PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on June 13, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Tamboran Resources Corporation

Suite 01, Level 39, Tower One, International Towers Sydney

100 Barangaroo Avenue

Barangaroo NSW 2000

June 12, 2025

To the Stockholders of Tamboran Resources Corporation:

You are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting”) of Tamboran Resources Corporation, a Delaware corporation (the “Company”), to be held virtually on Wednesday, July 16, 2025, at 5:00 p.m. Central time (being 8:00 a.m. AEDT on Thursday, July 17, 2025) at www.virtualshareholdermeeting.com/TBN2025SM.

At the Special Meeting, stockholders will be asked to consider and vote upon the following proposals:

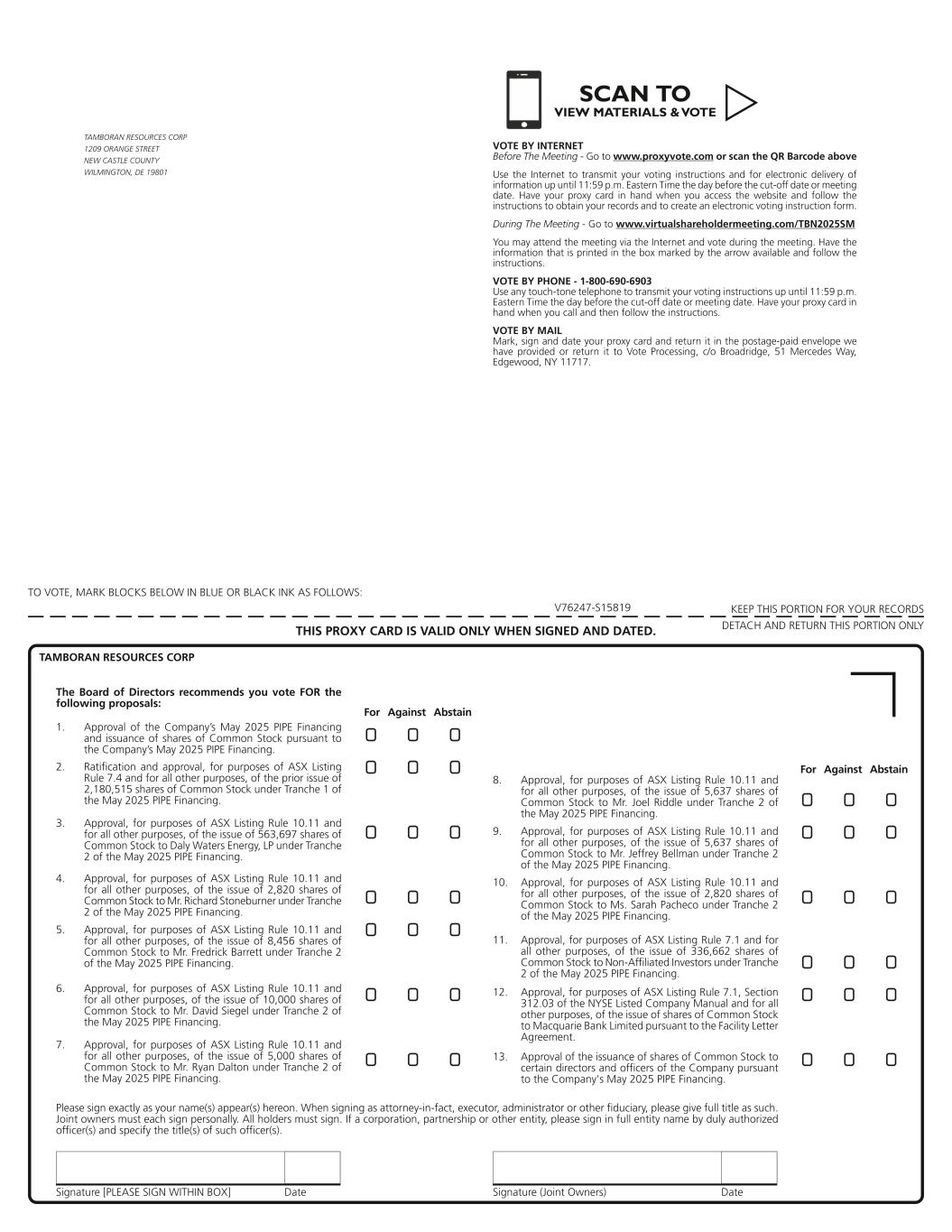

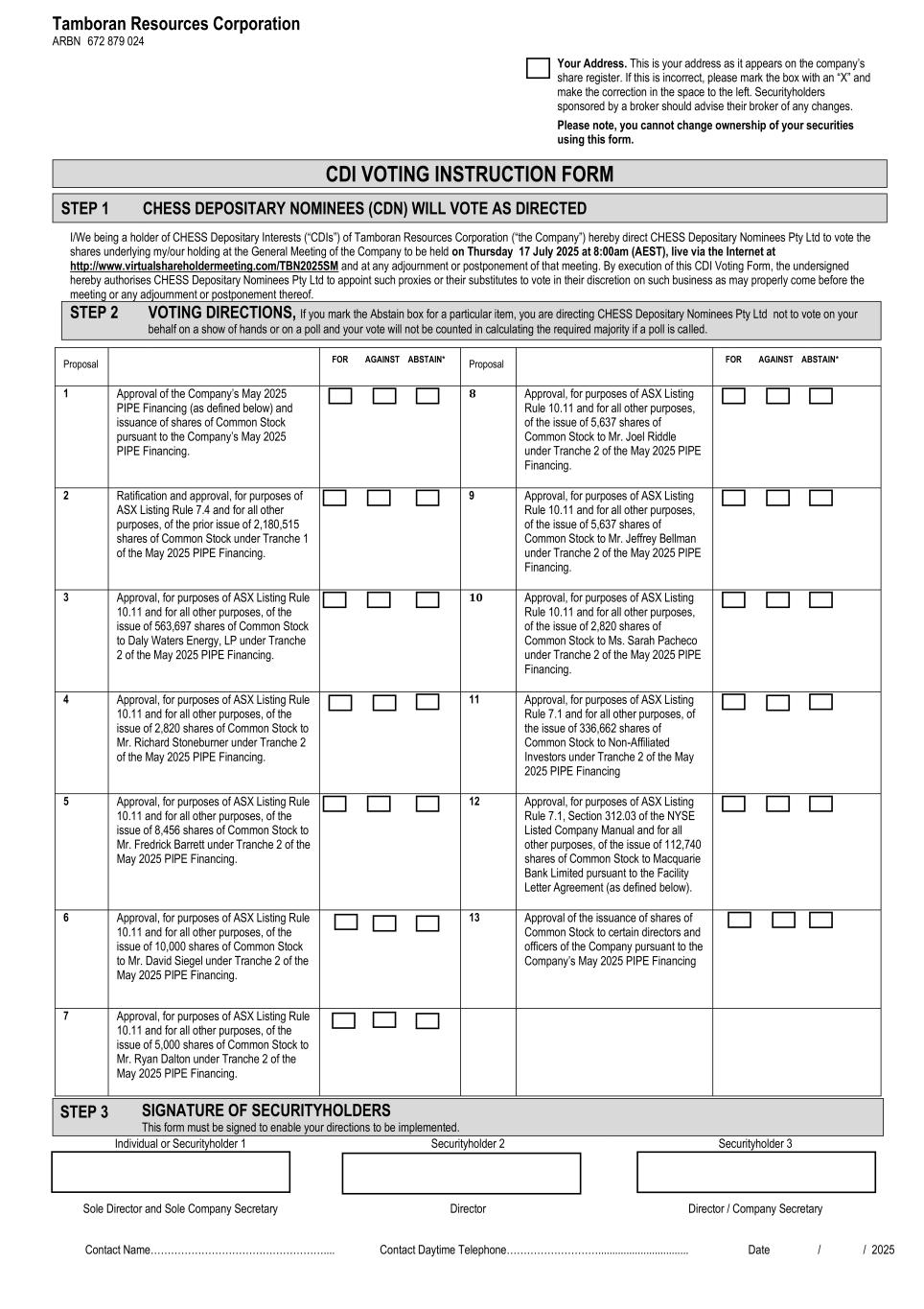

1.Approval of the Company’s May 2025 PIPE Financing and issuance of shares of Common Stock pursuant to the Company’s May 2025 PIPE Financing.

2.Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issue of 2,180,515 shares of Common Stock under Tranche 1 of the May 2025 PIPE Financing.

3.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 563,697 shares of Common Stock to Daly Waters Energy, LP under Tranche 2 of the May 2025 PIPE Financing.

4.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Mr. Richard Stoneburner under Tranche 2 of the May 2025 PIPE Financing.

5.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 8,456 shares of Common Stock to Mr. Fredrick Barrett under Tranche 2 of the May 2025 PIPE Financing.

6.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 10,000 shares of Common Stock to Mr. David Siegel under Tranche 2 of the May 2025 PIPE Financing.

7.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,000 shares of Common Stock to Mr. Ryan Dalton under Tranche 2 of the May 2025 PIPE Financing.

8.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Joel Riddle under Tranche 2 of the May 2025 PIPE Financing.

9.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Jeffrey Bellman under Tranche 2 of the May 2025 PIPE Financing.

10.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Ms. Sarah Pacheco under Tranche 2 of the May 2025 PIPE Financing.

11.Approval, for purposes of ASX Listing Rule 7.1 and for all other purposes, of the issue of 336,662 shares of Common Stock to Non-Affiliated Investors under Tranche 2 of the May 2025 PIPE Financing.

12.Approval, for purposes of ASX Listing Rule 7.1, Section 312.03 of the NYSE Listed Company Manual and for all other purposes, of the issue of shares of Common Stock to Macquarie Bank Limited pursuant to the Facility Letter Agreement.

13.Approval of the issuance of shares of Common Stock to certain directors and officers of the Company pursuant to the Company’s May 2025 PIPE Financing.

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE ABOVE PROPOSALS.

Pursuant to the provisions of the Company’s Certificate of Incorporation and Amended and Restated Bylaws, the board of directors of the Company (the “Board”) has fixed the close of business on June 12, 2025 as the record date for determining the stockholders of the Company entitled to notice of, and to vote at, the Special Meeting or any adjournment thereof. Accordingly, only stockholders of record at the close of business on June 12, 2025 are entitled to notice of, and to vote at, the Special Meeting and any postponement or adjournment thereof. Holders of Chess Depositary Interests (“CDIs”) of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct CHESS Depositary Nominees Pty Ltd, as depositary nominee (the “Depositary Nominee”) to vote the Company’s common stock, par value $0.001 per share (“Common Stock”) underlying their CDIs at the Special Meeting by completing the CDI Voting Instruction Form.

Holders of Common Stock will be able to vote and submit questions online through the virtual-meeting platform during the Special Meeting. To ensure that proxies are received in time to be counted prior to the Special Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Tuesday, July 15, 2025, and proxies submitted by mail should be received by the close of business on Tuesday, July 15, 2025 (the business day prior to the date of the Special Meeting).

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Special Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (“Boardroom”), the agent the Company has designated for the collection and processing of voting instructions from the Company’s CDI holders. Votes from CDI holders must be received by Boardroom by no later than 5:00 p.m. Central time on Monday, July 14, 2025 (being 8:00 a.m. AEDT on Tuesday, July 15, 2025) (48 hours prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

To be admitted to the Special Meeting at www.virtualshareholdermeeting.com/TBN2025SM, you must enter the 16-digit control number found on your proxy card. Holders of CDIs wishing to attend the Special Meeting will need to do so as guests.

Please review in detail the attached notice and proxy statement for a more complete statement of matters to be considered at the Special Meeting.

|

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Special Meeting, we encourage you to review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, and voter instruction form, as applicable) or by completing, signing, and mailing the enclosed proxy card in the enclosed envelope.

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Special Meeting by completing the CDI Voting Instruction Form.

| ||

By the Board of Directors:

/s/ Rohan Vardaro

Rohan Vardaro,

Senior Counsel and Corporate Secretary

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

The 2025 Special Meeting of stockholders (the “Special Meeting”) of Tamboran Resources Corporation (the “Company”) will be held on Wednesday, July 16, 2025, at 5:00 p.m. Central time (being 8:00 a.m. AEDT on Thursday, July 17, 2025). To increase access for all of our stockholders, the Special Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote, and submit questions during the Special Meeting via the live webcast on the Internet at www.virtualshareholdermeeting.com/TBN2025SM. You will not be able to attend the Special Meeting in person, nor will there be any physical location. You may vote by telephone, Internet, or mail prior to the Special Meeting. While we encourage you to vote in advance of the Special Meeting, you may also vote and submit questions relating to meeting matters during the Special Meeting (subject to time restrictions).

At the Special Meeting, Stockholders will be asked to consider and vote upon the following proposal:

1.Approval of the Company’s May 2025 PIPE Financing and issuance of shares of Common Stock pursuant to the Company’s May 2025 PIPE Financing.

2.Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issue of 2,180,515 shares of Common Stock under Tranche 1 of the May 2025 PIPE Financing.

3.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 563,697 shares of Common Stock to Daly Waters Energy, LP under Tranche 2 of the May 2025 PIPE Financing.

4.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Mr. Richard Stoneburner under Tranche 2 of the May 2025 PIPE Financing.

5.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 8,456 shares of Common Stock to Mr. Fredrick Barrett under Tranche 2 of the May 2025 PIPE Financing.

6.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 10,000 shares of Common Stock to Mr. David Siegel under Tranche 2 of the May 2025 PIPE Financing.

7.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,000 shares of Common Stock to Mr. Ryan Dalton under Tranche 2 of the May 2025 PIPE Financing.

8.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Joel Riddle under Tranche 2 of the May 2025 PIPE Financing.

9.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Jeffrey Bellman under Tranche 2 of the May 2025 PIPE Financing.

10.Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Ms. Sarah Pacheco under Tranche 2 of the May 2025 PIPE Financing.

11.Approval, for purposes of ASX Listing Rule 7.1 and for all other purposes, of the issue of 336,662 shares of Common Stock to Non-Affiliated Investors under Tranche 2 of the May 2025 PIPE Financing.

12.Approval, for purposes of ASX Listing Rule 7.1, Section 312.03 of the NYSE Listed Company Manual and for all other purposes, of the issue of shares of Common Stock to Macquarie Bank Limited pursuant to the Facility Letter Agreement.

13.Approval of the issuance of shares of Common Stock to certain directors and officers of the Company pursuant to the Company’s May 2025 PIPE Financing.

Only stockholders of record at the close of business on June 12, 2025 are entitled to notice of, and to vote at, the Special Meeting and any postponement or adjournment thereof. Holders of CDIs of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct the Depositary Nominee to vote the Company’s common stock, par value $0.001 per share (“Common Stock”) underlying their CDIs at the Special Meeting by completing the CDI Voting Instruction Form.

Holders of Common Stock will be able to vote and submit questions online through the virtual-meeting platform during the Special Meeting. To ensure that proxies are received in time to be counted prior to the Special Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Tuesday, July 15, 2025, and proxies submitted by mail should be received by the close of business on Tuesday, July 15, 2025 (the business day prior to the date of the Special Meeting).

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Special Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (“Boardroom”), the agent the Company has designated for the collection and processing of voting instructions from the Company’s CDI holders. Votes from CDI holders must be received by Boardroom by no later than 5:00 p.m. Central time on Monday, July 14, 2025 (being 8:00 a.m. AEDT on Tuesday, July 15, 2025) (48 hours prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

To be admitted to the Special Meeting at www.virtualshareholdermeeting.com/TBN2025SM, you must enter the 16-digit control number found on your proxy card. Holders of CDIs wishing to attend the Special Meeting will need to do so as guests.

| VOTE IN PERSON | VOTE BY INTERNET | VOTE BY PHONE | VOTE BY MAIL | |||||||||||||||||

Follow the instructions contained in this proxy statement to virtually attend the Special Meeting and vote your shares during the Special Meeting. |

Visit www.proxyvote.com with the control number found on the proxy card. |

Call the toll-free number (for residents of the U.S. and Canada) listed on the proxy card. Be sure to have the control number available. |

Complete and sign the enclosed proxy card and return it in the enclosed envelope or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | |||||||||||||||||

|

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Special Meeting, we encourage you to review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, and voter instruction form, as applicable) or by completing, signing, and mailing the enclosed proxy card in the enclosed envelope.

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Special Meeting by completing the CDI Voting Instruction Form.

| ||

Dated: June 12, 2025 By the Board of Directors:

/s/ Rohan Vardaro

Rohan Vardaro,

Senior Counsel and Corporate Secretary

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “commit,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods.

It is possible that the Company’s future financial performance may differ from expectations due to a variety of factors, including but not limited to: our early stage of development with no material revenue expected until 2026 and our limited operating history; the substantial additional capital required for our business plan, which we may be unable to raise on acceptable terms; our strategy to deliver natural gas to the Australian East Coast and select Asian markets being contingent upon constructing additional pipeline capacity, which may not be secured; the absence of proved reserves and the risk that our drilling may not yield natural gas in commercial quantities or quality; the speculative nature of drilling activities, which involve significant costs and may not result in discoveries or additions to our future production or reserves; the challenges associated with importing U.S. practices and technology to the Northern Territory, which could affect our operations and growth due to limited local experience; the critical need for timely access to appropriate equipment and infrastructure, which may impact our market access and business plan execution; the operational complexities and inherent risks of drilling, completions, workover, and hydraulic fracturing operations that could adversely affect our business; the volatility of natural gas prices and its potential adverse effect on our financial condition and operations; the risks of construction delays, cost overruns, and negative effects on our financial and operational performance associated with midstream projects; the potential fundamental impact on our business if our assessments of the Beetaloo are materially inaccurate; the concentration of all our assets and operations in the Beetaloo, making us susceptible to region-specific risks; the substantial doubt raised by our recurring operational losses, negative cash flows, and cumulative net losses about our ability to continue as a going concern; complex laws and regulations that could affect our operational costs and feasibility or lead to significant liabilities; community opposition that could result in costly delays and impede our ability to obtain necessary government approvals; exploration and development activities in the Beetaloo that may lead to legal disputes, operational disruptions, and reputational damage due to native title and heritage issues; the requirement to produce natural gas on a Scope 1 net zero basis upon commencement of commercial production, with internal goals for operational net zero, which may increase our production costs; the increased attention to environmental, social and governance matters and environmental conservation measures that could adversely impact our business operations; risks related to our corporate structure; risks related to our common stock and CDIs; the ability of the Company to satisfy the conditions to consummate the Offering; and the other risk factors discussed in the this report and the Company’s filings with the Securities and Exchange Commission (the “SEC”).

It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document, except as required by law.

TAMBORAN RESOURCES CORPORATION

Suite 01, Level 39, Tower One, International Towers Sydney

100 Barangaroo Avenue

Barangaroo NSW 2000

SPECIAL MEETING OF STOCKHOLDERS

To Be Held on July 16, 2025 PROXY STATEMENT

The Board of Directors of Tamboran Resources Corporation (the “Company,” “Tamboran,” “we,” “us,” or “our”) is soliciting proxies from its stockholders to be used at the 2025 Special Meeting of stockholders (the “Special Meeting”) to be held virtually at www.virtualshareholdermeeting.com/TBN2025SM, and at any postponements or adjournments thereof. This proxy statement (“Proxy Statement”) contains information related to the Special Meeting. This proxy statement and the accompanying form of proxy are first being sent to stockholders on or about June 23, 2025.

ABOUT THE SPECIAL MEETING

Why am I receiving this Proxy Statement?

You are receiving this proxy statement because you have been identified as a stockholder of the Company at the close of business on the record date, which our Board has determined to be June 12, 2025 (the “Record Date”), and thus you are entitled to notice of, and to vote at the Special Meeting. This document serves as a proxy statement used to solicit proxies for the Special Meeting. This document contains important information about the Special Meeting and the Company, and you should read it carefully.

How can I attend the Special Meeting?

Stockholders as of the Record Date (or their duly appointed proxy holder) may attend, vote, and submit questions virtually during the Special Meeting by logging in at www.virtualshareholdermeeting.com/TBN2025SM. To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card. If you are not a stockholder or do not have a control number (including Holders of CDIs), you may still access the meeting as a guest, but you will not be able to submit questions or vote at the meeting. The meeting will begin promptly at 5:00 p.m. Central time on Wednesday, July 16, 2025, 2025 (being 8:00 a.m. AEDT on Thursday, July 17, 2025). We encourage you to access the meeting prior to the start time. Online access will open at 4:45 p.m. Central time (being 7:45 a.m. AEST) and you should allow ample time to log in to the meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. A recording of the meeting will be available at www.virtualshareholdermeeting.com/TBN2025SM for 90 days after the meeting.

Holders of CDIs will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Special Meeting by completing the CDI Voting Instruction Form.

Can I ask questions at the virtual Special Meeting?

Stockholders as of the Record Date who attend and participate in our virtual Special Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. We also encourage you to submit questions in advance of the meeting until 11:59 p.m. Eastern time the day before the Special Meeting by going to www.virtualshareholdermeeting.com/TBN2025SM and logging in with your control number. During the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of procedure. The rules of procedure, including the types of questions that will be accepted, will be posted on the Special Meeting website. To ensure the orderly conduct of the Special Meeting, we encourage you to submit questions in advance. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card to ask questions during the meeting.

What if I have technical difficulties or trouble accessing the virtual Special Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page: www.virtualshareholdermeeting.com/TBN2025SM.

What proposals will be voted on at the Special Meeting?

Stockholders will vote on 13 proposals at the Special Meeting:

| Proposal | Matter | Board Recommendation | ||||||

| 1 |

Approval of the Company’s May 2025 PIPE Financing (as defined below) and issuance of shares of Common Stock pursuant to the Company’s May 2025 PIPE Financing.

|

FOR | ||||||

| 2 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issue of 2,180,515 shares of Common Stock under Tranche 1 of the May 2025 PIPE Financing. | FOR | ||||||

| 3 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 563,697 shares of Common Stock to Daly Waters Energy, LP under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 4 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Mr. Richard Stoneburner under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 5 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 8,456 shares of Common Stock to Mr. Fredrick Barrett under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 6 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 10,000 shares of Common Stock to Mr. David Siegel under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 7 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,000 shares of Common Stock to Mr. Ryan Dalton under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 8 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Joel Riddle under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 9 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Jeffrey Bellman under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 10 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Ms. Sarah Pacheco under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 11 | Approval, for purposes of ASX Listing Rule 7.1 and for all other purposes, of the issue of 336,662 shares of Common Stock to Non-Affiliated Investors under Tranche 2 of the May 2025 PIPE Financing. | FOR | ||||||

| 12 | Approval, for purposes of ASX Listing Rule 7.1, Section 312.03 of the NYSE Listed Company Manual and for all other purposes, of the issue of shares of Common Stock to Macquarie Bank Limited pursuant to the Facility Letter Agreement (as defined below). |

FOR | ||||||

| 13 | Approval of the issuance of shares of Common Stock to certain directors and officers of the Company pursuant to the Company’s May 2025 PIPE Financing. | FOR | ||||||

What happens if other business not discussed in this Proxy Statement comes before the meeting?

The Company does not know of any business to be presented at the Special Meeting other than the proposals discussed in this Proxy Statement. If other business properly comes before the meeting under our Certificate of Incorporation, Amended and Restated Bylaws, and rules established by the SEC, the proxies will use their discretion in casting all the votes that they are entitled to cast.

Who is entitled to vote?

As of the Record Date, 16,717,289 shares of Common Stock were outstanding. Only holders of record of our Common Stock as of the Record Date will be entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our Common Stock held by such stockholder on the Record Date. No cumulative voting rights are authorized. Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 200 CDIs held by such holder on the Record Date.

What does it mean to be a holder of CDIs?

CDIs are issued by the Company through the Depositary Nominee and traded on the Australian Securities Exchange. If you own CDIs, then you are the beneficial owner of one share of Common Stock for every 200 CDIs that you own. The Depositary Nominee, or its custodian, is considered the stockholder of record for the purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct the Depositary Nominee, or its custodian, as to how to vote the shares of Common Stock underlying your CDIs. As a beneficial owner, you are invited to attend the Special Meeting as a guest.

However, because you are not a holder of Common Stock, if you personally want to vote the shares of Common Stock underlying your CDIs at the Special Meeting, you must inform the Depositary Nominee via the CDI Voting Instruction Form that you wish to nominate yourself (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Special Meeting.

Under the rules governing CDIs, the Depositary Nominee is not permitted to vote on your behalf on any matter to be considered at the Special Meeting unless you specifically instruct the Depositary Nominee how to vote. We encourage you to communicate your voting instructions to the Depositary Nominee in advance of the Special Meeting to ensure that your vote will be counted by completing the CDI Voting Instruction Form and returning it in accordance with the instructions specified on that form.

How do I vote in advance of the Special Meeting?

If you are a holder of record of shares of Common Stock, you may direct your vote without attending the Special Meeting by following the instructions on the proxy card to vote by Internet or by telephone, or by signing, dating, and mailing a proxy card.

If you hold your shares in street name via a broker, bank, or other nominee, you may direct your vote without attending the Special Meeting by signing, dating, and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank, or other nominee for further details.

How do I vote during the Special Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Special Meeting by entering the 16-digit control number found on your proxy card when you log in to the meeting at www.virtualshareholdermeeting.com/TBN2025SM.

Shares held in street name through a brokerage account or by a broker, bank, or other nominee may only be voted at the Special Meeting by submitting voting instructions to your bank, broker or other nominee or by presenting a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

Even if you plan to attend the Special Meeting, we recommend that you vote in advance, as described above under “How do I vote in advance of the Special Meeting?” so that your vote will be counted if you are unable to attend the Special Meeting.

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 200 CDIs held by such holder on the Record Date. Persons holding CDIs are entitled to receive notice of and to attend the Special Meeting as guests. Holders of CDIs may direct the Depositary Nominee to vote their underlying Common Stock at the Special Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (“Boardroom”), the agent the Company has designated for the collection and processing of voting instructions from the Company’s CDI holders. Votes must be received by Boardroom by no later than 5:00 p.m. Central time on Monday, July 14, 2025 (being 8:00 a.m. AEDT on Tuesday, July 15, 2025) (48 hours prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

Alternatively, CDI holders can inform the Depositary Nominee via the CDI Voting Instruction Form that they wish to nominate themselves (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Special Meeting.

Can I change my vote or revoke my proxy or CDI Voting Instruction Form?

You may change your vote or revoke your proxy at any time before it is voted at the Special Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

•delivering to the attention of the Secretary at the address on the first page of this Proxy Statement a written notice of revocation of your proxy;

•delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or

•attending the Special Meeting and voting electronically, as indicated above under “How do I vote during the Special Meeting?,” but note that attendance at the Special Meeting will not, by itself, revoke a proxy.

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee. Please note that if your shares are held of record by a bank, broker, or other nominee and you decide to attend and vote at the Special Meeting, your vote at the Special Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker, or other nominee).

If you are a holder of CDIs and you direct the Depositary Nominee to vote by completing the CDI Voting Instruction Form, you may revoke those instructions by delivering to Boardroom a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent, which notice must be received by no later than 5:00 p.m. Central time on Monday, July 14, 2025 (being 8:00 a.m. AEDT on Tuesday, July 15, 2025).

What is a broker nonvote?

Brokers, banks, or other nominees holding shares on behalf of a beneficial owner (other than the Depositary Nominee) may vote those shares in their discretion on certain “routine” matters even if they do not receive timely voting instructions from the beneficial owner. With respect to “nonroutine” matters, the broker, bank, or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. Each of the Proposals are nonroutine matters.

A broker nonvote occurs when a broker, bank, or other nominee does not vote on a nonroutine matter because the beneficial owner of such shares has not provided voting instructions with regard to such matter. A broker, bank, or other nominee may exercise its discretionary voting authority on Proposal Two because Proposal Two is a routine matter, and as such, there will be no broker nonvotes on Proposal Two. Broker nonvotes may occur as to the other Proposals or any other nonroutine matters that are properly presented at the Special Meeting. The effect of broker nonvotes on each of the other Proposals is described below.

What constitutes a quorum?

The presence at the Special Meeting, either virtually or by proxy, of the holders of not less than a majority in voting power of the outstanding shares of stock entitled to vote at the Special Meeting shall be necessary and sufficient to constitute a quorum. Abstentions and broker nonvotes will be counted as present for the purpose of determining whether there is a quorum at the Special Meeting. Your shares are counted as being present if you participate virtually at the Special Meeting and cast your vote online during the meeting prior to the closing of the polls by visiting www.virtualshareholdermeeting.com/TBN2025SM, or if you vote by proxy via the Internet, by telephone, or by returning a properly executed and dated proxy card or voting instruction form by mail.

What vote is required to approve each matter to be considered at the Special Meeting?

Proposal |

Matter |

Vote Required |

Broker Discretionary Voting Allowed |

Effect of Broker Nonvotes |

Effect of Abstentions |

||||||||||||

1 |

Approval the Company’s May 2025 PIPE Financing and issuance of shares of Common Stock pursuant to the Company’s May 2025 PIPE Financing

|

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

2 |

Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issue of 2,180,515 shares of Common Stock under Tranche 1 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

3 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 563,697 shares of Common Stock to Daly Waters Energy, LP under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

4 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Mr. Richard Stoneburner under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

5 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 8,456 shares of Common Stock to Mr. Fredrick Barrett under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

6 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 10,000 shares of Common Stock to Mr. David Siegel under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

7 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,000 shares of Common Stock to Mr. Ryan Dalton under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

Proposal |

Matter |

Vote Required |

Broker Discretionary Voting Allowed |

Effect of Broker Nonvotes |

Effect of Abstentions |

||||||||||||

8 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Joel Riddle under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

9 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 5,637 shares of Common Stock to Mr. Jeffrey Bellman under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

10 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issue of 2,820 shares of Common Stock to Ms. Sarah Pacheco under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

11 |

Approval, for purposes of ASX Listing Rule 7.1 and for all other purposes, of the issue of 336,662 shares of Common Stock to Non-Affiliated Investors under Tranche 2 of the May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

12 |

Approval, for purposes of ASX Listing Rule 7.1, Section 312.03 of the NYSE Listed Company Manual and for all other purposes, of the issue of shares of Common Stock to Macquarie Bank Limited pursuant to the Facility Letter Agreement |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

13 |

Approval of the issuance of shares of Common Stock to certain directors and officers of the Company pursuant to the Company’s May 2025 PIPE Financing |

Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon |

No |

No Effect |

Vote Against |

||||||||||||

Voting exclusion statement

The Company will disregard any votes cast in favor of:

•Proposal 2, by or on behalf of any person who participated in the May 2025 Pipe Financing or their associates;

•Proposal 3, by or on behalf of Daly Waters Energy, LP and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 3 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 4, by or on behalf of Mr. Richard Stoneburner and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 4 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 5, by or on behalf of Mr. Fredrick Barrett and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 5 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 6, by or on behalf of Mr. David Siegel and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 6 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 7, by or on behalf of Mr. Ryan Dalton and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 7 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 8, by or on behalf of Mr. Joel Riddle and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 9, by or on behalf of Mr. Jeffrey Bellman and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 9 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 10, by or on behalf of Ms. Sarah Pacheco and any other person who will obtain a material benefit as a result of the issue of the securities under Proposal 10 (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 11, by or on behalf of a person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issue (except a benefit solely by reason of being a holder of shares of Common Stock or their associates);

•Proposal 12, by or on behalf of a person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issue (except a benefit solely by reason of being a holder of ordinary securities in the Company) or an associate of that person or persons.

However, the Company need not disregard a vote cast in favor of any of the above Proposals by:

•a person as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with directions given to the proxy or attorney to vote on the relevant Proposal in that way;

•the chair of the Special Meeting as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with a direction given to the chair to vote on the relevant Proposal as the chair decides; or

•a holder acting solely in a nominee, trustee or custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

othe beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the relevant Proposal; and

othe holder votes on the relevant Proposal in accordance with directions given by the beneficiary to the holder to vote in that way.

What is the deadline for submitting a proxy or CDI Voting Instruction Form?

To ensure that proxies are received in time to be counted prior to the Special Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Tuesday, July 15, 2025, and proxies submitted by mail should be received by the close of business on Tuesday, July 15, 2025 (the business day prior to the date of the Special Meeting).

CDI Voting Instruction Forms must be received by Boardroom by no later than 5:00 p.m. Central time on Monday, July 14, 2025 (being 8:00 a.m. AEDT on Tuesday, July 15, 2025) (48 hours prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

What does it mean if I receive more than one proxy card or CDI Voting Instruction Form?

If you hold your shares or CDIs in more than one account, you will receive one proxy card or CDI Voting Instruction Form for each account (as applicable). To ensure that all of your shares or CDIs are voted, please complete, sign, date, and return one proxy card or CDI Voting Instruction Form for each account or use the proxy card for each account to vote by Internet or by telephone.

How will my shares be voted if I return a blank proxy card or a blank CDI Voting Instruction Form?

If you are a holder of record of our Common Stock and you sign and return a proxy card or CDI Voting Instruction Form or otherwise submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations. If you hold your shares in street name via a broker, bank, or other nominee and do not provide the broker, bank, or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

•will be counted as present for purposes of establishing a quorum;

•will be voted in accordance with the broker’s, bank’s, or other nominee’s discretion on “routine” matters; and

•will not be counted in connection with the other Proposals or any other nonroutine matters that are properly presented at the Special Meeting. For each of these proposals, your shares will be treated as “broker nonvotes.”

Our Board knows of no matter to be presented at the Special Meeting other than Proposals identified in this Proxy Statement. If any other matters properly come before the Special Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

Why is the Company Seeking Stockholder Approval of Proposal 1 and Proposal 12?

Because our Common Stock is listed on the New York Stock Exchange (“NYSE”), we are subject to the NYSE’s rules and regulations. Section 312.03 of the NYSE Listed Company Manual requires stockholder approval prior to the issuance of common stock, or securities convertible into or exercisable for common stock, in any transaction or series of related transactions, subject to certain exceptions, in which:

•the common stock or securities convertible into or exercisable for common stock are issued to a director, officer, a controlling shareholder or member of a control group or any other substantial security holder of the company that has an affiliated person who is an officer or director of the company (an “Active Related Party”) if the number of shares of common stock to be issued, or if the number of shares of common stock into which the securities may be convertible or exercisable, exceeds either (i) one percent of the number of shares of common stock, or (ii) one percent of the voting power outstanding before the issuance (the “NYSE Active Related Party Cap”);

•a director, officer or substantial security holder of the company (each a “Related Party”) has a five percent or greater interest (or such persons collectively have a ten percent or greater interest), directly or indirectly, in the consideration to be paid in the transaction or series of related transactions and the present potential issuance of common stock, or securities convertible into common stock, could result in an issuance that exceeds either five percent of the number of shares of common stock or five percent of the voting power outstanding before the issuance (the “NYSE Related Party Cap”); or

•(i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20 percent of the voting power outstanding before the issuance of such stock or securities convertible into or exercisable for common stock, or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20 percent of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock (the “NYSE 20% Cap” and together with the NYSE Active Related Party Cap and NYSE Related Party Cap, the “NYSE Thresholds”).

The approval of the Company’s stockholders is required under the NYSE listing rules, because the PIPE Investors (as defined below) may be deemed to be an Active Related Party and/or a Related Party under NYSE listing rules, and the shares of common stock underlying the May 2025 PIPE Financing to be issued to PIPE Investors may exceed the NYSE Thresholds.

The approval of the Company’s stockholders is required because MBL (as defined below) may be deemed to be an Active Related Party and/or a Related Party under NYSE listing rules and the maximum number of shares of MBL Common Stock (as defined below) to be issued under the Facility Letter Agreement may exceed the NYSE Thresholds.

Why is the Company Seeking Stockholder Approval of Proposal 13?

Because our Common Stock is listed on the NYSE, we are subject to the NYSE’s rules and regulations. Section 303A.08 of the NYSE Listed Company Manual requires stockholder approval of any equity compensation plan.

The issuance of the D&O Shares (as defined below) to the D&O PIPE Investors (as defined below) in the May 2025 PIPE Financing at a discount, offered outside the Company’s 2024 Incentive Award Plan, may be considered an “equity-compensation plan” under Section 303A.08 of the NYSE Listed Company Manual.

Who will count the vote?

Broadridge Financial Solutions, Inc., or their appointed representative, will serve as the inspector of elections and will certify the voting results.

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Special Meeting will be available for inspection by stockholders for any purpose germane to the meeting for 10 business days prior to the Special Meeting, at Tamboran Resources Corporation, Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000 between the hours of 9:00 a.m. and 5:00 p.m. AEST. The stockholder list will also be available to stockholders of record for examination during the Special Meeting at www.virtualshareholdermeeting.com/TBN2025SM. You will need the control number included on your proxy card, or voting instruction form, or otherwise provided by your bank, broker, or other nominee.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we send only one Proxy Statement and one Annual Report to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge, by calling (866) 540-7095 or writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact Broadridge at the above telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

How can I find out the results of the voting at the Special Meeting?

We will announce preliminary voting results at the Special Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Special Meeting.

Whom can I contact for further information?

You may request additional copies, without charge, of this Proxy Statement and other proxy materials or ask questions about the Special Meeting, the proposals, or the procedures for voting your shares by writing to our Corporate Secretary at Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of June 12, 2025 (except as otherwise noted in the footnotes below) by each beneficial owner of more than 5% of the outstanding Common Stock known to the Company, each of the Company’s directors, director nominees, and NEOs, and all directors and executive officers as a group. The table also sets out the names of all persons and entities (of which the Company is aware) who are substantial holders in the Company within the meaning of section 671B of the Corporations Act and the number of shares of Common Stock in which each substantial holder has an interest. Unless otherwise noted below, the address of the persons and entities listed on the table is c/o Tamboran Resources Corporation, Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000, Australia.

| Name |

Amount and Nature of Beneficial Ownership (1) |

Percentage | |||||||||||||||||||||||||||

Bryan Sheffield (2) |

2,559,904 | 15.3 | % | ||||||||||||||||||||||||||

College Retirement Equities Fund (3) |

1,087,420 | 6.5 | % | ||||||||||||||||||||||||||

Helmerich & Payne International Holdings LLC (4) |

1,018,850 | 6.1 | % | ||||||||||||||||||||||||||

Liberty Oilfield Services LLC (5) |

893,328 | 5.3 | % | ||||||||||||||||||||||||||

HITE Hedge Asset Management LLC (6) |

809,505 | 4.8 | % | ||||||||||||||||||||||||||

Joel Riddle (7) |

122,083 | * | |||||||||||||||||||||||||||

Eric Dyer (8) |

56,682 | * | |||||||||||||||||||||||||||

Faron Thibodeaux (9) |

103,998 | * | |||||||||||||||||||||||||||

Richard Stoneburner (10) |

50,924 | * | |||||||||||||||||||||||||||

Fredrick Barrett (11) |

44,245 | * | |||||||||||||||||||||||||||

John Bell (12) |

— | * | |||||||||||||||||||||||||||

Ryan Dalton (13) |

21,729 | * | |||||||||||||||||||||||||||

Patrick Elliott (14) |

143,366 | * | |||||||||||||||||||||||||||

Andrew Robb (15) |

9,507 | * | |||||||||||||||||||||||||||

David Siegel (16) |

328,621 | 2.0 | % | ||||||||||||||||||||||||||

Jeffrey Bellman (17) |

5,502 | * | |||||||||||||||||||||||||||

All executive officers and directors as a group (11 persons): |

886,657 | 5.3 | % | ||||||||||||||||||||||||||

* Represents beneficial ownership of less than 1% of the outstanding shares of our Common Stock.

(1)Beneficial ownership, as determined in accordance with Rule 13d-3 under the Exchange Act, includes sole or shared power to vote or direct the voting of, or to dispose or direct the disposition of shares. Except as indicated in the footnotes to the table and to the extent authority is shared by spouses under applicable law, we believe that the persons named in the table have sole voting and dispositive power with respect to their reported shares of Common Stock. As of June 12, 2025, the Company had 16,717,289 shares of Common Stock outstanding. Includes shares of Common Stock represented by CDIs.

(2)Based the Schedule 13D amendment filed by Mr. Sheffield and affiliated entities on May 14, 2025. Includes (i) 1,734,980 shares of Common Stock represented by 343,557,601 CDIs held by the Depositary Nominee on trust for Sheffield Holdings, LP (“Sheffield Holdings”), and (ii) 312,500 shares of Common Stock issued to Daly Waters Energy, LP (“Daly Waters”) in satisfaction of certain payment obligations under a joint venture agreement between the Issuer and Daly Waters that would have become due in February 2025. Spraberry Interests, LLC is the general partner of Sheffield Holdings. Mr. Sheffield is the manager of Spraberry Interests, LLC. As a result, each of Mr. Sheffield and Spraberry Interests, LLC may be deemed to share beneficial ownership of the shares held directly by Sheffield Holdings. Formentera Australia Fund I GP, LP is the general partner of Daly Waters. Formentera Investments LLC is the general partner of Formentera Australia Fund I GP, LP. Mr. Sheffield is the managing member of Formentera Investments. As a result, each of Mr. Sheffield, Formentera Australia and Formentera Investments may be deemed to share beneficial ownership of the shares held directly by Daly Waters. The address for Sheffield Holdings is 300 Colorado Street, Ste. 1900, Austin TX 78701.

(3)Based on information known to the Company, as of June 27, 2024. Includes 1,087,420 shares of Common Stock represented by 217,484,106 CDIs held by the Depositary Nominee on trust for College Retirement Equities Fund (“CREF”) on behalf of two of its accounts, CREF Global Equities Account and CREF Stock Account. TIAA-CREF Investment Management, LLC (“TCIM”) makes all voting and investment decisions with respect to the shares beneficially owned by CREF. The address for TCIM is 730 Third Ave, New York, NY 10017.

(4)Based on a Schedule 13G filed October 25, 2024. Includes 529,762 shares of Common Stock represented by 105,952,380 CDIs held by the Depositary Nominee on trust for Helmerich & Payne International Holdings LLC (“H&P”). Represents the beneficial ownership of H&P. The board of directors of Helmerich & Payne, Inc., makes all voting and investment decisions with respect to the shares beneficially owned by H&P, and each member thereof disclaims beneficial ownership of such shares of Common Stock. The address for H&P is S. Boulder Ave., Suite 1400, Tulsa, Oklahoma 74119.

(5)Based on a Schedule 13G filed July 8, 2024. Includes 476,662 shares of Common Stock represented by 95,332,520 CDIs held by the Depositary Nominee on trust for Liberty Oilfield Services LLC (“LOS LLC”). Liberty Energy Inc. (“LBRT”) is the sole member of LOS LLC and therefore may be deemed to share voting and dispositive power over, and indirectly have beneficial ownership of, the Common Stock directly held by LOS

LLC. The address for LBRT and LOS LLC is 950 17th Street, Suite 2400, Denver, Colorado 80202. LBRT disclaims beneficial ownership of the Common Stock held by LOS LLC except to the extent of its pecuniary interest therein.

(6)Based on a Schedule 13G filed May 14, 2025.

(7)Includes (i) 1,644 shares of Common Stock represented by 328,924 CDIs held by the Depositary Nominee on trust for Mr. Riddle, (ii) 20,439 shares of Common Stock represented by 4,087,888 CDIs held by the Depositary Nominee on trust for Top Gun Nominees Pty Ltd., an entity controlled by Mr. Riddle, and (iii) 100,000 restricted stock units (“RSUs”), which will vest in full on August 6, 2027.

(8)Includes (i) 11,032 shares of Common Stock represented by 2,206,405 CDIs held by the Depositary Nominee on trust for Mr. Dyer, (ii) 10,860 shares of Common Stock underlying 2,172,023 CDIs held by the Depositary Nominee on trust for Northern Woods Australia Pty Ltd., an entity controlled by Mr. Dyer, and (iii) 45,000 RSUs, which will vest in full on August 6, 2027.

(9)Includes (i) 33,998 shares of Common Stock represented by 6,799,712 CDIs held by the Depositary Nominee on trust for Mr. Thibodeaux, and (ii) 55,000 RSUs, which will vest in full on August 6, 2027.

(10)Includes (i) 30,733 shares of Common Stock represented by 6,146,787 CDIs held by the Depositary Nominee on trust for Mr. Stoneburner, (ii) 2,505 RSUs, which will vest in full on January 31, 2026, and (iii) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(11)Includes (i) 22,705 shares of Common Stock represented by 4,541,044 CDIs held by the Depositary Nominee on trust jointly for Mr. Barrett and Mr. Barrett’s spouse, (ii) 6,889 RSUs, which will vest in full on January 31, 2026, and (ii) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(12)Mr. Bell serves as an executive officer of Helmerich and Payne, Inc. (NYSE: HP) and disclaims beneficial ownership of all shares of Common Stock owned by H&P.

(13)Includes (i) 4,227 RSUs, which will vest in full on January 31, 2026, and (ii) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(14)Includes (i) 16,383 share of Common Stock represented by 3,276,629 CDIs held by the Depositary Nominee on trust for Mr. Elliot, (ii) 117,730 shares of Common Stock represented by 23,546,044 CDIs held by the Depositary Nominee on trust for Yeronda Nominees Pty Ltd, an entity controlled by Mr. Elliott as trustee for Carrington Equity Superannuation Fund, of which Mr. Elliott is the sole beneficiary, (iii) 6,944 shares of Common Stock represented by 1,388,888 CDIs held by the Depositary Nominee on trust for Panstyn Investments Pty Limited, an entity controlled by Mr. Elliott, (iv) 2,309 RSUs, which will vest in full on January 31, 2026, and (v) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(15)Includes (i) 2,505 RSUs, which will vest in full on January 1, 2026, and (ii) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(16)Includes (i) 272,000 shares of Common Stock represented by 54,400,000 CDIs held by the Depositary Nominee on trust for Mr. Siegel, (ii) 7,000 shares of Common Stock represented by 1,400,000 CDIs held by the Depositary Nominee on trust for Robert Siegel (held on behalf of Mr. Siegel), (iii) 40,000 shares of Common Stock represented by 8,000,000 CDIs held by the Depositary Nominee on trust for DNS Capital Partners LLC, an entity controlled by Mr. Siegel, (iv) 4,619 RSUs, which will vest in full on January 1, 2026, and (v) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

(17)Includes (i) 500 shares of Common Stock, represented by 100,000 CDIs held by the Depositary Nominee on trust for Mr. Bellman and (ii) 5,002 RSUs, which will vest on the earlier of (a) May 16, 2026 and (b) the date of the next annual shareholders’ meeting occurring after the grant date.

PROPOSAL NO. 1

APPROVAL OF THE MAY 2025 PIPE FINANCING AND ISSUANCE OF SHARES OF COMMON STOCK PURSUANT TO THE COMPANY’S MAY 2025 PIPE FINANCING

Background

Subscription Agreements

As previously announced, on May 12, 2025, the Company entered into subscription agreements (the “Subscription Agreements”) with certain investors (the “PIPE Investors”), pursuant to which, among other things, the PIPE Investors agreed to subscribe for and purchase from the Company, and the Company agreed to issue and sell to the PIPE Investors, an aggregate of approximately 3.1 million newly issued shares of the Common Stock for an aggregate purchase price of approximately $55.4 million, on the terms and subject to the conditions set forth therein (the “May 2025 PIPE Financing”). Of the May 2025 PIPE Financing, $38.68 million closed on May 16, 2025, subject to the satisfaction of customary closing conditions (“Tranche 1”). The closing of the remaining $16.69 million is subject to approval by the Company’s stockholders and the satisfaction of other customary closing conditions (“Tranche 2”).

The foregoing description of the Subscription Agreements is not complete and is qualified in its entirety by reference to the Subscription Agreements, the forms of which were filed as exhibits to our Current Report on Form 8-K filed with the SEC on May 15, 2024.

Reasons for the Approval of the May 2025 PIPE Financing

Because our Common Stock is listed on the NYSE, we are subject to the NYSE’s rules and regulations. Section 312.03 of the NYSE Listed Company Manual requires stockholder approval prior to the issuance of common stock, or securities convertible into or exercisable for common stock, in any transaction or series of related transactions, subject to certain exceptions, in which (i) the common stock or securities convertible into or exercisable for common stock are issued to an Active Related Party if the number of shares of common stock to be issued, or if the number of shares of common stock into which the securities may be convertible or exercisable, exceeds the NYSE Active Related Party Cap, (ii) a Related Party has a five percent or greater interest (or Related Parties collectively have a ten percent or greater interest) in the consideration to be paid in the transaction or series of transactions, and the present potential issuance of common stock, or securities convertible into common stock, could result in an issuance that exceeds the NYSE Related Party Cap, and (iii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of the NYSE 20% Cap. The approval of the Company’s stockholders is required because the PIPE Investors may be deemed to be an Active Related Party and/or a Related Party under NYSE listing rules and the shares of common stock underlying the May 2025 PIPE Financing to be issued to the PIPE Investors may exceed the NYSE Thresholds.

Vote Required

“FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the Special Meeting are required to approve the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE MAY 2025 PIPE FINANCING AND ISSUANCE OF SHARES OF COMMON STOCK PURSUANT TO THE COMPANY’S MAY 2025 PIPE FINANCING.

PROPOSAL NO. 2

RATIFICATION AND APPROVAL, FOR PURPOSES OF ASX LISTING RULE 7.4 AND FOR ALL OTHER PURPOSES, OF THE PRIOR ISSUE OF 2,180,515 SHARES OF COMMON STOCK UNDER TRANCHE 1 OF THE MAY 2025 PIPE FINANCING

Background

The Company is seeking Stockholder ratification pursuant to ASX Listing Rule 7.4 for the issue of the 2,180,515 shares of Common Stock that were issued using the Company’s 15% placement capacity for the purposes of ASX Listing Rule 7.1 under Tranche 1 of the May 2025 PIPE Financing (“Tranche 1 Common Stock”).

The Tranche 1 Common Stock were issued to existing institutional Stockholders and new institutional investors introduced to the Company by the Board and lead manager, Bank of America on May 21, 2025.

ASX Listing Rule Requirements

Broadly speaking, and subject to a number of exceptions, ASX Listing Rule 7.1 limits the number of equity securities that a listed entity can issue without the approval of its stockholders over any 12-month period to 15% of the number of fully paid ordinary shares it had on issue at the start of that period.

However, in accordance with ASX Listing Rule 7.4, an issue of securities made without approval under ASX Listing Rule 7.1 is treated as having been made with approval if:

•the issue did not breach ASX Listing Rule 7.1; and

•the issue is subsequently approved or ratified by shareholders.

ASX Listing Rule 7.4 allows the stockholders of a listed company to approve an issue of equity securities after it has been made or agreed to be made. If they do, the issue is taken to have been approved under ASX Listing Rule 7.1 and so does not reduce the Company’s capacity to issue further equity securities without stockholder approval under that rule.

The Company wishes to retain as much flexibility as possible to issue additional equity securities into the future without having to obtain stockholder approval for such issues under ASX Listing Rule 7.1. To that end, Proposal 2 seeks Stockholder approval to subsequently approve the issue of the Tranche 1 Common Stock under and for the purposes of ASX Listing Rule 7.4.

The Tranche 1 Common Stock were issued under the Company’s 15% placement capacity under ASX Listing Rule 7.1 and are therefore included in the calculation of the Company’s capacity under ASX Listing Rule 7.1. There was no breach of ASX Listing Rule 7.1 as a result of the issue of the Tranche 1 Common Stock.

The purpose of this proposal is to seek ratification and approval, for the purposes of ASX Listing Rule 7.4 and for all other purposes, of the issue of the Tranche 1 Common Stock.

Effect of Proposal 2

If Proposal 2 is passed, the Tranche 1 Common Stock will not count towards the Company’s 15% placement capacity for the purposes of ASX Listing Rule 7.1, thereby increasing the Company’s ability to issue additional equity securities without Stockholder approval.

If Proposal 2 is not passed, the Tranche 1 Common Stock will count towards the Company’s 15% placement capacity for the purposes of ASX Listing Rule 7.1, thereby limiting the Company’s ability to issue additional equity securities without Stockholder approval.

Information Required under ASX Listing Rule 7.5

The following information is provided pursuant to the requirements of ASX Listing rule 7.5:

(a)the Tranche 1 Common Stock were issued to existing institutional Stockholders and new institutional investors introduced to the Company by the Board and lead manager, Bank of America. In accordance with paragraph 7.4 of ASX Guidance Note 21, the Company confirms that none of the recipients were (a) related parties of the Company, members of the Company’s key management personnel, substantial Stockholders of the Company, advisers of the Company or an associate of any of these parties; and (b) issued more than 1% of the Company’s current issued capital;

(b)2,180,515 shares of Common Stock were issued under Tranche 1 of the May 2025 PIPE Financing;

(c)the 2,180,515 Tranche 1 Common Stock were issued on May 21, 2025;

(d)the Tranche 1 Common Stock are fully paid shares of Common Stock, issued on the same terms and conditions as existing shares of Common Stock;

(e)the Tranche 1 Common Stock were issued at an issue price of US$17.74 per share of Common Stock, which raised approximately US$38.68 million;

(f)the purpose of the issue of the Tranche 1 Common Stock was for the Company to raise funds to be used for the Drilling of the remaining three wells required for Tamboran’s proposed 40 million cubic feet per day (MMcf/d) Pilot Project at the Shenandoah South location in the Beetaloo Basin to reach first production, which is planned for mid-2026, subject to weather and standard stakeholder approvals, funding of the Sturt Plateau Compression Facility until the Company and Daly Waters Energy, LP finalize terms with lenders and general working capital;

(g)the Tranche 1 Common Stock were issued pursuant to the Subscription Agreements on the material terms summarized in Proposal 1 and otherwise on standard terms for placements of such kind; and

(h)A voting exclusion statement applies to Proposal 2 and is included above.

Vote Required

“FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the Special Meeting are required to approve the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION AND APPROVAL, FOR PURPOSES OF ASX LISTING RULE 7.4 AND FOR ALL OTHER PURPOSES, OF THE PRIOR ISSUE OF 2,180,515 SHARES OF COMMON STOCK UNDER TRANCHE 1 OF THE MAY 2025 PIPE FINANCING.

PROPOSALS NO. 3 TO 10

APPROVAL, FOR PURPOSES OF ASX LISTING RULE 10.11 AND FOR ALL OTHER PURPOSES, OF THE ISSUE OF SHARES OF COMMON STOCK TO DALY WATERS ENERGY, LP, RICHARD STONEBURNER, FREDRICK BARRETT, DAVID SIEGEL, RYAN DALTON, JOEL RIDDLE, JEFFERY BELLMAN AND SARAH PACHECO UNDER TRANCHE 2 OF THE MAY 2025 PIPE FINANCING

Background

Proposals 3 to 10 (inclusive) seek the approval of Stockholders under ASX Listing Rule 10.11 to grant shares of Common Stock to Daly Waters Energy, LP, a private investment firm of which Mr. Sheffield serves as managing partner, directors of the Company, Mr. Richard Stoneburner, Mr. Fredrick Barrett, Mr. David Siegel, Mr. Ryan Dalton, Mr. Joel Riddle, Mr. Jeffrey Bellman, and to a spouse of a Director of the Company, Ms. Sarah Pacheco (together, the “Tranche 2 Related Parties”) under Tranche 2 of the May 2025 PIPE Financing in the respective amounts set out in the below table (the “Related Party Common Stock”).

| Related Party | Number of shares of Common Stock issued under Tranche 2 of the May 2025 PIPE Financing | ||||

| Daly Waters Energy, LP* | 563,697 shares of Common Stock | ||||

| Mr. Richard Stoneburner | 2,820 shares of Common Stock | ||||

| Mr. Fredrick Barrett | 8,456 shares of Common Stock | ||||

| Mr. David Siegel | 10,000 shares of Common Stock | ||||

| Mr. Ryan Dalton | 5,000 shares of Common Stock | ||||

| Mr. Joel Riddle | 5,637 shares of Common Stock | ||||

| Mr. Jeffrey Bellman | 5,637 shares of Common Stock | ||||

| Ms. Sarah Pacheco | 2,820 shares of Common Stock | ||||

| Total | 604,067 shares of Common Stock | ||||

*As announced to ASX on 14 May 2025 and 30 May 2025, the May 2025 PIPE Financing was supported by issue of the Mr. Bryan Sheffield and Formentera Partners. Mr. Bryan Sheffield is a substantial (10%+) Stockholder of the Company and has nominated two directors to the Board. Formentera Australia Fund I GP, LP is a Delaware limited partnership (“Formentera Australia”), is the general partner of Daly Waters Energy, LP. Formentera Investments LLC, a Delaware limited liability company (“Formentera Investments”), is the general partner of Formentera Australia. Bryan Sheffield is the managing member of Formentera Investments. As a result, Mr. Bryan Sheffield, may be deemed to share beneficial ownership of the shares held directly by Daly Waters Energy, LP. Daly Waters Energy, LP is a related party of the Company and is seeking to participate in Tranche 2 of the May 2025 PIPE Financing as the relevant subscribing entity for up to 563,697 shares of Common Stock.

ASX Listing Rule Requirements

ASX Listing Rule 10.11 provides that unless one of the exceptions in ASX Listing Rule 10.12 applies, the Company must not issue or agree to issue equity securities to:

•10.11.1 a related party;

•10.11.2 a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (30%+) holder;

•10.11.3 a person who is, or was at any time in the 6 months before the issue or agreement, a substantial (10%+) holder and who has nominated a director to the board pursuant to a relevant agreement which gives them a right or expectation to do so;

•10.11.4 an associate of a person referred to in ASX Listing Rule 10.11.1 to 10.11.3; or

•10.11.5 a person whose relationship with the person referred to in ASX Listing Rules 10.11.1 to 10.11.4 is such that, in ASX’s opinion, the issue or agreement should be approved by Stockholders,

unless it obtains the approval of Stockholders.

Daly Waters Energy, LP’s participation in the May 2025 PIPE Financing falls within ASX Listing Rule 10.11.4 and does not fall within any of the exceptions in ASX Listing Rule 10.12, therefore requiring the approval of Stockholders under ASX Listing Rule 10.11.

Directors of the Company, Mr. Richard Stoneburner, Mr. Fredrick Barrett, Mr. David Siegel, Mr. Ryan Dalton, Mr. Joel Riddle and Mr. Jeffrey Bellman’s participation in the May 2025 PIPE Financing falls within ASX Listing Rule 10.11.1 and does not fall within any of the exceptions in ASX Listing Rule 10.12, therefore requiring the approval of Stockholders under ASX Listing Rule 10.11.