: (a) the C10 Sale Interest; and (b) the Seller’s rights, interests and obligations under the C10 JOA and the Assumed Contracts, to the extent of the C10 Sale Interest. C10 Completion means the completion of the sale and purchase of the C10 Assets under clause 7.4. C10 Completion Date means the date which is 10 Business Days after satisfaction or waiver of the C10 Conditions, or such other date as the parties agree to in writing. C10 End Date means in relation to the DevA++ Conditions, 365 days after the Execution Date, or such other date as agreed between the parties. C10 JOA means the joint operating agreement to be entered into in by the relevant parties in respect of the C10 RL. C10 JV means, once formed, the unincorporated joint venture between the Seller, the Buyer and Falcon in respect of the C10 RL to be governed by the C10 JOA. C10 RL means the retention licence to be granted over the C10 Area.

Hamilton Locke Asset Sale Agreement 3 3468-7123-2057, v. 2 C10 Sale Interest means a 9.67% legal and beneficial interest in the C10 RL and a corresponding 9.67% interest in the C10 JOA and the relevant Petroleum Information. Cash Consideration means US$15,000,000 cash. Checkerboard Process means the implementation of the ‘Checkerboard Strategy’, as set out in the JVSA. Claim means any claim, action, proceeding, judgment, damage, debt, cost (including legal costs on a full indemnity basis), expense, loss, liability or any other cause of action whether present, unascertained, immediate, future or contingent and whether arising at common law, in equity, under statute or otherwise. Completion means the Dev A++ Completion and C10 Completion (as the context requires). Completion Date the Dev A++ Completion Date and the C10 Completion Date (as the context requires). Consequential Loss means any Loss arising or resulting from or in connection with any breach of this agreement which does not arise naturally and in the usual course of things from the relevant breach or circumstances, or was not within the contemplation of the parties at the time this agreement was entered into, and includes: (a) loss of goodwill and loss of opportunity; (b) loss of profit and other economic loss; and (c) any Loss that is sustained or incurred by any person and that is special, punitive or exemplary in nature, whether arising in contract, tort (including negligence) or otherwise. Continuing Clauses means clause 1 (Definitions and Interpretation), clause 12 (GST), clause 14 (Notices), clause 15 (General), and any other clause that by its terms survive termination of this agreement. Corporations Act means the Corporations Act 2001 (Cth). Dev A++ Assets means: (a) the Dev A++ Sale Interest; and (b) the Seller’s rights, interests and obligations under the Dev A++ JOA and the Assumed Contracts, to the extent of the Dev A++ Sale Interest. Dev A++ Completion means the completion of the sale and purchase of the Dev A++ Assets under clause 6. Dev A++ Completion Date means the date which is 10 Business Days after satisfaction or waiver of the Dev A++ Conditions, or such other date as the parties agree to in writing. Dev A++ Conditions means the conditions precedent set out in clause 4.1. Dev A++ End Date means, in relation to the DevA++ Conditions, 180 days after the Execution Date, or such other date as agreed between the parties. Dev A++ JOA means the joint operating agreement to be entered into in by the relevant parties in respect of the Dev A++ RL. Dev A++ JV means, once formed, the unincorporated joint venture between the Seller, the Buyer and Falcon in respect of the Dev A++ RL to be governed by the Dev A++ JOA.

Hamilton Locke Asset Sale Agreement 4 3468-7123-2057, v. 2 Dev A++ RL means the retention licence to be granted over the Dev A++ Area (as shown in the Amended JVSA). Dev A++ Sale Interest means a 19.38% legal and beneficial interest in the Dev A++ RL and a corresponding 19.38% interest in the Dev A++ JOA and the relevant Petroleum Information. Department means the Department of Mining and Energy of the Northern Territory Government of Australia. Duty means any stamp, transaction, transfer, landholder or registration duty or similar charge which is imposed by any Government Agency and includes any interest, fine, penalty, charge or other amount which is imposed. Encumbrance means any security for the payment of money or performance of obligations and includes a mortgage, charge, pledge, lien, trust, title retention, preferential right, easement, restrictive or positive covenant or any other adverse right or interest of any nature but does not include the Permitted Encumbrances. Escrow Account means the escrow account that is set-up under clause 2.2. Escrow Amount means the aggregate of the following amounts: (a) the Cash Consideration paid under this agreement, which the Seller and the Seller guarantor irrevocably direct the Buyer to, at Completion, pay into the Escrow Account; (b) the amount of funds that the Buyer or any of its Affiliates, or Bryan Sheffield or any of his Affiliates, subscribes for and pays to the Seller Guarantor in the PIPE; and (c) US$5,000,000 of the funds received by the Seller Guarantor in the PIPE from parties other than the Buyer or any of its Affiliates, or Bryan Sheffield or any of his Affiliates. Execution Date means the date this agreement is signed by the last party to do so. Existing JOA means the joint operating agreement between TB2 and Falcon dated 2 May 2014 (as amended from time to time). Existing JVSA means the first Amended and Restated Joint Venture Shareholders Agreement, between the Seller, Buyer, Sellers Guarantor, Sheffield Holdings, LP and TB1 dated 3 June 2024 (as amended from time to time). Falcon means Falcon Oil & Gas Australia Limited (ABN 53 132 857 008). Government Agency means any government, or governmental, semi-governmental, administrative, fiscal or judicial body, responsible minister, department, office, commission, delegate, authority, instrumentality, tribunal, board, agency, entity or organ of government, in respect of a sovereign state and includes any of the foregoing purporting to exercise any jurisdiction or power outside that sovereign state. Government Approval means an approval, permit, licence or authority required from a Government Agency. GST means goods and services tax or similar value added tax levied or imposed in Australia under the GST Act or otherwise on a supply. GST Act means the A New Tax System (Good and Services Tax) Act 1999 (Cth). Immediately Available Funds means cash, bank cheque or telegraphic or other electronic means of transfer of cleared funds into a bank account nominated in advance by the payee.

Hamilton Locke Asset Sale Agreement 5 3468-7123-2057, v. 2 Insolvency Event means, in relation to a party, the occurrence of any of the following events: (a) an application is made to a court for an order or an order is made that the party be wound up, and the application is not withdrawn, stayed or dismissed within 21 days of being made; (b) appointment of a liquidator, provisional liquidator, administrator, receiver, receiver and manager or controller in respect of the party or its assets; (c) except to reconstruct or amalgamate while solvent, the party enters into, or resolves to enter into, a scheme of arrangement, deed of company arrangement or composition with, or assignment for the benefit of, all or any class of its creditors, or it proposes a reorganisation, moratorium or other administration involving any of them; (d) the party resolves to wind itself up, or otherwise dissolve itself, or gives notice of intention to do so, except to reconstruct or amalgamate while solvent or is otherwise wound up or dissolved; (e) the party receives a deregistration notice under section 601AB of the Corporations Act or any communication from ASIC that might lead to such notice or applied for deregistration under section 601AA of the Corporations Act; (f) the party is or states that it is insolvent as that term is defined in section 95A of the Corporations Act; (g) as a result of the operation of section 459F(1) of the Corporations Act, the party is taken to have failed to comply with a statutory demand; (h) the party is or makes a statement from which it may be reasonably deduced that the body corporate is the subject of an event described in section 459C(2)(b) or section 585 of the Corporations Act; (i) the party takes any step to obtain protection or is granted protection from its creditors, under any applicable law; or (j) anything analogous or having a substantially similar effect to any of the events specified above happens under the law of any applicable jurisdiction. Law means: (a) the common law and equity; (b) all present and future Acts of Parliament of the Commonwealth and Parliament of any State or Territory of Australia; or (c) all enforceable regulations, subsidiary legislation, codes, ordinances, local laws, by- laws, orders, judgments, licences, rules, permits, agreements and enforceable requirements of any Government Agency. Liabilities means any liability, duty or obligation (whether past, present or future, actual, contingent or prospective, known or unknown, joint or several) including for any Loss. Loss includes any losses, liabilities, damages, costs, charges or expenses (including lawyers’ fees and expenses on a full indemnity basis), and fines and penalties, however arising. Macquarie Priority Deed means the agreement between the Seller, DWE and Macquarie Bank Limited (ABN 46 008 583 542) dated 19 December 2024.

Hamilton Locke Asset Sale Agreement 6 3468-7123-2057, v. 2 Midstream Infrastructure means the SPCF, the SPP and related midstream infrastructure governed by the ‘SPCF Holding – Unitholders’ and Shareholders’ Deed’ (and related documents) entered into by the midstream Affiliates of the Buyer and the Seller Guarantor. North FSDA JOA means the joint operating agreement to be entered into by Falcon and TB2 in respect of the North FSDA in accordance with the Amended JVSA. Notice has the meaning given in clause 14.1. Notified Contact Details has the meaning given in clause 14.1. Origin means Origin Energy Limited and includes any of its subsidiaries (as applicable). Payment Date means (i) the date of Completion, in relation to the Cash Consideration paid under this agreement; and (ii) otherwise the date that is 1 Business Day after the date that the Seller Guarantor receives the funds in respect of the PIPE. Permitted Encumbrances means, with respect to the Assets: (a) rights reserved to or vested in any Government Agency by the terms of any instrument or grant of the Dev A++ RL or the C10 RL; (b) Taxes and royalties imposed by the government; and (c) the reservations, limitations, conditions and endorsements applicable to the Permits recorded in the register maintained by the Department that would have shown on a title search conducted 5 Business Days before the Execution Date; and (d) agreements recognised under the Native Title Act 1993 (Cth) which may affect land use right (any Indigenous Land Use Agreement registered under the Native Title Act 1993 (Cth)). Petroleum Act means the Petroleum Act 1984 (NT). Petroleum Information means all information available in respect of the Dev A++ JV, the Dev A++ RL, the C10 RL or the C10 JV in the possession or control of the Seller or its Affiliates, howsoever held or stored. Petroleum Regulations means Petroleum Regulations 2020 (NT). PIPE means the ‘private investment in public equity’ capital raising being undertaken by the Seller Guarantor on or about the week commencing May 12, 2025. Related Bodies Corporate has the meaning given to that term in the Corporations Act. Retained Obligations means all obligations and liabilities of the Seller under or in connection with the Dev A++ JOA or the Assumed Contracts to the extent that they accrue or relate to the period prior to Completion, notwithstanding that they may materialise on or after Completion. Royalty Agreement means each agreement, deed or arrangement under which a Seller Group Member is obliged to pay a royalty (or any other payment referable to the production of Petroleum from the area of the Dev A++ RL or C10 RL) and includes the ‘Royalty Deed (EP 76, EP 98, EP 117) – Daly Waters’ entered into between the Seller Parent and Daly Waters Royalty, LP dated 18 September 2022. Sale Interest means the Dev A++ Sale Interest and the C10 Sale Interest (as the context applies). Seller Group Member means the Seller and each Related Body Corporate of the Seller.

Hamilton Locke Asset Sale Agreement 7 3468-7123-2057, v. 2 Seller Parent means Tamboran Resources Pty Ltd. Seller Warranties means the warranties given by the Seller set out in Schedule 2. Seller Guarantor Warranties means the warranties given by the Seller Guarantor set out in Schedule 3. South FSDA JOA means the joint operating agreement to be entered into by Falcon and TB2 in respect of the South FSDA in accordance with the Amended JVSA. SPCF means the facility and infrastructure comprising the proposed gas processing and compression facility located adjacent to the SS2 wellpad to be developed to process gas within the North FSDA, South FSDA, Dev A++ Area and Dev B Area. SPCF Holding – Unitholders’ and Shareholders’ Deed means the ‘Unitholders’ and Shareholders’ Deed’ governing the SPCF (including any related documents under which. SPP means the Stuart Plateau Pipeline connecting the SPCF and the gas fields located within the North FSDA, South FSDA, Dev A++ Area and Dev B Area. Tax or Taxes means all forms of present and future taxes, goods and services tax, stamp duty, excise, imposts, deductions, charges, withholdings, rates, levies or other governmental impositions imposed, assessed or charged by any Government Agency, together with all interest, penalties, fines, expenses and other additional statutory charges relating to any of them, imposed or withheld by a Government Agency. TB1 means Tamboran (B1) Pty Ltd (ACN 662 327 237). TB2 means Tamboran (B2) Pty Ltd (ACN 105 431 525). Transaction means: (a) the sale and purchase of the Assets for the Cash Consideration on the terms and conditions of this agreement; and (b) any other transaction contemplated in the Transaction Documents. Transaction Documents means: (a) this agreement; (b) the Transfer Documents; and (c) any other document the parties agree is a Transaction Document. Transfer means to sell, transfer, grant, farm-down, assign or otherwise dispose of (including by granting an encumbrance or similar). Transfer Documents means any documents necessary to transfer each Sale Interest from the Seller to the Buyer, including the instruments to transfer the Sale Interest to the Buyer, as required under the Petroleum Act and Petroleum Regulations. Warranty means any of the Buyer Warranty, Seller Warranty or Seller Guarantor Warranty and Warranties means all of them. 1.2 Interpretation In this agreement unless a contrary intention is expressed: (a) headings and italicised, highlighted or bold type do not affect the interpretation of this

Hamilton Locke Asset Sale Agreement 8 3468-7123-2057, v. 2 agreement; (b) the singular includes the plural and the plural includes the singular; (c) other parts of speech and grammatical forms of a word or phrase defined in this agreement have a corresponding meaning; (d) a reference to a ‘person’ includes any individual, firm, company, partnership, joint venture, an unincorporated body or association, trust, corporation or other body corporate and any Government Agency (whether or not having a separate legal personality); (e) a reference to a clause, party or schedule is a reference to a clause of, and a party and schedule to, this agreement and a reference to this agreement includes any clause and schedule; (f) a reference to a document (including this agreement) includes all amendments or supplements to, or replacements or novations of, that document; (g) a reference to a party to any document includes that party’s successors and permitted assigns; (h) a reference to time is to the time in Sydney, New South Wales; (i) a reference to any legislation includes all delegated legislation made under it and includes all amendments, consolidations, replacements or re-enactments of any of them, from time to time; (j) a reference to a document includes any agreement or contract in writing, or any certificate, notice, deed, instrument or other document of any kind; (k) a provision of this agreement may not be construed adversely to a party solely on the ground that the party (or that party’s representative) was responsible for the preparation of this agreement or the preparation or proposal of that provision; (l) a reference to a body, other than a party to this agreement (including an institute, association or authority), whether statutory or not, which ceases to exist or whose powers or functions are transferred to another body, is a reference to the body which replaces it or which substantially succeeds to its powers or functions; (m) the words ‘include’, ‘including’, ‘for example’, ‘such as’ or any form of those words or similar expressions in this agreement do not limit what else is included and must be construed as if they are followed by the words ‘without limitation’, unless there is express wording to the contrary; (n) if an act or event must occur or be performed on or by a specified day and occurs or is performed after 5.00 pm on that day, it is taken to have occurred or been done on the next day; (o) if anything under this agreement is required to be done by or on a day that is not a Business Day that thing must be done by or on the next Business Day; and (p) a reference to ‘$’, ‘USD’, ‘dollars’ or ‘Dollars’ is a reference to the lawful currency of the United States of America. 2. Escrow 2.1 Escrow arrangement

Hamilton Locke Asset Sale Agreement 9 3468-7123-2057, v. 2 (a) The Seller Guarantor acknowledges that this Transaction is being effected concurrently with a PIPE funding process that DWE, or its Affiliates, may participate in. (b) In consideration for entering into this agreement, the Seller Guarantor and DWE agree that: (i) the Escrow Amounts will each be paid on the relevant Payment Date into the Escrow Account; and (ii) any payment made from the Escrow Account must be made in accordance with this clause 2. (c) If required by either DWE or the Seller Guarantor, those parties shall enter into a fully formed escrow deed governing the escrow arrangement set out in this clause 2, noting that this clause 2 remains binding on the parties unless and until they do so. 2.2 Establishment of Escrow Account (a) DWE and the Seller Guarantor must, on or before the Payment Date, take all steps necessary to procure that the Escrow Account is opened on terms that at least 1 representative of DWE and at least 1 of the Seller Guarantor must both authorise any transactions on the Escrow Account. (b) The costs of the establishment and administration of the Escrow Account will be borne by the Seller Guarantor. 2.3 Operation of Escrow Account Each of DWE and the Seller Guarantor must promptly give or join in giving all instructions and take all other steps as may be necessary to procure that the Escrow Account is operated, and the balance in the Escrow Account is applied or paid, in accordance with this clause 2 (including where DWE makes a direction under clause 2.4). 2.4 Release of Escrow Amount If the Seller or any other Affiliate of the Seller Guarantor becomes liable to pay a cash call or similar funding request under either of the Existing JVSA, the Amended JVSA, the Existing JOA, the SPCF Holding – Unitholders’ and Shareholders’ Deed or any other document related to the Midstream Infrastructure, (a TBN Cash Call) then the Seller Guarantor and the Buyer must each cause any funds in the Escrow Account to be applied in payment of the relevant TBN Cash Call within 5 Business Days. If the Seller Guarantor and the Buyer cannot agree on the release of funds related to pay a TBN Cash Call within 5 Business Days, the Buyer may direct where the funds are to be allocated and the Seller Guarantor and the Buyer must each cause any funds in the Escrow Account to be applied in payment of the directed TBN Cash Call within 2 Business Days of such direction. 2.5 Interest on Escrow Amount Any interest earned on the Escrow Amount shall be applied to the final TBN Cash Call. 3. Sale and Purchase 3.1 Sale and purchase The Seller agrees to sell to the Buyer (or its nominee in accordance with clause 3.4), and the Buyer agrees to purchase (or procure that its nominee in accordance with clause 3.4 purchases) from the Seller, the Assets free from Encumbrances, on the terms and conditions

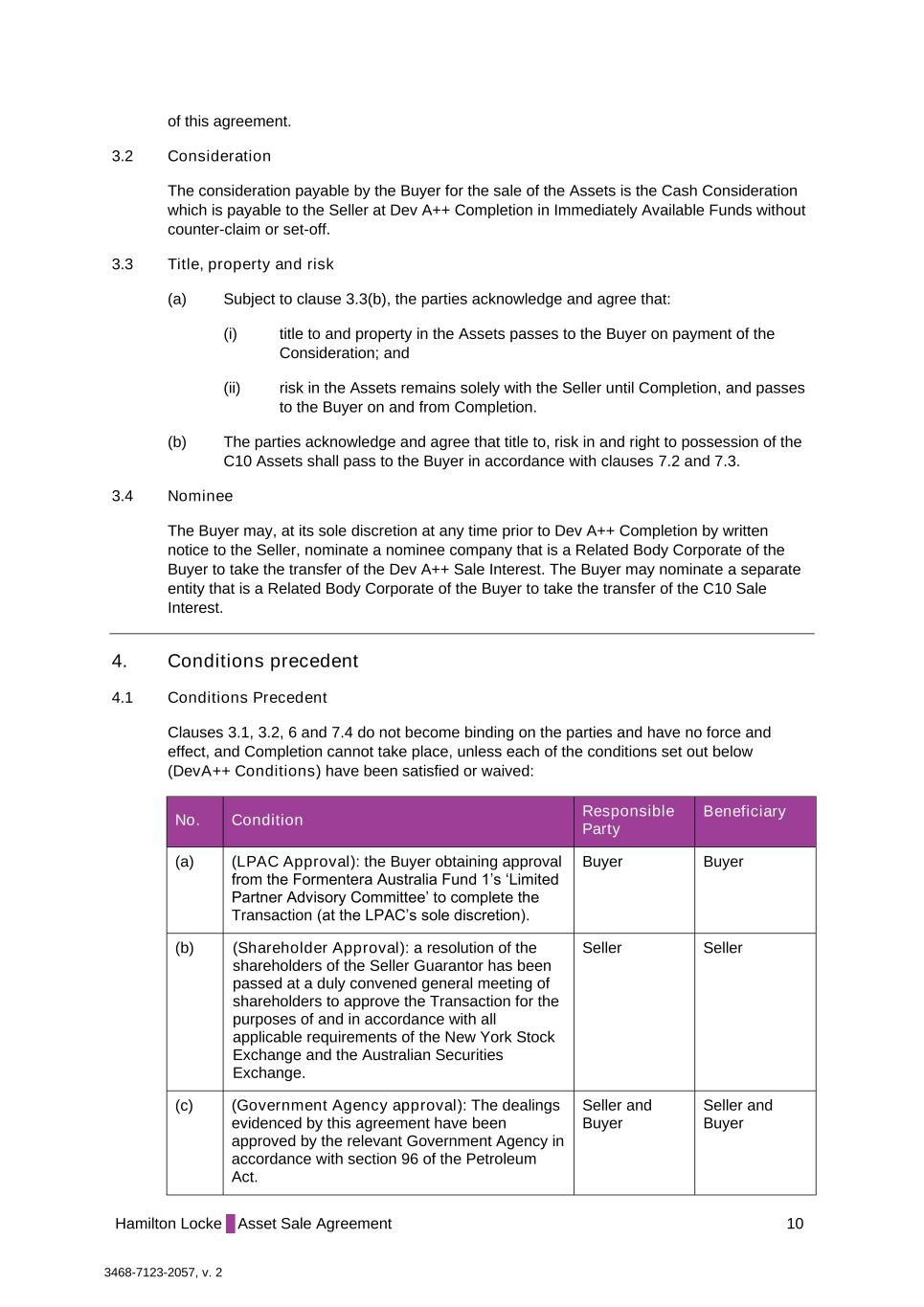

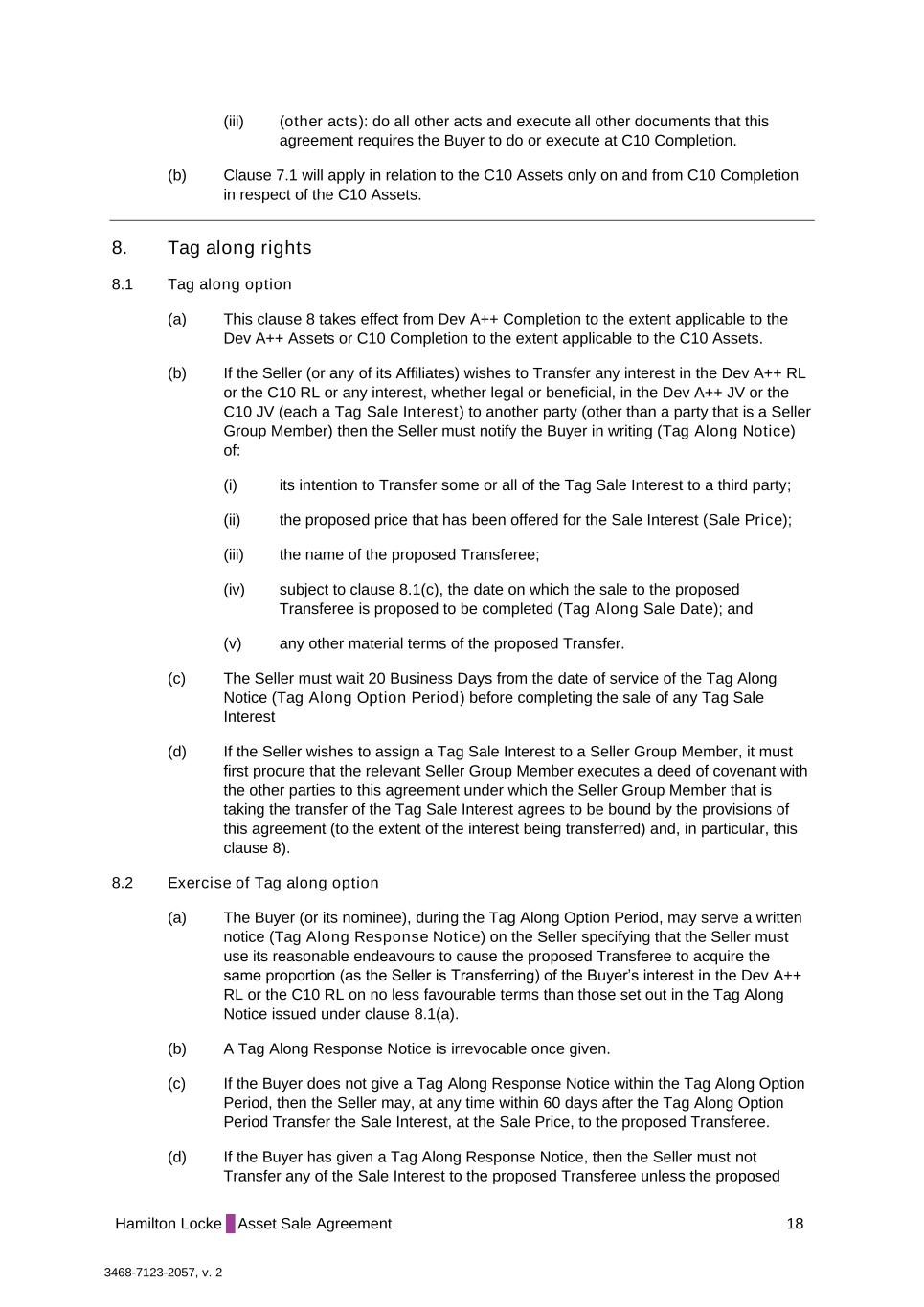

Hamilton Locke Asset Sale Agreement 10 3468-7123-2057, v. 2 of this agreement. 3.2 Consideration The consideration payable by the Buyer for the sale of the Assets is the Cash Consideration which is payable to the Seller at Dev A++ Completion in Immediately Available Funds without counter-claim or set-off. 3.3 Title, property and risk (a) Subject to clause 3.3(b), the parties acknowledge and agree that: (i) title to and property in the Assets passes to the Buyer on payment of the Consideration; and (ii) risk in the Assets remains solely with the Seller until Completion, and passes to the Buyer on and from Completion. (b) The parties acknowledge and agree that title to, risk in and right to possession of the C10 Assets shall pass to the Buyer in accordance with clauses 7.2 and 7.3. 3.4 Nominee The Buyer may, at its sole discretion at any time prior to Dev A++ Completion by written notice to the Seller, nominate a nominee company that is a Related Body Corporate of the Buyer to take the transfer of the Dev A++ Sale Interest. The Buyer may nominate a separate entity that is a Related Body Corporate of the Buyer to take the transfer of the C10 Sale Interest. 4. Conditions precedent 4.1 Conditions Precedent Clauses 3.1, 3.2, 6 and 7.4 do not become binding on the parties and have no force and effect, and Completion cannot take place, unless each of the conditions set out below (DevA++ Conditions) have been satisfied or waived: No. Condition Responsible Party Beneficiary (a) (LPAC Approval): the Buyer obtaining approval from the Formentera Australia Fund 1’s ‘Limited Partner Advisory Committee’ to complete the Transaction (at the LPAC’s sole discretion). Buyer Buyer (b) (Shareholder Approval): a resolution of the shareholders of the Seller Guarantor has been passed at a duly convened general meeting of shareholders to approve the Transaction for the purposes of and in accordance with all applicable requirements of the New York Stock Exchange and the Australian Securities Exchange. Seller Seller (c) (Government Agency approval): The dealings evidenced by this agreement have been approved by the relevant Government Agency in accordance with section 96 of the Petroleum Act. Seller and Buyer Seller and Buyer

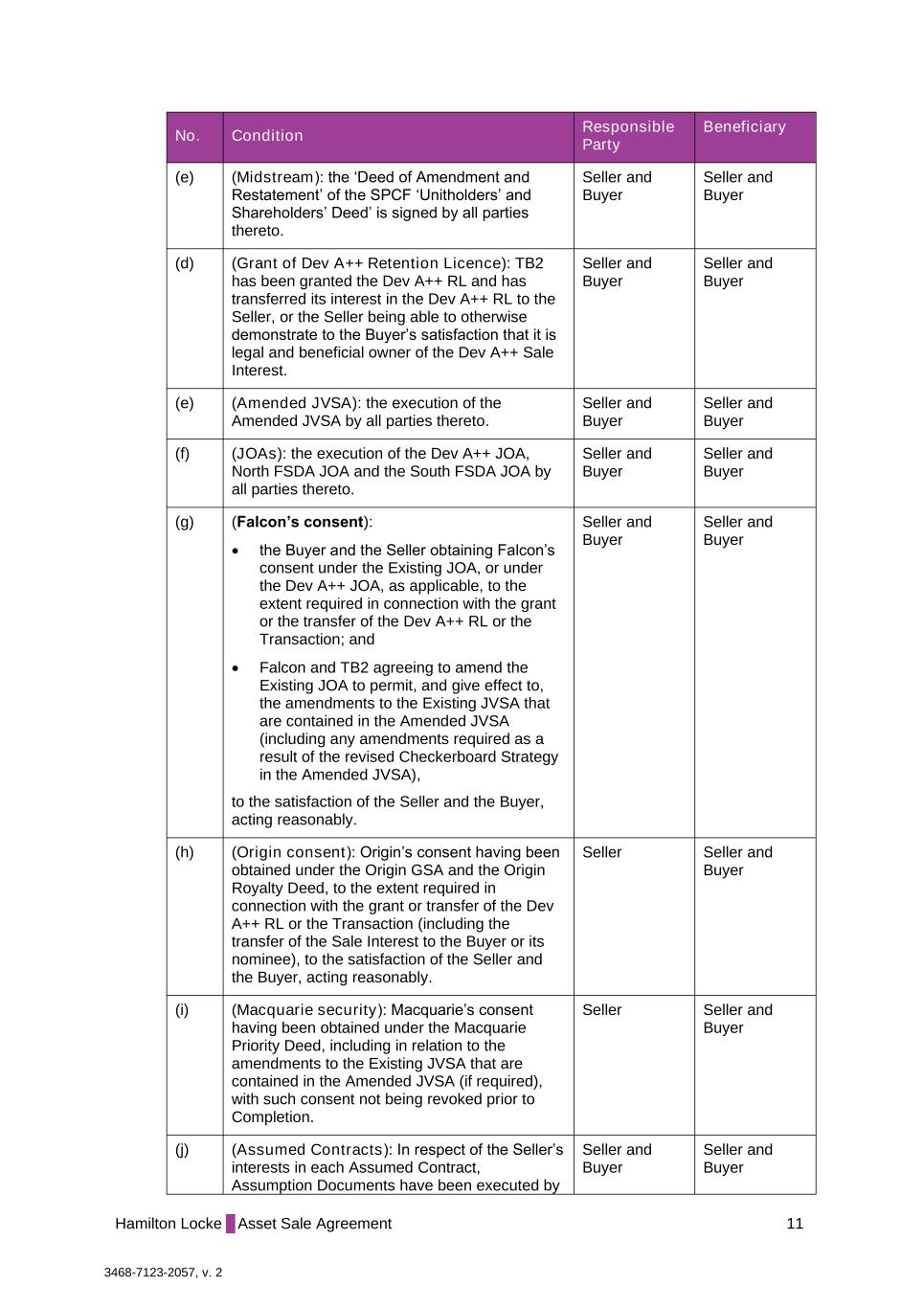

Hamilton Locke Asset Sale Agreement 11 3468-7123-2057, v. 2 No. Condition Responsible Party Beneficiary (e) (Midstream): the ‘Deed of Amendment and Restatement’ of the SPCF ‘Unitholders’ and Shareholders’ Deed’ is signed by all parties thereto. Seller and Buyer Seller and Buyer (d) (Grant of Dev A++ Retention Licence): TB2 has been granted the Dev A++ RL and has transferred its interest in the Dev A++ RL to the Seller, or the Seller being able to otherwise demonstrate to the Buyer’s satisfaction that it is legal and beneficial owner of the Dev A++ Sale Interest. Seller and Buyer Seller and Buyer (e) (Amended JVSA): the execution of the Amended JVSA by all parties thereto. Seller and Buyer Seller and Buyer (f) (JOAs): the execution of the Dev A++ JOA, North FSDA JOA and the South FSDA JOA by all parties thereto. Seller and Buyer Seller and Buyer (g) (Falcon’s consent): • the Buyer and the Seller obtaining Falcon’s consent under the Existing JOA, or under the Dev A++ JOA, as applicable, to the extent required in connection with the grant or the transfer of the Dev A++ RL or the Transaction; and • Falcon and TB2 agreeing to amend the Existing JOA to permit, and give effect to, the amendments to the Existing JVSA that are contained in the Amended JVSA (including any amendments required as a result of the revised Checkerboard Strategy in the Amended JVSA), to the satisfaction of the Seller and the Buyer, acting reasonably. Seller and Buyer Seller and Buyer (h) (Origin consent): Origin’s consent having been obtained under the Origin GSA and the Origin Royalty Deed, to the extent required in connection with the grant or transfer of the Dev A++ RL or the Transaction (including the transfer of the Sale Interest to the Buyer or its nominee), to the satisfaction of the Seller and the Buyer, acting reasonably. Seller Seller and Buyer (i) (Macquarie security): Macquarie’s consent having been obtained under the Macquarie Priority Deed, including in relation to the amendments to the Existing JVSA that are contained in the Amended JVSA (if required), with such consent not being revoked prior to Completion. Seller Seller and Buyer (j) (Assumed Contracts): In respect of the Seller’s interests in each Assumed Contract, Assumption Documents have been executed by Seller and Buyer Seller and Buyer

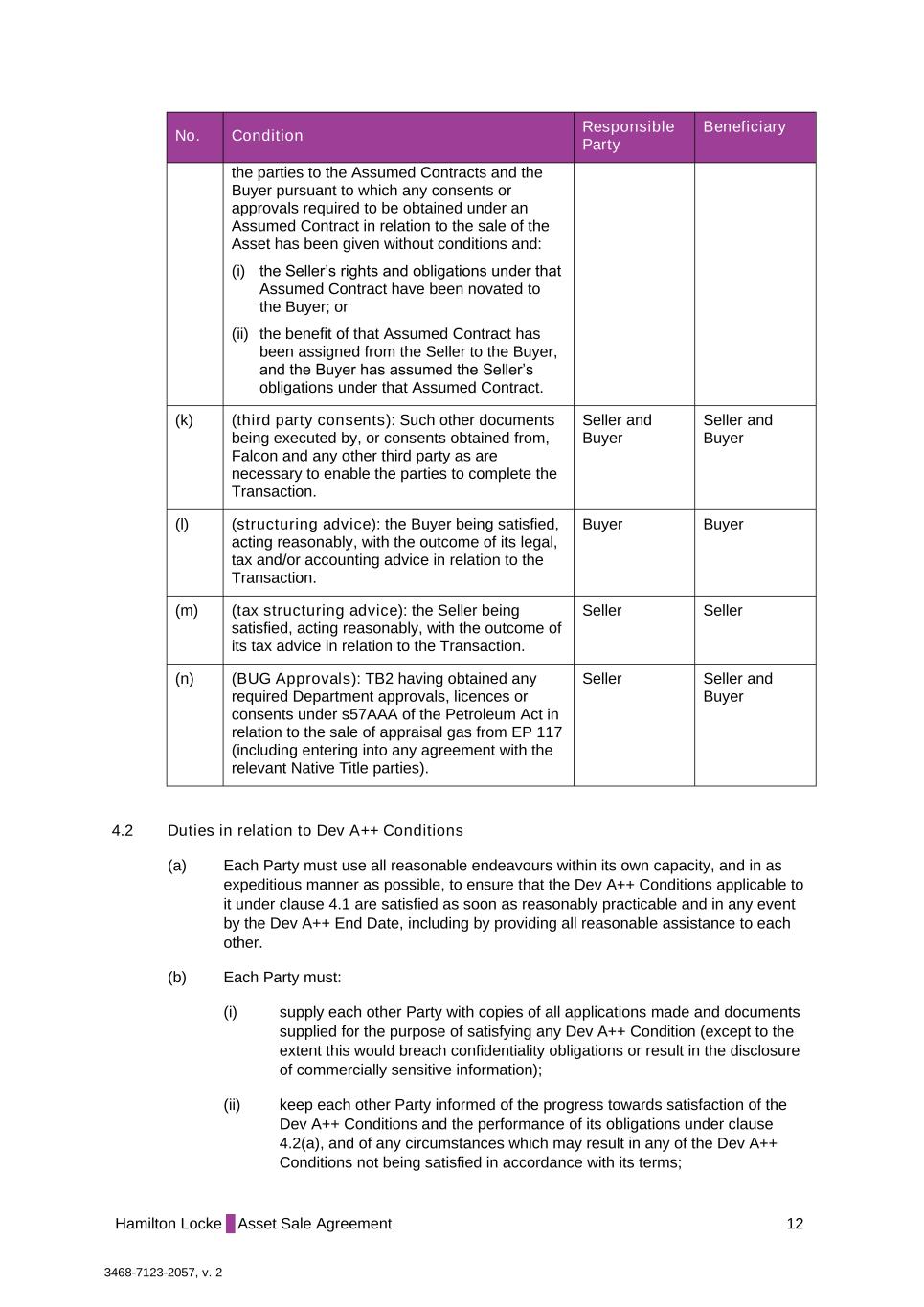

Hamilton Locke Asset Sale Agreement 12 3468-7123-2057, v. 2 No. Condition Responsible Party Beneficiary the parties to the Assumed Contracts and the Buyer pursuant to which any consents or approvals required to be obtained under an Assumed Contract in relation to the sale of the Asset has been given without conditions and: (i) the Seller’s rights and obligations under that Assumed Contract have been novated to the Buyer; or (ii) the benefit of that Assumed Contract has been assigned from the Seller to the Buyer, and the Buyer has assumed the Seller’s obligations under that Assumed Contract. (k) (third party consents): Such other documents being executed by, or consents obtained from, Falcon and any other third party as are necessary to enable the parties to complete the Transaction. Seller and Buyer Seller and Buyer (l) (structuring advice): the Buyer being satisfied, acting reasonably, with the outcome of its legal, tax and/or accounting advice in relation to the Transaction. Buyer Buyer (m) (tax structuring advice): the Seller being satisfied, acting reasonably, with the outcome of its tax advice in relation to the Transaction. Seller Seller (n) (BUG Approvals): TB2 having obtained any required Department approvals, licences or consents under s57AAA of the Petroleum Act in relation to the sale of appraisal gas from EP 117 (including entering into any agreement with the relevant Native Title parties). Seller Seller and Buyer 4.2 Duties in relation to Dev A++ Conditions (a) Each Party must use all reasonable endeavours within its own capacity, and in as expeditious manner as possible, to ensure that the Dev A++ Conditions applicable to it under clause 4.1 are satisfied as soon as reasonably practicable and in any event by the Dev A++ End Date, including by providing all reasonable assistance to each other. (b) Each Party must: (i) supply each other Party with copies of all applications made and documents supplied for the purpose of satisfying any Dev A++ Condition (except to the extent this would breach confidentiality obligations or result in the disclosure of commercially sensitive information); (ii) keep each other Party informed of the progress towards satisfaction of the Dev A++ Conditions and the performance of its obligations under clause 4.2(a), and of any circumstances which may result in any of the Dev A++ Conditions not being satisfied in accordance with its terms;

Hamilton Locke Asset Sale Agreement 13 3468-7123-2057, v. 2 (iii) co-operate with each other Party in approaching the relevant Governmental Agency or Third Party for the purposes of satisfying the Dev A++ Conditions, including using reasonable endeavours to allow the other Party the opportunity to be present at any meetings with any such Governmental Agency; (iv) not take any action that would, or could reasonably be expected to, prevent or hinder the satisfaction of any Dev A++ Condition; (v) notify each other Party if a Condition becomes incapable of being satisfied before the Dev A++ End Date; and (vi) within 2 Business Days of a Party becoming aware that a Dev A++ Condition has been satisfied, notify each other Party in writing of that fact. (c) The obligation imposed on a Party by clause 4.2(a) does not require the Party to waive any Dev A++ Condition. 4.3 Waiver A Dev A++ Condition may be waived only by the Beneficiary (as specified in clause 4.1) by giving written notice of the waiver to the other Parties (but only to the extent set out in the waiver). If there is more than one Beneficiary, then the Dev A++ Condition can only be waived by written agreement between both Beneficiaries. 4.4 Termination following failure to satisfy or waive Conditions If the Dev A++ Conditions are not all satisfied or waived in accordance with clause 4.3 by the Dev A++ End Date, then either the Seller or the Buyer may terminate this agreement by notice in writing to the Parties (provided that the terminating Party has complied with its obligations under clause 4.2(a)). 4.5 Effect of termination If this agreement is terminated pursuant to clause 4.4 then, in addition to any other rights, powers or remedies under Law: (a) this agreement will be of no further effect and no Party will be liable to any other Party except that each Party retains the rights it has against any other Party for any breach of this agreement that occurred or related to the period prior to the date of termination; and (b) each Party is released from its obligations to perform under this agreement. 5. Conduct prior to Completion 5.1 Conduct in relation to the Assets (a) Subject to clause 5.1(b), from the Execution Date until Dev A++ Completion or the date of termination of this agreement (whichever is earlier), the Seller and the Seller Guarantor must: (i) not enter into any material contract or incur any material liability in connection with the Dev A++ RL; (ii) not transfer any interest in the Dev A++ RL to any party (including the Seller or any Affiliate of the Seller);

Hamilton Locke Asset Sale Agreement 14 3468-7123-2057, v. 2 (iii) not dispose of, or agree to dispose of, any of the Assets (or part thereof); (iv) not create or allow any Encumbrance over the Assets; (v) not amend the Permits or seek to vary the terms and conditions on which they are held without the Buyer’s prior written consent; and (vi) not amend the Dev A++ Area or the C10 Area without the Buyer’s prior written consent; (vii) as soon as practicable provide to the Buyer any material communications received in relation to the Assets from time to time (except to the extent this would breach confidentiality obligations). (b) Nothing in clause 5.1(a) restricts the Seller from doing anything: (i) that is expressly permitted or required under this agreement or the Amended JVSA; or (ii) which is approved by the Buyer in writing, which must not be unreasonably withheld or delayed (and approval will be deemed to be given if the Buyer has not responded to a written request for approval within 5 Business Days). (c) From the Execution Date until the earlier of Dev A++ Completion or termination of this agreement, the Seller must not Transfer, or agree to Transfer, any of the Assets or its right to take an assignment of the Dev A++ RL and the C10 RL. 6. Dev A++ Completion 6.1 Time and place of Dev A++ Completion (a) Dev A++ Completion is to occur at 11am on the Dev A++ Completion Date or at such other place and time as is agreed in writing by the parties. (b) The parties agree that attendance in person at the location for Dev A++ Completion is not required and that the parties may conduct Dev A++ Completion via video-link, by telephone or electronic exchange over email, and each party agrees to all reasonable requirements (including escrow arrangements or reasonable solicitor undertakings relating to documents) in order to facilitate the delivery at Dev A++ Completion of originals of documents required to be delivered, and that each agreement or document contemplated in this agreement may be exchanged in counterpart in accordance with clause 15.10 with effect from Dev A++ Completion on the Dev A++ Completion Date. 6.2 Seller’s obligations at Dev A++ Completion At or prior to Dev A++ Completion, the Seller must: (a) deliver or cause to be delivered to the Buyer: (i) (Transfer): Transfer Documents for the Dev A++ RL in registrable form executed by the Seller (save for stamping and execution by the Buyer); and (ii) (Assumption Documents): counterparts of the Assumption Documents for each Assumed Contract, duly executed by the Seller and each other party to those documents (other than the Seller and the Buyer); and (iii) (third party consents): copies of such other documents executed by, or

Hamilton Locke Asset Sale Agreement 15 3468-7123-2057, v. 2 consents from, Falcon and any other third party as are necessary to enable the Buyer to exercise full ownership rights in relation to the Assets; and (b) (other acts): do all other acts and execute all other documents that this agreement requires the Seller to do or execute at Dev A++ Completion. 6.3 Buyer’s obligations at Completion (a) On or before Dev A++ Completion and subject to satisfaction by the Seller of its obligations under clause 6.2, the Buyer must: (i) (Completion Payment): pay the Cash Consideration into the Seller’s nominated bank account, in Immediately Available Funds; (ii) (Transfer): deliver to the Seller the Transfer Documents for the Dev A++ RL in registerable form executed by the Buyer (save for stamping and execution by the Seller); (iii) (Assumption Documents): deliver to the Seller counterparts of the Assumption Documents for each Assumed Contract, duly executed by the Buyer; and (iv) (other acts): do all other acts and execute all other documents that this agreement requires the Buyer to do or execute at Completion. 6.4 Completion simultaneous (a) Dev A++ Completion is taken to have occurred when the Buyer and the Seller have each performed all its obligations in clauses 6.2 and 6.3. (b) The actions to take place as contemplated by this clause 6 are interdependent and must take place, as nearly as possible, simultaneously. If one action does not take place, then without prejudice to any rights available to any party as a consequence: (i) there is no obligation on any party to undertake or perform any of the other actions; and (ii) to the extent that such actions have already been undertaken, the parties must do everything reasonably required to reverse those actions; and (iii) the Seller and the Buyer must each return to the other all documents delivered to it under clauses 6.2 and 6.3 and must each repay to the other all payments received, without prejudice to any other rights any party may have in respect of that failure. (c) The Buyer may, in its sole discretion, waive any or all of the actions that the Seller is required to perform under clause 6.2 and the Seller may, in its sole discretion, waive any or all of the actions that the Buyer is required to perform under clause 6.3. 6.5 Assumed obligations On and from Dev A++ Completion, the Buyer will: (a) assume and will be liable for the Assumed Obligations; (b) irrevocably and unconditionally release and discharge the Seller and its Affiliates from any and all Liabilities, Claims and obligations arising under or in respect of the Assumed Obligations; and

Hamilton Locke Asset Sale Agreement 16 3468-7123-2057, v. 2 (c) indemnify and hold harmless the Seller against all Claims or Liability incurred by the Seller or its Affiliates under or in respect of the Assumed Obligations whether arising before, on or after Dev A++ Completion, except to the extent expressly provided to the contrary in this agreement. 7. Post Completion requirements 7.1 Duty and Registration (a) The Buyer must, except to the extent already lodged before Completion, lodge the Transfer Documents for assessment of Duty with the relevant revenue office promptly after the Completion Date (or within the time required by law if that is earlier). The Buyer must promptly notify the Seller of any assessment notice issued by the relevant revenue office. (b) The Buyer must obtain all necessary approvals from the relevant Government Agency for the Transfer Documents (including in accordance with section 93 of the Petroleum Act) and, promptly and no later than 10 Business Days after the date on which the Transfer Documents have been stamped or endorsed by the relevant revenue office, lodge all documents with the Department as necessary to effect the transfer, and the registration of the transfer of the Sale Interest to the Buyer. (c) The parties must cooperate with each other and do all things reasonable and within their control to obtain registration of the Transfer Documents to the Buyer in accordance with this agreement, as soon as practicable after Completion and must keep the other parties informed of any fact, matter or circumstance of which it becomes aware that may result in registration of such transfers not being obtained. (d) Any Duty, application and registration fees associated with the sale and the transfer of the Assets to the Buyer must be borne by the Buyer. (e) The Buyer must upon the registration of each Transfer Document being obtained, promptly give the Seller notice of the registration and provide the Seller with a copy of the evidence of such registration. (f) After Completion, until such time as the transfer of the Sale Interest to the Buyer is registered, the Seller holds the Sale Interest for the benefit of the Buyer and in accordance with the Buyer's entitlements under this agreement and must act in accordance with any reasonable and lawful direction of the Buyer in relation to the Sale Interest. (g) In the event that the Transfer Documents are rejected or if approval and registration of the Transfer Documents is not obtained within one year of the relevant Completion Date, the Buyer will promptly provide notice to the Seller, following which the Buyer and the Seller will, as soon as reasonably practicable, confer to determine the basis on which: (i) approval and registration of the Transfer Documents can be obtained; or (ii) any failure to obtain the approval and registration of the Transfer Documents can be overcome. (h) A party must not unreasonably withhold its agreement to any reasonable proposal on the matters in clause 7.1(g)(i) or 7.1(g)(ii) that is not materially prejudicial to its interest.

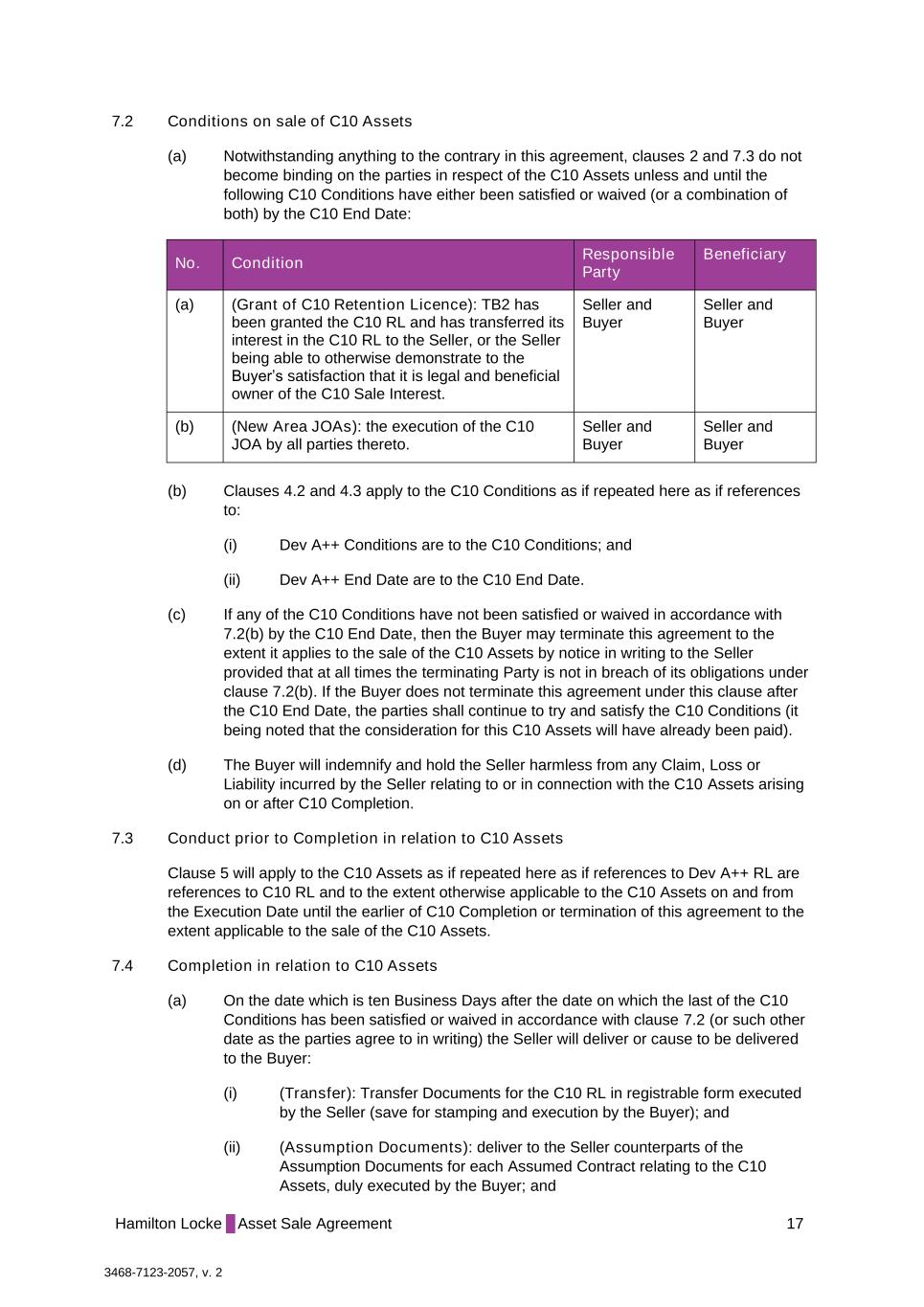

Hamilton Locke Asset Sale Agreement 17 3468-7123-2057, v. 2 7.2 Conditions on sale of C10 Assets (a) Notwithstanding anything to the contrary in this agreement, clauses 2 and 7.3 do not become binding on the parties in respect of the C10 Assets unless and until the following C10 Conditions have either been satisfied or waived (or a combination of both) by the C10 End Date: No. Condition Responsible Party Beneficiary (a) (Grant of C10 Retention Licence): TB2 has been granted the C10 RL and has transferred its interest in the C10 RL to the Seller, or the Seller being able to otherwise demonstrate to the Buyer’s satisfaction that it is legal and beneficial owner of the C10 Sale Interest. Seller and Buyer Seller and Buyer (b) (New Area JOAs): the execution of the C10 JOA by all parties thereto. Seller and Buyer Seller and Buyer (b) Clauses 4.2 and 4.3 apply to the C10 Conditions as if repeated here as if references to: (i) Dev A++ Conditions are to the C10 Conditions; and (ii) Dev A++ End Date are to the C10 End Date. (c) If any of the C10 Conditions have not been satisfied or waived in accordance with 7.2(b) by the C10 End Date, then the Buyer may terminate this agreement to the extent it applies to the sale of the C10 Assets by notice in writing to the Seller provided that at all times the terminating Party is not in breach of its obligations under clause 7.2(b). If the Buyer does not terminate this agreement under this clause after the C10 End Date, the parties shall continue to try and satisfy the C10 Conditions (it being noted that the consideration for this C10 Assets will have already been paid). (d) The Buyer will indemnify and hold the Seller harmless from any Claim, Loss or Liability incurred by the Seller relating to or in connection with the C10 Assets arising on or after C10 Completion. 7.3 Conduct prior to Completion in relation to C10 Assets Clause 5 will apply to the C10 Assets as if repeated here as if references to Dev A++ RL are references to C10 RL and to the extent otherwise applicable to the C10 Assets on and from the Execution Date until the earlier of C10 Completion or termination of this agreement to the extent applicable to the sale of the C10 Assets. 7.4 Completion in relation to C10 Assets (a) On the date which is ten Business Days after the date on which the last of the C10 Conditions has been satisfied or waived in accordance with clause 7.2 (or such other date as the parties agree to in writing) the Seller will deliver or cause to be delivered to the Buyer: (i) (Transfer): Transfer Documents for the C10 RL in registrable form executed by the Seller (save for stamping and execution by the Buyer); and (ii) (Assumption Documents): deliver to the Seller counterparts of the Assumption Documents for each Assumed Contract relating to the C10 Assets, duly executed by the Buyer; and

Hamilton Locke Asset Sale Agreement 18 3468-7123-2057, v. 2 (iii) (other acts): do all other acts and execute all other documents that this agreement requires the Buyer to do or execute at C10 Completion. (b) Clause 7.1 will apply in relation to the C10 Assets only on and from C10 Completion in respect of the C10 Assets. 8. Tag along rights 8.1 Tag along option (a) This clause 8 takes effect from Dev A++ Completion to the extent applicable to the Dev A++ Assets or C10 Completion to the extent applicable to the C10 Assets. (b) If the Seller (or any of its Affiliates) wishes to Transfer any interest in the Dev A++ RL or the C10 RL or any interest, whether legal or beneficial, in the Dev A++ JV or the C10 JV (each a Tag Sale Interest) to another party (other than a party that is a Seller Group Member) then the Seller must notify the Buyer in writing (Tag Along Notice) of: (i) its intention to Transfer some or all of the Tag Sale Interest to a third party; (ii) the proposed price that has been offered for the Sale Interest (Sale Price); (iii) the name of the proposed Transferee; (iv) subject to clause 8.1(c), the date on which the sale to the proposed Transferee is proposed to be completed (Tag Along Sale Date); and (v) any other material terms of the proposed Transfer. (c) The Seller must wait 20 Business Days from the date of service of the Tag Along Notice (Tag Along Option Period) before completing the sale of any Tag Sale Interest (d) If the Seller wishes to assign a Tag Sale Interest to a Seller Group Member, it must first procure that the relevant Seller Group Member executes a deed of covenant with the other parties to this agreement under which the Seller Group Member that is taking the transfer of the Tag Sale Interest agrees to be bound by the provisions of this agreement (to the extent of the interest being transferred) and, in particular, this clause 8). 8.2 Exercise of Tag along option (a) The Buyer (or its nominee), during the Tag Along Option Period, may serve a written notice (Tag Along Response Notice) on the Seller specifying that the Seller must use its reasonable endeavours to cause the proposed Transferee to acquire the same proportion (as the Seller is Transferring) of the Buyer’s interest in the Dev A++ RL or the C10 RL on no less favourable terms than those set out in the Tag Along Notice issued under clause 8.1(a). (b) A Tag Along Response Notice is irrevocable once given. (c) If the Buyer does not give a Tag Along Response Notice within the Tag Along Option Period, then the Seller may, at any time within 60 days after the Tag Along Option Period Transfer the Sale Interest, at the Sale Price, to the proposed Transferee. (d) If the Buyer has given a Tag Along Response Notice, then the Seller must not Transfer any of the Sale Interest to the proposed Transferee unless the proposed

Hamilton Locke Asset Sale Agreement 19 3468-7123-2057, v. 2 Transferee also acquires the same proportion (as the Seller is Transferring) of the Buyer’s interest in Dev A++ RL or the C10 RL on the same terms and conditions and at not less than the Sale Price. (e) If the Buyer has given a Tag Along Response Notice and, despite the Seller’s reasonable endeavours, the proposed Transferee refuses to purchase the Buyer’s Sale Interest, then the Seller must not transfer any of the Sale Interest to the proposed Transferee and the Tag Along Response Notice lapses. (f) The Seller shall not employ any device or technique or participate in any transaction designed to circumvent the provisions of this clause 8.2. (g) The Seller shall continue to be bound by this clause 8 following the purchase until the process in this clause 8 has completed. 9. Foreign resident capital gains withholding (a) In this clause 9: (i) Clearance Certificate means a certificate issued under section 14-220 of schedule 1 of the TA Act that is valid on the date it is given to the Buyer prior to Completion; and (ii) TA Act means the Taxation Administration Act 1953 (Cth). (b) The Seller may, at least 10 Business Days before Dev A++ Completion, give the Buyer a Clearance Certificate in respect of itself. (c) If the Seller provides a Clearance Certificate to the Buyer in accordance with clause 9(b), the Buyer shall not deduct any amount from the Cash Consideration to pay an amount to the Commissioner of Taxation under subdivision 14-D of schedule 1 to the TA Act. 10. Warranties and Indemnities 10.1 Seller Warranties The Seller represents and warrants to the Buyer that each of the Seller Warranties is true and correct and not misleading: (a) in respect of a Seller Warranty that is expressed to be given on a particular date, that date; and (b) in respect of each other Seller Warranty: (i) to the extent applicable to the Dev A++ Sale Interest, at the Execution Date and immediately before Dev A++ Completion; and (ii) to the extent applicable to the C10 Sale Interest, at the Execution Date and immediately before the C10 Completion. 10.2 Seller Guarantor Warranties The Seller Guarantor represents and warrants to the Buyer at the Execution Date and immediately before each Completion that that each of the Seller Guarantor Warranties is true and correct and not misleading.

Hamilton Locke Asset Sale Agreement 20 3468-7123-2057, v. 2 10.3 Buyer Warranties The Buyer represents and warrants to the Seller and the Seller Guarantor at the Execution Date and immediately before each Completion that each of the Buyer Warranties is true and correct and not misleading. 10.4 Reliance (a) The Seller and the Seller Guarantor acknowledges the Buyer has entered into this agreement and will complete this agreement in reliance on the Seller Warranties and Seller Guarantor Warranties. (b) The Buyer acknowledges that the Seller and the Seller Guarantor have entered into this agreement and will complete this agreement in reliance on the Buyer Warranties. 10.5 Separate Warranties Each Warranty is a separate Warranty and its meaning is not affected by any other Warranty. The Warranties survive Completion. 10.6 Seller Indemnity The Seller indemnifies and holds the Buyer harmless against all Loss and Claims which may be suffered, sustained or incurred by the Buyer directly or indirectly as a result of or in respect of a breach by the Seller of any of the Seller Warranties provided in this agreement. 10.7 Seller to disclose breach The Seller must disclose to the Buyer in writing, promptly upon becoming aware of the same, full details of any fact, matter, event or circumstance which: (a) causes, or is reasonably expected to cause, any Seller Warranty to become untrue, inaccurate or misleading, at any point in time; or (b) breaches any obligation or covenant of the Seller under this agreement. 10.8 Maximum amount To the extent permitted by Law, the maximum aggregate amount that a party is required to pay in respect of all Claims for a breach of a Warranty is limited to the value of the Cash Consideration. 10.9 Time limits for Claims of breach of Warranty The Seller and Seller Guarantor are each not liable in respect of a Claim for breach of a Warranty unless the Buyer gives notice describing in reasonable detail each fact, matter or circumstance giving rise to the Claim for breach of Warranty and stating the basis on which that fact, matter or circumstance may give rise to the Claim for breach of Warranty by no later than: (a) 12 months after the Dev A++ Completion in respect of any Warranty to the extent relating to the Dev A++ Sale Interest or its sale to the Buyer; or (b) 12 months after the C10 Completion in respect of any Warranty to the extent relating to the C10 Sale Interest or its sale to the Buyer. 10.10 Other limitations The Seller and Seller Guarantor are not liable in respect of any Claim arising under or in connection with this agreement to the extent that:

Hamilton Locke Asset Sale Agreement 21 3468-7123-2057, v. 2 (a) the loss or damage giving rise to the Claim is recovered by the Buyer (or any of its Related Bodies Corporate) under another Claim or is made good or otherwise compensated for without cost to the Buyer (or any of its Related Bodies Corporate); (b) the loss or damage giving rise to the Claim is recovered by Buyer (or any of its Related Bodies Corporate) under any contract of insurance; (c) the Claim is for breach of Warranty and arises out of anything done or omitted to be done in accordance with the terms of any Transaction Document or with the prior written consent of the Buyer; (d) the Claim is for a Loss or Liability that is contingent, prospective, not ascertained or not ascertainable, unless and until such Loss or Liability becomes an actual Loss or actual Liability and is due and payable; or (e) the Claim is for Consequential Loss. 10.11 No double recovery The Buyer shall not be entitled to recover damages, or obtain payment, reimbursement, restitution or damages more than once in respect of the same loss or breach of this agreement. 10.12 Exclusions Any limitations in this agreement (including under clause 10.8) will not apply to any Claims in the case of fraud or intentional misrepresentation of the Seller or Seller Guarantor. 11. Guarantee and indemnity 11.1 Guarantee of Seller’s performance (a) In consideration of the Buyer entering into this agreement, the Seller Guarantor guarantees to the Buyer the punctual performance by the Seller of the Seller’s obligations under: (i) this agreement; and (ii) any order, award, judgment or decision which binds the Seller relating to this agreement (Binding Decision), including their obligations to pay money. (b) The Guarantor must: (i) pay to the Buyer any amount that the Seller fails to pay the Buyer on or by the due date for payment as prescribed by this agreement or any Binding Decision; and (ii) comply with any of the Seller’s obligations that the Seller fails to comply with on or by the due date for compliance as prescribed by this agreement or any Binding Decision, whether or not demand has been made by the Buyer on the Seller. (c) Nothing in this clause 11.1 affects the Buyer’s other rights under this clause 11 or this agreement.

Hamilton Locke Asset Sale Agreement 22 3468-7123-2057, v. 2 11.2 Indemnity The Seller Guarantor indemnifies and must keep indemnified the Buyer against any Loss (including legal costs on a full indemnity basis) suffered or incurred by the Buyer arising from default or delay in the due and punctual performance of this agreement or a Binding Decision by the Seller. 11.3 Continuing obligation The guarantee and indemnity given under this clause 11 is a continuing obligation which continues after Completion and remains in full force and effect so long as the Seller has any liabilities or obligations to the Buyer under this agreement and until all of those liabilities or obligations have been fully discharged. 11.4 Obligations and rights not affected by certain matters The Seller Guarantor’s obligations under this clause 11 are absolute and are not released, discharged or otherwise affected by anything that, but for clause 11.5, might have that effect, including: (a) any concession (such as extra time) being given to any person, including the Seller Guarantor or the Seller; (b) the Buyer’s failure or delay in taking action or asserting a right, under this agreement or at Law; (c) the novation of a right of the Buyer; (d) this agreement (or any agreement entered into in order to perform this agreement) being varied; or (e) an obligation or liability of a person other than the Seller Guarantor being invalid or unenforceable. 11.5 Seller Guarantor’s rights suspended The Seller Guarantor must not do any of the following without the consent of the Buyer until all money payable to the Buyer in connection with this agreement is paid: (a) exercise a right of contribution or indemnity as against the Buyer; (b) take a step to enforce a right against the Buyer in connection with money the Seller Guarantor pays to the Buyer under this clause 11; (c) claim a share of any money the Buyer receives in connection with this agreement; (d) claim the benefit of (for example, by subrogation), or seek the transfer of, a guarantee, indemnity or security the Buyer holds in connection with this agreement; (e) try to reduce its liability under this clause 11 through set-off or counterclaim; or (f) prove in competition with the Buyer if the Seller is unable to pay their debts when due. 11.6 Reinstating the Buyer’s rights If a Claim is made (such as a Claim under the Law relating to insolvency) that a payment or transfer to the Buyer in connection with this agreement is void or voidable and that Claim is upheld, conceded or compromised, then the Buyer is immediately entitled to the rights the Buyer had against the Seller Guarantor before the payment or transfer was made.

Hamilton Locke Asset Sale Agreement 23 3468-7123-2057, v. 2 11.7 Applying money paid by the Seller Guarantor The Buyer may apply amounts received from the Seller Guarantor under this clause 11 in any manner or order the Buyer chooses. 12. Termination 12.1 Termination by the Buyer The Buyer may terminate this agreement at any time before Dev A++ Completion by Notice in writing to the Seller if: (a) the Seller commits a material breach of this agreement and,10 Business Days after notice of such material breach has been provided to the Seller, that breach remains unremedied to the reasonable satisfaction of the Buyer; or (b) an Insolvency Event occurs in relation to the Seller. 12.2 Termination by the Seller and/or Seller Guarantor The Seller and/or the Seller Guarantor may terminate this agreement at any time before Dev A++ Completion by Notice in writing to the Buyer if: (a) the Buyer commits a material breach of this agreement and, 10 Business Days after notice of such material breach has been provided to the Buyer, that breach remains unremedied to the reasonable satisfaction of the Seller; or (b) an Insolvency Event occurs in relation to the Buyer. 12.3 Effect of termination If this agreement is terminated under clauses 12.1 or 12.2: (a) each party is absolutely and irrevocably released from its obligations to further perform its obligations under this agreement in relation to the other parties, except those expressed to survive termination; (b) each party retains the rights it has against the other parties in respect of any breach of this agreement occurring before termination including, for the avoidance of doubt, under any indemnity except to the extent expressly provided to the contrary in this agreement; (c) the rights and obligations of each party under the Continuing Clauses will continue independently from the other obligations of the parties and survive termination of this agreement; and (d) all filings, applications and other submissions made pursuant to this agreement must, to the extent practicable, be withdrawn from the Relevant Authority to which such filings, applications or other submissions were made. 13. Goods and Services Tax (GST) 13.1 Preliminary Words or expressions used in this clause 13 that are defined have the same meaning given to them in the GST Act. 13.2 GST exclusive

Hamilton Locke Asset Sale Agreement 24 3468-7123-2057, v. 2 Unless otherwise stated in this agreement, any amount specified in this agreement as the consideration payable for any taxable supply does not include any GST payable in respect of that supply. 13.3 Liability to pay GST If a party makes a taxable supply under this agreement (Supplier), then the recipient of the taxable supply (Recipient) must also pay, in addition to the GST-exclusive amount of the consideration for that supply, the amount of GST payable in respect of the taxable supply (as amended in accordance with clause 13.5) at the time the consideration for the taxable supply is payable under this agreement. 13.4 Tax Invoice Notwithstanding clause 13.3, the Recipient is not obliged under this agreement to pay the amount of any GST payable until the Supplier provides it with a valid tax invoice for the taxable supply. 13.5 Adjustment Event If an adjustment event arises in relation to a taxable supply made by a Supplier under this agreement, the amount paid or payable by the Recipient pursuant to clause 13.3 will be amended to reflect this and a payment equal to the amount of the difference will be made by the Recipient to the Supplier or vice versa as the case may be. The Supplier must issue an adjustment note to the Recipient in respect of any adjustment event occurring in relation to a supply made under or in connection with this agreement as soon as reasonably practicable after the Supplier becomes aware of the adjustment event. 13.6 Reimbursement of Expenses If a third party makes a taxable supply and this agreement requires a party to this agreement (payer) to pay for, reimburse or contribute to (pay) any expense or liability incurred by the other party to that third party for that taxable supply, the amount the payer must pay will be the GST-exclusive amount of that expense or liability plus the amount of any GST payable in respect thereof but reduced by the amount of any input tax credit to which the other party is entitled in respect of the expense or liability. 13.7 Non Merger This clause does not merge on Dev A++ Completion and will continue to apply after expiration or termination of this agreement. 14. Notices 14.1 Requirements All notices, requests, demands, consents, approvals, or other communications under this agreement (Notice) to, by or from a party must be: (a) in writing in English; and (b) addressed to a party in accordance with its details set out in Schedule 1 or as otherwise specified by that party by Notice (Notified Contact Details). 14.2 How a Notice must be given In addition to any other method of giving Notices permitted by statute, a Notice must be:

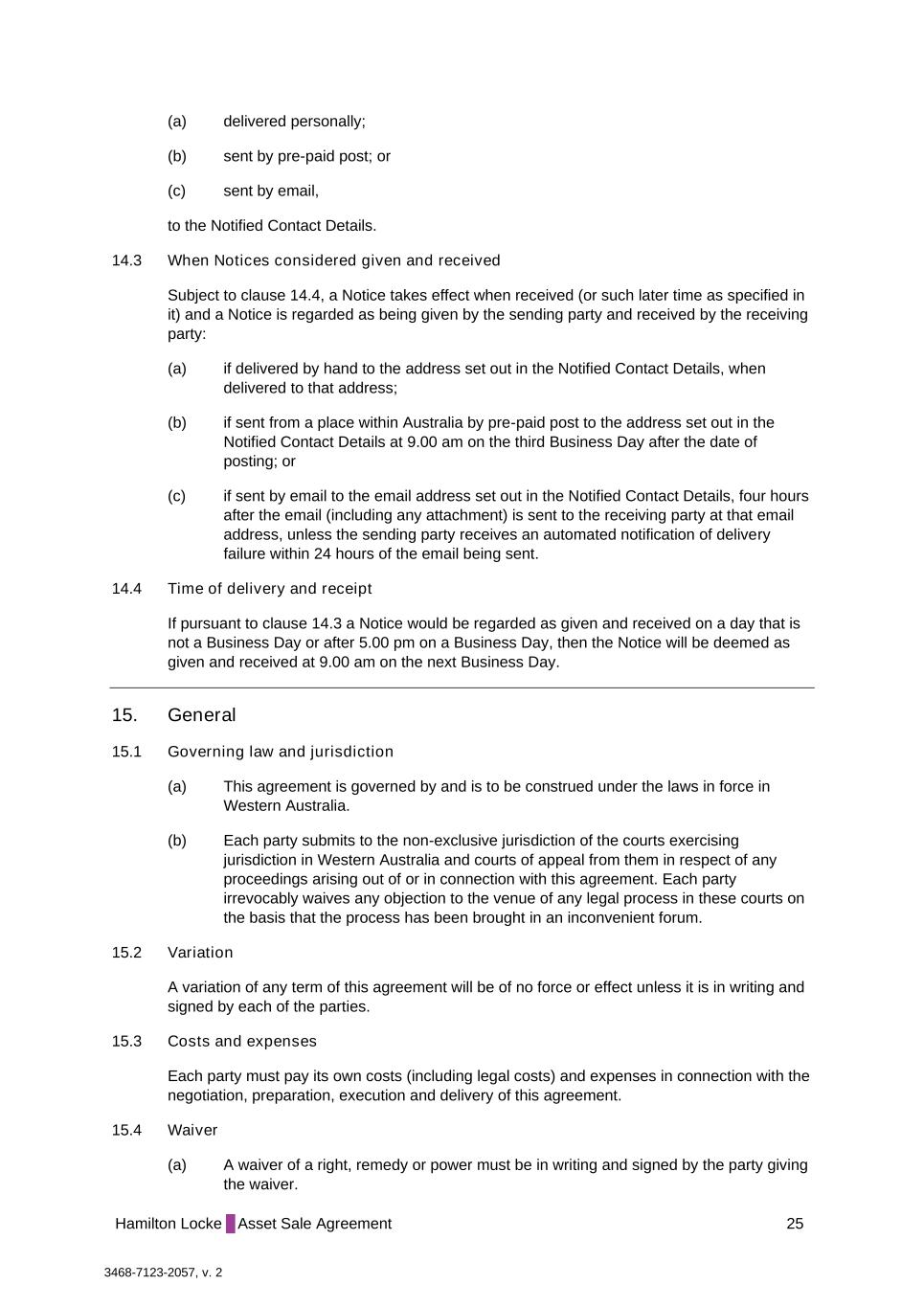

Hamilton Locke Asset Sale Agreement 25 3468-7123-2057, v. 2 (a) delivered personally; (b) sent by pre-paid post; or (c) sent by email, to the Notified Contact Details. 14.3 When Notices considered given and received Subject to clause 14.4, a Notice takes effect when received (or such later time as specified in it) and a Notice is regarded as being given by the sending party and received by the receiving party: (a) if delivered by hand to the address set out in the Notified Contact Details, when delivered to that address; (b) if sent from a place within Australia by pre-paid post to the address set out in the Notified Contact Details at 9.00 am on the third Business Day after the date of posting; or (c) if sent by email to the email address set out in the Notified Contact Details, four hours after the email (including any attachment) is sent to the receiving party at that email address, unless the sending party receives an automated notification of delivery failure within 24 hours of the email being sent. 14.4 Time of delivery and receipt If pursuant to clause 14.3 a Notice would be regarded as given and received on a day that is not a Business Day or after 5.00 pm on a Business Day, then the Notice will be deemed as given and received at 9.00 am on the next Business Day. 15. General 15.1 Governing law and jurisdiction (a) This agreement is governed by and is to be construed under the laws in force in Western Australia. (b) Each party submits to the non-exclusive jurisdiction of the courts exercising jurisdiction in Western Australia and courts of appeal from them in respect of any proceedings arising out of or in connection with this agreement. Each party irrevocably waives any objection to the venue of any legal process in these courts on the basis that the process has been brought in an inconvenient forum. 15.2 Variation A variation of any term of this agreement will be of no force or effect unless it is in writing and signed by each of the parties. 15.3 Costs and expenses Each party must pay its own costs (including legal costs) and expenses in connection with the negotiation, preparation, execution and delivery of this agreement. 15.4 Waiver (a) A waiver of a right, remedy or power must be in writing and signed by the party giving the waiver.

Hamilton Locke Asset Sale Agreement 26 3468-7123-2057, v. 2 (b) A party does not waive a right, remedy or power if it delays in exercising, fails to exercise or only partially exercises that right, remedy or power. (c) A waiver given by a party in accordance with clause 15.4(a): (i) is only effective in relation to the particular obligation or breach in respect of which it is given and is not to be construed as a waiver of that obligation or breach on any other occasion; and (ii) does not preclude that party from enforcing or exercising any other right, remedy or power under this agreement nor is it to be construed as a waiver of any other obligation or breach. 15.5 Severance If a provision in this agreement is wholly or partly void, illegal or unenforceable in any relevant jurisdiction that provision or part must, to that extent, be treated as deleted from this agreement for the purposes of that jurisdiction. This does not affect the validity or enforceability of the remainder of the provision or any other provision of this agreement. 15.6 Confidentiality The parties agree that this agreement, and the Transaction contemplated by it, is confidential information for the purposes of the JVSA and are bound by the confidentiality provisions contained in the JVSA. 15.7 Further assurances Each party must, at its own expense, do all things and execute all further documents necessary to give full effect to this agreement and the transactions contemplated by it. 15.8 No reliance No party has relied on any statement by any other party which has not been expressly included in this agreement. 15.9 Entire agreement This agreement states all of the express terms of the agreement between the parties in respect of its subject matter. It supersedes all prior discussions, negotiations, understandings and agreements in respect of its subject matter. 15.10 Counterparts (a) This agreement may be executed electronically, and in any number of counterparts, each signed by one or more parties. Each counterpart when so executed is deemed to be an original and all such counterparts taken together constitute one document. (b) A party that has executed a counterpart of this agreement may exchange that counterpart with another party by emailing it to the other party or the other party’s legal representative and, if that other party requests it, promptly delivering that executed counterpart by hand or post to the other party or the other party’s legal representative. However, the validity of this agreement is not affected if the party who has emailed the counterpart delays in delivering or does not deliver it by hand or by post. 15.11 Remedies cumulative Except as provided in this agreement and permitted by law, the rights, powers and remedies

Hamilton Locke Asset Sale Agreement 27 3468-7123-2057, v. 2 provided in this agreement are cumulative with and not exclusive of the rights, powers or remedies provided by law independently of this agreement. 15.12 No merger A term or condition of, or act done in connection with, this agreement or Completion does not operate as a merger of any of the undertakings, warranties and indemnities in this agreement or the rights or remedies of the parties under this agreement which continue unchanged. 15.13 Electronic signature (a) Each party warrants that immediately prior to entering into this Agreement, it has unconditionally consented to: (i) the requirement for a signature under any law being met; and (ii) any other party to this deed executing it, by any method of electronic signature that other party uses (at that other party’s discretion), including signing on an electronic device or by digital signature. (b) Without limitation, the parties agree that their communication of an offer or acceptance of this agreement, including exchanging counterparts, may be by any electronic method that evidences that party’s execution of this agreement. 15.14 Clauses that survive termination Without limiting or impacting upon the continued operation of any clause which as a matter of construction is intended to survive the termination of this agreement, the Continuing Clauses survive the termination of this agreement.

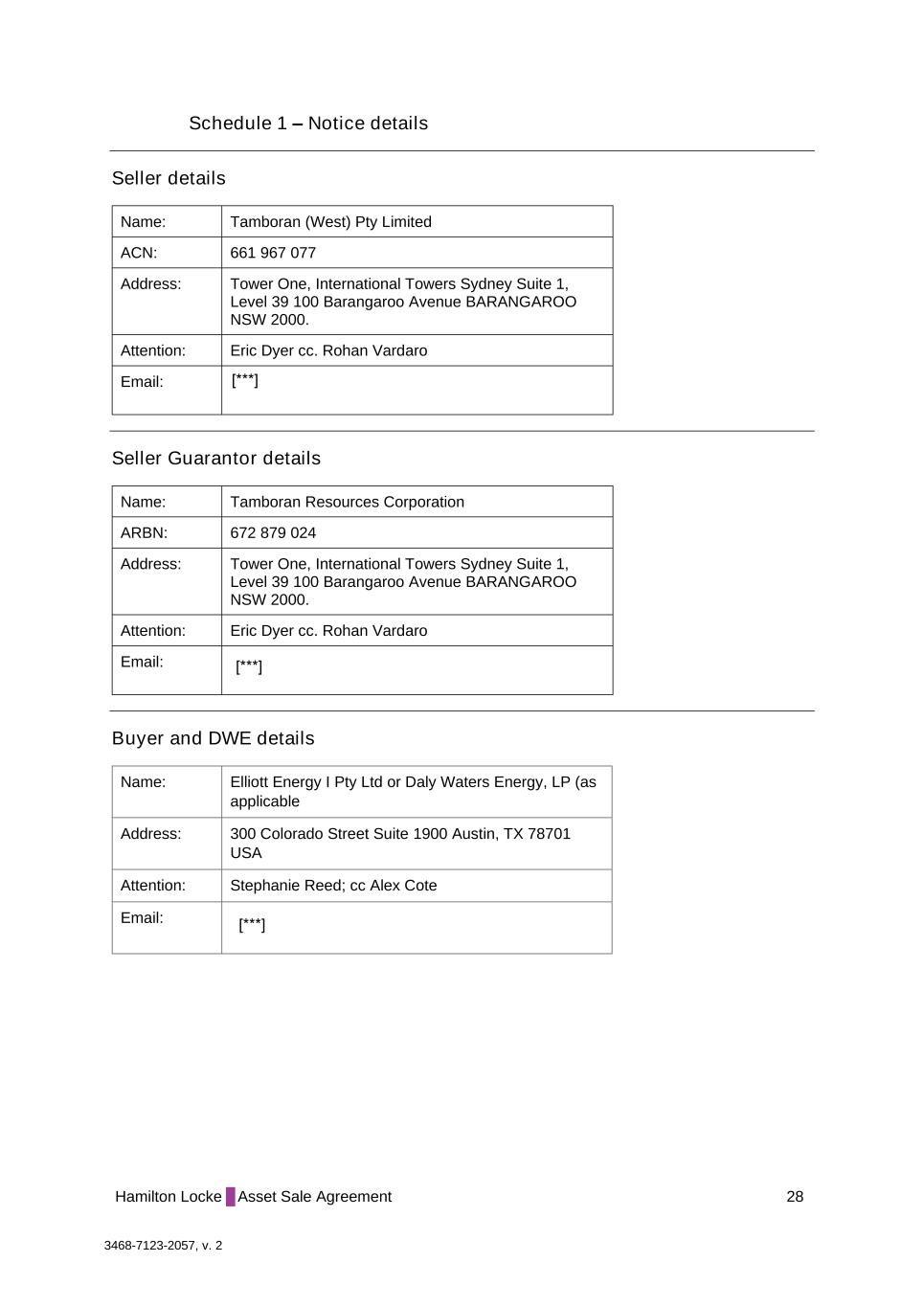

Hamilton Locke Asset Sale Agreement 28 3468-7123-2057, v. 2 Schedule 1 – Notice details Seller details Name: Tamboran (West) Pty Limited ACN: 661 967 077 Address: Tower One, International Towers Sydney Suite 1, Level 39 100 Barangaroo Avenue BARANGAROO NSW 2000. Attention: Eric Dyer cc. Rohan Vardaro Email: Seller Guarantor details Name: Tamboran Resources Corporation ARBN: 672 879 024 Address: Tower One, International Towers Sydney Suite 1, Level 39 100 Barangaroo Avenue BARANGAROO NSW 2000. Attention: Eric Dyer cc. Rohan Vardaro Email: Buyer and DWE details Name: Elliott Energy I Pty Ltd or Daly Waters Energy, LP (as applicable Address: 300 Colorado Street Suite 1900 Austin, TX 78701 USA Attention: Stephanie Reed; cc Alex Cote Email: [***] [***] [***]

Hamilton Locke Asset Sale Agreement 29 3468-7123-2057, v. 2 Schedule 2 – Seller Warranties 1. No legal impediment The execution, delivery and performance by the Seller of its obligations under this agreement complies with: (a) each law, regulation, authorisation, ruling, judgement, order or decree of any Government Agency; (b) the constitution or other constituent documents of the Seller; and (c) any security interest or document. which is binding on the Seller with respect to Assets or the transaction contemplated by this agreement. 2. Power and capacity The Seller has full power and lawful authority to execute and deliver this agreement and to observe and perform, or cause to be observed or perform, all of its obligations contemplated in and under this agreement without breach or causing the breach of any applicable law. 3. Binding agreement This agreement constitutes a valid and legally binding obligation of the Seller in accordance with its terms. 4. No event of insolvency No Insolvency Event has occurred in relation to the Seller nor is there any act which has occurred or any omission made which may result in an Insolvency Event occurring in relation to the Seller. 5. No litigation (a) As at the date of this agreement the Seller is not involved in any litigation, arbitration, mediation, conciliation, criminal or administrative proceeding materially adversely affecting the Dev A RL and no such proceeding is threatened against the Seller. (b) As at the date of this agreement, the Seller is not involved in any litigation, arbitration, mediation, conciliation, criminal or administrative proceeding materially adversely affecting the C10 RL and no such proceeding is threatened against the Seller. (c) To the best of the Seller's knowledge as at the date of this agreement, no litigation, arbitration, mediation, conciliation, criminal or administrative proceedings are pending or threatened which, if adversely determined, could have a material adverse effect on the ability of the Seller to perform its obligations under this agreement. (d) As at the date of this agreement, there are no unsatisfied or outstanding judgments, orders, decrees, stipulations, or notices affecting the Seller that could have a material adverse effect on the ability of the Seller to perform its obligations under this agreement.

Hamilton Locke Asset Sale Agreement 30 3468-7123-2057, v. 2 6. Assets (a) Subject to satisfaction of the Conditions, on grant of the Dev A++ RL, the Seller will be transferred, or will have a right to be transferred, a 77.5% interest in the Dev A++ RL. (b) Subject to satisfaction of the Conditions, on grant of the C10 RL, the Seller will be transferred, or will have a right to be transferred, a 77.5% interest in the C10 RL. (c) As at Dev A++ Completion: (i) the Seller is sole legal and beneficial holder of the Dev A++ Assets; (ii) no other person except the Seller and the Buyer has any rights of any nature in respect of the Dev A++ Assets; (iii) the Seller has full right, power and authority to sell, assign and transfer the Dev A++ Assets to the Buyer in accordance with this agreement and such assignment shall convey to the Buyer lawful, valid and unencumbered beneficial title to the Dev A++ Assets; and (iv) the Dev A++ Assets transferred to the Buyer will be free from all mortgages, charges, liens and other encumbrances of whatsoever nature other than the Permitted Encumbrances. (d) As at C10 Completion: (i) the Seller is sole legal and beneficial holder of the C10 Assets; (ii) no other person except the Seller and the Buyer has any rights of any nature in respect of the C10 Assets; (iii) the Seller has full right, power and authority to sell, assign and transfer the C10 Assets to the Buyer in accordance with this agreement and such assignment shall convey to the Buyer lawful, valid and unencumbered beneficial title to the C10 Assets; and (iv) the C10 Assets transferred to the Buyer will be free from all mortgages, charges, liens and other encumbrances of whatsoever nature other than the Permitted Encumbrances.

Hamilton Locke Asset Sale Agreement 31 3468-7123-2057, v. 2 Schedule 3 – Seller Guarantor Warranties 1. No legal impediment The execution, delivery and performance by the Seller Guarantor of this agreement complies with: (a) each law, regulation, authorisation, ruling, judgement, order or decree of any Government Agency; (b) the constitution or other constituent documents of the Seller Guarantor; and (c) any security interest or document. 2. Power and capacity The Seller Guarantor has full power and lawful authority to execute and deliver this agreement and to observe and perform, or cause to be observed or perform, all of its obligations in and under this agreement without breach or causing the breach of any applicable law. 3. Binding agreement This agreement constitutes a valid and legally binding obligation of the Seller Guarantor in accordance with its terms. 4. No event of insolvency No Insolvency Event has occurred in relation to the Seller Guarantor nor is there any act which has occurred or any omission made which may result in an Insolvency Event occurring in relation to the Seller Guarantor. 5. Incorporation The Seller Guarantor is duly incorporated and registered in Australia, has full corporate power to own its assets and to carry on its business as now conducted. 6. No litigation (a) As at the date of this agreement, the Seller Guarantor is not involved in any material litigation, arbitration, mediation, conciliation, criminal or administrative proceeding that could have a material adverse effect on the ability of the Seller Guarantor to perform its obligations under this agreement and no such proceeding is threatened against the Seller Guarantor. (b) There are no unsatisfied or outstanding judgments, orders, decrees, stipulations, or notices affecting the Seller Guarantor that could have a material adverse effect on the ability of the Seller Guarantor to perform its obligations under this agreement. (c) To the best of the Seller Guarantor’s knowledge as at the date of this agreement, no litigation, arbitration, mediation, conciliation, criminal or administrative proceedings are pending or threatened which, if adversely determined, could have a material adverse effect on the ability of the Seller Guarantor to perform its obligations under this agreement.