PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on October 7, 2024

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

TAMBORAN RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

On or about October 17, 2024, we will begin mailing to certain stockholders this Proxy Statement and our Annual Report to the stockholders for the fiscal year ended June 30, 2024, which includes our Annual Report on Form 10-K for the fiscal year ended June 30, 2024 (the Annual Report), as filed with the Securities and Exchange Commission on September 23, 2024, and instructions on how to vote online. The Proxy Statement and Annual Report are available at www.proxyvote.com.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on November 4, 2024

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the Annual Meeting) of Tamboran Resources Corporation, a Delaware corporation (the Company or Tamboran), will be held on Monday, November 4, 2024, at 4:00 p.m. Central time (being 9:00 a.m. AEDT on Tuesday, November 5, 2024). To increase access for all of our stockholders, the Annual Meeting will be online and a completely virtual meeting of stockholders. You may attend, vote, and submit questions during the Annual Meeting via the live webcast on the Internet at www.virtualshareholdermeeting.com/TBN2024. You will not be able to attend the Annual Meeting in person, nor will there be any physical location. You may vote by telephone, Internet, or mail prior to the Annual Meeting. While we encourage you to vote in advance of the Annual Meeting, you may also vote and submit questions relating to meeting matters during the Annual Meeting (subject to time restrictions).

Only stockholders of record at the close of business on September 17, 2024, are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. Holders of Chess Depositary Interests (CDIs) of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting. Holders of CDIs can direct CHESS Depositary Nominees Pty Ltd, as depositary nominee (the Depositary Nominee) to vote the Companys common stock, par value $0.001 per share (Common Stock), underlying their CDIs at the Annual Meeting by completing the CDI Voting Instruction Form.

Holders of Common Stock will be able to vote and submit questions online through the virtual-meeting platform during the Annual Meeting. To ensure that proxies are received in time to be counted prior to the Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Sunday, November 3, 2024, and proxies submitted by mail should be received by the close of business on Friday, November 1, 2024 (the business day prior to the date of the Annual Meeting).

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Annual Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (Boardroom), the agent the Company has designated for the collection and processing of voting instructions from the Companys CDI holders. Votes from CDI holders must be received by Boardroom by no later than 4:00 p.m. Central time on Saturday, November 2, 2024 (being 9:00 a.m. AEDT on Sunday, November 3, 2024) (48 hours prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/TBN2024, you must enter the 15-digit control number found on your proxy card. Holders of CDIs wishing to attend the Annual Meeting will need to do so as guests.

|

VOTE IN PERSON |

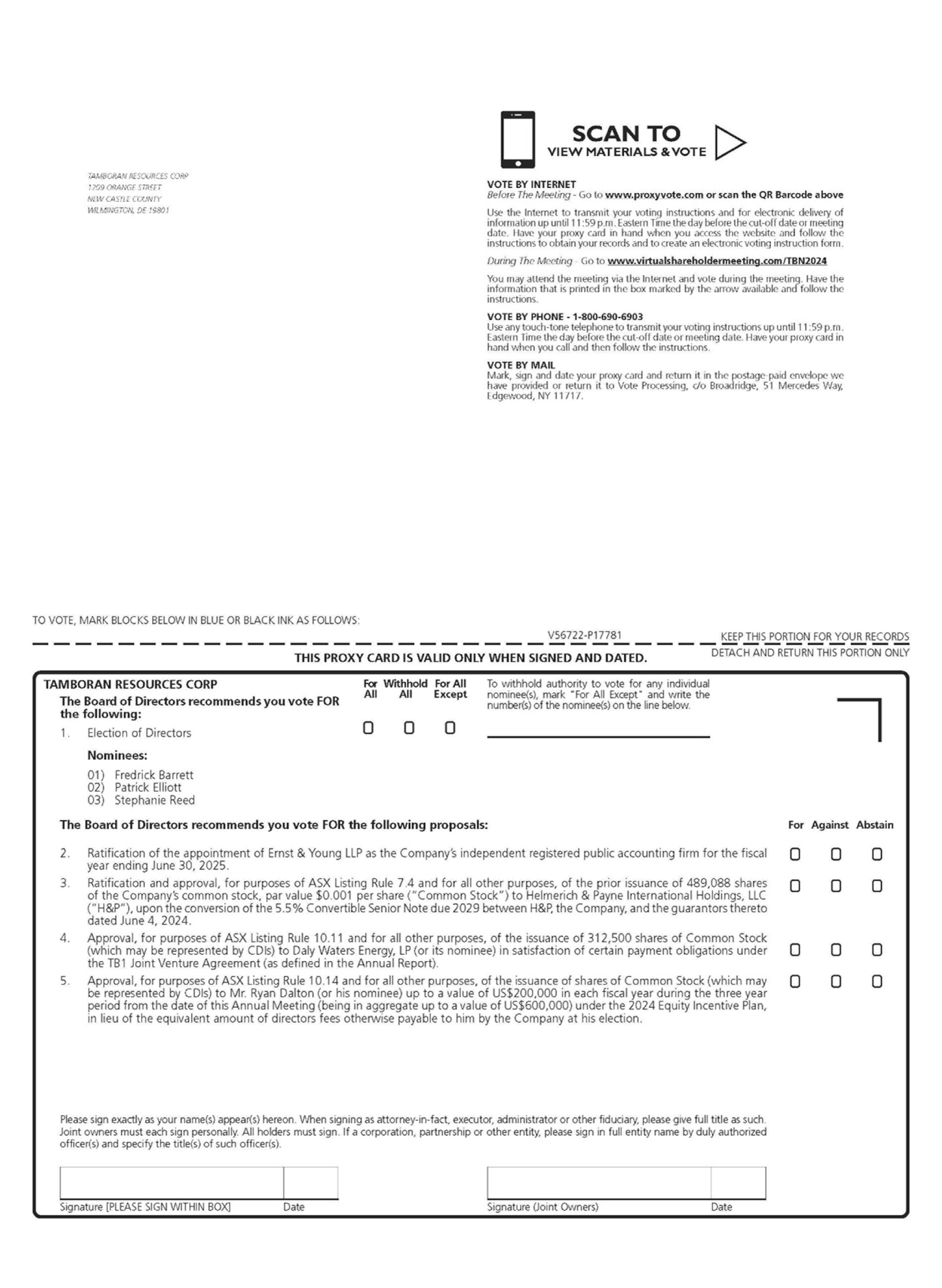

VOTE BY INTERNET |

VOTE BY PHONE |

VOTE BY MAIL |

|||

|

Follow the instructions contained in this Proxy Statement to virtually attend the Annual Meeting and vote your shares during the Annual Meeting. |

Visit www.proxyvote.com with the control number found on the proxy card. |

Call the toll-free number (for residents of the U.S. and Canada) listed on the proxy card. Be sure to have the control number available. |

Complete and sign the enclosed proxy card and return it in the enclosed envelope or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

|||

1

Table of Contents

Meeting Agenda

You are cordially invited to virtually attend the Annual Meeting for the purpose of considering and voting upon the following proposals (collectively, the Proposals):

| Proposal | Matter | Board

|

||

| 1 | The election of the Companys three Class I directors, being each of:

(1) Fredrick Barrett (2) Patrick Elliott (3) Stephanie Reed |

FOR each | ||

| 2 | Ratification of the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending June 30, 2025. |

FOR | ||

| 3 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issuance of 489,088 shares of the Companys Common Stock to Helmerich & Payne International Holdings, LLC (H&P), upon the conversion of the 5.5% Convertible Senior Note due 2029 between H&P, the Company, and the guarantors thereto dated June 4, 2024 (the Convertible Note). |

FOR | ||

| 4 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of 312,500 shares of Common Stock (which may be represented by CDIs) to Daly Waters Energy, LP (or its nominee) in satisfaction of certain payment obligations under the TB1 Joint Venture Agreement (as defined in the Annual Report). |

FOR | ||

| 5 | Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the issuance of shares of Common Stock (which may be represented by CDIs) to Mr. Ryan Dalton (or his nominee) up to a value of US$200,000 in each fiscal year during the three year period from the date of this Annual Meeting (being in aggregate up to a value of US$600,000) under the 2024 Equity Incentive Plan, in lieu of the equivalent amount of directors fees otherwise payable to him by the Company at his election.

|

FOR | ||

|

Your vote is very important. You may vote at the virtual meeting or by proxy. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to review the proxy materials and submit your proxy or voting instructions as soon as possible. You may vote your proxy by telephone or Internet (instructions are on your proxy card, and voter instruction form, as applicable) or by completing, signing, and mailing the enclosed proxy card in the enclosed envelope.

Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Annual Meeting by completing the CDI Voting Instruction Form.

|

||||

By the Board of Directors,

/s/ Rohan Vardaro

Rohan Vardaro

Senior Counsel and Corporate Secretary

October 7, 2024

Sydney, Australia

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 13 | ||||

| 19 | ||||

| 24 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

26 | |||

| 28 | ||||

| 29 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

i

Table of Contents

This Proxy Statement contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: anticipate, intend, plan, goal, commit, seek, believe, project, estimate, expect, strategy, future, likely, may, should, will and similar references to future periods.

It is possible that the Companys future financial performance may differ from expectations due to a variety of factors, including but not limited to: our early stage of development with no material revenue expected until 2026 and our limited operating history; the substantial additional capital required for our business plan, which we may be unable to raise on acceptable terms; our strategy to deliver natural gas to the Australian East Coast and select Asian markets being contingent upon constructing additional pipeline capacity, which may not be secured; the absence of proved reserves and the risk that our drilling may not yield natural gas in commercial quantities or quality; the speculative nature of drilling activities, which involve significant costs and may not result in discoveries or additions to our future production or reserves; the challenges associated with importing U.S. practices and technology to the Northern Territory, which could affect our operations and growth due to limited local experience; the critical need for timely access to appropriate equipment and infrastructure, which may impact our market access and business plan execution; the operational complexities and inherent risks of drilling, completions, workover, and hydraulic fracturing operations that could adversely affect our business; the volatility of natural gas prices and its potential adverse effect on our financial condition and operations; the risks of construction delays, cost overruns, and negative effects on our financial and operational performance associated with midstream projects; the potential fundamental impact on our business if our assessments of the Beetaloo are materially inaccurate; the concentration of all our assets and operations in the Beetaloo, making us susceptible to region-specific risks; the substantial doubt raised by our recurring operational losses, negative cash flows, and cumulative net losses about our ability to continue as a going concern; complex laws and regulations that could affect our operational costs and feasibility or lead to significant liabilities; community opposition that could result in costly delays and impede our ability to obtain necessary government approvals; exploration and development activities in the Beetaloo that may lead to legal disputes, operational disruptions, and reputational damage due to native title and heritage issues; the requirement to produce natural gas on a Scope 1 net zero basis upon commencement of commercial production, with internal goals to offset Scope 1 and 2 emissions in our upstream business, based in an equity share approach, which may increase our production costs; the increased attention to ESG matters and environmental conservation measures that could adversely impact our business operations; risks related to our corporate structure; risks related to our common stock and CDIs; and the other risk factors discussed in the this Proxy Statement and the Companys filings with the Securities and Exchange Commission (the SEC).

It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Companys results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document, except as required by law.

Table of Contents

This summary highlights certain information contained elsewhere in this Proxy Statement. This is only a summary, so please refer to the full Proxy Statement and the Annual Report before you vote.

Annual Meeting Logistics

| Date and Time: |

Monday, November 4, 2024, at 4:00 p.m. Central time (being 9:00 a.m. AEDT on Tuesday, November 5, 2024) |

|

| Location: |

Online only at www.virtualshareholdermeeting.com/TBN2024 |

|

| Record Date: |

September 17, 2024 |

|

| Voting Matters and Board Recommendations |

||

| Proposal | Matter | Board Recommendation |

||

| 1 | The election of the Companys three Class I directors, being each of:

(1) Fredrick Barrett (2) Patrick Elliott (3) Stephanie Reed |

FOR each | ||

| 2 | Ratification of the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending June 30, 2025. |

FOR | ||

| 3 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issuance of 489,088 shares of the Companys Common Stock to H&P, upon the conversion of the Convertible Note. |

FOR | ||

| 4 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of 312,500 shares of Common Stock (which may be represented by CDIs) to Daly Waters Energy, LP (or its nominee) in satisfaction of certain payment obligations under the TB1 Joint Venture Agreement (as defined in the Annual Report). |

FOR | ||

| 5 | Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the issuance of shares of Common Stock (which may be represented by CDIs) to Mr. Ryan Dalton (or his nominee) up to a value of US$200,000 in each fiscal year during the three year period from the date of this Annual Meeting (being in aggregate up to a value of US$600,000) under the 2024 Equity Incentive Plan, in lieu of the equivalent amount of directors fees otherwise payable to him by the Company at his election. |

FOR | ||

2

Table of Contents

Suite 01, Level 39, Tower One, International Towers Sydney

100 Barangaroo Avenue

Barangaroo NSW 2000

ANNUAL MEETING OF STOCKHOLDERS

November 4, 2024

This Proxy Statement is being furnished to the stockholders of the Company in connection with the solicitation of proxies for the Companys Annual Meeting to be held on Monday, November 4, 2024, at 4:00 p.m. Central time (being 9:00 a.m. AEDT on Tuesday, November 5, 2024), or at any adjournment or postponement thereof, for the purposes set forth herein.

The Annual Meeting will be held via live webcast on the Internet at www.virtualshareholdermeeting.com/TBN2024. This solicitation is being made by the board of directors of the Company (the Board of Directors or the Board). Holders of Common Stock will be able to vote and submit questions online through the virtual-meeting platform during the Annual Meeting. To ensure that proxies are received in time to be counted prior to the Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Sunday, November 3, 2024, and proxies submitted by mail should be received by the close of business on Friday, November 1, 2024 (the business day prior to the date of the Annual Meeting).

Holders of Chess Depositary Interests (CDIs) of the Company will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting. Holders of CDIs can direct CHESS Depositary Nominees Pty Ltd, as depositary nominee (the Depositary Nominee) to vote the Common Stock underlying their CDIs at the Annual Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (Boardroom), the agent the Company has designated for the collection and processing of voting instructions from the Companys CDI holders. Votes from CDI holders must be received by Boardroom by no later than 4:00 p.m. Central time on Saturday, November 2, 2024 (being 9:00 a.m. AEDT on Sunday, November 3, 2024) (48 hours prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

3

Table of Contents

THE INFORMATION PROVIDED IN THE QUESTIONS AND ANSWERS FORMAT BELOW IS FOR YOUR CONVENIENCE. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

Why am I receiving these materials?

We are distributing our proxy materials because our Board is soliciting your proxy to vote at the Annual Meeting. This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares.

How can I attend the Annual Meeting?

Stockholders as of the Record Date (or their duly appointed proxy holder) may attend, vote, and submit questions virtually during the Annual Meeting by logging in at www.virtualshareholdermeeting.com/TBN2024. To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card. If you are not a stockholder or do not have a control number (including Holders of CDIs), you may still access the meeting as a guest, but you will not be able to submit questions or vote at the meeting. The meeting will begin promptly at 4:00 p.m. Central time on Monday, November 4, 2024, at 4:00 p.m. Central time (being 9:00 a.m. AEDT on Tuesday, November 5, 2024). We encourage you to access the meeting prior to the start time. Online access will open at 3:45 p.m. Central time (being 6:45 a.m. AEDT) and you should allow ample time to log in to the meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. A recording of the meeting will be available at www.virtualshareholdermeeting.com/TBN2024 for 90 days after the meeting.

Holders of CDIs will be entitled to receive notice of, and to attend as guests (but not vote at) the Annual Meeting. Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs at the Annual Meeting by completing the CDI Voting Instruction Form.

Can I ask questions at the virtual Annual Meeting?

Stockholders as of the Record Date who attend and participate in our virtual Annual Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. We also encourage you to submit questions in advance of the meeting until 11:59 p.m. Eastern time the day before the Annual Meeting by going to www.virtualshareholdermeeting.com/TBN2024 and logging in with your control number. During the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of procedure. The rules of procedure, including the types of questions that will be accepted, will be posted on the Annual Meeting website. To ensure the orderly conduct of the Annual Meeting, we encourage you to submit questions in advance. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card to ask questions during the meeting.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page: www.virtualshareholdermeeting.com/TBN2024.

4

Table of Contents

What proposals will be voted on at the Annual Meeting?

Stockholders will vote on five proposals at the Annual Meeting:

| Proposal | Matter |

Board Recommendation

|

||

| 1 | The election of the Companys three Class I directors, being each of:

(1) Fredrick Barrett (2) Patrick Elliott (3) Stephanie Reed

|

FOR each | ||

| 2 |

Ratification of the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending June 30, 2025. |

FOR | ||

| 3 |

Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issuance of 489,088 shares of the Companys Common Stock to H&P, upon the conversion of the Convertible Note. |

FOR | ||

| 4 |

Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of 312,500 shares of Common Stock (which may be represented by CDIs) to Daly Waters Energy, LP (or its nominee) in satisfaction of certain payment obligations under the TB1 Joint Venture Agreement (as defined in the Annual Report). |

FOR | ||

| 5 |

Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the issuance of shares of Common Stock (which may be represented by CDIs) to Mr. Ryan Dalton (or his nominee) up to a value of US$200,000 in each fiscal year during the three year period from the date of this Annual Meeting (being in aggregate up to a value of US$600,000) under the 2024 Equity Incentive Plan, in lieu of the equivalent amount of directors fees otherwise payable to him by the Company at his election. |

FOR |

What happens if other business not discussed in this Proxy Statement comes before the meeting?

The Company does not know of any business to be presented at the Annual Meeting other than the proposals discussed in this Proxy Statement. If other business properly comes before the meeting under our Certificate of Incorporation (the Charter), Amended and Restated Bylaws (the Bylaws), and rules established by the SEC, the proxies will use their discretion in casting all the votes that they are entitled to cast.

Who is entitled to vote?

As of the Record Date, 14,224,274 shares of Common Stock were outstanding. Only holders of record of our Common Stock as of the Record Date will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our Common Stock held by such stockholder on the Record Date. No cumulative voting rights are authorized. Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 200 CDIs held by such holder on the Record Date.

5

Table of Contents

What does it mean to be a holder of CDIs?

CDIs are issued by the Company through the Depositary Nominee and traded on the Australian Securities Exchange. If you own CDIs, then you are the beneficial owner of one share of Common Stock for every 200 CDIs that you own. The Depositary Nominee, or its custodian, is considered the stockholder of record for the purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct the Depositary Nominee, or its custodian, as to how to vote the shares of Common Stock underlying your CDIs. As a beneficial owner, you are invited to attend the Annual Meeting as a guest.

However, because you are not a holder of Common Stock, if you personally want to vote the shares of Common Stock underlying your CDIs at the Annual Meeting, you must inform the Depositary Nominee via the CDI Voting Instruction Form that you wish to nominate yourself (or another person) to be appointed as the Depositary Nominees proxy for the purposes of virtually attending and voting at the Annual Meeting.

Under the rules governing CDIs, the Depositary Nominee is not permitted to vote on your behalf on any matter to be considered at the Annual Meeting unless you specifically instruct the Depositary Nominee how to vote. We encourage you to communicate your voting instructions to the Depositary Nominee in advance of the Annual Meeting to ensure that your vote will be counted by completing the CDI Voting Instruction Form and returning it in accordance with the instructions specified on that form.

How do I vote in advance of the Annual Meeting?

If you are a holder of record of shares of Common Stock, you may direct your vote without attending the Annual Meeting by following the instructions on the proxy card to vote by Internet or by telephone, or by signing, dating, and mailing a proxy card.

If you hold your shares in street name via a broker, bank, or other nominee, you may direct your vote without attending the Annual Meeting by signing, dating, and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank, or other nominee for further details.

How do I vote during the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Annual Meeting by entering the 15-digit control number found on your proxy card when you log in to the meeting at www.virtualshareholdermeeting.com/TBN2024.

Shares held in street name through a brokerage account or by a broker, bank, or other nominee may only be voted at the Annual Meeting by submitting voting instructions to your bank, broker or other nominee issued in your name from the record holder (your bank, broker or other nominee).

Even if you plan to attend the Annual Meeting, we recommend that you vote in advance, as described above under How do I vote in advance of the Annual Meeting? so that your vote will be counted if you are unable to attend the Annual Meeting.

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 200 CDIs held by such holder on the Record Date. Persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting as guests. Holders of CDIs may direct the Depositary Nominee to vote their underlying Common Stock at the Annual Meeting by completing and returning the CDI Voting Instruction Form to Boardroom Pty Ltd (Boardroom), the agent the Company has designated for the collection and processing of voting instructions

6

Table of Contents

from the Companys CDI holders. Votes must be received by Boardroom by no later than 4:00 p.m. Central time on Saturday, November 2, 2024 (being 9:00 a.m. AEDT on Sunday, November 3, 2024) (48 hours prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

Alternatively, CDI holders can inform the Depositary Nominee via the CDI Voting Instruction Form that they wish to nominate themselves (or another person) to be appointed as the Depositary Nominees proxy for the purposes of virtually attending and voting at the Annual Meeting.

Can I change my vote or revoke my proxy or CDI Voting Instruction Form?

You may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

| · | delivering to the attention of the Secretary at the address on the first page of this Proxy Statement a written notice of revocation of your proxy; |

| · | delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or |

| · | attending the Annual Meeting and voting electronically, as indicated above under How do I vote during the Annual Meeting?, but note that attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee.

If you are a holder of CDIs and you direct the Depositary Nominee to vote by completing the CDI Voting Instruction Form, you may revoke those instructions by delivering to Boardroom a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent, which notice must be received by no later than 4:00 p.m. Central time on Thursday, October 31, 2024 (being 9:00 a.m. AEDT on Friday, November 1, 2024).

What is a broker nonvote?

Brokers, banks, or other nominees holding shares on behalf of a beneficial owner (other than the Depositary Nominee) may vote those shares in their discretion on certain routine matters even if they do not receive timely voting instructions from the beneficial owner. With respect to nonroutine matters, the broker, bank, or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. The only routine matter to be presented at the Annual Meeting is the proposal to ratify the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending June 30, 2025 (Proposal Two). Each of the other Proposals are nonroutine matters.

A broker nonvote occurs when a broker, bank, or other nominee does not vote on a nonroutine matter because the beneficial owner of such shares has not provided voting instructions with regard to such matter. A broker, bank, or other nominee may exercise its discretionary voting authority on Proposal Two because Proposal Two is a routine matter, and as such, there will be no broker nonvotes on Proposal Two. Broker nonvotes may occur as to the other Proposals or any other nonroutine matters that are properly presented at the Annual Meeting. The effect of broker nonvotes on each of the other Proposals is described below.

7

Table of Contents

What constitutes a quorum?

The presence at the Annual Meeting, either virtually or by proxy, of the holders of not less than a majority in voting power of the outstanding shares of stock entitled to vote at the Annual Meeting shall be necessary and sufficient to constitute a quorum. Abstentions and broker nonvotes will be counted as present for the purpose of determining whether there is a quorum at the Annual Meeting. Your shares are counted as being present if you participate virtually at the Annual Meeting and cast your vote online during the meeting prior to the closing of the polls by visiting www.virtualshareholdermeeting.com/TBN2024, or if you vote by proxy via the Internet, by telephone, or by returning a properly executed and dated proxy card or voting instruction form by mail.

What vote is required to approve each matter to be considered at the Annual Meeting?

| Proposal |

Matter |

Vote Required |

Broker Discretionary Voting Allowed |

Effect of Broker Nonvotes |

Effect of |

|||||

| 1 | The election of the Companys three Class I directors, being each of:

(1) Fredrick Barrett (2) Patrick Elliott (3) Stephanie Reed |

Plurality of Votes Cast |

No | No Effect | No Effect | |||||

| 2 | Ratification of the appointment of Ernst & Young LLP as the Companys independent registered public accounting firm for the fiscal year ending June 30, 2025. | Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon | Yes |

No Effect |

Vote Against |

|||||

| 3 | Ratification and approval, for purposes of ASX Listing Rule 7.4 and for all other purposes, of the prior issuance of 489,088 shares of the Companys Common Stock to H&P, upon the conversion of the Convertible Note. | Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon | No |

No Effect |

Vote Against |

|||||

8

Table of Contents

| Proposal |

Matter |

Vote Required |

Broker Discretionary Voting Allowed |

Effect of Broker Nonvotes |

Effect of |

|||||

| 4 | Approval, for purposes of ASX Listing Rule 10.11 and for all other purposes, of the issuance of 312,500 shares of Common Stock (which may be represented by CDIs) to Daly Waters Energy, LP (or its nominee) in satisfaction of certain payment obligations under the TB1 Joint Venture Agreement (as defined in the Annual Report). | Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon | No |

No Effect |

Vote Against |

|||||

| 5 | Approval, for purposes of ASX Listing Rule 10.14 and for all other purposes, of the issuance of shares of Common Stock (which may be represented by CDIs) to Mr. Ryan Dalton (or his nominee) up to a value of US$200,000 in each fiscal year during the three year period from the date of this Annual Meeting (being in aggregate up to a value of US$600,000) under the 2024 Equity Incentive Plan, in lieu of the equivalent amount of directors fees otherwise payable to him by the Company at his election. | Affirmative Vote of the Holders of a Majority in Voting Power of the Shares of Stock of the Company which are Present Virtually or by Proxy and Entitled to Vote Thereon | No |

No Effect |

Vote Against |

|||||

Voting exclusion statement

The Company will disregard any votes cast in favor of:

| · | Proposal Three, by or on behalf of a person who is expected to participate in, or who will obtain a material benefit as a result of, the proposed issuance (except a benefit solely by reason of being a holder of ordinary |

9

Table of Contents

| securities in the Company) or an associate of that person or persons. The Company has identified that Helmerich & Payne International Holdings, LLC and its associates are excluded from voting; |

| · | Proposal Four, by or on behalf of Daly Waters Energy, LP, Sheffield Holdings, LP, Mr. Bryan Sheffield, Stephanie Reed and any other person who will obtain a material benefit as a result of the issuance of the securities under Proposal Four (except a benefit solely by reason of being a holder of shares of Common Stock (or CDIs)) or their associates; and |

| · | Proposal Five, by or on behalf of Mr. Dalton or any of his associates as well as any Listing Rule 10.11 party who is eligible to participate in the 2024 Equity Incentive Plan or an associate of those persons. |

However, the Company need not disregard a vote cast in favor of any of the above Proposals by:

| · | a person as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with directions given to the proxy or attorney to vote on the relevant Proposal in that way; |

| · | the chair of the Annual Meeting as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with a direction given to the chair to vote on the relevant Proposal as the chair decides; or |

| · | a holder acting solely in a nominee, trustee or custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met: |

| · | the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the relevant Proposal; and |

| · | the holder votes on the relevant Proposal in accordance with directions given by the beneficiary to the holder to vote in that way. |

What is the deadline for submitting a proxy or CDI Voting Instruction Form?

To ensure that proxies are received in time to be counted prior to the Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern time on Sunday, November 3, 2024, and proxies submitted by mail should be received by the close of business on Friday, November 1, 2024 (the business day prior to the date of the Annual Meeting).

CDI Voting Instruction Forms must be received by Boardroom by no later than 4:00 p.m. Central time on Saturday, November 2, 2024 (being 9:00 a.m. AEDT on Sunday, November 3, 2024) (48 hours prior to the date of the Annual Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

What does it mean if I receive more than one proxy card or CDI Voting Instruction Form?

If you hold your shares or CDIs in more than one account, you will receive one proxy card or CDI Voting Instruction Form for each account (as applicable). To ensure that all of your shares or CDIs are voted, please complete, sign, date, and return one proxy card or CDI Voting Instruction Form for each account or use the proxy card for each account to vote by Internet or by telephone.

How will my shares be voted if I return a blank proxy card or a blank CDI Voting Instruction Form?

If you are a holder of record of our Common Stock and you sign and return a proxy card or CDI Voting Instruction Form or otherwise submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Boards recommendations. If you hold your shares in street name via a broker, bank, or other nominee and do not provide the broker, bank, or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

| · | will be counted as present for purposes of establishing a quorum; |

10

Table of Contents

| · | will be voted in accordance with the brokers, banks, or other nominees discretion on routine matters, which includes the proposal to ratify the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending June 30, 2025 (Proposal Two); and |

| · | will not be counted in connection with the other Proposals or any other nonroutine matters that are properly presented at the Annual Meeting. For each of these proposals, your shares will be treated as broker nonvotes. |

Our Board knows of no matter to be presented at the Annual Meeting other than Proposals identified in this Proxy Statement. If any other matters properly come before the Annual Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

Who is making this solicitation and who will pay the expenses?

This proxy solicitation is being made on behalf of the Board. The Company will pay for the cost of soliciting proxies. Proxies may be solicited on the Companys behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. We have hired D. F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, to solicit proxies. We will pay D.F. King & Co., Inc. a fee of $7,000.00 plus expenses for these services. Arrangements may be made with brokerage houses, custodians, nominees, and fiduciaries to send proxy materials to their principals, and we may reimburse them for their expenses.

Who will count the vote?

Broadridge Financial Solutions, Inc., or its appointed representative, will serve as the inspector of elections and will certify the voting results.

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by stockholders for any purpose germane to the meeting for 10 business days prior to the Annual Meeting, at Tamboran Resources Corporation, Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000 between the hours of 9:00 a.m. and 5:00 p.m. AEDT. The stockholder list will also be available to stockholders of record for examination during the Annual Meeting at www.virtualshareholdermeeting.com/TBN2024. You will need the control number included on your proxy card, or voting instruction form, or otherwise provided by your bank, broker, or other nominee.

What is householding and how does it affect me?

We have adopted a procedure approved by the SEC called householding. Under this procedure, we send only one Proxy Statement and one Annual Report to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge, by calling (866) 540-7095 or writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact Broadridge at the above telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

11

Table of Contents

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

When are stockholder proposals due for the 2025 annual meeting of the stockholders?

A stockholder desiring to submit a proposal for inclusion in the Companys proxy statement for the 2025 annual meeting of stockholders may do so by following the procedures prescribed in Rule 14a-8 of the Exchange Act. Any such proposal must be received by the Company no later than June 19, 2025. The Company requests that all such proposals be addressed to the Corporate Secretary at Tamboran Resources Corporation, Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000, and be mailed by certified mail, return receipt requested.

Stockholders wishing to submit proposals or director nominations outside the procedures prescribed in Rule 14a-8 of the Exchange Act must give timely notice thereof in writing to the Corporate Secretary and follow the procedures contained in the Companys Bylaws. To be timely, a stockholders notice must be delivered to, or mailed and received at, the principal executive offices of the Corporation not less than 90 days nor more than 120 days prior to the one-year anniversary of the preceding years annual meeting; provided, however, that if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered, or mailed and received, not more than the 120th day prior to such annual meeting and not later than (i) the 90th day prior to such annual meeting or, (ii) if later, the tenth day following the day on which public disclosure of the date of such annual meeting was first made by the Corporation. In no event shall any adjournment or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of timely notice.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Companys nominees must provide notice to the Company that sets forth the information required by Rule 14a-19 under the Exchange Act.

In connection with our solicitation of proxies for our 2025 annual meeting of stockholders, we intend to file a proxy statement and WHITE proxy card with the SEC. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed with the SEC without charge from the SECs website at: www.sec.gov.

Whom can I contact for further information?

You may request additional copies, without charge, of this Proxy Statement and other proxy materials or ask questions about the Annual Meeting, the proposals, or the procedures for voting your shares by writing to our Corporate Secretary at Suite 01, Level 39, Tower One, International Towers Sydney, 100 Barangaroo Avenue, Barangaroo NSW 2000.

12

Table of Contents

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

TO APPROVE, THE ELECTION OF THE COMPANYS THREE CLASS I DIRECTORS, BEING EACH

OF: (1) FREDRICK BARRETT, (2) PATRICK ELLIOTT, (3) STEPHANIE REED

General

At the Annual Meeting, our stockholders will vote on the three Class I directors for a three-year term and until the election and qualification of their respective successors in office, or until such directors earlier death, resignation, or removal. ASX Listing Rule 14.5 requires that an entity which has directors must hold an election of directors at each Annual Meeting. Further, in accordance with ASX Listing Rule 14.4, a director must not hold office (without re-election) past the third Annual Meeting following their appointment of 3 years, whichever is longer.

The directors named herein have agreed to serve, if elected, until the next annual meeting of stockholders and until their successors have been duly elected and qualified or until their earlier death, resignation, or removal. There are no family relationships between or among any of our executive officers, nominees, or continuing directors.

The election of each director will be voted on separately.

If a proposal to elect a director is approved, the director will be appointed for a three-year term as outlined above. If a proposal to elect a director is not approved, the director will not be appointed and will cease to be a director, and the board may be required to take steps to fill that vacancy.

Director Nominees

The following table sets forth information with respect to our director nominees for election at the Annual Meeting:

| Name |

Independent |

Age |

||||

| (1) Fredrick Barrett | Yes | 63 | ||||

| (2) Patrick Elliott | Yes | 72 | ||||

| (3) Stephanie Reed | No | 42 |

13

Table of Contents

More detailed biographical descriptions of the nominees are set forth in the text below. These descriptions include the experience, qualifications, qualities, and skills that led to the conclusion that each director should serve as a member of our Board at this time.

|

Age: 63

Director since: 2014

Committees:

Nomination & Governance, Audit & Risk Management and Sustainability. Class: I |

(1) Fredrick Barrett served as an independent Director for Tamboran Resource Limited (TR Ltd.) since September 2014, a Director of the Company since December 2023 and has over 35 years of experience in the oil and gas resources industry. Mr. Barrett served as an independent Non-Executive Director on the Board of Asian American Gas Energy Holdings (AAG), a leading coalbed methane natural gas company focused in China, from 2015-2018. Mr. Barrett served as Chairman of the New Business Committee for AAG from 2016-2018. During 2014 and 2015, Mr. Barrett served on the Unconventional Advisory Panel at Santos Ltd (ASX: STO), an independent exploration and production oil and gas company headquartered in Adelaide, Australia. Mr. Barrett no longer serves in any advisory function for Santos. Mr. Barrett co-founded Bill Barrett Corporation (NYSE: BBG) in January 2002 and served in various positions from 2002-2013, including President and Chief Operating Officer from 2002-2006 and Chief Executive Officer and Chairman of the Board from 2006-2013. Prior to that, Mr. Barrett was a senior exploration geologist for Barrett Resources Corp. (NYSE: BRR) in the U.S. Rocky Mountain Region from 1989 to 2001, and a lead geologist for various Rockies areas from 1989 to 1996. Mr. Barrett was a Co-Founder and Partner in Terred Oil Company from 1987 to 1989, a private oil and gas partnership that provided geologic oil and gas services for the U.S. Rocky Mountain Region. Mr. Barrett worked as a project and wellsite geologist for various periods from 1983 to 1986 for Barrett Resources and held similar roles for various periods for the Barrett Energy and Aeon Energy companies from 1981 to 1983. Mr. Barrett received a Bachelor of Science in Geology from Ft. Lewis College and a Master of Science in Geology from Kansas State University. He is also a graduate of the Harvard Business School Advanced Management Program. We believe Mr. Barrett is qualified to be on our board of directors due to his public company experience and technical background. |

|

|

Age: 72

Director since: 2009

Committees: Audit & Risk Management (Chair) and Sustainability.

Class: I |

(2) Patrick Elliott is a founding shareholder and joined the board of TR Ltd. in February 2009, serving as the Chairman from February 2009 to November 2020, and a Director of the Company since December 2023. Mr. Elliott has over 40 years of diverse experience working in commercial and management roles in the upstream oil and gas mineral resources industries. Mr. Elliott has served on the boards of Cap-XX Ltd (LON: CPX) since August 2011, Rockfire Resources plc (LON: ROCK) since March 2019, Argonaut Resources N.L. (ASX: ARE) from 1993 to October 2023, Orpheus Minerals Ltd (ASX: ORP) from August 2020 to October 2023, and Ioneer Ltd (ASX: INR) from June 2003 to November 2020. Mr. Elliott has served on boards of numerous private companies over the last 40 years. Mr. Elliott is a Certified Practicing Accountant in Australia. Mr. Elliott received a Bachelor of Science from The University of Auckland, a Bachelor in Commerce (Accounting and Financial Management) from the University of New South Wales, and a Master of Business Administration in Mineral Economics from the Macquarie Graduate School of Management. We believe that Mr. Elliott is qualified to be on our board of directors due to his corporate finance and investment experience. |

|

14

Table of Contents

|

Age: 42

Director since: 2023

Committees: Compensation and Sustainability.

Class: I |

(3) Stephanie Reed has served as a Director of TR Ltd. since September 2023 and a Director of the Company since December 2023. Ms. Reed has over 15 years of experience in the oil and gas industry. Ms. Reed has been a Partner of Formentera Partners since April 2022, where she oversees all aspects of funds business development efforts, and land geosciences, legal, human resources, and marketing & midstream, while additionally assisting with asset management and operations. Ms. Reed previously served as Vice President of Oil & Gas Marketing & Midstream at Pioneer Natural Resources USA (NYSE: PXD) from January 2021 to April 2022. While at Pioneer, Ms. Reed served on the Cybersecurity Steering Committee. Prior to joining Pioneer, Ms. Reed served in several roles at Parsley Energy, Inc. (NYSE: PE), from January 2010 to January 2021, including Senior Vice President, Land, Marketing & Midstream. While at Parsley, Ms. Reed oversaw all business development, land, regulatory, midstream, and marketing business units. Ms. Reed also served on the Parsleys Executive Personnel Committee and Management Team, Corporate Governance Committee, Financial Reporting Committee, IT Steering Committee, and Sustainability Committee. Ms. Reed graduated from Texas Tech University with a Bachelors in Applied Science and a Master of Business Administration. We believe Ms. Reed is qualified to be on our board of directors due to her experience in the oil and gas industry. |

Our directors bring a range of skills and experience in relevant areas, including oil and gas, exploration and production, finance, international business, as well leadership and management. We believe this cross-section of capabilities enables our Board of Directors to help guide our objectives and leading corporate governance practices.

Recommendation of Our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR STOCKHOLDERS VOTE FOR THE ELECTION OF EACH NOMINEE NAMED ABOVE.

Continuing Directors

|

Age: 54

Director since: 2023

Committees: Nominations & Governance

Class: II |

John BellDirector. John Bell has served as a Director for TR Ltd. since April 2023 and a Director of the Company since December 2023. Mr. Bell has been Senior Vice President of International and Offshore Operations of Helmerich & Payne, Inc. (NYSE: HP) (H&P) since 2020 and oversees H&Ps drilling operations in South America, the Middle East, and the Gulf of Mexico. Mr. Bell joined H&P in 1998 as a Business Systems Analyst and has held a variety of senior leadership positions from Vice President of Human Resources to Vice President of Corporate Services. Early in his career, Mr. Bell was involved in and led various projects focused on improving rig operations such as rig moves, offshore crane operations, and maintenance systems. During his time in corporate roles, Mr. Bell held leadership roles in a variety of initiatives, most notably Workforce Staffing, global Human Resources cloud-based system, and global ERP implementation. He is a current member of the Executive Leadership Team. Mr. Bell serves on the Baylor University Hankamer School of Business Advisory Board. Mr. Bell received a Bachelor of Business Administration with a double major in Economics and Marketing from Baylor University. We believe Mr. Bell is qualified to be on our board of directors due to his drilling operational experience. |

15

Table of Contents

|

Age: 45

Director since: 2023

Committees: Nominations & Governance and Audit & Risk Management

Class: II |

Ryan DaltonDirector. Ryan Dalton has served as a Director of TR Ltd. since September 2023 and a Director of the Company since December 2023. Mr. Dalton has over 20 years of financial experience, including a decade in the oil & gas industry. Mr. Dalton most recently served as Executive Vice President, Chief Financial Officer, at Parsley Energy, Inc. (NYSE: PE) from 2012-2021, until being acquired by Pioneer Natural Resources. Prior to joining Parsley Energy, Mr. Dalton served as an investment banker in Rothschilds restructuring group, and as a consultant at Alix Partners. Mr. Dalton received a Bachelor of Business Administration in Finance from Southern Methodist University and a Master of Business Administration from the University of Virginia. We believe that Mr. Dalton is qualified to be on our board of directors due to his background in corporate finance, strategic planning, public and private capital raising, as well as risk management. |

|

|

Age: 73

Director since: 2023

Committees: Compensation, Sustainability (Chair), and Nominations & Governance.

Class: II |

Andrew RobbDirector. The Hon. Andrew Robb AO has served as a Director of TR Ltd. since April 2023 and a Director of the Company since December 2023. Mr. Robb served as a Member of Australias House of Representatives from 2004-2016 and as Australias Minister for Trade, Investment and Tourism from 2013-2016. While serving as Minister for Trade, Investment and Tourism, Mr. Robb negotiated Free Trade Agreements with South Korea, Japan and China; the 12 country Trans Pacific Partnership (TPP) free trade agreement; the Comprehensive Strategic Partnership with Singapore; and conducted 85 investment roundtables with 28 countries. While serving in the House of Representatives, Mr. Robb also held positions as Chairman of the Governments Workplace Relations Taskforce, Assistant Minister for Immigration and Multicultural Affairs and then Minister for Vocational and Further Education. In Opposition, Mr. Robb held positions as Shadow Minister for Foreign Affairs, Shadow Minister for Infrastructure and Climate Change, Chairman of the Coalition Policy Development Committee and Shadow Minister for Finance, Deregulation and Debt Reduction. Mr. Robb was awarded the Office of the Order of Australia (AO) for his service to agriculture, politics, and the community. Mr. Robb retired from politics in 2016 and currently serves as Chairman of The Robb Group, CBMA and CLARA Energy and as a Board Member of the Kidman cattle enterprise, CNSDose, Mind Medicine Australia, CDMA, and strategic advisor to Seafarms Ltd, as well as a range of national and international businesses. Mr. Robb previously served as a director of Ten Network Holdings (ASX: TEN) from 2016-2017, in addition to previously serving as a director of other privately held companies. Mr. Robb received a Diploma in Agricultural Science from Dookie Agricultural College and a Bachelors in Economics from LaTrobe University. We believe that Mr. Robb is qualified to be on our board of directors due to his extensive leadership and international trade experience. |

|

16

Table of Contents

|

Age: 50

Director since: 2018

Committees: N/A

Class: III |

Joel RiddleChief Executive Officer and Director. Joel Riddle joined TR Ltd. as Chief Executive Officer in September 2013, was appointed as a Director of TR Ltd. in December 2018 and has served as Chief Executive Officer and Director of the Company since October 2023. Mr. Riddle brings over 25 years of experience in the upstream oil and gas industry. Prior to joining TR Ltd., Mr. Riddle served as Vice President, Commercial and Planning at Cobalt International Energy (Cobalt) from 2006 to 2013, where he worked closely with executive management in the initial evaluation and implementation of the exploration growth strategy in the Gulf of Mexico and West Africa and played a role in Cobalts initial public offering. Cobalt filed a voluntary petition for bankruptcy on December 14, 2017. Prior to his position with Cobalt, Mr. Riddle served in various management positions including business development, commercial and strategic planning with Unocal Corporation from 2002-2005 and Murphy Oil Corporation from 2005-2006. Prior to Unocal Corporation, from 2001-2002, Mr. Riddle was a senior associate with Andersen Consulting, serving upstream exploration and production clients on strategy and performance improvement engagements. Mr. Riddle began his career in 1997 as a senior reservoir engineer with ExxonMobil, serving various assignments focused on upstream oil and gas operations in the Gulf of Mexico. Mr. Riddle received a Bachelor of Science with Honors in Mechanical Engineering from the University of Florida and a Master of Business Administration from the University of Chicago. We believe Mr. Riddle is qualified to be on our board of directors due to his extensive experience with the Company and the global energy industry and his technical acumen. |

|

|

Age: 70

Director since: 2016

Committees: N/A

Class: III |

Richard StoneburnerChairman. Richard (Dick) Stoneburner has served on the board of directors of TR Ltd. since May 2016 and was named Chairman of TR Ltd. in February 2021 and Chairman of the Company in December 2023. Mr. Stoneburner has approximately 45 years of experience in upstream oil and gas exploration and production. Since 2013, Mr. Stoneburner has been a Partner and Senior Advisor for Pine Brook Partners, a private equity firm focusing on investments in the energy sector. Mr. Stoneburner was a Co-Founder and former President and Chief Operating Officer of Petrohawk Energy Corporation from 2003-2011 and President North America Shale Production Division for BHP Billiton Petroleum from 2011-2012. Prior to co-founding Petrohawk in 2003, Mr. Stoneburner was Executive Vice President Exploration for 3TEC Energy Corporation and worked for several E&P companies, including Hugoton Energy Corporation, Stoneburner Exploration Inc., Weber Energy and Texas Oil & Gas. Mr. Stoneburner currently serves on the board of Sitio Royalties Corp. (NYSE: STR) (formerly Brigham Minerals, Inc.; NYSE: MNRL), a position he has held since 2018. He also previously served on the board of Yuma Energy, Inc. (NYSE American: YUMA) from 2014-2020 and currently serves on the boards of private companies in the oil and gas industry. Mr. Stoneburner received a Bachelor in Science in Geological Sciences from the University of Texas at Austin and a Master of Science in Geology from Wichita State University. We believe Mr. Stoneburner is qualified to be on our board of directors due to his extensive leadership experience and professional experience in upstream oil and gas exploration and production. |

|

17

Table of Contents

|

Age: 62

Director since: 2021

Committees: Compensation (Chair) and Audit & Risk Management.

Class: III |

David SiegelDirector. David Siegel has served as a Director of TR Ltd. since March 2021 and a Director of the Company since December 2023. Mr. Siegel has 30 years of experience in the aerospace and aviation industry. Since October 2017, Mr. Siegel has acted as a Senior Advisor for Apollo Global Management. Mr. Siegel served as Chairman of Sun Country Airlines (NASDAQ: SNCY) from April 2018 to February 2023 and Chairman of Genesis Park Acquisition Corp (formerly NYSE: GNPK) from November 2020 to September 2021 and currently serves on the boards of private airline companies. Prior to joining Apollo, Mr. Siegel served as Chief Executive Officer for a number of operators, including Ansett Worldwide Aviation Services from 2016-2017, Frontier Airlines (NASDAQ: ULCC) from 2012-2015, XOJET from 2008-2010, US Airways (formerly NYSE: LCC) from 2002-2004, during which he successfully guided the company through bankruptcy and returned it to profitability in 2003, and Avis Budget Group Inc. (NASDAQ: CAR). After beginning his career as a consultant at Bain & Company, where he worked from 1983 to 1990, Mr. Siegel served in various senior management roles at Continental Airlines, Inc. (formerly NYSE: CAL) and Northwest Airlines Corp. (formerly NYSE: NWA). Mr. Siegel holds a Bachelor of Science from Brown University and a Master of Business Administration from Harvard Business School. We believe that Mr. Siegel is qualified to be on our board of directors due to his substantial experience in managing public companies. |

18

Table of Contents

Our Board believes sound corporate-governance processes and practices, as well as high ethical standards, are critical to handling challenges and to achieving business success. We embrace leading governance practices and conduct ongoing reviews of our governance structure and processes to reflect changing circumstances. Below are highlights of our corporate-governance practices and principles.

Director Independence

The majority of the members of the Board are independent in accordance with the New York Stock Exchange listing standards. The Board has affirmatively determined that each of the following directors is an independent director of the Company under the listing standards of the New York Stock Exchange: Richard Stoneburner, Fredrick Barrett, Ryan Dalton, Patrick Elliott, Andrew Robb, and David Siegel. Joel Riddle, our current Managing Director and CEO, is not independent. The Board has determined that, other than John Bell and Stephanie Reed, none of our directors has any material relationships with the Company other than their roles as directors.

In making such determinations, the Board considered the relationships that each such director has with the Company and all other facts and circumstances the Board deemed relevant in determining independence. The Board determined that Mr. Siegel is independent as the ORRIs granted to Mr. Siegels children were consideration in connection with the Share Exchange Agreement completed in 2021 and not direct compensation. Further, no royalty payments have been made to Mr. Siegel or his children. See Certain Relationships and Related Party Transactions for further information.

Board Leadership Structure

The Board may elect one or more of its members to serve as Chairman or Vice-Chairman of the Board. The Board has elected Richard Stoneburner to serve as the Chairman and Joel Riddle as the Chief Executive Officer. Our Bylaws provide that the Chief Executive Officer shall report directly to the Chairman and, if present and in the absence of the Chairman, preside at meetings of the stockholders and of the Board.

Role of the Board in Risk Oversight

The Board is responsible for the oversight of risk, while management is responsible for the day-to-day management of risk. The Board, directly and through its committees, carries out its oversight role by regularly reviewing and discussing with management the risks inherent in the operation of our business and applicable risk mitigation efforts. Management meets regularly to discuss the Companys business strategies, challenges, risks and opportunities and reviews those items with the Board at regularly scheduled meetings. The Compensation Committee is responsible for overseeing the management of risks relating to our compensation plans and arrangements, including whether the Companys incentive compensation plans encourage excessive or inappropriate risk taking. The Audit & Risk Management Committee is responsible for overseeing our risk assessment and management processes related to, among other things, our financial reports and record-keeping, major litigation and financial risk exposures, information technology risks, including cybersecurity and data privacy risks and the steps management has taken to monitor and control such exposures. The Nominations & Governance Committee is responsible for risk oversight associated with corporate governance practices and the composition of our Board and its committees. The Sustainability Committee is responsible for the oversight of the Companys sustainability policies and reviewing and updating the Companys Sustainability Plan.

Evaluations of the Board of Directors

The Board evaluates its performance and the performance of its committees and individual directors on an annual basis through an evaluation process administered by our Nominations & Governance Committee. The Board discusses each evaluation to determine what, if any, actions should be taken to improve the effectiveness of the Board or any committee thereof or of the directors.

19

Table of Contents

Board and Committee Meetings and Attendance

Directors are expected to make every effort to attend all meetings of the Board and all meetings of the committees on which they serve. During fiscal year 2024, our Board had eight Board meetings. During fiscal year 2024, each member of our Board attended at least 75% of all Board and relevant Committee meetings held during the period in which such director served. Our independent directors hold regularly scheduled executive sessions without our management present. These executive sessions of independent directors are chaired by our Chairman of the Board.

Board Attendance at Annual Stockholders Meeting

Each director is encouraged and generally expected to attend the Companys Annual Meeting.

Board Committees

Our Board has established an Audit & Risk Management Committee, a Compensation Committee, a Nominations & Governance Committee and a Sustainability Committee. The composition and responsibilities of each of the committees of our Board are described below. Copies of the charters of the committees are available on the investor relations page of our website at https://ir.tamboran.com/corporate-governance/governance-documents. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement. Members serve on these committees until their resignation or until otherwise determined by our Board. Our Board may establish other committees as it deems necessary or appropriate from time to time.

The following table provides current membership and meeting information for fiscal year 2024 for each of these committees of our Board with directors marked with an asterisk (*) identified as committee chair:

|

Name |

Audit & Risk Management |

Nominations & Governance |

Compensation | Sustainability | ||||

| Frederick Barrett |

✓ | ✓* | ✓ | |||||

| Patrick Elliott |

✓* | ✓ | ||||||

| Stephanie Reed |

✓ | ✓ | ||||||

| The Hon. Andrew Robb AO | ✓ | ✓ | ✓* | |||||

| David Siegel |

✓ | ✓* | ||||||

| Ryan Dalton |

✓ | ✓ | ||||||

| John Bell |

✓ | |||||||

| Total meetings held in fiscal year 2024 | 5 | 4 | 4 | 2 |

Audit & Risk Management Committee

Messrs. Elliott, Barrett, Siegel and Dalton are the members of the Audit & Risk Management Committee. Mr. Elliott is the Chairman of the Audit & Risk Management Committee. Each proposed member of the Audit & Risk Management Committee qualifies as an independent director under the NYSE corporate governance standards and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has determined that Messrs. Elliott and Dalton each qualify as an audit committee financial expert as such term is defined in Item 407(d)(5) of Regulation S-K, and that each of the members of the Audit & Risk Management Committee meets the financial literacy requirements under current NYSE listing standards.

Under its charter, the functions of the Audit & Risk Management Committee include, among other things, assisting the Board in fulfilling its oversight responsibilities with respect to:

| · | the integrity of the Companys financial statements; |

| · | the Companys compliance with legal and regulatory requirements |

| · | the Companys accounting and financial processes; |

20

Table of Contents

| · | the independent auditors qualifications and independence; |

| · | the performance of the Companys independent auditor; |

| · | the Companys risk management processes and systems, including information technology risks, including cybersecurity and data privacy risks; |

| · | the Companys compliance with legal and regulatory requirements; and |

| · | the design and implementation of the Companys internal audit function; and |

| · | the performance of the internal audit function after it has been established. |

Nominations & Governance Committee

Messrs. Barrett, Bell, Robb and Dalton are members of the Nominations & Governance Committee. Mr. Barrett is the Chairman of the Nominations & Governance Committee. Except for Mr. Bell, the members of the Nominating & Governance Committee are independent directors under current NYSE listing standards.

Under its charter, the functions of the Nominations & Governance Committee include, among other things, assisting the Board in fulfilling its oversight responsibilities with respect to Corporate Governance, including:

| · | identifying individuals qualified to become Board members consistent with criteria approved by the Board; |

| · | recommending that the Board select the director nominees for the next annual meeting of the Companys shareholders; |

| · | developing and recommending to the Board a set of Corporate Governance Guidelines; and |

| · | overseeing the evaluation of the Board. |

The Nominations & Governance Committee has the sole authority to retain and terminate any search firm to be used to identify director candidates, including sole authority to approve such search firms fees and other retention terms. The Nominations & Governance Committee, with the approval of its committee chair, has the authority to retain counsel, experts or any other advisors that the Nominations & Governance Committee believes to be desirable and appropriate and has the sole authority to retain and terminate the consultants or advisors and to review and approve related fees and other retention terms.

The Nominations & Governance Committee meets periodically, and no less frequently than annually, to assess, develop and communicate with the full Board concerning the appropriate criteria for nominating and appointing directors, including the Boards size and composition, corporate governance policies, applicable listing standards and laws, individual director performance, expertise, experience, qualifications, attributes, skills, tenure and willingness to serve actively, the number of other public and private Company Boards on which a director candidate serves, consideration of director nominees proposed or recommended by stockholders and related policies and procedures, and other appropriate factors. Whenever a new seat or a vacated seat on the Board is being filled, candidates that appear to best fit the needs of the Board and the Company will be identified, interviewed and evaluated by the Nominations & Governance Committee. Potential director candidates recommended by the Companys management and stockholders are evaluated in the same manner as nominees identified by the Nominations & Governance Committee. Candidates selected by the Nominations & Governance Committee will then be recommended to the full Board.

Director Nominations by Stockholders

Nominations of persons for election to the Board may be made by any stockholder of the Company who is a stockholder of record and complies with the notice procedures set forth in the Bylaws. The stockholder must

21

Table of Contents

provide the information, agreements and questionnaires with respect to such stockholder and its candidate for nomination as set forth in the Bylaws. All candidates, regardless of the source of their recommendation, are evaluated in the same manner as nominees identified by the Nominations & Governance Committee.

Election of Directors

Our Bylaws provide that, at all meeting of stockholders for the election of directors at which a quorum is present, a plurality of the votes cast shall be sufficient to elect.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

We have adopted Corporate Governance Guidelines and a written Code of Business Conduct and Ethics, which are available on our website at https://ir.tamboran.com/corporate-governance/governance-documents. The information in or accessible through our website is not incorporated into, and is not considered part of, this Proxy Statement.

Our Corporate Governance Guidelines provide the framework for our corporate governance along with our Charter, Bylaws, committee charters and other key governance practices and policies. Our Corporate Governance Guidelines cover a wide range of subjects, including the conduct of Board meetings, independence and selection of directors, Board membership criteria, and Board committee composition.

Our Code of Business Conduct and Ethics is applicable to our directors, executive officers and employees. The Code of Business Conduct and Ethics codifies the business and ethical principles that govern all aspects of the Companys business. Any waiver of this Code of conduct for any individual director or officer of our Company must be approved, if at all, by our board of directors. Any such waivers granted, as well as substantive amendments to this Code, will be publicly disclosed by appropriate means in compliance with applicable listing standards and SEC rules.

Prohibition on Hedging and Pledging of Company Securities

We have adopted an Insider Trading Compliance Policy and Procedures. The information is not considered part of this Proxy Statement. This policy, among other things, prohibits officers, directors, employees, contractors, and any other person designated as being subject to this policy by the Senior Counsel or his or her designee, from engaging in hedging transactions, such as prepaid variable forward contracts, equity swaps, collars and exchange funds, or other transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Companys equity securities. Officers, directors, and employees of the Company are also subject to pre-clearance procedures with respect to all transactions involving the Companys securities.

Stockholder and Interested Party Communications

We have adopted a policy regarding stockholder and interested party communications with the Board (the Interested Party Communications Policy), which is available on our website at https://ir.tamboran.com/corporate-governance/governance-documents. Under the Interested Party Communications Policy, any stockholder or other interested party may communicate directly with the independent members of the Board and the lead independent director, if any, about corporate governance, corporate strategy, Board-related matters or other substantive matters that our Senior Counsel, lead independent director, if any, and chairman of the Board consider to be important for the director(s) to know, by addressing any communications to the intended recipient by name or position in care of: Senior Counsel, rohan.vardaro@tamboran.com.

The Senior Counsel will initially receive all interested party communications and will review the communications for compliance with the Interested Party Communications Policy. Communications that are deemed to comply with the Interested Party Communications Policy and to be appropriate for delivery will be forwarded to the Board or the relevant director(s). The Senior Counsel may consult with the chairman of the Board and lead independent director, if any, when determining whether a communication is appropriate for

22

Table of Contents