EX-99.1

Published on May 14, 2025

NYSE: TBN, ASX: TBN 3Q FY25 Result Presentation Joel Riddle – Chief Executive Officer North America: May 14, 2025 | Australia: May 15, 2025 SHENANDOAH SOUTH 2 WELLPAD, NORTHERN TERRITORY, AUSTRALIA

The information in this presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which include statements on Tamboran Resources Corporation's ("we", "us" or the "Company") opinions, expectations, beliefs, plans objectives, assumptions or projections regarding future events or future results. All statements, other than statements of historical fact included in this presentation regarding our strategy, present and future operations, financial position, estimated revenues and losses, projected costs, estimated reserves, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, words such as “may,” “assume,” “forecast,” “could,” “should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget”, "achieve," "progress," "target," "expand," "deliver“, "potential," "propose," "enter," "provide," "contribute," and similar expressions are used to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events at the time such statement was made. These forward‐looking statements are not a guarantee of our performance, and you should not place undue reliance on such statements. Forward looking statements may include statements about, among other things: our business strategy and the successful implementation of our business strategy; our future reserves; our financial strategy, liquidity and capital required for our development programs; estimated natural gas prices; our dividend policy; the timing and amount of future production of natural gas; our drilling and production plans; competition and government regulation; our ability to obtain and retain permits and governmental approvals; legal, regulatory or environmental matters; marketing of natural gas; business or leasehold acquisitions and integration of acquired businesses; our ability to develop our properties; the availability and cost of developing appropriate infrastructure around and transportation to our properties; the availability and cost of drilling rigs, production equipment, supplies, personnel and oilfield services; costs of developing our properties and of conducting our operations; our ability to reach FID and execute and complete our planned pipeline or planned LNG export projects; our anticipated Scope 1, Scope 2 and Scope 3 emissions from our businesses and our plans to offset our Scope 1, Scope 2 and Scope 3 emissions from our business; our ESG strategy and initiatives, including those relating to the generation and marketing of environmental attributes or new products seeking to benefit from ESG related activities; general economic conditions, including cost inflation; credit markets and the ability to obtain future financing on commercially acceptable terms; our ability to expand our business, including through the recruitment and retention of skilled personnel; our dependence on our key management personnel; our future operating results; and our plans, objectives, expectations and intentions. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Tamboran is subject to known and unknown risks, many of which are beyond the ability of Tamboran to control or predict. These risks may include, for example, movements in oil and gas prices, risks associated with the development and operation of the acreage, exchange rate fluctuations, an inability to obtain funding on acceptable terms or at all, loss of key personnel, an inability to obtain appropriate licenses, permits and or/or other approvals, inaccuracies in resource estimates, share market risks and changes in general economic conditions. Such risks may affect actual and future results of Tamboran and its securities. Maps and diagrams contained in this presentation are provided to assist with the identification and description of Tamboran’s interests. The maps and diagrams may not be drawn to scale. This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications or other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, which could cause our results to differ materially from those expressed in these third-party publications. Numbers in this report have been rounded. As a result, some figures may differ insignificantly due to rounding and totals reported may differ insignificantly from arithmetic addition of the rounded numbers. All currency amounts are represented as USD unless otherwise stated (AUD/USD exchange rate of 0.64). This presentation does not purport to be all inclusive or to necessarily contain all the information that you may need or desire to perform your analysis. In all cases, you should conduct your own investigation and analysis of the data set forth in this presentation, and should rely solely on your own judgment, review and analysis in evaluating this presentation. This presentation contains trademarks, tradenames and servicemarks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, tradenames and servicemarks to imply relationships with, or endorsement or sponsorship of us by, these other companies. This announcement was approved and authorised for release by Mr. Joel Riddle, the Chief Executive Officer of Tamboran Resources Corporation. Disclaimer 2

3 Tamboran Resources Corporation (NYSE: TBN, ASX: TBN) 3Q FY25 highlights Successful completion of 35 stages in the SS-2H ST1 well over 5,483-feet. Following a 62 day “soaking” period, the well commenced IP90 flow testing in mid-May 2025 Drilling of SS-4H, 5H and 6H wells planned in 2H 2025, targeting <25 days spud to TD timing and demonstrating increased cost efficiencies for 10,000-foot horizontal drilling First gas from the proposed SS Pilot Project on track for mid-2026. Evaluating Phase 1 expansion for incremental local NT demand, supported by LOI with Arafura Rare Earths Limited (ASX: ARU) ~240 stages of batch completions across SS-3H, 4H, 5H and 6H wells planned in late 2025 – 1H 2026, incorporating local sand and learnings from SS-2H ST1 Engaged RBC Capital Markets to commence farmout of ~400,000 acres in the Phase 2 Development Area, following completion of checkerboard process with Daily Waters Energy, LP Cash balance of US$25.6 million on March 31, 2025. US$70.4 million raised in May 2025, increases pro forma cash to US$96.0 million. Expected to be fully funded to drill remaining three wells to deliver 40 MMcf/d to the Proposed SS Pilot 1 2 4 3 5 6

Phase 1 proposed SS Pilot Project update Targeting SS-2H ST1 IP30 flow test in June 2025 | Funded to drill three wells in 2H 2025 ahead of production in mid-2026 − Concluded stimulation operations on SS-2H ST1, which was successfully completed across 35 stages over a 5,483-foot (1,671-metre) horizontal section in the Mid Velkerri B Shale, reaching Beetaloo Basin records for average proppant intensity − Commenced “soaking” of SS-2H ST1 in March 2025. Technical analysis of benefits of “soaking” has demonstrated higher productivity for a longer duration soak, when compared to SS-1H due to increase stimulation intensity − SS-2H ST1 commenced IP30 flow testing in mid-May 2025 and is targeting IP30 flow test results in June 2025. The well is planned to be tested for a full 90-day period − Planning to drill the final three wells (SS-4H, 5H and 6H) for the proposed Pilot Project, which is planned to commence in mid-2025. The SS-3H, 4H, 5H and 6H wells are planned to be stimulated following the drilling program, with a single well tested for 30 days prior to the commencement of production in mid-2026 4 Initial testing of SS-2H ST1 well on the SS2 pad, Beetaloo Basin

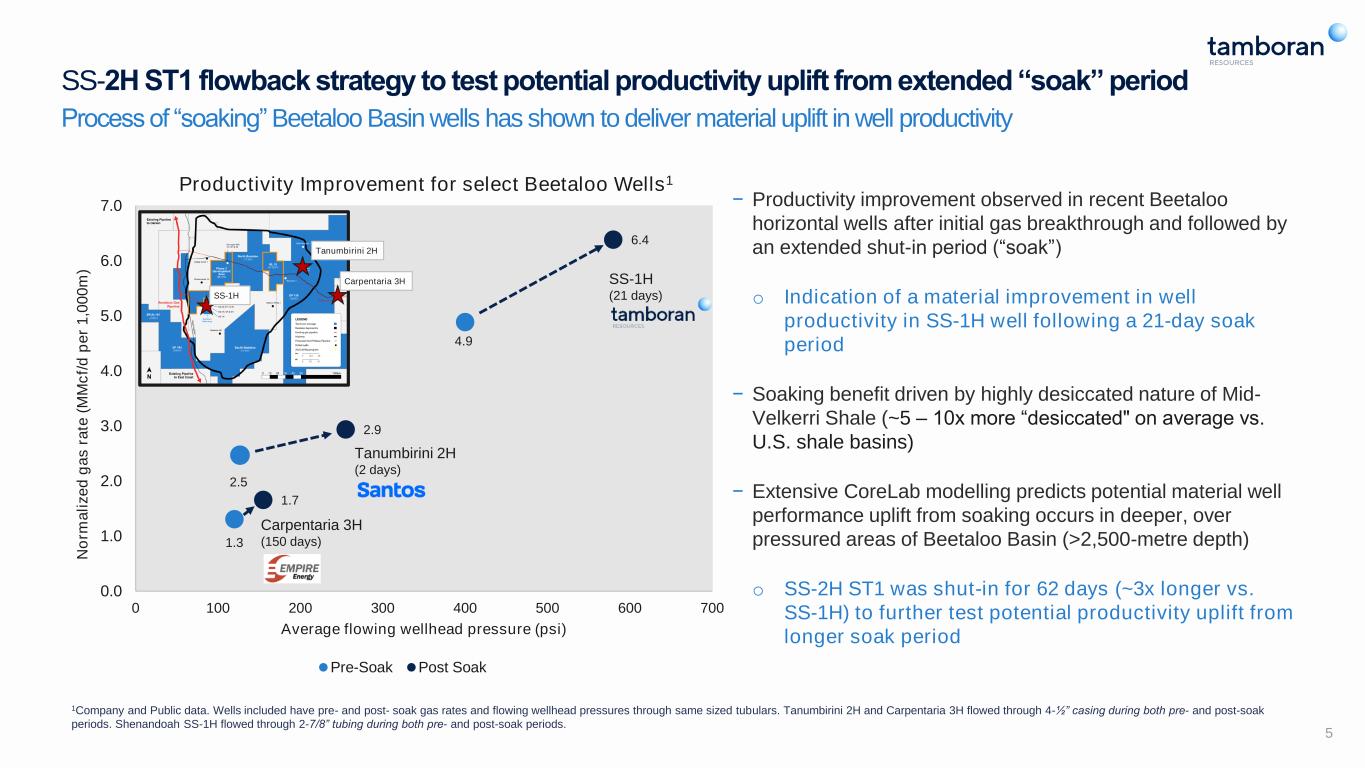

2.5 1.3 4.9 2.9 1.7 6.4 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 0 100 200 300 400 500 600 700 N o rm a li z e d g a s r a te ( M M c f/ d p e r 1 ,0 0 0 m ) Average flowing wellhead pressure (psi) Productivity Improvement for select Beetaloo Wells1 Pre-Soak Post Soak Carpentaria 3H (150 days) SS-1H (21 days) SS-2H ST1 flowback strategy to test potential productivity uplift from extended “soak” period Process of “soaking” Beetaloo Basin wells has shown to deliver material uplift in well productivity − Productivity improvement observed in recent Beetaloo horizontal wells after initial gas breakthrough and followed by an extended shut-in period (“soak”) o Indication of a material improvement in well productivity in SS-1H well following a 21-day soak period − Soaking benefit driven by highly desiccated nature of Mid- Velkerri Shale (~5 – 10x more “desiccated" on average vs. U.S. shale basins) − Extensive CoreLab modelling predicts potential material well performance uplift from soaking occurs in deeper, over pressured areas of Beetaloo Basin (>2,500-metre depth) o SS-2H ST1 was shut-in for 62 days (~3x longer vs. SS-1H) to further test potential productivity uplift from longer soak period 5 1Company and Public data. Wells included have pre- and post- soak gas rates and flowing wellhead pressures through same sized tubulars. Tanumbirini 2H and Carpentaria 3H flowed through 4-½” casing during both pre- and post-soak periods. Shenandoah SS-1H flowed through 2-7/8” tubing during both pre- and post-soak periods. Tanumbirini 2H (2 days) Carpentaria 3H Tanumbirini 2H SS-1H

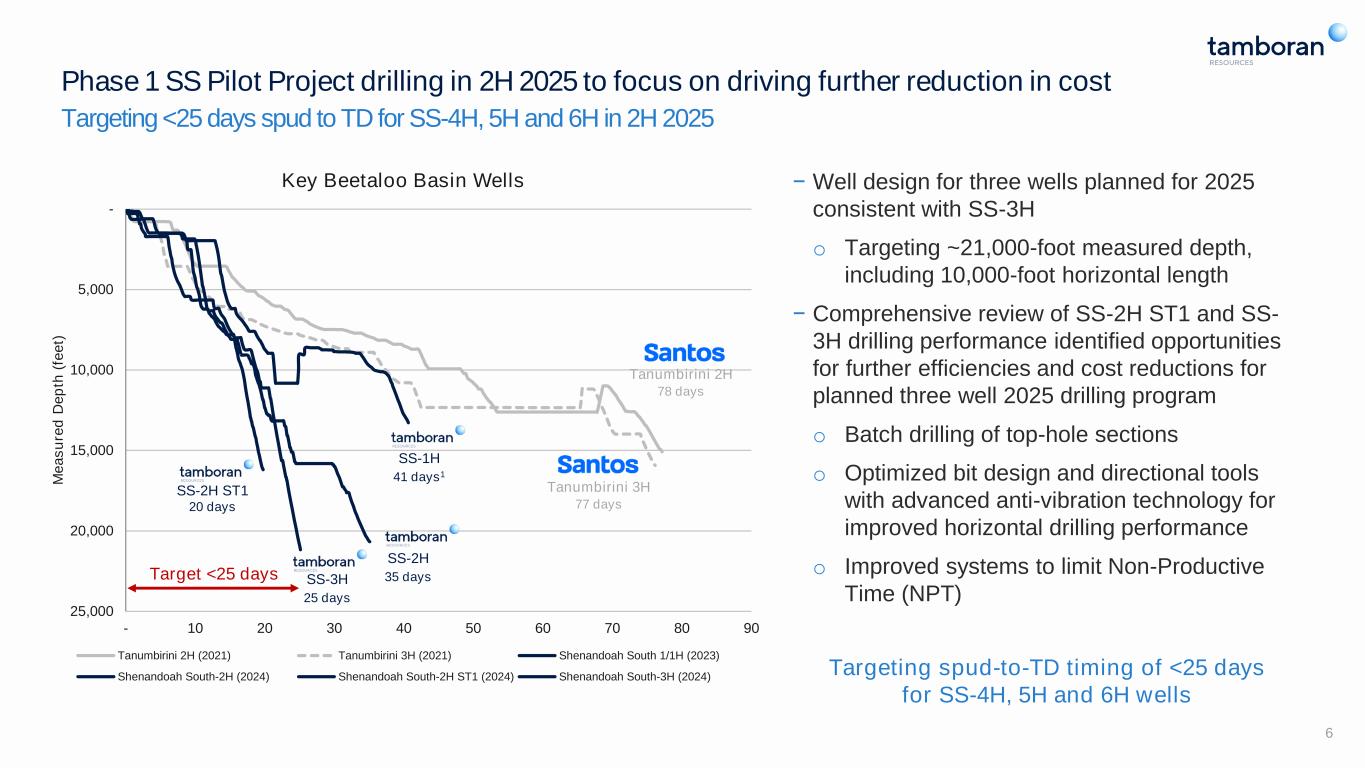

6 Phase 1 SS Pilot Project drilling in 2H 2025 to focus on driving further reduction in cost Targeting <25 days spud to TD for SS-4H, 5H and 6H in 2H 2025 - 5,000 10,000 15,000 20,000 25,000 - 10 20 30 40 50 60 70 80 90 M e a s u re d D e p th ( fe e t) Key Beetaloo Basin Wells Tanumbirini 2H (2021) Tanumbirini 3H (2021) Shenandoah South 1/1H (2023) Shenandoah South-2H (2024) Shenandoah South-2H ST1 (2024) Shenandoah South-3H (2024) Tanumbirini 2H 78 days SS-2H 35 days Tanumbirini 3H 77 days SS-1H 41 days1 SS-2H ST1 20 days − Well design for three wells planned for 2025 consistent with SS-3H o Targeting ~21,000-foot measured depth, including 10,000-foot horizontal length − Comprehensive review of SS-2H ST1 and SS- 3H drilling performance identified opportunities for further efficiencies and cost reductions for planned three well 2025 drilling program o Batch drilling of top-hole sections o Optimized bit design and directional tools with advanced anti-vibration technology for improved horizontal drilling performance o Improved systems to limit Non-Productive Time (NPT) Targeting spud-to-TD timing of <25 days for SS-4H, 5H and 6H wells Target <25 days SS-3H 25 days

7 Batch completion of SS Pilot Project wells planned in 4Q 2025 – 1H 2026 SS-3H, 4H, 5H and 6H wells to incorporate local sand and key learnings from SS-2H ST1 flow test performance SS-3H SS-4H SS-5H SS-6H - 500 1,000 1,500 2,000 2,500 3,000 3,500 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 P ro p p a n t In te n s it y ( lb /f t) SS-2H ST1 stimulation intensity compared to SS-1H (average) SS-2H ST1 SS-1H Increase in spacing optimized stimulation − SS-3H well will be completed in conjunction with completion of SS-4H, 5H and 6H wells (up to 240 total stages) o Completion design will target up to 60 total stages over each 10,000-foot horizontal section (~165-foot spacing) − Key learnings from SS-2H ST1 flow test performance will be applied into optimized Tamboran V2 design for SS-3H, 4H, 5H and 6H wells o Targeting optimized proppant placement at >100 barrels per minute o Opportunity to use local supply of sand and to pump deliver >5 stages per day by integrating zipper fracturing with Liberty Energy (NYSE: LBRT) equipment SS-2H ST1

8 Phase 1 SS Pilot Project first gas on schedule for mid-2026 Compression and pipeline infrastructure delivered to Australia ahead of the commencement of construction in 2H 2025 Sturt Plateau Pipeline (SPP) − Pipe delivered into Darwin, Australia in April 2025 − APA Group (ASX: APA) has submitted Pipeline License Application and is expected to commence construction in September 2025 − Pipeline on track for first gas in 1H 2026 SPP SPCF Existing Amadeus Gas 12” Pipeline Sturt Plateau Compression Facility (SPCF) − Compressors delivered into Brisbane, Australia in April 2025 − Gas dehydration equipment is complete and awaiting shipment from Malaysia to Australia − SPCF construction due to commence immediately following Final Investment Decision, which is schedule for mid-2025 − SPCF on track to deliver first gas in mid-2026 Sturt Plateau Pipeline (SPP) delivered to Darwin, Australia Compressor for the SPCF delivered and offloaded in Brisbane, Australia

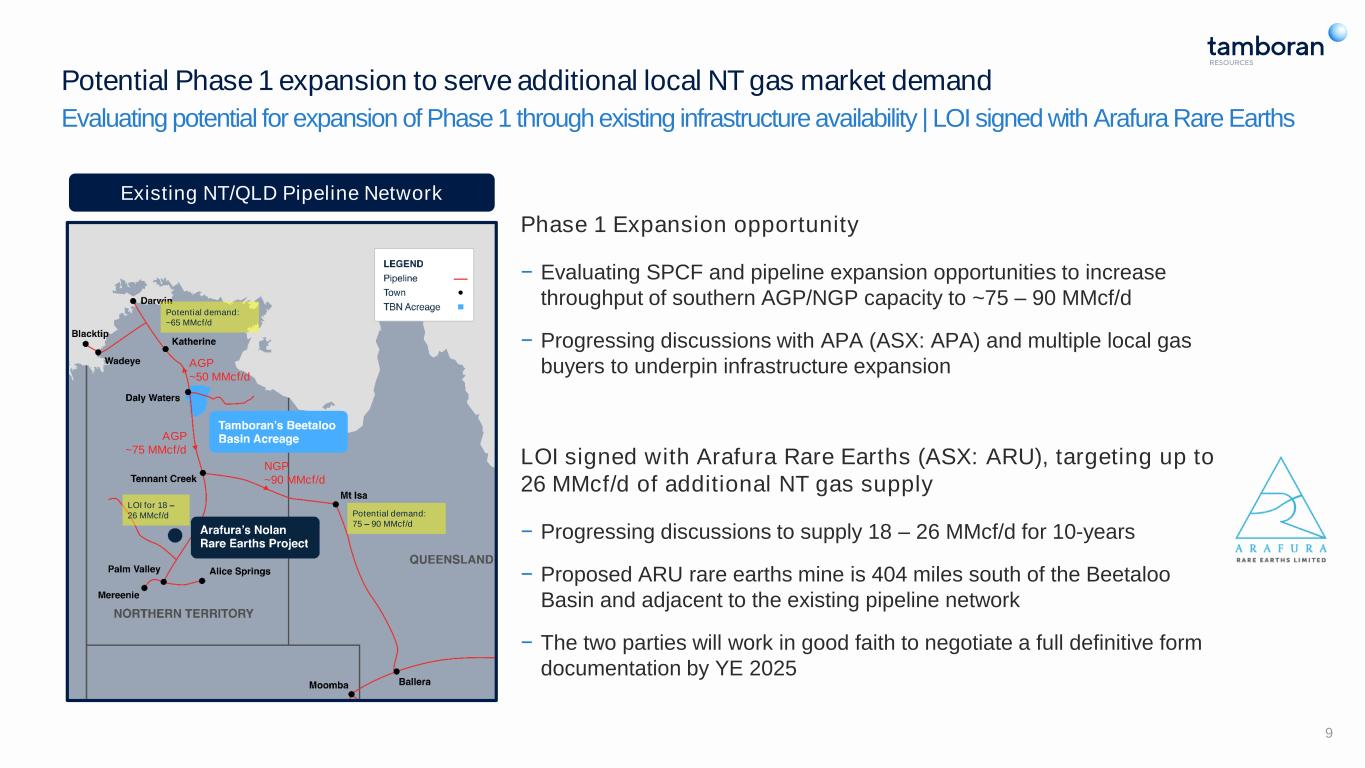

Potential Phase 1 expansion to serve additional local NT gas market demand Evaluating potential for expansion of Phase 1 through existing infrastructure availability | LOI signed with Arafura Rare Earths Phase 1 Expansion opportunity − Evaluating SPCF and pipeline expansion opportunities to increase throughput of southern AGP/NGP capacity to ~75 – 90 MMcf/d − Progressing discussions with APA (ASX: APA) and multiple local gas buyers to underpin infrastructure expansion LOI signed with Arafura Rare Earths (ASX: ARU), targeting up to 26 MMcf/d of additional NT gas supply − Progressing discussions to supply 18 – 26 MMcf/d for 10-years − Proposed ARU rare earths mine is 404 miles south of the Beetaloo Basin and adjacent to the existing pipeline network − The two parties will work in good faith to negotiate a full definitive form documentation by YE 2025 9 Existing NT/QLD Pipeline Network AGP ~50 MMcf/d AGP ~75 MMcf/d NGP ~90 MMcf/d LOI for 18 – 26 MMcf/d Potential demand: 75 – 90 MMcf/d Potential demand: ~65 MMcf/d

Tamboran/DWE checkerboard process and farmout update Finalized checkerboard process1 | Tamboran progressing towards farmout of ~400,000 acres in Phase 2 Development Area “Phase 2 Development Area” is most “development- ready” acreage in the Beetaloo Basin given derisked resources, supportive land access and proximity to existing infrastructure − 406,693 gross prospective acres (236,370 net operated acres to TBN) in close proximity to derisked Phase 1 Pilot Project and SPP − Focused development strategy to supply East Coast domestic gas market in 2029-30 to address anticipated ~1 Bcf/d shortfall as highlighted by ACCC and AEMO − Targeting multiple wells in 2026 to book reserves to support a Phase 2 project sanctioning decision − RBC Capital Markets engaged to lead formal process to farm out Tamboran’s working interest in “Phase 2 Development Area” during 2H 20252 10 1Subject to the completion of certain conditions precedent and regulatory approvals. 2DWE will have participation rights to any transaction on the same terms. Phase 2 Development Area (TBN: 58.12%*, DWE: 19.38% & FOG: 22.5%)

Pro forma cash position provides pathway to SS Pilot Project first production − Pro forma, adjusted cash balance of US$96.0 million following PIPE and acreage sale during May 2025 − Cash predominantly used for drilling and stimulation activities, and midstream infrastructure for the proposed SS Pilot Project − Finalizing terms for potential financing of the remaining capital to fund the SPCF to completion ahead of proposed divestment − Following the completion of the US$55.4 million PIPE1 and US$15 million acreage sale2, Tamboran expects to be fully funded to drill and complete the remaining three wells required to deliver first gas under the proposed SS Pilot Project − RBC Capital engaged to commence farm down process of Phase 2 Development Area o Potential for cash and well carry to support delineation of resource ahead of project sanction 11 Chris to update once finance finalize the quarterly 1The initial US$44.4 million of the PIPE is expected to close on Friday May 16, 2025, subject to the satisfaction of customary closing conditions. The closing of the remaining US$11.0 million is subject to approval by Tamboran’s shareholders and the satisfaction of other customary closing conditions. 2subject to certain conditions precedent including, and not limited to, DWE obtaining approval from the Formentera Australia Fund, LP’s Limited Partner Advisory Committee, Tamboran shareholder approval and regulatory approvals. 3Cash flow from investing adjusted for receivables relating to cash calls of US$18.1 million from Daly Waters Energy, LP under the Tamboran (B2) incorporated joint venture. 4Cash flow from investing includes cash associated with drilling activity and infrastructure. 5Includes performance bond facility fee (-US$0.2 million), repayment of lease liability (-US$1.0 million) and FX adjustments (+US$1.4 million). Being updated… Will include the raise post-March cash balance and show pro- forma impact. 25.6 96.0 (14.3) (19.7)3,4 59.4 0.25 55.4 15.0 Cash Balance (Dec 31, 2024) Cash Flow from Operations Cash Flow from Investing Other Cash Balance (Mar 31, 2025) PIPE Offer (pre-fees) Checker Sale to DWE Adjusted Cash Balance Post Funding U S $ m il li o n US$25.6 million cash at March 31, 2025 | Completed US$70 million raise to fully fund SS Pilot Project drilling and stimulation activities in 2025/26

Upcoming catalysts Progressing towards production from proposed ~40 MMcf/d (gross, ~19 MMcf/d net) Pilot Project in mid-2026 12Note: Timing of upcoming catalysts is indicative, and subject to change in the event of unforeseen events, delays due to weather and key stakeholder and Joint Venture approvals. Refer to disclaimer on Slide 2. May 2025 Commence 90-day flow testing of SS-2H ST1 June 2025 Announce IP30 flow test results from SS-2H ST1 Mid-2025 Commence three well drilling program of remaining proposed SS Pilot Project wells to reach production Mid-2025 Proposed Final Investment Decision of the SS Pilot 2H 2025 Commence construction of SPCF and SPP 4Q 2025 – 1H 2026 Stimulation of four wells and 30-day flow test of a single well Mid-2026 Target for first gas from proposed SS Pilot Project

13 Appendix A: Additional Information

Beetaloo Basin working interests and acreage positions ~1.9 million net prospective acres across the Beetaloo Basin depocenter 14 Gross Acres Tamboran working interest Tamboran net prospective acres Proposed North Pilot Area1 20,309 47.50%* 9,647 Proposed South Pilot Area 20,309 38.75% 7,870 Phase 2 Development Area 406,693 58.12%* 236,370 Proposed Retention Lease 10 219,030 67.83%* 148,568 Remaining ex-EP 76, 98 and 117 acreage 1,487,418 77.50%* 1,152,749 EP 136 207,000 100.00%* 207,000 EP 161 512,000 25.00% 128,000 Total 2,872,759 1,890,204 May not add due to rounding. *Denotes operator of acreage. 1Subject to the completion of the SS-2H ST1 and SS-3H wells on the Shenandoah South pad 2.