S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on June 24, 2024

Table of Contents

As filed with the Securities and Exchange Commission on June 21, 2024

Registration No. 333-279119

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Tamboran Resources Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

1311 |

93-4111196 |

||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Suite 01, Level 39, Tower One, International Towers Sydney

100 Barangaroo Avenue, Barangaroo NSW 2000

Australia +61 2 8330 6626

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

C T Corporation System

1209 Orange Street, Wilmington, County of New Castle, Delaware 19801

(302) 658-7581

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael Chambers David J. Miller Latham & Watkins LLP 300 Colorado St., Suite 2400 Austin, Texas 78701 (737) 910-7300 |

Trevor Lavelle Andrew S. Epstein Clifford

Chance US LLP Houston, TX 77002 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging Growth Company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated June 21, 2024

Preliminary Prospectus

6,500,000 Shares

Tamboran Resources Corporation

Common Stock

This is the initial public offering of common stock of Tamboran Resources Corporation, a Delaware corporation. We are offering 6,500,000 shares of our common stock. We have granted the underwriters a 30-day option to purchase up to 975,000 additional shares from us at the initial public offering price, less the underwriting discounts and commissions.

Depositary interests, referred to as CHESS Depository Interests (CDIs), each representing beneficial interests of 1/200th of a share of our common stock, are listed on the Australian Stock Exchange (ASX) under the symbol TBN. This prospectus does not constitute an offer to sell, or the solicitation of any offer to buy, any CDIs.

We anticipate that the initial public offering price of our common stock will be between $24.00 and $27.00 per share. We have applied to list our common stock on the New York Stock Exchange (the NYSE) under the symbol TBN. We have been authorized to list our common stock on the NYSE, subject to official notice.

Sheffield Holdings, LP (an affiliate of Bryan Sheffield), Scott Sheffield, Liberty Energy, and the Charlotte G. Yates Family (the cornerstone investors) have, severally and not jointly, indicated an interest in purchasing up to an aggregate of $22.5 million in shares of our common stock in this offering at the initial public offering price. Because this indication of interest is not a binding agreement or commitment to purchase, the cornerstone investors may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the cornerstone investors. The underwriters will receive the same discount on any of our shares of common stock purchased by the cornerstone investors as they will from any other shares sold to the public in this offering.

At the closing of this offering, we intend to issue to Daly Waters Energy, LP (Daly Waters), a portfolio company of Formentera Partners, LP (a private investment firm co-founded and managed by Bryan Sheffield), or its nominee, $7.5 million in shares of our common stock at the initial public offering price in satisfaction of certain payment obligations under a joint venture agreement between us and Daly Waters. See BusinessAgreements Relating to the Development of our AssetsTB1 Joint Venture Agreement for more information.

We are an emerging growth company as the term is used in the Jumpstart Our Business Startups Act of 2012 (JOBS Act) and, as such, have elected to comply with certain reduced public company reporting requirements. See Prospectus SummaryEmerging Growth Company Status.

Investing in our common stock involves risks, including those described under Risk Factors beginning on page 21 of this prospectus.

| Per Share | Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount and commissions(1) |

$ | $ | ||

| Proceeds to us before expenses |

$ | $ |

| (1) | The underwriters will also be reimbursed for certain expenses incurred in this offering. See Underwriting for additional information regarding underwriting compensation. |

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock on or about , 2024.

Joint Book-Running Managers

| BofA Securities | Citigroup | RBC Capital Markets |

Co-Managers

| Johnson Rice & Company | Piper Sandler |

The date of this prospectus is , 2024

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 19 | ||||

| 21 | ||||

| 61 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 68 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

71 | |||

| 86 | ||||

| 95 | ||||

| 127 | ||||

| 133 | ||||

| 144 | ||||

| 147 | ||||

| 150 | ||||

| 158 | ||||

| 161 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR COMMON STOCK |

164 | |||

| 168 | ||||

| 177 | ||||

| 178 | ||||

| 179 | ||||

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY INFORMATION |

F-1 | |||

Through and including , 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealers obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be distributed to you. We and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you, and neither we, nor the underwriters take responsibility for any other information others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We and the underwriters have not done anything that would permit a public offering of the securities offered hereby or possession or distribution of this prospectus, any amendment or supplement to this prospectus, or any applicable free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus, any amendment or supplement to this prospectus, or any applicable free writing prospectus

i

Table of Contents

must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus, any amendment or supplement to this prospectus, or any applicable free writing prospectus outside of the United States.

This prospectus, the registration statement of which this prospectus forms a part and the offering have not been, nor will they need to be, lodged with the Australian Securities & Investments Commission. This prospectus and the registration statement of which this prospectus forms a part are not a Prospectus under Chapter 6D of the Corporations Act 2001 (Cth) of Australia, or the Australian Corporations Act. Any offer of shares of our common stock in Australia is made only to persons to whom it is lawful to offer shares of our common stock without disclosure under one or more of certain of the exemptions set out in section 708 of the Australian Corporations Act, or an exempt person. Further details of the exemptions are set out below in UnderwritingNotice to Prospective InvestorsAustralia. By accepting this prospectus, an offeree in Australia represents that the offeree is an exempt person. No shares of our common stock will be issued or sold in this offering in circumstances that would require the giving of a Prospectus under Chapter 6D of the Australian Corporations Act.

Industry and Market Data

In this prospectus, we present certain market and industry data. This information is based on third-party sources that we believe to be reliable as of their respective dates. Neither we nor the underwriters have independently verified any third-party information. Some data is also based on our good faith estimates. Expectations of our and our industrys future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Risk Factors. These and other factors could cause future performance to differ materially from our expectations. See Cautionary Statement Regarding Forward-Looking Statements.

Presentation of Financial and Operating Data

Our fiscal year ends on June 30. Unless otherwise noted, any reference to a year preceded by the words fiscal year refers to the twelve months ended June 30 of that year. For example, references to fiscal year 2022 refer to the twelve months ended June 30, 2022. References to dollars, $, U.S. dollars and US$ refer to United States dollars; and references to Australian dollars and A$ refer to Australian dollars.

Tamboran Resources Corporation (Tamboran) was incorporated on October 3, 2023 and does not have financial operating results prior to the corporate reorganization effective December 13, 2023. As a result of the corporate reorganization, Tamboran became the parent company of Tamboran Resources Pty Ltd (f/k/a Tamboran Resources Limited) (TR Ltd.), and for financial reporting purposes, the financial statements of TR Ltd. became the financial statements of Tamboran. As a result of the corporate reorganization, Tamboran issued to eligible shareholders of TR Ltd. one CDI of its common stock for every one ordinary share of TR Ltd., with each CDI representing 1/200th of a share of Tamborans common stock. For purposes of this prospectus, the historical financial statements of Tamboran have been presented as though the corporate reorganization had taken place on July 1, 2021 and Tamboran had existed as the parent of TR Ltd. as of that date. All share and per share data presented in this prospectus have been retroactively adjusted to reflect a one for two hundred (1:200) exchange ratio and all options over ordinary shares in the predecessor have been retroactively presented as options over CDIs in Tamboran. See Corporate Reorganization included elsewhere in this prospectus. Unless otherwise indicated, information presented in this prospectus (i) assumes that the underwriters option to purchase additional common stock is not exercised, (ii) assumes that the initial public offering price of the shares of our common stock will be $25.50 per share (which is the midpoint of the estimated price range set forth on the cover page of this prospectus) and (iii) reflects the completion of our corporate reorganization described in this prospectus under Corporate Reorganization.

ii

Table of Contents

Our operating and financial data may not be comparable between periods presented in this prospectus and to future periods. See Managements Discussion and Analysis of Financial Condition and Results of Operations.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

Rounding and Percentages

The financial information and certain other information presented in this prospectus have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers in a column may not conform exactly to the total figure given for that column in certain tables in this prospectus. In addition, certain percentages presented in this prospectus reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based upon the rounded numbers or may not sum due to rounding.

Currency Exchange Rate Data

Our functional currency is the Australian dollar and our consolidated financial statements are presented in the U.S. dollar. The functional currency is the currency of the primary economic environment in which an entitys operations are conducted. We translate our consolidated financial statements into the presentation currency using exchange rates in effect on the relevant balance sheet date for assets and liabilities and average exchange rates for the period for statement of operations accounts, with the difference recognized as a separate component of stockholders equity.

The following exchange rates were used to translate our consolidated financial statements and other financial and operational data shown in constant currency:

| Average for the Nine Months ended March 31, |

Average for the Fiscal Year |

|||||||||||||||

| 2024 | 2023 | 2023 | 2022 | |||||||||||||

| A$1.00 |

$ | 0.65 | $ | 0.68 | $ | 0.67 | $ | 0.73 | ||||||||

The following table lists, for each period presented, the high and low exchange rates, the average of the exchange rates on each business day during the period indicated and the exchange rates at the end of the period for one Australian dollar, expressed in U.S. dollars, based on the closing midrate as reported by FactSet.

| Nine Months ended March 31, |

Fiscal Year | |||||||||||||||

| 2024 | 2023 | 2023 | 2022 | |||||||||||||

| High for the period |

0.689x | 0.712x | 0.712x | 0.762x | ||||||||||||

| Low for the period |

0.629x | 0.622x | 0.622x | 0.688x | ||||||||||||

| End of the period |

0.652x | 0.670x | 0.666x | 0.688x | ||||||||||||

| Average for the period(1) |

0.655x | 0.675x | 0.673x | 0.726x | ||||||||||||

| (1) | Average represents the average of the rates on each business day during the period. |

iii

Table of Contents

The above rates may differ from the actual rates used in the preparation of the financial statements and other financial information appearing in this prospectus. Our inclusion of these exchange rates is not meant to suggest that the Australian dollar amounts actually represent such U.S. dollar amounts or that such amounts could have been converted into U.S. dollars at any particular rate, if at all.

Other Considerations

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See Risk Factors and Cautionary Statement Regarding Forward-Looking Statements for additional information regarding these risks.

You should read this prospectus and any written communication prepared by us or on our behalf in connection with this offering, together with the additional information described in the section of this prospectus titled Where You Can Find More Information. We have not authorized anyone to provide you with information or to make any representation in connection with this offering other than those contained herein. If anyone makes any recommendation or gives any information or representation regarding this offering, you should not rely on that recommendation, information or representation as having been authorized by us, the underwriters or any other person on our behalf. The information contained in this prospectus is accurate only as of the date of which it is shown, or if no date is otherwise indicated, the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our shares of common stock. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. Our business, financial condition, results of operations and prospects may have changed since that date. Information contained on our website is not part of this prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of shares of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

Glossary of Natural Gas Terms

The following are abbreviations and definitions of certain terms used in this prospectus, which are commonly used in the natural gas industry:

analogous reservoir refers to analogous reservoirs, as used in resources assessments, having similar rock and fluid properties, reservoir conditions (depth, temperature and pressure) and drive mechanisms, but are typically at a more advanced stage of development than the reservoir of interest and thus may provide concepts to assist in the interpretation of more limited data and estimation of recovery. When used to support proved reserves, an analogous reservoir refers to a reservoir that shares the following characteristics with the reservoir of interest: (i) same geological formation (but not necessarily in pressure communication with the reservoir of interest); (ii) same environment of deposition; (iii) similar geological structure; and (iv) same drive mechanism.

appraisal well refers to a vertical or horizontal well designed to assess the properties of the prospective formation by performing open hole logging activities, diagnostic fracture injection testing, fracture stimulation, flow testing, or any combination of the above for the purpose of formation evaluation. Our use of the term appraisal well correlates to the term exploratory well as defined in Rule 4-10(a) of Regulation S-X.

Bcf refers to one billion cubic feet.

Bcf/d refers to one billion cubic feet per day.

iv

Table of Contents

Btu refers to British thermal unit, which is the heat required to raise the temperature of one pound of liquid water by one degree Fahrenheit.

CCUS refers to carbon capture, utilization and sequestration.

CO2 refers to carbon dioxide.

CO2e refers to carbon dioxide equivalent.

completion refers to the installation of permanent equipment for production of oil or gas.

developed acres refers to the number of acres that are allocated or assignable to productive wells.

development well refers to a well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

drilling space unit or DSU refers to the area allocated to a well for the purpose of drilling for or producing oil or gas.

estimated ultimate recovery or EUR refers to the sum of reserves remaining as of a given date and cumulative production as of that date.

exploratory well refers to a well drilled to find or establish a new productive oil or natural gas reservoir, or to delineate the extent of a known productive reservoir.

extension well refers to a well drilled in an effort to extend the limits of a known productive reservoir.

farmin agreement refers to an agreement under which the owner of a working interest in license assigns the working interest or a portion of the working interest to another party (the farmee) as a means to share the costs and risks of development. Generally, the farmee agrees to pay the cost of the working interest owner (the farmor) to drill one or more wells. As consideration for the farmees services, the farmor transfers to the farmee a portion of the farmors interest in the license.

frac refers to the drilling method for extracting oil and natural gas.

gross acres or gross wells refers to the total acres or wells, as the case may be, in which a working interest is owned.

Henry Hub refers to a natural gas pipeline located in Erath, Louisiana that serves as the official delivery location for futures contracts on the NYMEX. The settlement prices at the Henry Hub are used as benchmarks for the North American natural gas market.

IP30 refers to 30-day initial production.

IP60 refers to 60-day initial production.

IP90 refers to 90-day initial production.

Mcf refers to one thousand cubic feet.

Mcf/d refers to one thousand cubic feet per day.

MMboe refers to one million barrels of oil equivalent.

MMBtu refers to one million Btus.

MMcf refers to one million cubic feet.

v

Table of Contents

MMcf/d refers to one million cubic feet per day.

Mtpa refers to million metric tons per year.

net acres refers to the gross acres on which an owner holds an interest, proportionally reduced by the working interest in such acreage. For example, an owner who has 50% interest in 100 acres owns 50 net acres.

net wells refers to the gross wells on which an owner holds an interest, proportionally reduced by the working interest in such wells. For example, an owner who has 50% interest in 100 wells owns 50 net wells.

ORRI refers to overriding royalty interest.

petrophysical analysis refers to the integration and analysis of various data types, including well logs, core samples and fluid samples and comparison of data with other relevant geological and geophysical information to describe the reservoir properties.

probable reserves refers to additional reserves that are less certain to be recognized than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

productive well refers to an exploratory, development, or extension well that is capable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well.

prospective resources refers to quantities of oil and gas estimated to exist in naturally occurring accumulations. A portion of the resources may be estimated to be recoverable, and another portion may be considered to be unrecoverable. Resources include both discovered and undiscovered accumulations.

proved reserves refers to quantities of oil, natural gas and NGLs that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible-from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government regulations-prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or we must be reasonably certain that it will commence within a reasonable time. For a complete definition of proved crude oil and natural gas reserves, refer to the SECs Regulation S-X, Rule 4-10(a)(22).

reserves refer to estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project.

resources refers to quantities of oil and gas estimated to exist in naturally occurring accumulations. A portion of the resources may be estimated to be recoverable, and another portion may be considered to be unrecoverable. Resources include both discovered and undiscovered accumulations.

royalty interest refers to an interest in an oil and natural gas lease that gives the owner of the interest the right to receive a portion of the production from the leased acreage (or of the proceeds of the sale thereof), but generally does not require the owner to pay any portion of the costs of drilling or operating the wells on the leased acreage. Royalties may be either landowners royalties, which are reserved by the owner of the leased acreage at the time the lease is granted, or overriding royalties, which are usually reserved by an owner of the leasehold in connection with a transfer to a subsequent owner.

vi

Table of Contents

Scope 1 emissions refers to direct GHG emissions that occur from sources that are controlled or owned by an organization.

Scope 2 emissions refers to indirect GHG emissions associated with the purchase of electricity, steam, heat or cooling.

Scope 3 emissions refers to GHG emissions that result from the end use of an organizations products, as well as emissions from other business activities from assets not owned or controlled by the organization but that the organization indirectly impacts in its value chain.

unconventional drilling refers to the application of advanced technology, other than traditional vertical well extraction, to extract oil and natural gas resources. Unconventional drilling typically includes directional drilling across long, lateral intervals within narrow horizontal formations offering greater contact area with the producing formation, and various types of hydraulic fracturing at multiple stages to optimize production.

unconventional natural gas refers to natural gas that cannot be produced at economic flow rates nor in economic volumes unless the well is stimulated by a hydraulic fracture treatment, a horizontal wellbore, or by using multilateral wellbores or some other technique to expose more of the reservoir to the wellbore.

unconventional play refers to a set of known or postulated oil and or natural gas resources or reserves warranting further exploration which are extracted from (a) low-permeability sandstone and shale formations and (b) coalbed methane. These plays require the application of unconventional drilling to extract the oil and natural gas resources.

unconventional resources refers to the umbrella term for oil and natural gas that is produced by means that do not meet the criteria for conventional production. What has qualified as unconventional at any particular time is a complex function of resource characteristics, the available exploration and production technologies, the economic environment, and the scale, frequency and duration of production from the resource. The term is most commonly used in reference to oil and gas resources whose porosity, permeability, fluid trapping mechanism, or other characteristics differ from conventional sandstone and carbonate reservoirs. Coalbed methane, gas hydrates, shale gas, shale oil, fractured reservoirs and tight gas sands are considered unconventional resources.

undeveloped acre refers to acreage on which wells have not been drilled or completed to a point that would permit the production of economic quantities of crude oil, NGLs, and natural gas, regardless of whether such acreage contains proved reserves. Undeveloped acres include net acres held by operations until a productive well is established in the spacing unit.

unproved properties refers to properties with no proved reserves.

working interest refers to the right granted to the lessee of a property to explore for and to produce and own natural gas or other minerals. The working interest owners bear the exploration, development, and operating costs on either a cash, penalty, or carried basis.

Commonly Used Defined Terms

As used in this prospectus, unless the context indicates or otherwise requires, the terms listed below have the following meanings:

Beetaloo refers to the Beetaloo Basin of the Northern Territory, Australia.

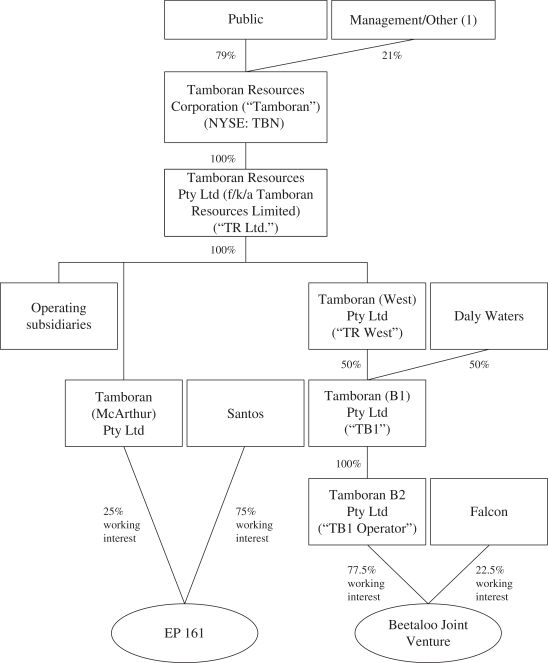

Beetaloo Joint Venture refers to the unincorporated joint venture in respect to EPs 76, 98 and 117, between TB1 Operator (77.5% working interest) and Falcon (22.5% non-operated working interest).

vii

Table of Contents

bp refers to BP Singapore Pte. Ltd, a subsidiary of BP plc.

bylaws refers to the bylaws of Tamboran Resources Corporation.

CDI refers to a CHESS Depository Interest.

certificate of incorporation refers to the certificate of incorporation of Tamboran Resources Corporation.

Code refers the Internal Revenue Code of 1986, as amended.

Convertible Note refers to the 5.5% Convertible Senior Note due 2029 between Helmerich & Payne International Holdings, LLC, Tamboran Resources Corporation, and the guarantors thereto dated June 4, 2024.

corporate reorganization refers to the transactions pursuant to which, among other things, we (i) issued to eligible shareholders of TR Ltd. one CDI of our common stock for every one ordinary share of TR Ltd., in each case, as held on the scheme record date, (ii) amended the terms of each of the outstanding options to acquire ordinary shares of TR Ltd. so that the entitlements of option holders to be issued ordinary shares in TR Ltd. instead became entitlements to be issued CDIs in the Company, (iii) maintained an ASX listing for our CDIs, with each CDI representing 1/200th of a share of our common stock, (iv) delisted TR Ltd.s ordinary shares from the ASX, and (v) became the parent company to TR Ltd.

Corporations Act refers to the Australian Corporations Act, 2001 (Cth).

Daly Waters or DWE refers to Daly Waters Energy, LP, which is 100% owned by Formentera Australia Fund, LP, which is managed by Formentera Partners, LP, a private equity firm of which Bryan Sheffield serves as managing partner.

Daly Waters Placement refers to the intended issuance at the closing of the offering of $7.5 million in shares of our common stock at the initial public offering price to Daly Waters, or its nominee, in satisfaction of certain payment obligations under the TB1 Joint Venture Agreement. See BusinessAgreements Relating to the Development of our AssetsTB1 Joint Venture Agreement.

Daly Waters Royalty refers to Daly Waters Royalty, LP.

ESG refers to environmental, social and governance.

Falcon or Falcon Oil & Gas or FOG refers to Falcon Oil and Gas Australia Ltd, a wholly owned subsidiary of Falcon Oil and Gas Limited (TSX.V: FOG, London AIM: FO).

Federal Government refers to the federal government of Australia.

GAAP refers to generally accepted accounting principles in the United States.

GHG refers to greenhouse gases.

governing documents refers to our certificate of incorporation and our bylaws.

H&P refers to Helmerich & Payne International Holdings, LLC, a subsidiary of Helmerich and Payne, Inc. (NYSE: HP).

Northern Territory refers to the Northern Territory of Australia.

operational net zero refers to the full elimination and/or offset of Scope 1 and Scope 2 emissions in our owned and operated upstream businesses.

viii

Table of Contents

Origin B2 refers to Origin Energy B2 Pty Ltd., a subsidiary of Origin Energy.

Origin Energy refers to Origin Energy Limited (ASX: ORG).

Origin Retail refers to Origin Energy Retail Pty Ltd., a subsidiary of Origin Energy.

Petroleum Act refers to the Petroleum Act 1984 (NT).

Santos or Santos QNT refers to Santos QNT Pty Ltd, a wholly owned subsidiary of Santos Ltd (ASX: STO).

scheme of arrangement refers to a statutory scheme of arrangement under Australian law under Part 5.1 of the Corporations Act.

Shell refers to Shell Eastern Trading (Pte) Ltd, a subsidiary of Shell plc (NYSE: SHEL).

Tamboran refers to Tamboran Resources Corporation, a Delaware corporation.

TB1 refers to Tamboran (B1) Pty Ltd, an Australian private limited company, which is a 50 / 50 joint venture between us and Daly Waters that holds a 77.5% working interest in the Beetaloo Joint Venture through its wholly owned subsidiary, TB1 Operator.

TB1 Operator refers to Tamboran B2 Pty Ltd, an Australian private limited company.

TR Ltd. refers to Tamboran Resources Pty Ltd (f/k/a Tamboran Resources Limited), an Australian private limited company.

TR West refers to Tamboran (West) Pty Ltd, an Australian private limited company.

ix

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment decision in shares of our common stock, including the information under the headings Risk Factors, Cautionary Statement Regarding Forward-Looking Statements, Managements Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. Except where the context suggests otherwise, the information presented in this prospectus assumes (i) an initial public offering price of $25.50 per share of common stock (the midpoint of the price range set forth on the cover of this prospectus), (ii) that the underwriters do not exercise their option to purchase up to an additional 975,000 shares of our common stock and (iii) reflects the completion of our corporate reorganization described in this prospectus under Corporate Reorganization. In this prospectus, unless the context otherwise requires, the terms we, us, our and the Company refer to (i) Tamboran Resources Pty Ltd (f/k/a Tamboran Resources Limited), an Australian private limited company formed in 2009, and its subsidiaries (TR Ltd.) and (ii) Tamboran Resources Corporation, a Delaware corporation formed in 2023 (Tamboran), the issuer of the common stock being sold in this offering and the parent entity of TR Ltd. following our corporate reorganization described in this prospectus. Please read Corporate Reorganization. We have provided definitions for some of the natural gas industry terms used in this prospectus in the Glossary. References to dollars, $, U.S. dollars and US$ refer to United States dollars; and references to Australian dollars and A$ refer to Australian dollars.

Our Company

Overview

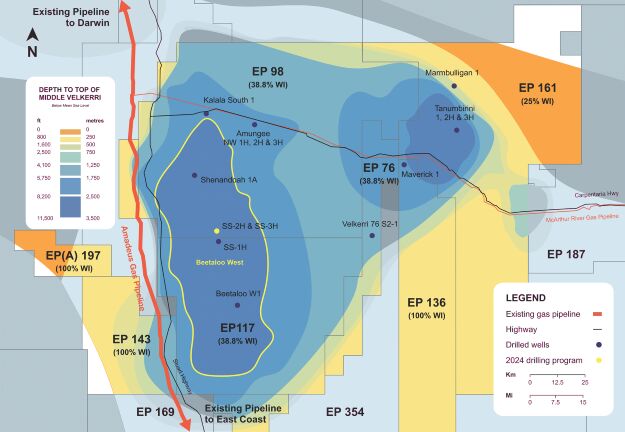

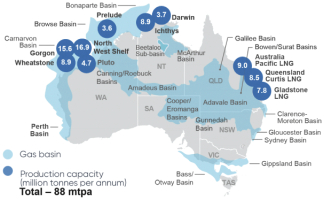

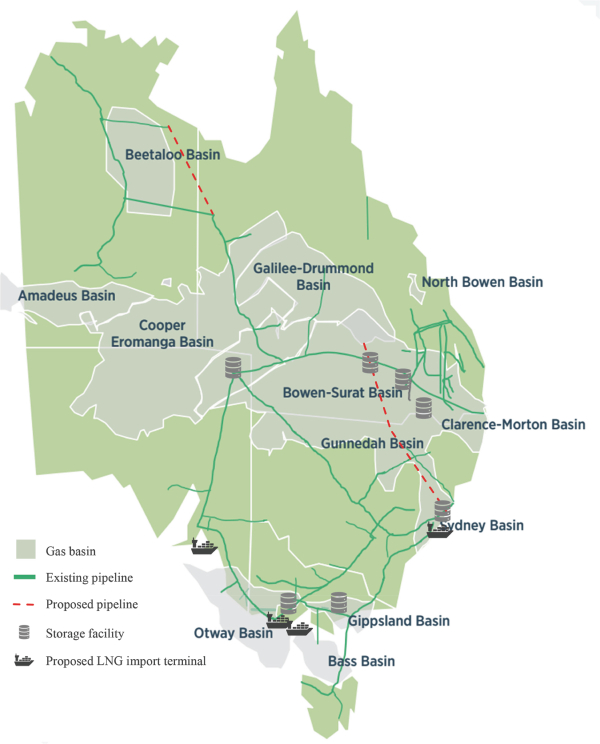

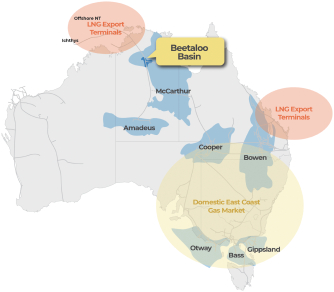

We are an early stage, growth-driven independent natural gas exploration and production company focused on an integrated approach to the commercial development of the natural gas resources in the Beetaloo located within the Northern Territory of Australia. We and our working interest partners have exploration permits (EPs) to approximately 4.7 million contiguous gross acres (approximately 1.9 million net acres to Tamboran) and are currently the largest acreage holder in the Beetaloo. We believe natural gas will play a significant role in the transition to cleaner energy and are committed to supporting the global energy transition by developing commercial production of natural gas in the Beetaloo with net zero equity Scope 1 and 2 emissions.

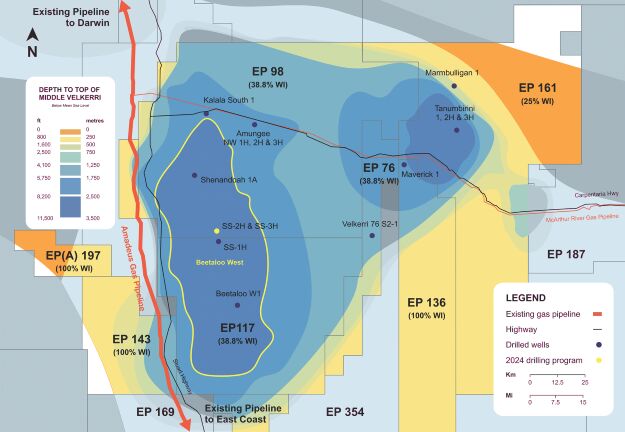

Our Assets

The Beetaloo, located approximately 300 miles southeast of the city of Darwin in the Northern Territory of Australia, covers approximately seven million acres (approximately 10,800 square miles) of outback and is believed to contain significant quantities of unconventional natural gas resources. To date, more than $600 million has been invested by various public and private companies in the exploration, appraisal and development of the Beetaloo. Based on data from our appraisal wells, we believe the most productive sections of the Beetaloo to be those at greater than 6,000-foot vertical depth. Initial data suggests that these sections demonstrate the highest productivity and reservoir pressures and exhibit the lowest decline rates in the Beetaloo. To date, our appraisal and development activities have focused on the dry gas shale target of the Middle Velkerri B formation, although we expect to eventually evaluate other benches for future development. Regional data from exploration wells, initial results from our appraisal wells, including well log and core data, as well as available 2-D seismic data, indicate that the geological properties of the Middle Velkerri section in the Beetaloo are widespread and contiguous across an area encompassing approximately 610,400 acres (approximately 950 square miles) and that the Beetaloo has geology similar to that of the Marcellus Shale of the Appalachian Basin in the northeastern United States (the Marcellus). In particular, the dry gas areas of the Marcellus qualify as an appropriate analogous reservoir to the Middle Velkerri shale of the Beetaloo, having similar rock and fluid properties (such as organic-rich source rock and similar thermal maturity), similar reservoir conditions (including depth, pressure gradient and temperature ranges), and drive mechanism (using pressure depletion and gas

1

Table of Contents

desorption). While the Marcellus is at a more advanced stage of development than the Beetaloo, we believe comparison to the Marcellus may assist in our estimations and interpretation of data.

We have participated in six appraisal wells over the last three fiscal years, four of which we drilled as the operator:

| Well Name |

Operator | Non-Operator(s) | Exploration Permit |

Date Drilled | Tamboran Working Interest |

|||||||

| Tanumbirini #2 (T2H) |

Santos | Tamboran | 161 | May 2021 | 25 | % | ||||||

| Tanumbirini #3 (T3H) |

Santos | Tamboran | 161 | August 2021 | 25 | % | ||||||

| Maverick 1V (M1V) |

Tamboran | N/A | 136 | August 2022 | 100 | % | ||||||

| Amungee NW-2H (A2H) |

Tamboran | DWE & FOG | 98 | November 2022 | 38.75 | % | ||||||

| Shenandoah South 1H (SS1H) |

Tamboran | DWE & FOG | 117 | August 2023 | 38.75 | % | ||||||

| Amungee NW 3H (A3H) |

Tamboran | DWE & FOG | 98 | September 2023 | 38.75 | % | ||||||

SS1H delivered an average 30-day initial production (IP30) flow rate of 3.2 MMcf/d over the 1,644-foot, 10-stage stimulated length within the Middle Velkerri B Shale, a 60-day initial production (IP60) flow rate of 3.0 MMcf/d, and a 90-day initial production (IP90) flow rate of 2.9 MMcf/d. Normalizing the production rate for a 10,000-foot horizontal lateral, the IP30 flow rate in SS1H would have been approximately 19.5 MMcf/d, the IP60 flow rate would have been approximately 18.4 MMcf/d, and the IP90 flow rate would have been approximately 17.8 MMcf/d. Flow test results from the two wells in which we participated on a non-operated basis, the T2H and T3H, delivered IP30 rates of 2.1 MMcf/d and 3.1 MMcf/d, respectively, over approximately 2,200-foot and 2,000-foot horizontal sections. Normalizing those production rates to our optimal development plan of 10,000-foot horizontal sections, we expect the IP30 rates in T2H and T3H would have been approximately 9.5 MMcf/d and 15.5 MMcf/d, respectively.

2

Table of Contents

To date, 21 wells have been drilled in the Beetaloo intersecting the Middle Velkerri shales. Of those wells we have participated in the drilling of seven wells, though we consider only the six drilled in the last three fiscal years to be our appraisal wells (our wells). The remaining 14 wells drilled to date in the Beetaloo were drilled by third parties. None of the wells drilled in the Beetaloo to date are currently flowing to sales. Four of our wells (SS1H, T2H, T3H, and A2H) are horizontal wells that have been stimulated, flow tested, and produced natural gas to the surface in test volumes. Based on the initial flow rates of our wells, we believe only SS1H is currently a productive well, meaning it is capable of producing sufficient quantities of gas to justify completion. We believe T2H, T3H, and A2H will likely be capable of producing sufficient quantities of gas to justify completion or recompletion at a future date with further investment and workover. No flow test information is currently available for M1V and A3H, so at this time we do not have sufficient data to determine whether these wells are capable of producing sufficient quantities of gas to justify completion or recompletion.

T2H and T3H were drilled with low intensity, shorter lateral lengths (approximately 2,000 feet), while SS1H and A3H were drilled with Helmerich & Payne International Holdings, LLCs (H&P) modern US FlexRig® that was imported into Australia in 2023 and will increase spacing between well pads. In our next phase of drilling and completion, we anticipate increasing frac stages by extending the horizontal length of our wells. Our contiguous acreage position and the scarcity of other operators or urban areas near the Beetaloo will provide us with the space necessary to eventually drill pad wells with up to three to four-mile horizontal laterals, greatly increasing efficiencies and production from a relatively smaller number of wells. We have experienced geologic complexity similar to that of U.S. shale basins in our drilling activities to date, and based on our experience and seismic data, we believe such complexity to be generally characteristic of the Beetaloo. We believe the relative lack of complexity in the geology of the Beetaloo will enable us to achieve more predictable well recoveries and permit greater lateral lengths.

Our key assets are (i) a 25% non-operated working interest in EP 161, (ii) a 38.75% working interest in EP 76, 98 and 117, where we are the operator, and (iii) a 100% working interest in EPs 136, 143 and EP(A) 197, where we are the operator, all of which are located in the Beetaloo. We have an undivided 50% interest in EPs covering four million gross (1.5 million net) acres through TB1, EPs 76, 98 and 117. We hold our rights in the Beetaloo through EPs granted by the government of the Northern Territory for initial periods of five years with a right to renew twice for additional five-year periods, and with a further right to extend the term with Ministerial approval based upon approval of a work program. An EP grants the holder the exclusive right to explore for petroleum and to carry on such operations and execute such works as are necessary for that purpose, in the exploration permit area. We are also entitled to apply for a retention license in areas where petroleum has been identified but commercial viability is yet to be established. Retention licenses are for a term of five years and may be renewed without a statutory limitation. A retention license would provide us with the exclusive right to carry on in the license area geological, geophysical, and geochemical programs and other operations and works, including appraisal drilling, as reasonably necessary to evaluate the prospective resources in the license area. Upon commercialization of the natural gas properties subject to an EP or retention licenses, we are eligible to apply to convert relevant productive areas of our EPs (or any future retention licenses) into production licenses with an initial term of either 21 or 25 years as determined by the Northern Territory Minister for Environment (the Minister), which can be further renewed. A production license grants a party or parties exclusive rights to explore for petroleum and recover it from the license area and to carry out such operations and execute such works in the license area as are necessary for the exploration for and recovery of petroleum. We will be required to pay a statutory royalty to the Northern Territory Government (NT Government) of 10% of the gross value, at the well-head, of all petroleum produced in connection with a production license or EP in a project area. The gross value of that petroleum is determined by the Petroleum Royalty Act (NT). Additionally, we will pay royalties of between 6% to 11% to other third parties under certain commercial arrangements. See BusinessOur Assets Within the Beetaloo, BusinessEnvironmental Matters and Regulation and Certain Relationships and Related Party Transactions.

3

Table of Contents

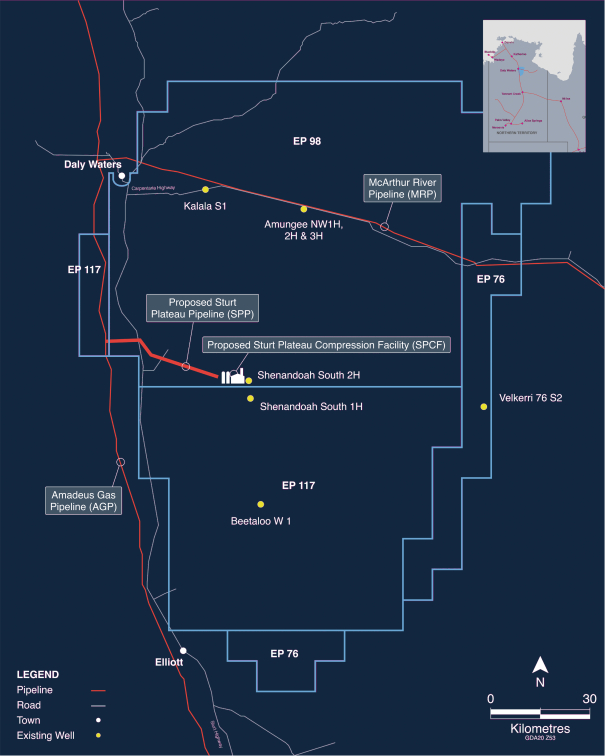

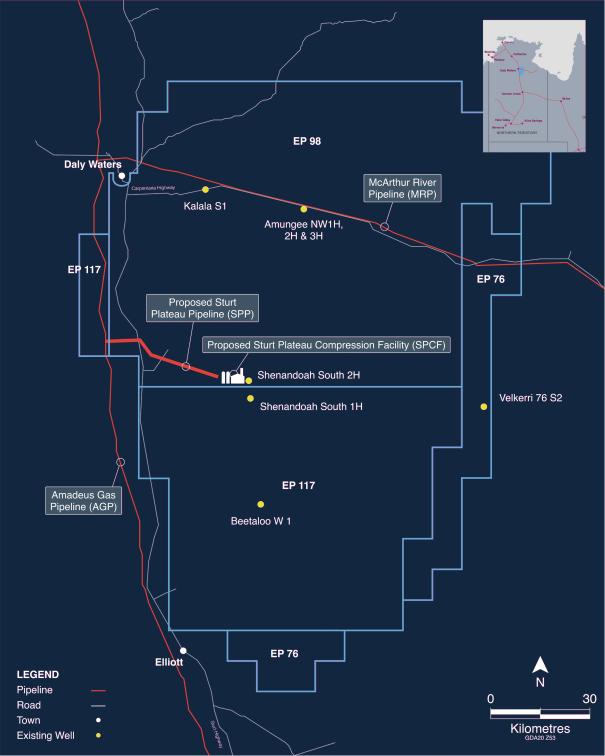

Our Business Plan

Our business plan consists of three distinct phases in the development of the Beetaloo. The focus of the first phase will be on the transition from exploration activities to the commercialization of our Beetaloo properties. In furtherance of that goal, we expect to drill and complete an additional two wells in 2024, four wells in 2025, progress a project to design and construct a 40 MMcf/d compression and dehydration plant, and progress a ~20 mile pipeline to the existing gas pipeline network (collectively, the Shenandoah South Pilot Project). Our goal is joint venture approval of the Shenandoah South Pilot Project in mid-2024 and believe we can achieve ~40 MMcf/d (gross) plateau production in 1H 2026. Based on our petrophysical analysis from completed appraisal wells, we have already identified what we believe to be the most productive acreage and shale benches to target for our first stage wells. The two wells in the 2024 drilling program will create two drilling space units (DSUs) totaling 51,200 gross acres around the second Shenandoah South well pad (SS2) well pad. The 51,200 gross acre area has the potential to accommodate 23 well pads, or 138 total wells based on six wells drilled per pad. We believe the two DSUs will be more than enough to accommodate all wells associated with the Shenandoah South Pilot Project and over 100 wells for future development phases.

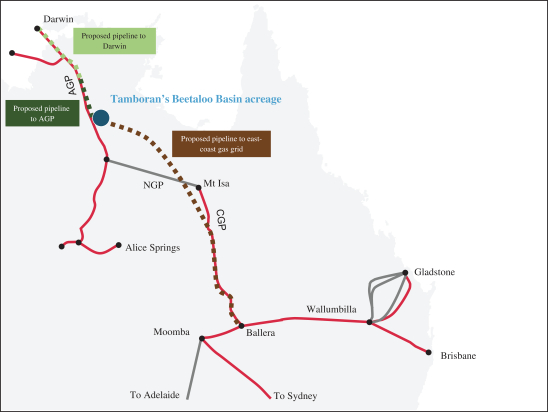

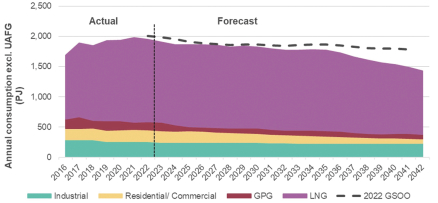

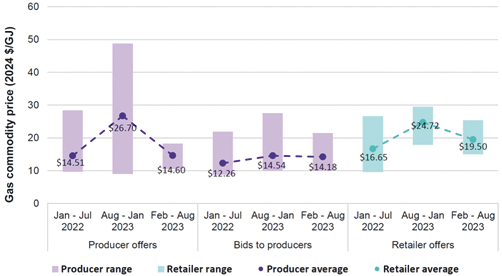

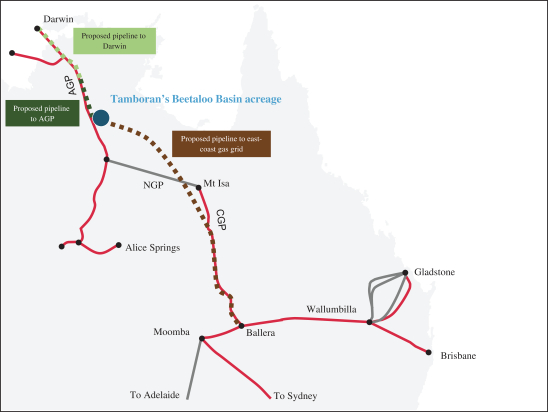

Beginning in 2026, subject to approval by the Minister responsible for the Petroleum Act, we plan to market the gas produced from our initial wells in the Northern Territory. While the natural gas production from these wells will be modest, the revenue generated from sales of these volumes is expected to offset our overhead (but not operating) expenses. The Beetaloo is currently serviced by two open-access pipelines that are sized to accommodate the ~60 MMcf/d local market and also provide access to the deeper Australian East Coast market. We have early development agreements with APA Group (ASX: APA), Australias largest gas infrastructure company by volume whereby APA has commenced preliminary work on a project with the goal to ultimately build, own, and operate a new ~20 mile pipeline to connect our wells to the existing gas transmission network through the Amadeus Gas Pipeline (AGP) and the 40 MMcf/d compression facility that would upgrade the raw gas to meet sales gas quality, subject to the terms of definitive development agreements. We estimate the capital required to deliver the first development phase to production will be approximately $125 million (A$195 million) to $165 million (A$250 million) net to Tamboran. We expect to spend approximately $70 million (A$105 million) to $80 million (A$125 million) net on drilling and completion costs, $10 million (A$15 million) to $13 million (A$20 million) net on costs related to the development of the compression facility, $23 million (A$35 million) to $30 million (A$45 million) net on related pad construction and gathering infrastructure and $26 million (A$40 million) to $40 million (A$60 million) net on transaction and general and administrative expenses. We intend to fund these costs with the proceeds of this offering, cash on hand, as well as additional future capital raising efforts, if required. Gas sales are expected to commence from our wells in the first quarter of 2026. Through the course of the completion of the additional six wells, we believe we can reduce costs through greater efficiency while simultaneously providing us sufficient data to confirm the estimated ultimate recovery (EUR) for wells drilled in the Beetaloo. Our development plan seeks to efficiently drill from pad wells, utilizing long laterals and modern completion techniques employed by U.S. onshore operators. We expect the cost structure and production profiles achieved with our initial wells to lead to a financial investment decision (FID) for an initial large scale drilling program in our second phase.

4

Table of Contents

The second phase of our business plan involves building our drilling program to produce natural gas to supply the Australian East Coast and Northern Territory markets. We anticipate drilling as many as 100 to 200

5

Table of Contents

wells during this second phase, which may commence as early as 2026, subject to the completion of certain third-party infrastructure projects. The current pipeline infrastructure, the AGP in the Northern Territory, can export ~50 MMcf/d northbound and ~50 MMcf/d to the East Coast. We have a set of early development agreements with APA whereby APA has committed to evaluate a project to build, own, and operate, and subject to the definitive terms of the development agreements, to construct, a new approximately 1,000 mile pipeline to connect the Beetaloo to the main trunk line of the East Coast Gas Grid. The new pipeline is anticipated to reduce the cost of transporting gas from the Northern Territory to the East Coast by up to 50%. We have non-binding letters of intent from six of Australias largest energy retailers with respect to the purchase of natural gas from us, with an aggregate volume of 875 MMcf/d for a period of up to 10 to 15 years.

In the third phase of our business plan, following commercialization of the Beetaloo, we intend to drill additional wells with the intent to supply natural gas for export through the existing liquified natural gas (LNG) plants in Darwin and our proposed 6.9 Mtpa Northern Territory LNG export facility (NTLNG) to South and East Asian markets. Depending on the volume of unused capacity then available at existing LNG plants in Darwin, this phase may occur before or in parallel with the second phase. In consideration of our proposed NTLNG project, the government of the Northern Territory of Australia has awarded us exclusive use of an approximately 420 acre site for a term extending to December 31, 2024 for a concept select study with respect to our proposed NTLNG project within the Middle Arm Sustainable Development precinct (MASD). We completed the concept select study in the first quarter of 2024, which affirmed the feasibility of commencement of commissioning of the first LNG train in 2030, and are progressing toward binding land agreements with the NT Government. The MASD, an industrial complex adjacent to the city of Darwin, seeks to provide infrastructure focused on low emissions operations, for the export, processing, storage, shipping and rail transportation of LNG and other hydrocarbons. The MASD precinct is currently home to an export hub with two

6

Table of Contents

existing and operational LNG export terminals, the Darwin LNG terminal with a capacity of 3.7 Mtpa and the Ichthys LNG terminal with a capacity of 8.9 Mtpa. The Australian government has committed A$1.5 billion in investments commencing in 2025 to further develop MASD infrastructure and access, including dredging of the deepwater port, construction of road and rail access and distribution of electricity. We estimate total time required for construction of the NTLNG project to be between three to five years and have a non-binding memorandum of understanding with each of BP Singapore Pte. Ltd (bp) and Shell Eastern Trading (Pte) Ltd (Shell) for 20-year LNG purchase contracts. We could additionally sell our future production if, for example, our NTLNG project faces any delays, through the two existing and operational LNG terminals near Darwin. We intend to seek additional strategic partners for the financing and development of these and other infrastructure projects.

Our business and development plans include the continuous focus on reducing cost while increasing production efficiencies. We believe that importing U.S. unconventional drilling and completion techniques, best-practices and technology, together with the right personnel, will reduce the incremental cost to drill and complete each subsequent well. We currently have on contract with Helmerich and Payne, Inc. (NYSE: HP), one H&P FlexRig® until August 2025 with a 10-year option to contract for up to five additional rigs. We have entered into a two-year preferred arrangement with Liberty Energy Inc. (NYSE: LBRT) (Liberty Energy) to provide us dedicated frac fleets and personnel on market terms (as reasonably determined by the Beetaloo Joint Venture). The drilling and stimulation costs for our most recent SS1H well was $19.4 million (A$28.9 million), and we expect an additional $5.1 million (A$7.7 million) is required to fund the 90-day extended production test. We estimate the drilling and completion costs of each of the remainder of our initial wells will be approximately $26 million gross as a result of our application of U.S. practices, longer lateral lengths and increased number of stimulated stages. We are targeting long-term development well costs of $16 million per well at depths of approximately 9,800 feet with 60 stages. We believe by taking advantage of efficiencies related to economies of scale, continued infrastructure development in the Beetaloo and resource maturation, over time we will significantly reduce the cost to drill and complete our wells.

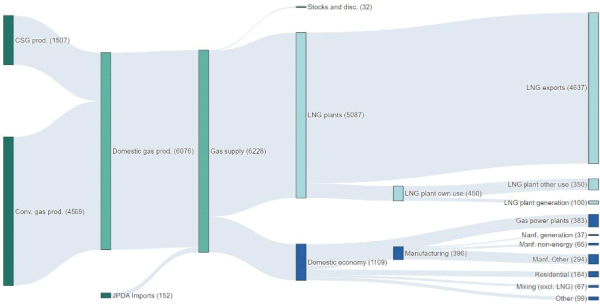

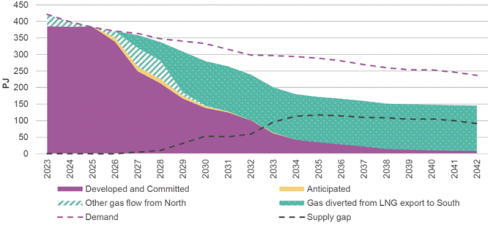

The Opportunity

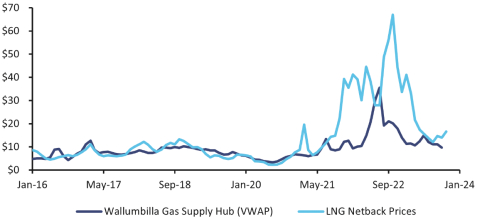

We believe there is significant opportunity to supply natural gas to both domestic Australian markets and select South and East Asian markets. According to the International Energy Agency, 70% of future growth in global electricity demand will come from high-growth and high-demand markets in Asia. Demand from Australias East Coast natural gas market has increased significantly in recent years, as a result of the construction of export projects during the 2010s and underinvestment in natural gas production and infrastructure on the East Coast, and is now expected to result in gas shortages through the remainder of this decade, according to the Australian Competition and Consumer Commission. Meeting this forecasted demand will require significant investment in new natural gas production and infrastructure.

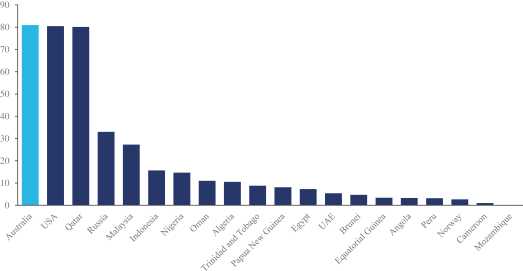

The relative geographic proximity of the existing and planned LNG export terminals in northern Australia to Asian markets provides Northern Territory operators with competitive advantages over current LNG suppliers from the Middle East and the United States. For example, LNG can be delivered from Darwin to Singapore in less than four days, and to China and Japan within six days. Shipments from the Middle East must travel through the Red Sea, while shipments from the United States must travel around the southern cape of Africa or through the Panama Canal, all of which often result in delays or higher costs. The cost to ship LNG from Darwin to Japan is approximately 40% lower than the cost to ship LNG from Qatar. Additionally, spot prices in certain South and East Asian regional markets have historically been significantly higher than spot prices at Henry Hub. For example, during the calendar year ended 2023, spot prices for natural gas delivered to Henry Hub averaged $2.54 per MMBtu while over that same period the Japan Korea Marker (JKM) continuous futures price for LNG averaged $14.45 per MMBtu.

7

Table of Contents

The following image illustrates the delivery times of LNG from Australia to select South and East Asian markets:

Preliminary results and third-party data indicate that natural gas produced in the Beetaloo generally has lower carbon dioxide content compared to natural gas produced elsewhere in Northern Australia and major fields supplying Australias East Coast gas market. We believe our application of U.S. drilling and completion technology will provide us with a competitive advantage to achieve natural gas production in compliance with the Australian governments recently enacted GHG regulations. The Australian governments current policy is to target net zero carbon emissions economy-wide by 2050. Additionally, the Australian government requires all shale gas production in the Beetaloo following commercialization to be conducted on a Scope 1 net zero emissions basis. We have set a target to exceed these requirements by reaching net zero equity Scope 1 and 2 GHG emissions upon commencement of commercial production. We expect there to be a variety of means in

8

Table of Contents

which we could achieve our operational net zero equity goals, including but not limited to, utilizing carbon offsets, for which the prices are capped by applicable law, exploring opportunities to power our facilities with renewable energy sources, implementing methane minimization technology in the design of our facilities and integrating a carbon capture storage hub with our proposed NTLNG project.

We believe natural gas produced in the Beetaloo can play a key role in supporting the emissions reduction targets of many regional markets through the transition of coal-to-gas fired power plants. The domestic Australian market is primarily reliant on coal with over 60% of electricity generation across Victoria, New South Wales and Queensland supplied from coal-fired power, according to the Australian Department of Industry, Science, Energy and Resources. According to the U.S. Energy Information, in 2021, coal supplied a majority of the total energy consumption in China as well as Southeast Asia generally.

Competitive Strengths

We have a number of strengths that we believe will help us successfully execute our business strategy, including:

| | Leading acreage holder and operator in the high-quality Beetaloo. As a result of a series of opportunistic acquisitions, we have established the largest contiguous acreage position in the Beetaloo today. Our Beetaloo assets cover approximately 4.7 million contiguous gross acres (approximately 1.9 million net acres), the most extensive position currently reported in the Beetaloo. Approximately 5,000 miles of 2-D seismic data has been collected over the Beetaloo. Based on the extensive 2-D seismic data available to us as well as our own preliminary well results, we believe our acreage position consists of significant quantities of high-quality natural gas resources in what we believe to be the core of the Velkerri shale gas play. Our initial development area of the Middle Velkerri-B shale shows an average shale thickness of 230 feet across approximately 610,400-acres (approximately 950 square miles). We estimate the Middle Velkerri section to be continuous across the same area. The Beetaloo has very few operators and no urban areas. The geographical features of the Beetaloo, our expansive contiguous acreage position and very few restrictive boundaries support 10,000-foot laterals and U.S. style unconventional drilling techniques. In addition, we believe our position as the leading acreage holder in the Beetaloo will support our efforts to establish commercial production in volumes sufficient to stimulate investment in in-basin frac sand and other services. |

| | Premium Markets. We expect the relative geographic proximity of the Beetaloo to the major population centers on the Australian East Coast and the Asian LNG markets to provide us the opportunity to potentially obtain attractive prices for our natural gas relative to markets in North America based on historical pricing. For example, during the calendar year ended 2023, spot prices for natural gas delivered from Henry Hub averaged $2.54 per MMBtu. Over that same period, the Japan Korea Marker (JKM) continuous futures price of LNG averaged $14.45 per MMBtu. Although production costs in the Beetaloo are currently significantly higher than U.S. onshore operations, upon full commercialization of the Beetaloo, we expect those costs to decline. If the Australian East Coast and the Asian LNG markets maintain elevated prices relative to North America and we achieve our cost targets, we believe we will have an opportunity to potentially capture higher margins as compared to natural gas produced in the Marcellus Shale of the Appalachian Basin. |

| | High caliber and experienced management team with a track record of success. We maintain a highly experienced and knowledgeable management team with an average of over 25 years of experience among our senior management team. Our leadership team has significant experience managing integrated energy and power assets for large-scale enterprises, including companies such as Unocal, Chevron, Apache, and ExxonMobil. We also have a management team with extensive experience with vertical and horizontal drilling in unconventional plays. Joel Riddle, our CEO since |

9

Table of Contents

| 2013, has more than 25 years of experience in the upstream oil and gas industry, and Faron Thibodeaux, our COO, has over 40 years of technical and operations experience in the energy industry. The board includes our Chairman Dick Stoneburner, the former co-founder, President and Chief Operating Officer of Petrohawk Energy Corporation and President North America Shale Production Division for BHP Billiton Petroleum, a subsidiary of BHP Group Ltd. (NYSE: BHP), and Fredrick Barrett, co-founder and former CEO of Bill Barrett Corporation, each of whom have more than 35 years of experience raising capital and operating assets in the oil and gas industry. We have raised more than $230 million to date through an initial public equity offering on the ASX, follow-on offerings, and private placements. |

| | Net Zero Equity Scope 1 and Scope 2 Emissions. Australian law requires that natural gas reserves in the Beetaloo be produced on a Scope 1 net zero basis upon achieving commercial production. We have a comprehensive sustainability program, which is overseen and directed by a Sustainability Committee composed of board members. We believe natural gas delivered from the Beetaloo will provide an attractive alternative for domestic and Asian economies seeking to reduce reliance on coal and reduce their own GHG emissions. |

| | High quality, blue-chip strategic partners. We have contracted H&P to exclusively provide drilling services for our wells in the Beetaloo. We have an agreement with Liberty Energy to provide a dedicated frac fleet and personnel. Our agreements with APA Group contemplate providing access to existing natural gas transmission pipelines to transport initial gas production and the construction of additional pipelines to connect with systems on the Australian East Coast and to Darwin in the Northern Territory. Our memoranda of understanding with each of bp and Shell contemplate 20-year LNG purchase agreements from our proposed NTLNG development. We have entered into a gas sales agreement with the NT Government for gas sales of up to ~40 MMcf/d for a period of up to 15.5 years. We also have non-binding letters of intent from six of Australias largest energy retailers with respect to the purchase of natural gas from us, with an aggregate volume of 875 MMcf/d for a period of up to 10 to 15 years. We are seeking to enter into definitive agreements with these strategic partners as we execute on subsequent phases of our business plan, and we will continue to seek additional strategic partnerships in the development of the Beetaloo. See BusinessAgreements Relating to the Development of our Assets and Certain Relationships and Related Party Transactions. |

Business Strategies

We intend to execute the following business strategies:

| | Commercialize our resources in the Beetaloo. We intend to commercialize our natural gas resources in the Beetaloo in accordance with the first phase of our business plan over the next two to three years. Leveraging the experience and data derived from our initial well program, we anticipate commencing a multi-year drilling program as early as 2026 for as many as 100 to 200 wells, subject to our ability to obtain the necessary capital and completion of certain third-party infrastructure projects, including the proposed pipelines with APA Group. |

| | Pursue an integrated approach to the development and scale of natural gas production and transportation projects. We aim to build additional infrastructure with partners to support the take-away of up to 2.0 Bcf/d of gross production following the initial commercialization of the Beetaloo. Adjacent to the Beetaloo are currently two natural gas pipelines, one running north to Darwin and another pipeline to the Australian East Coast. We are in discussion with APA Group with respect to the construction of two larger diameter pipelines to each of Darwin and the Australian East Coast, and we anticipate commencing construction of our NTLNG project as early as 2027, subject to receiving the necessary approvals. Additionally, there are two LNG export terminals in operation near Darwin through which we can eventually sell additional production, subject to capacity constraints. |

10

Table of Contents

| | Import U.S. best practices to become a low-cost provider of natural gas to the Australian domestic market and regional Asian markets. We will continue to import best practices from the U.S. E&P industry to enhance production and reserve recovery per well while simultaneously reducing capital and operating costs. To date, horizontal drilling and completion techniques and pad drilling have not been widely used in the Australian E&P industry. Based on analysis of our preliminary results and seismic data, we believe the geology of the Beetaloo is conducive to U.S.-style unconventional drilling, and we have entered into an agreement with H&P to bring U.S. unconventional drilling rigs to the Beetaloo. We currently have on contract an H&P FlexRig® until August 2025 with an option to contract for additional rigs. We have an agreement with Liberty Energy to provide a dedicated frac fleet and personnel. Our A3H well was drilled to a total depth of 12,589 feet in less than 18 days, the fastest rate of any well drilled with a horizontal section in the Beetaloo, where wells have historically been drilled to depth in 45 days or more. |

| | Lower Emissions from Natural Gas Production. We aim to fulfill the Australian governments requirements in the achievement of net zero for our equity share of Scope 1 and 2 emissions from natural gas production. We intend to participate in an open-access, multi-user CCUS (carbon capture utilization and sequestration) project at the proposed NTLNG facility and will seek to power our gathering and processing facilities from renewable sources, including solar and wind, to the extent available. Our goal is to deliver LNG to global markets from net zero equity Scope 1 and 2 facilities in an effort to replace coal consumption, particularly in Australian and East Asian markets, with lower-emissions natural gas from the Beetaloo. |

Our Joint Venture Partner

Our largest shareholder is Bryan Sheffield. Mr. Sheffield, through Sheffield Holdings, LP (Sheffield), first began acquiring interests in TR Ltd. in November 2021, has made three subsequent equity investments and has now grown to become Tamborans largest shareholder, currently holding 16.7% of outstanding common shares. Mr. Sheffield has significant investment experience in the U.S. unconventional energy sector. He previously served as the Chairman, CEO and Founder of Parsley Energy Inc., a major independent unconventional oil and gas producer in the Permian Basin in Texas. Parsley Energy was acquired by Pioneer Natural Resources Company in January 2021 for $7.3 billion. He is currently the Managing Partner of Formentera Partners, an energy private equity firm, which has raised $1.2 billion in equity since 2021.

In September 2022, Mr. Sheffield, through Daly Waters, partnered with TR Ltd. through a newly formed 50 / 50 joint venture, TB1, to acquire a 77.5% interest in EPs 76, 98, and 117 covering approximately four million gross acres (1.5 million net acres). On March 4, 2024, Falcon, the owner of the remaining 22.5% interest in the assets, capped its participation to 5% in the Beetaloo Joint Ventures second Shenandoah South well pad (SS2) and the two wells in the 2024 drilling program. On March 21, 2024, TB1 Operator agreed to pick up Falcons interest, increasing the Companys working interest to at least 47.5% in SS2 and the two wells in the 2024 drilling program. Daly Waters interest in TB1 will be transferred to Mr. Sheffields private equity firm, Formentera Partners, where they intend to participate in the assets continued development. Mr. Sheffield, through Daly Waters Royalty, LP (Daly Waters Royalty) also holds a 2.3% overriding royalty interest (ORRI) over all of our Beetaloo assets. See BusinessAgreements Relating to the Development of our Assets and Certain Relationships and Related Party Transactions.

Corporate Reorganization

Tamboran Resources Corporation (Tamboran), the issuer of the common stock being sold in this offering, was incorporated in Delaware on October 3, 2023 for the purpose of effecting our corporate reorganization pursuant to a scheme of arrangement under Australian law between Tamboran and TR Ltd., which we refer to as

11

Table of Contents

the corporate reorganization. On December 13, 2023, Tamboran acquired all of the outstanding ordinary shares of TR Ltd. in exchange for 1,716,672,600 CDIs representing beneficial interests in 8,583,363 shares of our common stock, with each CDI representing 1/200th of a share of our common stock. Upon consummation of the corporate reorganization, TR Ltd.s ordinary shares were delisted from the ASX and our CDIs were listed on the ASX. Other than the CDIs, Tamborans common stock will not be listed on any Australian securities exchange. For additional information concerning our CDIs, see Description of Capital StockCHESS Depositary Interests. Following the corporate reorganization, Tamborans assets consist primarily of 100% of the ordinary shares of TR Ltd.

The description of our business included in this prospectus as of the dates and for the periods prior to the corporate reorganization reflect the business of TR Ltd., and the description of our business as of the dates and for the periods from and after the corporate reorganization reflect the business of Tamboran and its consolidated subsidiaries, in each case unless otherwise expressly stated or the context otherwise requires. The consolidated financial statements and other financial information of Tamboran included in this prospectus reflect the historical financial statements of TR Ltd., as retroactively adjusted to give effect to the corporate reorganization. Please see Note 1 to the consolidated financial statements.

12

Table of Contents

Our Structure

The following diagram shows our simplified ownership structure immediately following this offering, the conversion of the Convertible Note, and the Daly Waters Placement (assuming that the underwriters option to purchase additional shares is not exercised):

| (1) | Consists of Mr. Sheffield and his controlled funds, H&P, and our management and directors. |

13

Table of Contents

Emerging Growth Company Status

We are an emerging growth company within the meaning of the federal securities laws. For as long as we are an emerging growth company, we may not be required to comply with certain requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, the auditor attestation requirements of Section 404 of the U.S. Sarbanes-Oxley Act of 2002, as amended (the SOX), the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. Additionally, an emerging growth company can also take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the Securities Act), for complying with new or revised accounting standards.

We intend to take advantage of these exemptions until we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (i) the last day of the fiscal year in which we have $1.235 billion or more in annual revenues, (ii) the date on which we become a large accelerated filer (the fiscal year-end on which the total market value of our common equity securities held by non-affiliates is $700.0 million or more as of December 31 of such year), (iii) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period or (iv) the last day of the fiscal year following the fifth anniversary of this offering.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. We have elected to take advantage of this extended transition period, which means that the financial statements included in this prospectus, as well as any financial statements that we file or furnish in the future, will not be subject to all new or revised accounting standards generally applicable to public companies for the transition period for so long as we remain an emerging growth company. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates for such new or revised standards.

For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see Risk FactorsRisks Related to the Offering, our Common Stock and our CDIsFor as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and certain disclosure about our executive compensation, that apply to other public companies.

Corporate Information